The Asia Pacific Telecom Order Management Market would witness market growth of 11.7% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Telecom Order Management Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $854 million by 2032. The Japan market is registering a CAGR of 10.8% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 12.4% during (2025 - 2032). The China and Japan led the Asia Pacific Telecom Order Management Market by Country with a market share of 31.4% and 15.2% in 2024. The Malaysia market is expected to witness a CAGR of 15.4% during throughout the forecast period.

The Asia Pacific Telecom Order Management Market has changed quickly because of digital transformation, the growth of 4G and 5G networks, and the growing number of subscribers. In the 2G era, the region went from manually provisioning to using advanced cloud-native OSS/BSS systems that support large-scale activations, IoT services, and enterprise connectivity. Governments in India, Japan, South Korea, Singapore, China, and Australia all pushed for digital modernization. At the same time, OEMs like Huawei, Ericsson, Nokia, and ZTE made scalable, automated order-management platforms that were designed for high-volume service delivery. Today, APAC is still a world leader thanks to the rollout of fiber, the digitalization of businesses, the growth of edge computing, and the integration of AI, eKYC, and unified digital service flows.

Some important trends in the market are the move toward automated and AI-driven order fulfillment, deep integration with 5G standalone networks, and the quick growth of digital customer experience platforms. NTT Communications, Reliance Jio, Singtel, Telstra, China Mobile, KT, and SK Telecom are all modernizing their OSS/BSS stacks with microservices, orchestration engines, TM Forum Open APIs, and cloud infrastructure. Big telecom companies and global vendors are in charge of the competition, with help from cloud companies like AWS, Google Cloud, and Azure. Real-time provisioning, dynamic network slicing, enterprise SLAs, and seamless, app-based service activation for both consumer and business markets are now the main strategic goals for the whole region.

Based on Component, the market is segmented into Solution, and Service. The Solution market segment dominated the India Telecom Order Management Market by Component is expected to grow at a CAGR of 11.9 % during the forecast period thereby continuing its dominance until 2032. Also, The Service market is anticipated to grow as a CAGR of 13 % during the forecast period during (2025 - 2032).

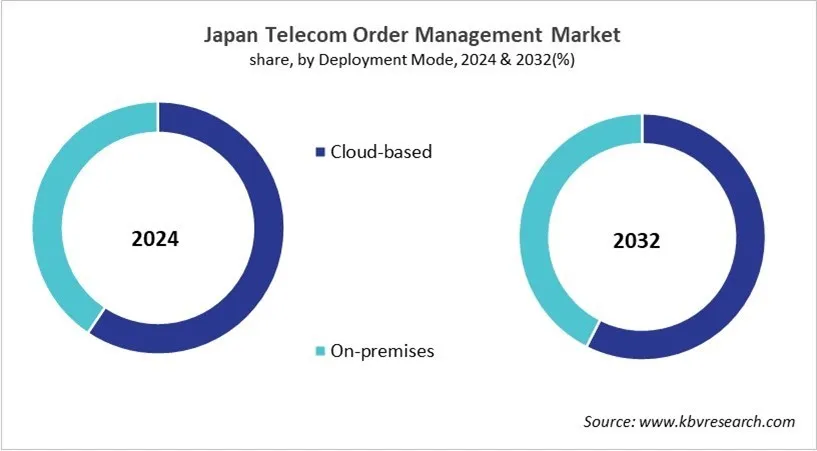

Based on Deployment Mode, the market is segmented into Cloud-based, and On-premises. With a compound annual growth rate (CAGR) of 10.4% over the projection period, the Cloud-based Market, dominate the Japan Telecom Order Management Market by Deployment Mode in 2024 and would be a prominent market until 2032. The On-premises market is expected to witness a CAGR of 11.4% during (2025 - 2032).

Free Valuable Insights: The Telecom Order Management Market is Predicted to reach USD 9.79 Billion by 2032, at a CAGR of 11.2%

China has one of the most advanced and large-scale telecom markets in the world. China Mobile, China Telecom, and China Unicom are the three biggest companies in this market, and they handle huge amounts of service across mobile, broadband, enterprise, and IoT. Their digital transformation reports show that BSS/OSS systems are still being updated. Intelligent order management is very important for meeting the needs of 5G, fiber, and IoT provisioning. Policies for "New Infrastructure" pushed by the government speed up the rollout of 5G, FTTH, industrial IoT, and smart cities, which makes orchestration needs even greater. Rapid rollout of 5G SA, more businesses using NB-IoT, and more industries going digital are all driving automation, real-time fulfillment, and the growth of cloud-native technologies. Huawei and ZTE are the main players in the competitive landscape, but Ericsson, Nokia, and Amdocs are also there. As more companies work with cloud providers like Alibaba Cloud and Tencent Cloud, the market changes.

By Network Type

By Component

By Deployment Mode

By Organization Size

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.