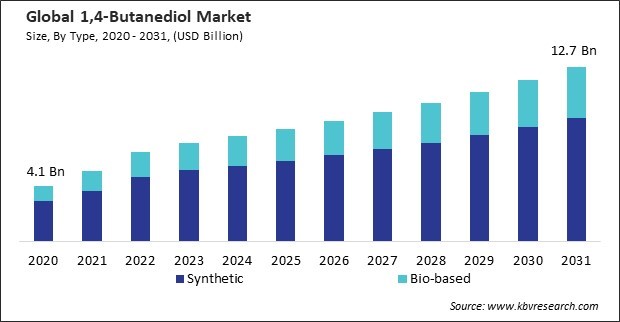

“Global 1,4-Butanediol Market to reach a market value of USD 12.7 Billion by 2031 growing at a CAGR of 7.5%”

The Global 1,4-Butanediol Market size is expected to reach $12.7 billion by 2031, rising at a market growth of 7.5% CAGR during the forecast period.

Europe has been at the forefront of promoting sustainable and eco-friendly manufacturing processes. There is an increasing shift towards the production of bio-based BDO to reduce reliance on fossil fuels. Consequently, the European region would acquire nearly 22% of the total market shar by 2031. Also, the German market would consume 48.48 Kilo Tonnes of this chemical by 2031.

Increased awareness of environmental issues, such as plastic pollution and the impact of non-biodegradable materials on ecosystems, has prompted consumers, businesses, and governments to seek alternative solutions that minimize environmental harm. Many companies commit to sustainability goals and incorporate biodegradable materials into their products and packaging. Therefore, these factors will fuel the demand for this chemical.

Additionally, R&D efforts focus on optimizing manufacturing processes for 1,4-butanediol to improve efficiency, yield, and product quality. Additionally, market players invest in R&D to develop purification technologies and refining processes that yield high-purity 1,4-butanediol with precise specifications. Hence, these aspects will assist in the growth of the market.

However, Regulatory agencies impose strict health and safety regulations governing the handling, storage, transportation, and disposal of BDO and BDO-derived products. Additionally, environmental regulations restrict the release of BDO and its by-products into the environment to prevent pollution and minimize ecological damage. Thus, these factors can decrease demand for this chemical in the coming years.

Based on type, the market is segmented into synthetic and bio based. In 2023, the bio-based segment garnered 28% revenue share in the market. In terms of voluime, the segment registered 2,999.4 kilo tonnes in 2023. Increasing awareness of environmental issues and the need to reduce carbon footprints have driven demand for sustainable and eco-friendly products.

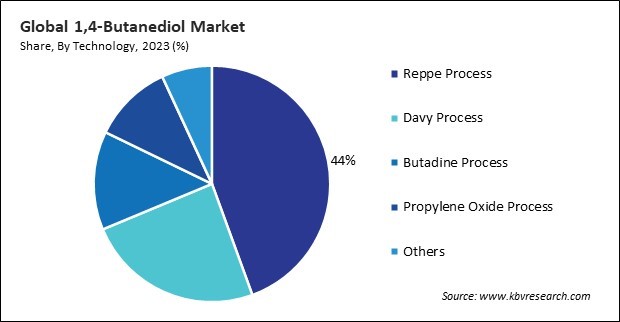

On the basis of technology, the market is divided into Reppe process, Davy process, butadine process, propylene oxide process, and others. The Davy process segment acquired 24% revenue share in the market in 2023. This process, which involves the catalytic hydrogenation of maleic anhydride, has gained traction due to its ability to produce BDO with high selectivity and yield.

On the basis of application, the market is divided into tetrahydrofuran, polybutylene terephthalate, gamma butyrolactone, polyurethane, and others. In 2023, the polybutylene terephthalate segment witnessed 20% revenue share in the market. In terms of volume, the segment registered 2,999.4 kilo tonnes in 2023. Polybutylene terephthalate (PBT) is extensively used in the automotive industry to manufacture components such as connectors, sensor housings, and various under-the-hood parts.

Free Valuable Insights: Global 1,4-Butanediol Market size to reach USD 12.7 Billion by 2031

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 49% revenue share in the market in 2023. BDO is used in the synthesis of pharmaceuticals and personal care products. The growing healthcare sector in the region, coupled with rising consumer awareness and demand for personal care products, contributes to the increased consumption of BDO.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 7.2 Billion |

| Market size forecast in 2030 | USD 12.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.5% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, CAGR from 2020-2031 |

| Number of Pages | 318 |

| Tables | 641 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Technology, Application, Region |

| Country scope |

|

| Companies Included | Lonza Group Ltd., BASF SE, Mitsubishi Chemical Holdings Corporation, Nan Ya Plastics Corp. (NPC), Sipchem Company, Ashland Inc., INEOS Group Holdings S.A., Evonik Industries AG (RAG-Stiftung), LyondellBasell Industries Holdings B.V. and Sinopec Group (China Petrochemical Corporation) |

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Technology

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

This Market size is expected to reach $12.7 billion by 2031.

Surge in demand for biodegradable plastics and green chemicals are driving the Market in coming years, however, HRegulatory constraints and compliance challenges restraints the growth of the Market.

Lonza Group Ltd., BASF SE, Mitsubishi Chemical Holdings Corporation, Nan Ya Plastics Corp. (NPC), Sipchem Company, Ashland Inc., INEOS Group Holdings S.A., Evonik Industries AG (RAG-Stiftung), LyondellBasell Industries Holdings B.V. and Sinopec Group (China Petrochemical Corporation)

The expected CAGR of this Market is 7.5% from 2024 to 2031.

The Reppe Process segment led the Market by Technology in 2023; thereby, achieving a market value of $5.4 billion by 2031.

The Asia Pacific region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $6.1 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges