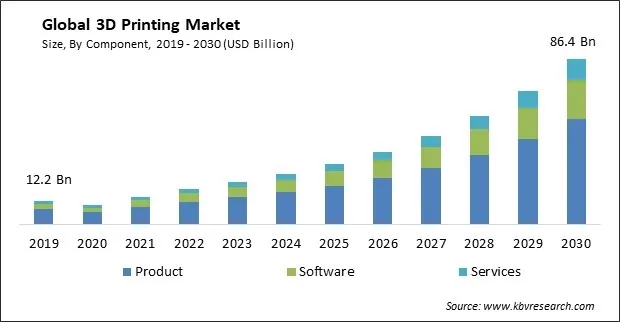

The Global 3D Printing Market size is expected to reach $86.4 billion by 2030, rising at a market growth of 21.4% CAGR during the forecast period.

3D printing is transforming healthcare by allowing the production of patient-specific implants, prosthetics, and anatomical models for surgical planning. Consequently, the Healthcare segment would register 1/5th share in the market by 2030. This technology improves patient outcomes, reduces surgery times, and enhances medical training. The dental industry benefits from 3D-printed crowns, bridges, and orthodontic devices. Drug delivery systems and tissue engineering applications have also emerged, offering promising solutions for personalized medicine and regenerative therapies. The efficiency, precision, and customization capabilities of 3D printing in healthcare significantly impacts patient care and the medical field's overall advancement.

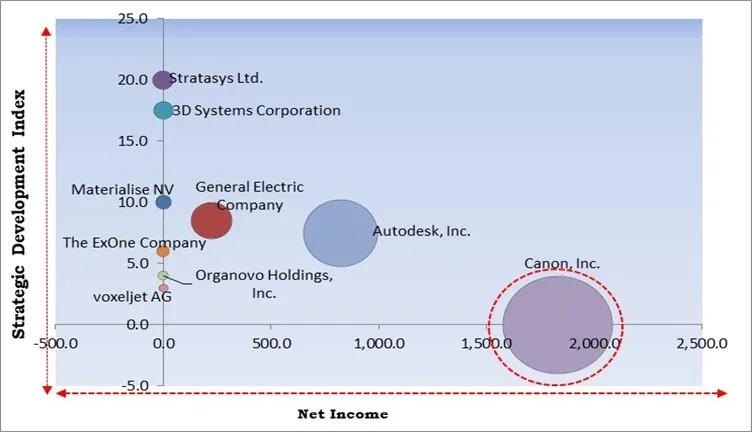

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Voxeljet AG unveiled Cold IOB, a new inorganic 3D process technology. This launch would be an important step towards further adoption of printed cores and molds with inorganic binders in the foundry industry. Additionally, In June, 2022, Stratasys unveiled Stratasys RadioMatrix, to produce ‘radio-realistic models’ that could be under CT scans & X-rays.

Based on the Analysis presented in the KBV Cardinal matrix; Canon, Inc. is the forerunner in the 3D Printing Market. Companies such as Autodesk, Inc., Stratasys Ltd., and 3D Systems Corporation are some of the key innovators in 3D Printing Market. In May, 2022, Stratasys launched F190 CR and F370 CR machines, F123 Series of FDM 3D printers, and FDM Nylon-CF10 material, new carbon fiber-reinforced, developed for manufacturers & industrial machinists to produce end-use components, and jigs, fixtures & work holding tools.

Governments worldwide recognize the potential of 3D printing to drive innovation, boost local manufacturing, and address various societal challenges. China has made significant investments in 3D printing as part of its "Made in China 2025" initiative, which aims to upgrade its manufacturing capabilities. The German government has supported various 3D printing projects and research initiatives, especially in Industry 4.0. Germany's Fraunhofer Institute, a leading research organization, has been involved in numerous additive manufacturing projects. Some governments offer tax incentives and subsidies to encourage the adoption of 3D printing in manufacturing and small businesses. These incentives can help reduce the initial investment required for 3D printing equipment and materials. Thus, the rising support from government bodies is enabling the expansion of the market.

The expansion of the global manufacturing sector profoundly impacts the 3D printing market. One significant effect is the growing adoption of 3D printing technology across various manufacturing industries. As manufacturers seek to streamline their production processes, reduce lead times, and improve cost efficiency, 3D printing offers an attractive solution. Moreover, the expansion has led to greater collaboration between traditional manufacturing processes and 3D printing. Companies are integrating 3D printing to create tooling, molds, and prototypes, supporting a seamless transition from design to production. Therefore, the expansion of the global manufacturing sector has significantly impacted the 3D printing market by driving adoption, fostering innovation, promoting on-demand production, and encouraging collaboration between 3D printing and traditional manufacturing processes.

The high initial costs associated with 3D printing technology can significantly hinder its broader adoption and growth. For many businesses and organizations, especially smaller enterprises, the substantial upfront investment required to acquire 3D printing equipment and related infrastructure can be a deterrent. These costs encompass the purchase of the 3D printer itself and the expenditure on materials, software, and maintenance. Consequently, the restricted material selection can hinder the adoption of 3D printing in industries that demand a broader range of material options for their production needs. Thus, the high initial costs and limited material selection significantly deter the growth of the 3D printing market.

Based on components, the 3D printing market is characterized into product, software, and services. The services segment procured a considerable growth rate in the 3D printing market in 2022. The service segment is gaining significant momentum as a source of profit generation as a result of advancements in printing technology and materials. Many businesses across various industries are anticipated to outsource everything, from product design to production, to survive in the fiercely competitive markets, as 3D printing technology makes it possible to manufacture products with complicated shapes and presents competitive pricing in contrast to traditional manufacturing methods.

The product segment is further segmented into printer and material. The printer segment acquired the largest revenue share in the 3D printing market in 2022. 3D printers are versatile tools that offer rapid prototyping, enabling designers to quickly iterate and test their concepts. These printers are cost-effective for low-volume production, promote customization, and reduce material waste. They support on-demand and localized manufacturing, shortening supply chains, and can serve as educational tools.

The printer segment is further bifurcated into industrial and desktop. The desktop segment garnered a remarkable growth rate in the revenue share in the 3D printing market in 2022. Desktop 3D printers are typically more budget-friendly than industrial-grade counterparts, making them accessible to individuals, hobbyists, small businesses, and educational institutions with limited budgets. Many desktop 3D printers are designed to be user-friendly and require minimal setup. They often come with intuitive software interfaces that simplify the 3D printing process, making it accessible to beginners.

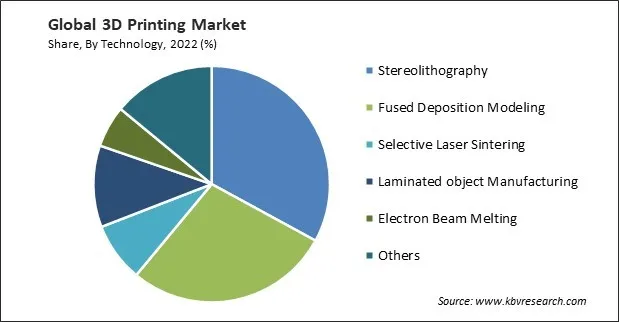

By technology, the 3D printing market is segmented into stereolithography, selective laser sintering, electron beam melting, fused deposition modeling, laminated object manufacturing, and others. The stereolithography segment garnered the maximum revenue share in the 3D printing market in 2022. Stereolithography (SLA) is known for its exceptional precision and surface finish. It excels at producing highly detailed and intricate parts, making it ideal for jewelry, dentistry, and medical field applications. SLA's ability to create complex geometries with minimal support structures reduces post-processing efforts, saving time and resources.

Based on application, the 3D printing market is classified into education/research, visual aids, presentation modeling, fit & assembly, prototype tooling, metal casting, functional parts, and others. The fit and assembly segment witnessed a remarkable growth rate in the 3D printing market in 2022. 3D printing's precision in creating parts with exact fit and assembly capabilities is invaluable. It enables the production of seamlessly integrated components, reducing the need for post-processing adjustments. This leads to enhanced product quality, streamlined manufacturing, and reduced assembly time. The technology also supports just-in-time production, eliminating excess inventory and reducing storage costs.

On the basis of vertical, the 3D printing market is fragmented into education, industrial, automotive, aerospace & defense, healthcare, consumer goods, construction, and others. The aerospace and defense segment recorded a considerable growth rate in the 3D printing market in 2022. 3D printing has become a game-changer in the aerospace and defense sectors by significantly reducing the weight of aircraft and spacecraft components, enhancing fuel efficiency, and lowering production costs. The technology allows for the rapid prototyping and production of complex, lightweight, and high-strength parts, which translates to improved performance, reduced maintenance needs, and faster innovation cycles.

On the basis of software, the 3D printing market is divided into design software, inspection software, printer software, and scanning software. The design software segment recorded the largest revenue share in the 3D printing market in 2022. 3D design software offers a plethora of benefits. It empowers designers and engineers to create intricate 3D models with precision and ease, facilitating rapid prototyping and product development. They often include design validation and analysis features, helping identify and address potential issues early in the design process.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 18.6 Billion |

| Market size forecast in 2030 | USD 86.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 21.4% from 2023 to 2030 |

| Number of Pages | 551 |

| Number of Table | 934 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Technology, Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the 3D printing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region procured the maximum revenue share in the 3D printing market in 2022. North American manufacturers increasingly use 3D printing for low-volume and small-batch production runs. The COVID-19 pandemic underscored the importance of supply chain resilience. 3D printing supports localized and on-demand manufacturing, reducing reliance on global supply chains and ensuring a more resilient production process. North America's healthcare industry has embraced 3D printing for applications like patient-specific implants, surgical guides, and medical devices. These applications improve patient outcomes, reduce surgery times, and enhance medical treatment.

Free Valuable Insights: Global 3D Printing Market size to reach USD 86.4 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hoganas AB, 3D Systems Corporation, Materialise NV, General Electric Company, Stratasys Ltd., Autodesk, Inc., The ExOne company (Desktop Metal, Inc.), Organovo Holdings, Inc., voxeljet AG and Canon, Inc.

By Component

By Technology

By Application

By Vertical

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.