“Global 5G Enterprise Private Network Market to reach a market value of USD 43.3 Billion by 2031 growing at a CAGR of 48.9%”

The Global 5G Enterprise Private Network Market size is expected to reach $43.3 billion by 2031, rising at a market growth of 48.9% CAGR during the forecast period.

The manufacturing sector is driven by the increasing need for automation, robotics, and IoT-powered processes, all of which require the high-speed, low-latency capabilities of 5G networks. As manufacturers embrace smart factories, they depend on real-time data collection, machine-to-machine communication, and predictive maintenance, improving operational efficiency and reducing downtime. Consequently, the manufacturing segment procured 28% revenue share in the market in 2023. 5G private networks provide the reliable, high-performance connectivity necessary for these advanced applications, making it a critical technology for the digital transformation of manufacturing operations.

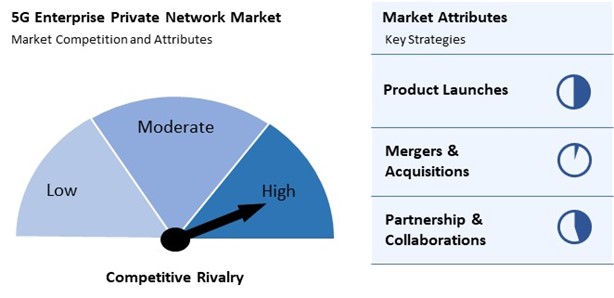

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2024, Hewlett Packard Enterprise unveiled HPE Aruba Networking Enterprise Private 5G, designed to simplify private 5G network deployment in large environments. Additionally, In June, 2024, Vodafone Group Plc unveiled a Raspberry Pi–based private 5G base station aimed at developers to drive private 5G innovation, targeting developers to drive innovation in the field.

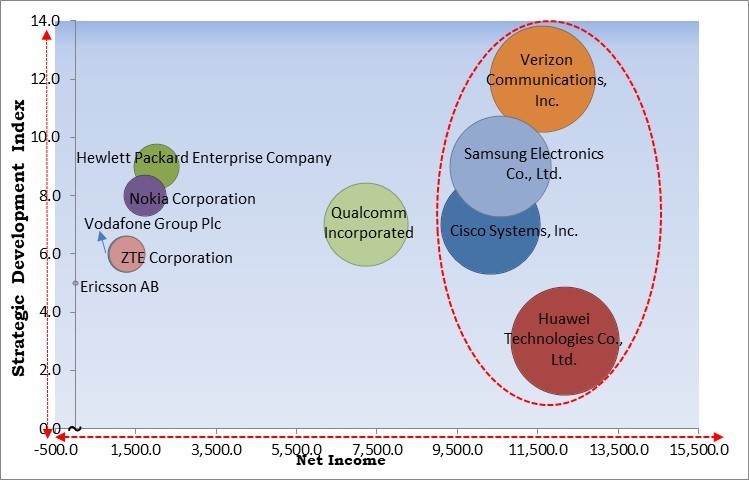

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc., Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., and Verizon Communications, Inc. are the forerunners in the 5G Enterprise Private Network Market. In May, 2024, Verizon Communications, Inc. unveiled the first phase of certifying Nokia Digital Automation Cloud (DAC) for its private network offerings. Companies such as Hewlett Packard Enterprise Company, Qualcomm Incorporated, and Nokia Corporation are some of the key innovators in 5G Enterprise Private Network Market.

The faster data transfer speeds offered by 5G networks enable handling large volumes of data in real-time. This allows for more efficient communication between devices, systems, and users, supporting the increasing demand for data-driven applications and services. With higher bandwidth and faster speeds, 5G private networks can accommodate a wide range of connected devices and applications without experiencing congestion or reduced performance, even under heavy traffic conditions. Hence, the superior network performance of 5G is a major driver of its adoption in private network settings.

The integration of edge computing with 5G improves data privacy and security by allowing sensitive data to be processed locally rather than being transmitted over vast distances. This minimizes the risk of data breaches and supports industries with strict regulatory requirements. Thus, integrating 5G networks with edge computing is a powerful driver for expanding the 5G enterprise private network market.

The absence of a clear and standardized regulatory framework around spectrum allocation also contributes to uncertainty in the market. Many enterprises hesitate to invest in 5G private networks when unsure whether they will have long-term access to the necessary spectrum. The potential for changes in government policy, spectrum reallocation, or new regulations adds another layer of risk for companies considering 5G investments. Without the certainty of reliable and easy spectrum access, businesses may delay their decision to deploy private networks, further hindering market growth. Thus, access to spectrum may hamper the growth of the market.

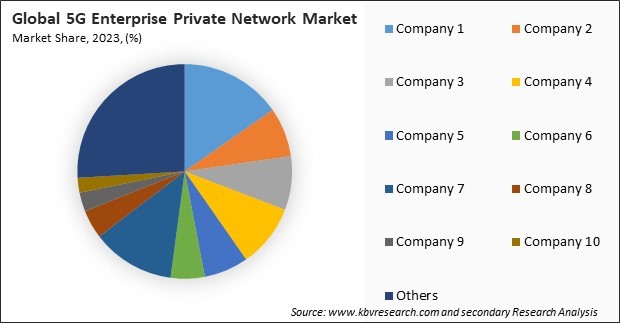

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration above shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on component, the market is classified into hardware, software, and services. The software segment procured 34% revenue share in the market in 2023. With the complexity of 5G networks, enterprises rely on software-defined networking (SDN), network function virtualization (NFV), and AI-powered solutions to optimize network performance, automate processes, and ensure security. The demand for real-time analytics, network slicing, and traffic management is also contributing to the growth of this segment as businesses seek to maximize the efficiency and flexibility of their private 5G networks.

On the basis of the frequency band, the market is bifurcated into sub-6 GHz and mmWave. The mmWave segment recorded 34% revenue share in the market in 2023. mmWave frequencies provide incredibly fast data rates and support a high density of connected devices. This makes them especially appealing for industries like healthcare, smart cities, and high-tech manufacturing, where precise, real-time data is critical. mmWave's ability to deliver unparalleled performance in dense urban environments or high-demand applications has contributed to its growing adoption in the 5G enterprise private network market.

By organization size, the market is divided into large enterprises and small & medium-sized enterprises. The large enterprises segment witnessed 63% revenue share in the market in 2023. Large organizations, especially in manufacturing, energy, healthcare, and logistics sectors, have the financial resources and technological infrastructure needed to deploy and manage private 5G networks at scale. These enterprises are increasingly adopting 5G to enhance operational efficiency, enable automation, and support large-scale IoT deployments requiring robust, secure, high-performance networks.

Based on industry vertical, the market is segmented into BFSI, manufacturing, energy & utilities, retail, government, public safety, office building, and others. The energy & utilities segment acquired 15% revenue share in the market in 2023. The energy and utilities sector increasingly relies on 5G private networks to support real-time monitoring, remote management, and automation across vast areas, such as power grids, oil rigs, and renewable energy installations. 5G's low-latency, secure communication capabilities are essential for managing critical infrastructure and ensuring continuous power distribution and smart metering operations.

Free Valuable Insights: Global 5G Enterprise Private Network Market size to reach USD 43.3 Billion by 2031

The 5G Enterprise Private Network Market is witnessing fierce competition as organizations seek secure, high-performance networks tailored to their specific needs. Providers are competing to offer private 5G solutions that deliver enhanced security, low latency, and greater control over network operations. Industries such as manufacturing, logistics, and healthcare are driving demand for these private networks to support mission-critical applications. As enterprises increasingly adopt 5G for improved connectivity and automation, the competition revolves around offering highly customizable and scalable solutions.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 38% revenue share in the market in 2023. The high demand for advanced network solutions in key sectors like manufacturing, healthcare, and logistics largely drives this growth. The region's strong industrial base, combined with significant investment in digital transformation and automation, has made it a leader in adopting private 5G networks.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.9 Billion |

| Market size forecast in 2031 | USD 43.3 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 48.9%from 2024 to 2031 |

| Number of Pages | 321 |

| Number of Tables | 473 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Frequency Band, Organization Size, Component, Industry Vertical, Region |

| Country scope |

|

| Companies Included | Nokia Corporation, Vodafone Group Plc, Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Samsung Electronics Co., Ltd. (Samsung Group), Verizon Communications, Inc., Ericsson AB, ZTE Corporation, Hewlett Packard Enterprise Company, Qualcomm Incorporated (Qualcomm Technologies, Inc.) |

By Frequency Band

By Organization Size

By Component

By Industry Vertical

By Geography

This Market size is expected to reach $43.3 billion by 2031.

Enhanced Network Performance and Low Latency are driving the Market in coming years, however, High Capital Expenditure and Complexity restraints the growth of the Market.

Nokia Corporation, Vodafone Group Plc, Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Samsung Electronics Co., Ltd. (Samsung Group), Verizon Communications, Inc., Ericsson AB, ZTE Corporation, Hewlett Packard Enterprise Company, Qualcomm Incorporated (Qualcomm Technologies, Inc.)

The expected CAGR of this Market is 48.9% from 2024 to 2031.

The Sub-6 GHz segment is leading the Market by Frequency Band in 2023; thereby, achieving a market value of $27.5 billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $15.8 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges