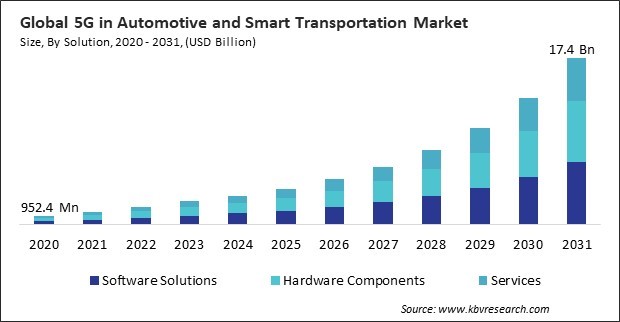

“Global 5G in Automotive and Smart Transportation Market to reach a market value of 17.4 Billion by 2031 growing at a CAGR of 28.3%”

The Global 5G in Automotive and Smart Transportation Market size is expected to reach $17.4 billion by 2031, rising at a market growth of 28.3% CAGR during the forecast period.

5G technology has revolutionized logistics by facilitating quicker and more dependable connectivity between supply chain systems, warehouses, and automobiles. This has enhanced the efficiency of operations in areas such as real-time tracking, route optimization, and inventory management. The ability to handle large volumes of data with low latency makes 5G essential for optimizing logistics and warehousing processes, contributing to the sector’s growing revenue share in the smart transportation and automotive market. Thus, In 2023, the warehousing & logistics segment procured 18% revenue share in the 5G in automotive and smart transportation market.

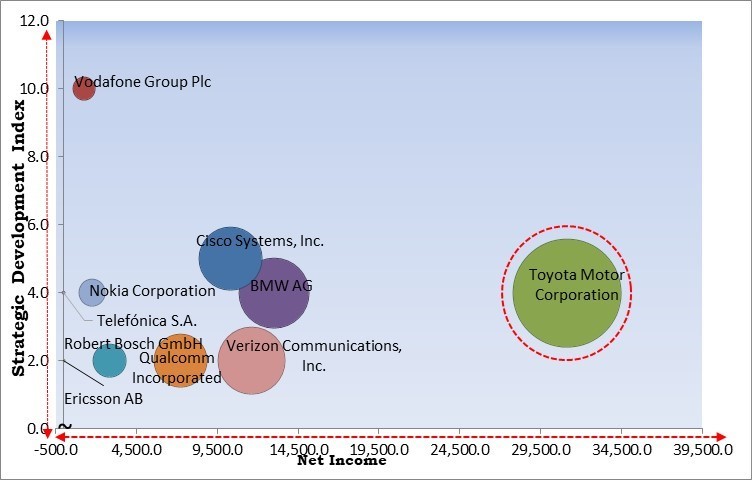

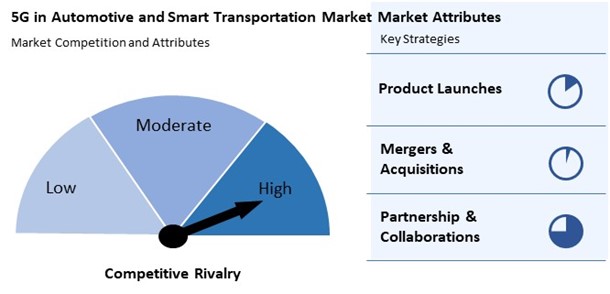

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2024, Qualcomm Incorporated and Google have partnered to develop generative AI-enabled digital cockpits and software-defined vehicles (SDVs). Their collaboration focuses on creating a standardized platform leveraging 5G technologies, Snapdragon chips, and Google Cloud to enhance real-time updates, voice assistants, and vehicle connectivity. Additionally, In September, 2024, Robert Bosch GmbH and Pirelli collaborate on intelligent tyre technology, integrating Pirelli's sensors with Bosch's software to enhance safety, comfort, and driving dynamics. The system processes real-time tyre data for vehicle stability, advancing connected and autonomous driving technologies.

Based on the Analysis presented in the KBV Cardinal matrix; Toyota Motor Corporation is the forerunners in the 5G in Automotive and Smart Transportation Market. Companies such as Cisco Systems, Inc. and Vodafone Group Plc and BMW AG are some of the key innovators in 5G in Automotive and Smart Transportation Market. In March, 2023, Vodafone partnered with Zaragoza City Council to launch Europe's first 5G-connected smart bus, enabling real-time communication with city infrastructure. The electric bus features automated driving, obstacle detection, and energy efficiency, supporting sustainable mobility and advancing autonomous transport technologies.

The automotive industry is witnessing a dramatic shift toward smarter vehicles, with enhanced connectivity and autonomous driving technologies being the central focus. 5G technology is crucial to satisfying consumer demands for increasingly sophisticated car capabilities, like real-time navigation, over-the-air software updates, and vehicle-to-vehicle communication.

Additionally, the increasing availability of 5G networks also provides an economic boost to the smart transportation sector by fostering innovation and attracting investment. As 5G technology becomes more ubiquitous, automakers and tech companies are more likely to collaborate on developing next-generation smart vehicles and transportation systems. Hence, the expansion of the 5G technology rollout worldwide is hindering the market's growth.

While 5G offers transformative potential for the automotive and smart transportation industry, the high costs associated with deploying 5G infrastructure are a significant barrier to widespread adoption. The deployment of 5G networks requires massive investments in base stations, fiber optics, and other components, which can be a financial burden for governments and private enterprises, especially in regions with less-developed infrastructure. Therefore, high infrastructure costs for 5G deployment in transportation networks impede the market's growth.

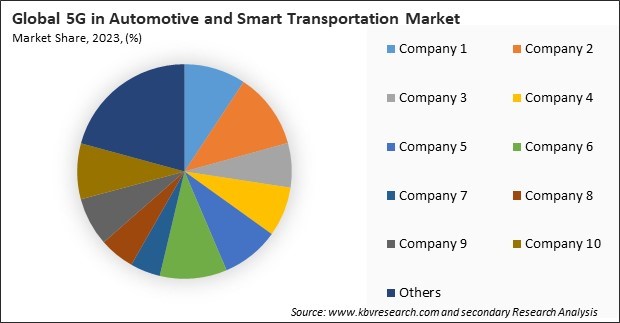

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

The hardware segment is further subdivided into telematics control units (TCUs), roadside units (RSUs), and onboard units (OBUs). In 2023, the telematics control units (TCUs) segment garnered 42% revenue share in the market. TCUs enable connectivity and communication between vehicles and infrastructure, such as traffic signals and roadside systems, through 5G networks.

The services segment is further subdivided into integration & installation services, consultation services, and maintenance and support services. The consultation services segment held 29% revenue share in the market in 2023. As the automotive and smart transportation industries adopt 5G technologies, consultation services are crucial in guiding businesses through the complexities of 5G adoption, network design, and strategic planning.

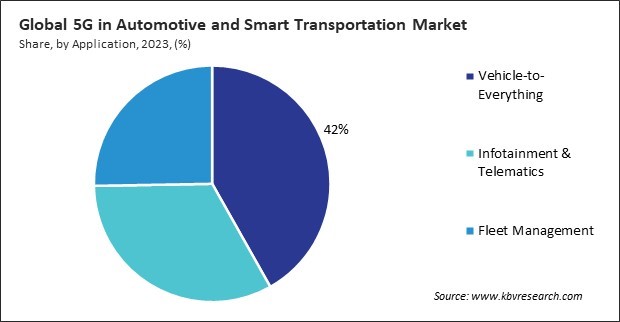

On the basis of application, the market is segmented into vehicle-to-everything, infotainment & telematics, and fleet management. In 2023, the infotainment & telematics segment attained 33% revenue share in the market. Infotainment and telematics systems, which provide entertainment, navigation, and vehicle diagnostics, increasingly rely on 5G connectivity for faster data transfer and seamless user experiences.

By industry, the market is divided into automotive, defense, transportation infrastructure, warehousing & logistics, public safety, and others. In 2023, the automotive segment registered 33% revenue share in the market. The automotive industry has been at the forefront of adopting 5G technology to enable innovations like autonomous driving, advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication.

Based on solution, the market is divided into hardware components, software solutions, and services. In 2023, the software solutions segment attained 40% revenue share in the market. This is largely due to the growing reliance on software to enable advanced features like real-time traffic management and autonomous driving. Software solutions are critical in processing and analyzing the vast amounts of data generated by 5G-enabled vehicles and infrastructure.

Free Valuable Insights: Global 5G in Automotive and Smart Transportation Market size to reach USD 17.4 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated 31% revenue share in the market in 2023. This growth is largely driven by countries like India, China, Japan, and South Korea investing heavily in 5G infrastructure and automotive technologies.

The 5G in Automotive and Smart Transportation Market is highly competitive, driven by the increasing demand for remote healthcare solutions and enhanced patient care. Providers are focused on developing innovative monitoring devices that offer real-time data on vital signs, enabling healthcare professionals to make informed decisions promptly. As the shift towards telehealth and home healthcare continues, competition intensifies around features such as connectivity, accuracy, and user-friendliness. Additionally, integration with electronic health records and wearable technology is essential for maintaining a competitive edge in this rapidly evolving market.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 2.5 Billion |

| Market size forecast in 2031 | USD 17.4 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 28.3% from 2024 to 2031 |

| Number of Pages | 376 |

| Tables | 552 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Solution, Application, Industry, Region |

| Country scope |

|

| Companies Included | BMW AG, Robert Bosch GmbH, Cisco Systems, Inc., Vodafone Group Plc, Nokia Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Telefónica S.A., Verizon Communications, Inc., Toyota Motor Corporation and Ericsson AB |

By Solution

By Application

By Industry

By Geography

This Market size is expected to reach $17.4 billion by 2031.

Increased demand for enhanced vehicle connectivity and autonomous driving technologies are driving the Market in coming years, however, High infrastructure costs for 5G deployment in transportation networks restraints the growth of the Market.

BMW AG, Robert Bosch GmbH, Cisco Systems, Inc., Vodafone Group Plc, Nokia Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Telefónica S.A., Verizon Communications, Inc., Toyota Motor Corporation and Ericsson AB

The expected CAGR of this Market is 28.3% from 2024 to 2031.

The Vehicle-to-Everything segment is leading the Market by Application in 2023; thereby, achieving a market value of $6.9 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $6.1 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges