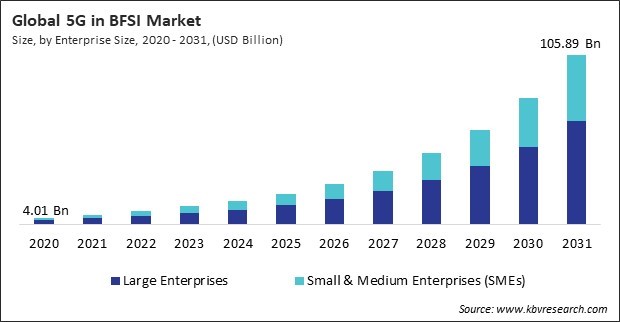

“Global 5G in BFSI Market to reach a market value of USD 105.89 Billion by 2031 growing at a CAGR of 32.5%”

The Global 5G in BFSI Market size is expected to reach $105.89 billion by 2031, rising at a market growth of 32.5% CAGR during the forecast period.

The North America segment witnessed 36% revenue share in this market in 2023. North America dominates the industry because of its early adoption of 5G networks, high smartphone penetration, and sophisticated technological infrastructure. The region’s well-established financial institutions invest heavily in digital transformation to improve customer experiences and operational efficiencies.

The increasing digitalization of the BFSI sector has brought unprecedented convenience and efficiency to financial operations. However, it has also exposed the industry to heightened risks of cyber threats such as data breaches, identity theft, phishing attacks, and ransomware. According to the Association of Certified Fraud Examiners (ACFE), organizations worldwide lose an estimated 5% of revenue to fraud each year, underscoring the need for robust detection mechanisms. Consequently, as the BFSI sector undergoes digital transformation, the necessity for comprehensive cybersecurity measures becomes increasingly urgent.

Additionally, The integration of IoT and AI technologies in the BFSI sector is transforming customer experiences and operational efficiencies. IoT devices, such as connected ATMs, smart branches, and wearable payment solutions, leverage 5G’s high-speed and low-latency connectivity to provide seamless and real-time services. Connected ATMs can be managed remotely, reducing downtime, while smart branches use IoT sensors to enhance service personalization and optimize operations. Thus, IoT, AI, and 5G synergy is revolutionizing the BFSI sector by enabling smarter, faster, and more secure financial services.

However, The BFSI sector, being a custodian of sensitive customer data such as personal, financial, and transactional information, faces significant risks when adopting new technologies like 5G. The introduction of 5G brings enhanced connectivity and higher data transmission speeds, enabling BFSI institutions to streamline operations and offer advanced services. Hence, these factors may hamper the expansion of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on enterprise size, the 5G in BFSI market is bifurcated into large enterprises and small & medium enterprises (SMEs). The small & medium enterprises (SMEs) segment procured 37% revenue share in this market in 2023. The adaptability and agility of SMEs make them well-suited to explore cost-effective 5G applications that enhance customer engagement and streamline operations. Technologies such as video-based KYC, mobile banking enhancements, and IoT-driven solutions empower SMEs to cater to customer demands efficiently.

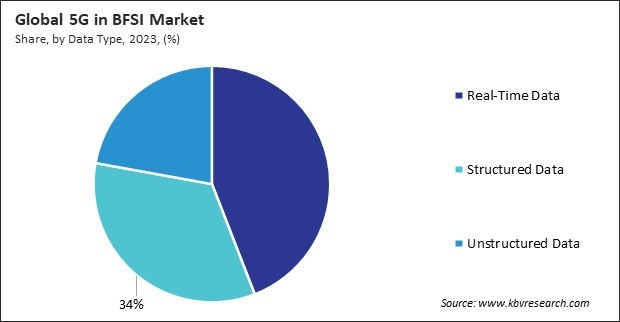

On the basis of data type, the 5G in BFSI market is classified into real-time data, structured data, and unstructured data. The structured data segment recorded 34% revenue share in this market in 2023. Structured data, including transaction records, customer profiles, and regulatory reports, benefits significantly from 5G's ability to efficiently manage large volumes of organized information. Financial institutions leverage 5G technology to optimize data storage, retrieval, and analysis, enabling improved decision-making and personalized financial offerings.

By service, the 5G in BFSI market is divided into managed services, consulting services, and professional services. The consulting services segment garnered 35% revenue share in this market in 2023. These services help BFSI players understand the potential applications of 5G, assess infrastructure readiness, and develop strategic implementation roadmaps. Consulting providers assist in identifying tailored use cases, ensuring regulatory compliance, and mitigating cybersecurity risks associated with 5G deployment.

Based on deployment type, the 5G in BFSI market is segmented into cloud-based, on-premises, and hybrid. The on-premises segment acquired 28% revenue share in this market in 2023. Institutions dealing with sensitive financial data often opt for on-premises solutions to maintain compliance with regulatory standards and reduce cybersecurity risks. 5G enhances the efficiency of on-premises deployments by enabling high-speed connectivity for localized networks, ensuring reliability and minimizing latency.

On the basis of application, the 5G in BFSI market is divided into mobile banking & payments, fraud detection & security, real-time trading & investment services, customer service (chatbots, AI), smart branches & ATMs, and others. The fraud detection & security segment witnessed 24% revenue share in this market in 2023. The enhanced capabilities of 5G, including real-time data processing and low latency, empower institutions to detect and respond to fraudulent activities more effectively. Large datasets may be analyzed in real-time by sophisticated AI and machine learning algorithms to spot unusual trends.

By technology, the 5G in BFSI market is segmented into mobile connectivity, AI & ML, cloud computing, IoT, Blockchain, edge computing, and others. The AI & ML segment acquired 20% revenue share in this market in 2023. Financial institutions leverage AI and ML for real-time fraud detection, personalized customer experiences, and predictive analytics. For example, AI-driven chatbots like Bank of America’s Erica and advanced risk assessment tools rely on 5G’s high-speed connectivity to analyze vast datasets instantly and provide tailored solutions.

Free Valuable Insights: Global 5G in BFSI Market size to reach USD 105.89 Billion by 2031

Region-wise, the 5G in BFSI market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment garnered 32% revenue share in this market in 2023. European financial institutions leverage 5G to comply with stringent data privacy regulations like GDPR while improving operational efficiency. The region's emphasis on fintech innovation and integration of AI in financial services creates a favorable environment for 5G adoption.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 11.28 Billion |

| Market size forecast in 2031 | USD 105.89 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 32.5% from 2024 to 2031 |

| Number of Pages | 408 |

| Number of Tables | 670 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Enterprise Size, Data Type, Service, Deployment Type, Application, Technology, Region |

| Country scope |

|

| Companies Included | Vodafone Group Plc, Telefónica S.A., AT&T Inc., Verizon Communications, Inc., Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Samsung Electronics Co., Ltd. (Samsung Health), ZTE Corporation, and Qualcomm Incorporated (Qualcomm Technologies, Inc.) |

By Enterprise Size

By Data Type

By Service

By Deployment Type

By Application

By Technology

By Geography

This Market size is expected to reach $105.89 billion by 2031.

Rise In Cybersecurity Needs In The BFSI Sector are driving the Market in coming years, however, Cybersecurity And Data Privacy Concerns restraints the growth of the Market.

Vodafone Group Plc, Telefónica S.A., AT&T Inc., Verizon Communications, Inc., Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Samsung Electronics Co., Ltd. (Samsung Health), ZTE Corporation, and Qualcomm Incorporated (Qualcomm Technologies, Inc.)

The expected CAGR of this Market is 32.5% from 2024 to 2031.

The Mobile Banking & Payments segment led the maximum revenue in the Market by Application in 2023, thereby, achieving a market value of $37.4 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $36.5 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges