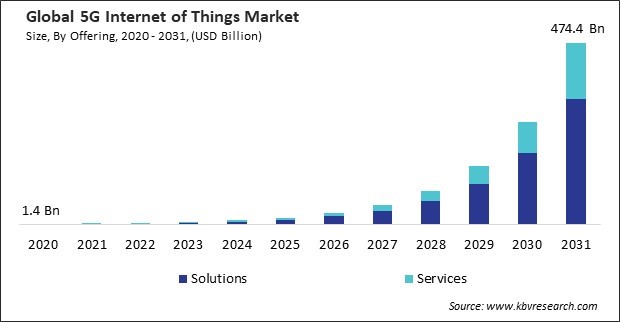

“Global 5G Internet of Things Market to reach a market value of USD 474.4 Billion by 2031 growing at a CAGR of 69.3%”

The Global 5G Internet of Things Market size is expected to reach $474.4 billion by 2031, rising at a market growth of 69.3% CAGR during the forecast period.

The Asia Pacific segment procured 37% revenue share in the 5G Internet of Things market in 2023. The rapid adoption of 5G technology in key countries such as China, Japan, South Korea, and India is expected to account for this substantial share. The region is home to several leading technology manufacturers, strong government support for 5G deployments, and an increasing number of smart city projects.

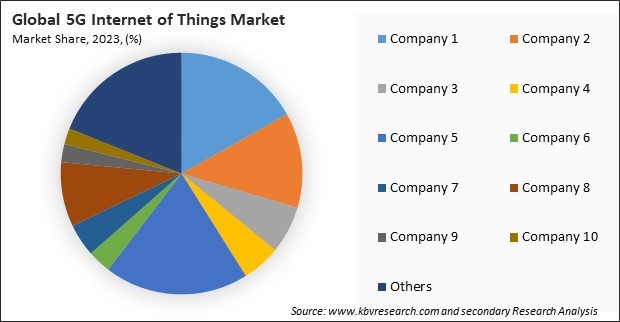

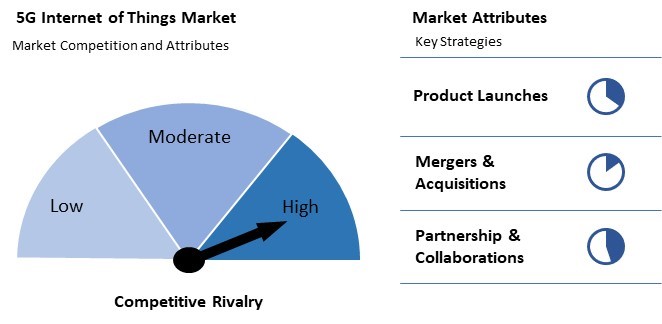

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2020, IBM Corporation announced a partnership with Verizon, a global telecommunications company, to enhance industrial operations by combining Verizon’s 5G and IoT capabilities with IBM’s AI and asset management solutions. Their goal is to improve efficiency in smart factories through real-time monitoring, predictive maintenance, and automation, helping companies boost productivity, safety, and resilience. Moreover, In September, 2024, Nokia Corporation announced a partnership with Rockwell Automation, an automation solutions provider. The aim of the partnership is to enhance industrial connectivity, improve operational efficiency, and increase network customization and security.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation are the forerunners in the 5G Internet of Things Market. In March, 2023, Microsoft Corporation announced a partnership with HFCL, a telecom gear maker, to develop private 5G solutions aimed at enhancing digital transformation for enterprises in various sectors, including manufacturing and retail. Companies such as Huawei Technologies Co., Ltd., IBM Corporation, Verizon Communications, Inc. are some of the key innovators in 5G Internet of Things Market.

The increasing reliance on real-time data processing and the need for seamless communication across various industries has significantly driven the demand for high-speed and low-latency connectivity. As manufacturing, logistics, and healthcare industries embrace digital transformation, the requirements for faster and more reliable network connections have surged, paving the way for adopting Industrial 5G technology. In conclusion, rising demand for high-speed and low-latency connectivity drives the market's growth.

Additionally, Industries are increasingly adopting automation technologies to enhance efficiency and reduce labour costs. Industrial 5G facilitates remote monitoring and control of automated systems, enabling operators to manage processes from afar. The proliferation of Internet of Things (IoT) devices in industrial settings requires reliable, high-speed connectivity to enable real-time data transmission and monitoring. Thus, the increasing need for remote monitoring and control capabilities drives the market's growth.

Transitioning from previous generations of mobile technology (such as 4G) to 5G often requires substantial upgrades to existing infrastructure, including base stations, antennas, and transmission lines. This can involve high capital expenditures, particularly for industries with limited budgets. 5G networks require a denser network of small cells to provide adequate coverage, especially in urban and industrial areas. Installing these small cells incurs significant costs, including site acquisition, installation, and ongoing maintenance. Hence, high infrastructure costs associated with 5G deployment hamper the market's growth.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on offering, this market is bifurcated into solutions and services. The services segment procured 28% revenue share in this market in 2023. This segment includes consulting, integration, and support services for deploying and managing 5G-enabled IoT systems. There has been a rising demand for consulting and managed services that help ensure the smooth integration of 5G IoT solutions into existing infrastructures.

On the basis of enterprise size, this market is classified into large enterprises and small & medium enterprises. The small & medium enterprises segment garnered 35% revenue share in this market in 2023. SMEs leverage 5G IoT services for enhanced connectivity, customer engagement, and operational automation, often relying on cloud-based solutions and managed services to overcome budget constraints.

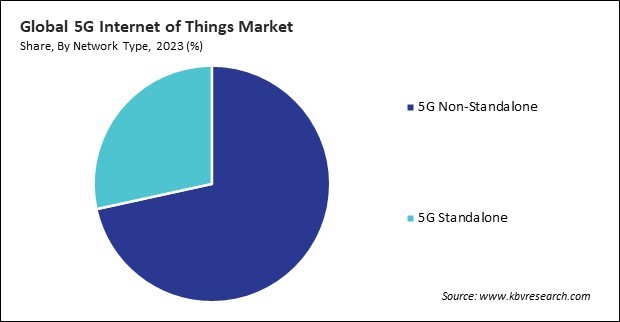

By network type, this market is divided into 5G standalone and 5G non-standalone. The 5G standalone segment acquired 28% revenue share in this market in 2023. The standalone architecture uses an independent 5G core network, offering enhanced capabilities such as ultra-low latency, higher capacity, and network slicing. These features are crucial for supporting advanced IoT applications, such as autonomous vehicles, remote surgery, and mission-critical industrial automation, where the full potential of 5G's capabilities is required.

Based on end user, this market is segmented into manufacturing, healthcare, energy & utilities, transportation & logistics, agriculture, government & public safety, and others. The energy & utilities segment witnessed 23% revenue share in this market in 2023. 5G IoT technology is vital in smart grid development, enabling utilities to optimize energy distribution, manage supply and demand, and improve grid reliability. For instance, smart meters connected through 5G allow for near-instantaneous data transfer, enabling better energy consumption management and reduced operational costs.

Free Valuable Insights: Global 5G Internet of Things Market size to reach USD 474.4 Billion by 2031

The 5G Internet of Things (IoT) market is highly competitive, driven by innovation and demand across industries like healthcare, automotive, and manufacturing. Without key players, smaller firms and new entrants are capitalizing on niche solutions, driving fragmentation. Intense competition fosters rapid advancements in connectivity, efficiency, and scalability.

Region-wise, the 5G Internet of Things market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired 31% revenue share in the 5G Internet of Things market in 2023. The United States and Canada have been actively investing in 5G infrastructure, driven by the increasing demand for faster and more reliable connectivity to support various IoT applications. The presence of major technology companies and telecom operators and the high adoption rate of new technologies have contributed to the region's strong market performance.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 7.4 Billion |

| Market size forecast in 2031 | USD 474.4 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 69.3% from 2024 to 2031 |

| Number of Pages | 344 |

| Number of Tables | 533 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Enterprise Size, Network Type, End User, Region |

| Country scope |

|

| Companies Included | Nokia Corporation, Ericsson AB, ZTE Corporation, IBM Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Verizon Communications, Inc., Microsoft Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Siemens AG, and Thales Group S.A. |

By Offering

By Enterprise Size

By Network Type

By End User

By Geography

This Market size is expected to reach $474.4 billion by 2031.

Rising Demand For High-Speed And Low-Latency Connectivity are driving the Market in coming years, however, High Infrastructure Costs Associated With 5g Deployment restraints the growth of the Market.

Nokia Corporation, Ericsson AB, ZTE Corporation, IBM Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Verizon Communications, Inc., Microsoft Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Siemens AG, and Thales Group S.A.

The expected CAGR of this Market is 69.3% from 2024 to 2031.

The 5G Non-Standalone segment captured the maximum revenue in the Market by Network Type in 2023, thereby, achieving a market value of $330.4 billion by 2031.

The Asia Pacific region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $182.7 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges