“Global 5G Radio Access Network Market to reach a market value of USD 65.68 Billion by 2031 growing at a CAGR of 18.0%”

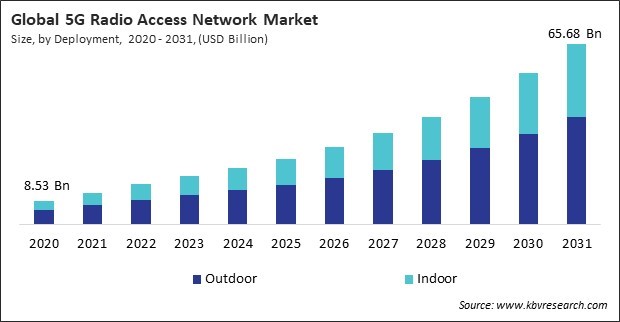

The Global 5G Radio Access Network Market size is expected to reach $65.68 billion by 2031, rising at a market growth of 18.0% CAGR during the forecast period.

The North America region witnessed 39% revenue share in this market in 2023. This is largely due to the robust investments in 5G networks by major telecom companies in the U.S., such as Verizon, AT&T, and T-Mobile. These operators focus on enhancing coverage, speed, and reliability to meet the increasing demand for data and connected services. Government initiatives and the growing adoption of 5G-enabled devices in sectors like healthcare and automotive further contribute to the region's market growth.

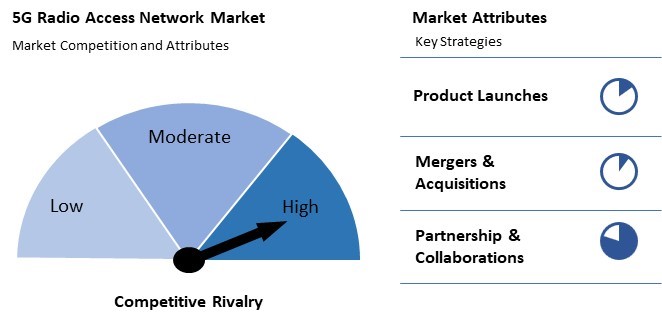

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2024, Ericsson AB partnered with Turkcell for a successful 5G Cloud RAN trial deployment, enhancing Turkcell’s network flexibility and scalability. This collaboration supports Turkcell’s shift toward Open RAN and strengthens digital transformation efforts in Türkiye. Moreover, In November, 2024, Cisco and NEC Corporation has partnered to resell private 5G core network solutions across Europe, the Middle East, and Africa, combining Cisco's technology with NEC's integration services. This collaboration aims to enhance digital transformation for enterprises, impacting this market.

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Cisco Systems, Inc., VMware, Inc., and Verizon Communications, Inc. are the forerunners in the 5G Radio Access Network Market. In February, 2024, Samsung and TELUS are collaborating to establish Canada’s first commercial virtualized and Open RAN network, enhancing performance, flexibility, and energy efficiency. This deployment will leverage Samsung's vRAN technology and multi-vendor solutions, marking a significant advancement in Canadian telecommunications. Companies such as Ericsson AB and Nokia Corporation are some of the key innovators in 5G Radio Access Network Market.

The demand for high-speed data and low-latency services is rapidly increasing as industries and consumers rely more on data-intensive applications. Streaming services, video conferencing, cloud computing, and gaming require vast bandwidth and low latency to function optimally. As 5G networks can support speeds up to 100 times faster than 4G and reduce latency to as low as 1 millisecond, they are ideally suited to meet this demand. Thus, increasing demand for high-speed data and low-latency services drives the market's growth.

Additionally, Governments worldwide heavily invest in 5G infrastructure in their digital transformation agendas. Many nations have launched initiatives to promote the adoption of 5G networks, recognizing that they will be pivotal in advancing economic growth and technological innovation. By providing financial support, regulatory incentives, and policy frameworks that encourage the development of 5G networks, governments are fueling the growth of 5G RAN. Hence, government initiatives and investments in 5G infrastructure propel the market's growth.

However, One of the most significant barriers to the widespread adoption of 5G RAN is the high capital expenditure required for infrastructure deployment. Building a 5G network requires significant investment in new base stations, antennas, fiber optics, other components, and the necessary software and hardware systems for network management. The expense of building out 5G networks, particularly in rural or underserved regions, can be prohibitive for telecom operators, especially those with limited financial resources. Therefore, high capital expenditure for 5G infrastructure deployment hinders market growth.

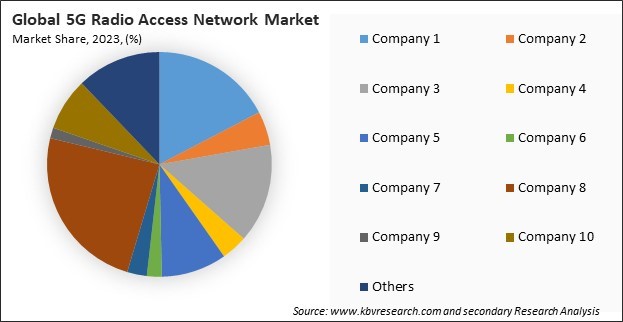

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

On the basis of architecture type, the 5G radio access network market is segmented into CRAN, ORAN, and VRAN. In 2023, the ORAN segment attained 34% revenue share in this market. ORAN is gaining significant traction as it promotes openness, flexibility, and vendor diversification in the 5G ecosystem. Unlike traditional RAN architectures, ORAN is designed to be interoperable across various vendors' hardware and software components. This reduces dependency on a single vendor and enables telecom operators to build more cost-effective and customized networks.

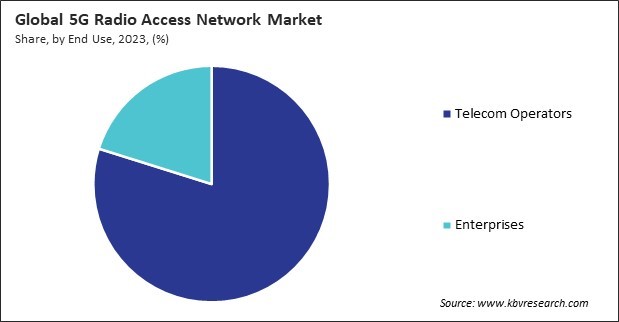

By end use, the 5G radio access network market is divided into telecom operators and enterprises. The enterprises segment procured 20% revenue share in this market in 2023. Enterprises are increasingly adopting 5G technology to support their digital transformation, enhance connectivity for their operations, and leverage advanced applications such as augmented reality, virtual reality, and cloud computing.

Based on deployment, the 5G radio access network market is categorized into outdoor and indoor. The indoor segment witnessed 39% revenue share in this market in 2023. The increasing demand for high-speed internet and improved connectivity inside buildings, such as offices, shopping malls, stadiums, and airports, is driving the growth of indoor 5G deployments. Indoor networks are necessary for addressing connectivity challenges in dense environments where outdoor signals might not penetrate effectively.

Based on component, the 5G radio access network market is divided into hardware, software, and services. In 2023, the software segment held 12% revenue share in this market. This segment includes the various software solutions integral to the management, optimization, and performance of 5G networks. These software solutions are crucial in ensuring efficient radio resource management, network automation, and integration of the different components within the RAN architecture.

Free Valuable Insights: Global 5G Radio Access Network Market size to reach USD 65.68 Billion by 2031

The 5G Radio Access Network (RAN) market is highly competitive without top key players, as it opens opportunities for smaller and emerging companies to innovate and capture niche markets. Focus shifts to cost-effective solutions, energy efficiency, and localized deployments. Regional players and new entrants can thrive by addressing specific customer needs, driving innovation in open RAN technologies, and leveraging partnerships.

Region-wise, the 5G radio access network market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 28% revenue share in this market. This share is driven by the rapid adoption of 5G technology in countries like China, Japan, South Korea, and India. These nations are investing heavily in expanding their 5G networks to support advanced technologies like IoT, smart cities, and autonomous vehicles. Additionally, Asia Pacific has many telecom operators and technology providers, accelerating the growth of 5G infrastructure and services.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 17.73 Billion |

| Market size forecast in 2031 | USD 65.68 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 18.0% from 2024 to 2031 |

| Number of Pages | 470 |

| Number of Tables | 803 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Deployment, Architecture Type, End Use, Region |

| Country scope |

|

| Companies Included | Ericsson AB, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Nokia Corporation, Intel Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Verizon Communications, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), VMware, Inc. (Broadcom Inc.), and ZTE Corporation |

By Deployment

By Component

By Architecture Type

By End Use

By Geography

The Market size is projected to reach USD 65.68 billion by 2031.

Increasing Demand For High-Speed Data And Low Latency Services are driving the Market in coming years, however, High Capital Expenditure For 5G Infrastructure Deployment restraints the growth of the Market.

Ericsson AB, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Nokia Corporation, Intel Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Verizon Communications, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), VMware, Inc. (Broadcom Inc.), and ZTE Corporation

The expected CAGR of this Market is 18.0% from 2024 to 2031.

The Outdoor segment captured the maximum revenue in the Market by Deployment in 2023, thereby, achieving a market value of $39 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $17.6 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges