“Global 5G Radio Frequency Chip (RF Chip) Market to reach a market value of USD 116.68 Billion by 2031 growing at a CAGR of 19.1%”

The Global 5G Radio Frequency Chip (RF Chip) Market size is expected to reach $116.68 billion by 2031, rising at a market growth of 19.1% CAGR during the forecast period.

The rapid expansion of 5G networks and mobile connectivity in India and China is driving significant growth in the market. As global leaders in telecommunications, both nations are experiencing a surge in 5G base station deployments, rising mobile subscriber bases, and increasing data consumption. These advancements are accelerating the demand for RF chips, essential for signal transmission, network efficiency, and seamless connectivity in 5G devices and infrastructure. Thus, the Asia Pacific segment recorded 36% revenue share in the market in 2023.

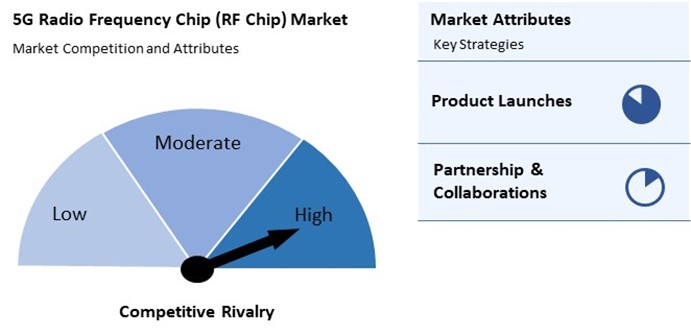

The major strategies followed by the market participants are product launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2024, Qorvo, Inc. unveiled three RF multi-chip modules (MCMs) for advanced radar applications, enhancing performance and reducing size, noise, and power consumption. These compact modules streamline design and assembly, supporting phased array radar systems. Qorvo’s Anokiwave acquisition strengthens its position in high-performance RF solutions for defense and aerospace. Additionally, In January, 2024, Texas Instruments, Inc. unveiled the AWR2544 77 GHz radar sensor for satellite radar architectures, enhancing ADAS decision-making. It features launch-on-package (LOP) technology, reducing sensor size by 30% and extending range beyond 200m. TI also unveiled software-programmable driver chips for safer battery management and powertrains.

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunner in the 5G Radio Frequency Chip (RF Chip) Market. Companies such as Qualcomm Incorporated, Broadcom, Inc., Texas Instruments, Inc. are some of the key innovators in 5G Radio Frequency Chip (RF Chip) Market. In June, 2021, Samsung Electronics Co., Ltd. unveiled its 8nm RF technology, enhancing 5G chip performance with multi-channel and multi-antenna support. Expanding from sub-6GHz to mmWave strengthens Samsung’s RF leadership. Having shipped 500M+ RF chips since 2017, Samsung aims for superior signal quality and efficiency in next-gen wireless communications.

The global push toward faster, more reliable internet connectivity has accelerated the demand for 5G networks, which offer ultra-low latency and high-speed data transmission. The increasing penetration of applications such as high-definition video streaming, cloud gaming, virtual reality (VR), and augmented reality (AR) has heightened the need for efficient RF chips to support these bandwidth-intensive services. Hence, this growing ecosystem of 5G-driven applications is expected to sustain high demand for RF chips in the coming years.

The growing adoption of 5G-capable smartphones and consumer electronics is driving the rapid expansion of 5G technology. Leading smartphone manufacturers like Apple, Samsung, and Xiaomi increasingly integrate 5G RF chips to enhance network performance and cater to evolving consumer demands. Therefore, this trend is expected to sustain the growth of the RF chip industry as 5G penetration continues to expand globally.

Producing advanced RF chips involves complex semiconductor fabrication processes requiring high-precision lithography, advanced materials, and specialized manufacturing equipment. The transition to higher frequency bands, such as mmWave, necessitates using costly materials like gallium nitride (GaN) and silicon-germanium (SiGe), further increasing production expenses. Thus, the high cost of advanced RF chip manufacturing hinders the market's growth.

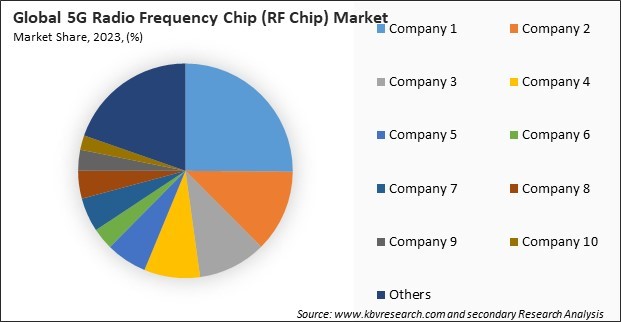

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

On the basis of type of chip, the market is classified into radio frequency integrated circuits (RFICs) and millimeter-wave ICs. The millimeter-wave ICs segment recorded 33% revenue share in the market in 2023. Millimeter-wave ICs are essential for ultra-high-speed data transmission in mmWave 5G networks, which are being deployed in high-density urban environments and for applications requiring low latency, such as autonomous vehicles and AR/VR.

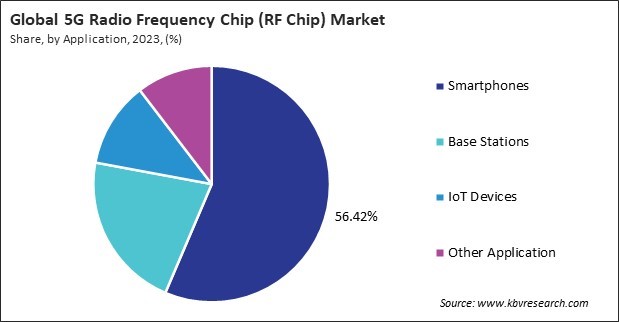

By application, the market is divided into smartphones, base stations, IoT devices, and others. The smartphones segment witnessed 56% revenue share in the market in 2023. The increasing adoption of 5G-enabled smartphones worldwide has been a primary driver of RF chip demand. As consumers shift from 4G to 5G devices, smartphone manufacturers require advanced RF chips to support multiple frequency bands, ensure seamless connectivity, and enhance data transfer speeds.

Based on frequency band, the market is characterized into sub-6 GHz frequency band and mmWave (millimeter wave). The sub-6 GHz frequency band segment garnered 72% revenue share in the market in 2023. This dominance is primarily due to the widespread adoption of sub-6 GHz networks for early-stage 5G deployments, particularly in regions like North America, Europe, and Asia-Pacific. The sub-6 GHz band balances coverage and speed, making it ideal for urban, suburban, and rural deployments.

Free Valuable Insights: Global 5G Radio Frequency Chip (RF Chip) Market size to reach USD 116.68 billion by 2031

The 5G radio frequency (RF) chip market is highly competitive, driven by increasing demand for high-speed connectivity, low latency, and advanced network capabilities. Market players focus on technological advancements, miniaturization, and power efficiency to enhance chip performance. Competition intensifies with the rise of millimeter-wave (mmWave) and sub-6 GHz technologies, requiring continuous innovation. Growing adoption in smartphones, IoT devices, and automotive applications fuels rivalry. Strategic partnerships, R&D investments, and supply chain optimizations play a crucial role in maintaining market leadership.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed 28% revenue share in the market in 2023. The region’s growing emphasis on digital transformation and significant investments in 5G infrastructure by countries like Germany, the UK, and France has propelled market expansion. European telecom providers are actively rolling out 5G services, leading to increased demand for RF chips in base stations and mobile devices.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 29.32 Billion |

| Market size forecast in 2031 | USD 116.68 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 19.1% from 2024 to 2031 |

| Number of Pages | 252 |

| Number of Tables | 342 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Marker Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Frequency Band, Application, Type of Chip, Region |

| Country scope |

|

| Companies Included | Qualcomm Incorporated (Qualcomm Technologies, Inc.), MediaTek, Inc., Skyworks Solutions, Inc., Qorvo, Inc., Broadcom, Inc., Murata Manufacturing Co., Ltd., NXP Semiconductors N.V., Samsung Electronics Co., Ltd. (Samsung Group), Infineon Technologies AG and Texas Instruments, Inc. |

By Frequency Band

By Application

By Type of Chipr

By Geography

This Market size is expected to reach $116.68 billion by 2031.

Rising Demand for High-Speed Connectivity and Low Latency Applications are driving the Market in coming years, however, High Cost of Advanced RF Chip Manufacturing restraints the growth of the Market.

Qualcomm Incorporated (Qualcomm Technologies, Inc.), MediaTek, Inc., Skyworks Solutions, Inc., Qorvo, Inc., Broadcom, Inc., Murata Manufacturing Co., Ltd., NXP Semiconductors N.V., Samsung Electronics Co., Ltd. (Samsung Group), Infineon Technologies AG and Texas Instruments, Inc.

The expected CAGR of this Market is 19.1% from 2023 to 2031.

The Radio Frequency Integrated Circuits (RFICs) segment is leading the Market by Type of Chip in 2023; thereby, achieving a market value of $76.4 billion by 2031.

The Asia Pacific market dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $43.8 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges