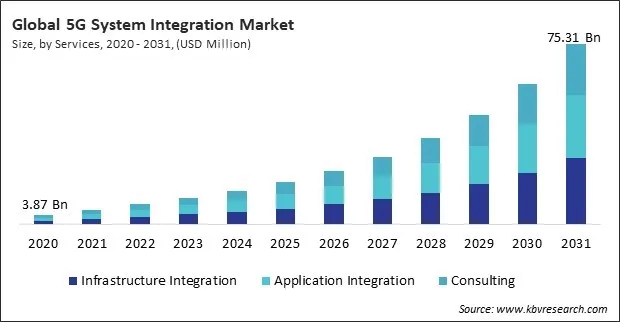

“Global 5G System Integration Market to reach a market value of 75.31 billion by 2031 growing at a CAGR of 27.1%”

The Global 5G System Integration Market is expected to reach $75.31 billion by 2031, rising at a market growth of 27.1% CAGR during the forecast period.

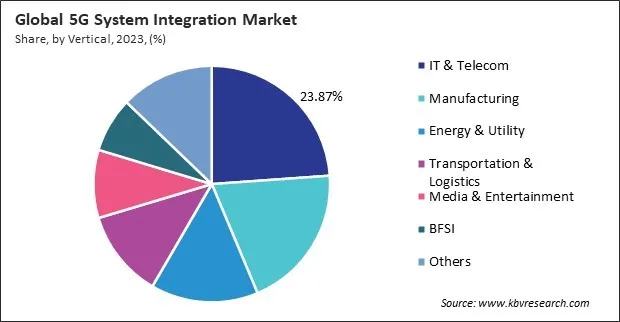

Telecom operators are the primary entities responsible for building the infrastructure needed for 5G technology and ensuring its integration with existing systems. The 5G system integration market’s growth in this vertical is driven by the need to enhance network performance, provide low-latency connections, and meet the growing demands for high-speed data transfer. Telecom companies are also exploring new revenue streams, such as offering enhanced IoT services and smart city solutions, further contributing to the segment’s growth. Thus, the IT & telecom segment recorded 24% revenue share in the market in 2023. This is largely due to the central role telecom providers play in deploying and integrating 5G networks.

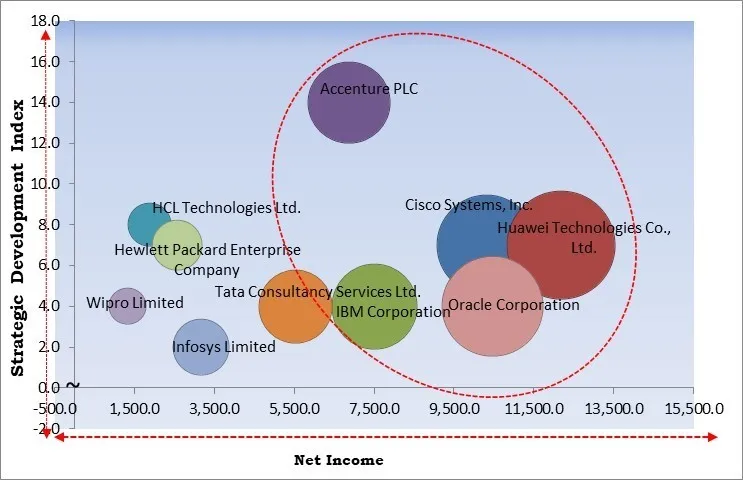

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2025, HCL Technologies Ltd. and Vodafone Idea came into partnership to automate 4G and 5G networks using HCL’s AI-powered Augmented Network Automation platform. This collaboration aims to enhance network performance, reduce energy consumption, and improve customer experience by optimizing multi-vendor network operations. Additionally, In November, 2024, Huawei Technologies Co., Ltd. and China Unicom have partnered to launch the world’s first large-scale integrated 5G-Advanced intelligent network in Beijing. The network promises faster speeds, improved coverage, and AI-driven optimization, supporting advanced applications like XR, IoT, and smart agriculture, while focusing on sustainability.

Based on the Analysis presented in the KBV Cardinal matrix Accenture PLC, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Oracle Corporation and IBM Corporation are the forerunners in the 5G System Integration Market. Companies such as Tata Consultancy Services Ltd., Hewlett Packard Enterprise Company and HCL Technologies Ltd. are some of the key innovators in 5G System Integration Market. In March, 2023, Accenture PLC partnered with TELUS to develop a next-generation entertainment and digital life platform, integrating cloud, AI, and future 5G capabilities. The platform enhances TV and OTT services while enabling IoT, automation, and smart home solutions for improved customer experiences.

The global demand for high-speed internet is experiencing unprecedented growth, driven by the rise of data-intensive applications such as 4K/8K video streaming, immersive augmented and virtual reality experiences, and real-time gaming. The surge in remote work, online learning, and digital content consumption further accelerates this demand. Thus, increasing demand for high-speed internet and low-latency communications drives the market's growth.

Mobile data traffic has increased exponentially over the past few years, fuelled by the growing adoption of smartphones, tablets, and connected devices. With the advent of 5G technology, mobile users expect even faster data speeds and a more reliable connection for high-demand applications. The increased number of connected devices also places tremendous pressure on network infrastructures. In conclusion, the surge in mobile data traffic and the need for network optimization propel the market's growth.

High Costs of 5G Infrastructure Deployment and System Integration The high cost of deploying 5G infrastructure is one of the primary challenges facing telecom operators and system integrators. 5G deployment involves extensive investment in upgrading existing networks, installing new base stations, antennas, and fibre optic connections, and acquiring additional spectrum. Thus, the high costs of 5G infrastructure deployment and system integration impede the market's growth.

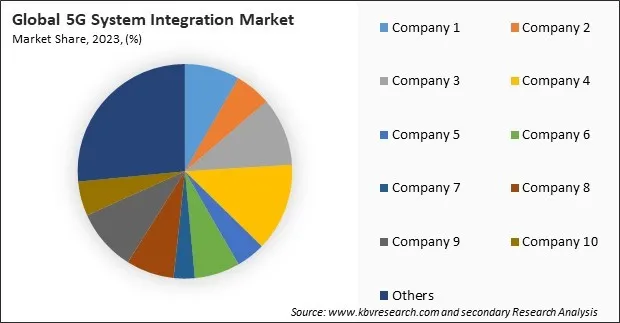

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on services, the market is divided into consulting, infrastructure integration, and application integration. The consulting segment held 28% revenue share in the market in 2023. As businesses and telecom providers look to roll out 5G networks, consulting services play a pivotal role in guiding them through the complex and multifaceted process.

On the basis of vertical, the market is segmented into manufacturing, energy & utility, media & entertainment, IT & telecom, transportation & logistics, BFSI, and others. The BFSI segment procured 8% revenue share in the market in 2023. The adoption of the BFSI sector’s 5G system integration is likely driven by the demand for faster, more secure transactions, real-time data processing, and enhanced customer experiences.

By application, the market is divided into home & office broadband, smart city, logistics & inventory monitoring, vehicle-to-everything (V2X), industrial sensors, collaborate robot /cloud robot, wireless industry camera, drone, gaming & mobile media, remote patient & diagnosis management, and others. The collaborate robot /cloud robot segment procured 8% revenue share in the market in 2023. This segment emerged with a remarkable revenue share due to 5G’s ability to provide the low latency and reliability needed for real-time data exchange.

Free Valuable Insights: Global 5G System Integration Market size to reach USD 75.31 billion by 2031

The 5G system integration market is intensifying with a focus on seamless integration of diverse technologies like IoT, AI, and cloud computing into robust networks. Market players vie for dominance by offering specialized integration services that optimize network performance, ensure interoperability, and enhance user experience across industries. The competition is driven by innovation in software-defined networking (SDN) and network function virtualization (NFV), aiming to meet the growing demand for reliable, high-speed connectivity globally. As the market evolves, partnerships and strategic alliances are crucial for scaling capabilities and addressing complex integration challenges.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 27% revenue share in the market. Countries like China, Japan, South Korea, and India oversee deploying 5G networks. China’s ambitious plans to dominate the 5G space and the country’s significant investments in smart manufacturing, autonomous vehicles, and urban development have contributed to a high adoption rate of 5G technologies.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 11.18 Billion |

| Market size forecast in 2031 | USD 75.31 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 27.1% from 2024 to 2031 |

| Number of Pages | 341 |

| Number of Tables | 473 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Application, Services, Vertical, Region |

| Country scope |

|

| Companies Included | Accenture PLC, HCL Technologies Ltd., Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Infosys Limited, Tata Consultancy Services Ltd., Wipro Limited, Oracle Corporation, IBM Corporation and Hewlett Packard Enterprise Company |

By Application

By Services

By Vertical

By Geography

This Market size is expected to reach $75.31 billion by 2031.

Increasing Demand for High-Speed Internet and Low Latency Communications are driving the Market in coming years, however, High Costs of 5G Infrastructure Deployment and System Integration restraints the growth of the Market.

Accenture PLC, HCL Technologies Ltd., Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Infosys Limited, Tata Consultancy Services Ltd., Wipro Limited, Oracle Corporation, IBM Corporation and Hewlett Packard Enterprise Company

The expected CAGR of this Market is 27.1% from 2023 to 2031.

The Infrastructure Integration segment is leading the Market by Services in 2023; thereby, achieving a market value of $27.4 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $25.62 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges