The Global Access Control Hardware Market size is expected to reach $7.6 billion by 2030, rising at a market growth of 6.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 61,922.7 Units experiencing a growth of 5.5% (2019-2022).

The rise of IoT (Internet of Things) and smart building technologies has propelled the access controllers segment forward. Hence, the access controllers segment would acquire around 10% share in the market by 2030. These controllers often leverage cloud-based or networked solutions, enabling remote management and real-time monitoring. This connectivity enhances security and provides operational efficiency benefits, allowing organizations to streamline access control processes and respond promptly to security incidents or access requests. All these benefits will boost the segment's demand for access control hardware.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in March 2023, Siemens Smart Infrastructure, a part of Siemens AG unveiled a Connect Box, an open and easy-to-use IOT solution designed to manage small and medium-sized buildings. The launched Connect Box would be a user-friendly approach for monitoring building performance, with the potential to optimize energy efficiency by up to 30 percent. Additionally, In September, 2023, Southco, Inc. launched the Keypanion app, to provide an easy way for anyone to step into the next generation of electronic access.

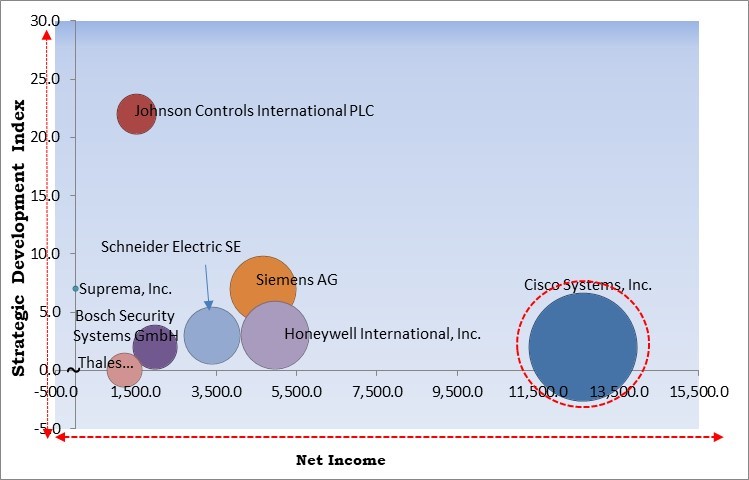

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. is the major forerunner in Market. In June, 2022, Cisco Systems Inc. launched Cisco Security Cloud, a global, cloud-delivered, integrated platform that secures and connects organizations of any shape and size. The launched product would be created to protect the integrity of the entire IT ecosystem without public cloud lock-in. Companies such as Honeywell International, Inc., Siemens AG, Schneider Electric SE are some of the key innovators in the Market.

In the commercial sector, businesses of all sizes recognize the importance of safeguarding their premises, data, and assets. With a growing concern for physical security and data protection, access control hardware offers a reliable means of restricting unauthorized entry, preventing theft, and checking that only authorized personnel can access sensitive areas. This heightened awareness has led commercial enterprises to invest in access control solutions that provide tailored access rights for employees, contractors, and visitors. Likewise, in the industrial sector, access control hardware is crucial for maintaining safety and security within manufacturing facilities, warehouses, and critical infrastructure sites. By implementing access control systems, industrial organizations can mitigate security risks, monitor employee movements, and respond swiftly to any security breaches or incidents. This sector's need for comprehensive security measures has driven substantial investments in access control technology.

Advanced analytics can detect unusual or suspicious access events and trigger immediate alerts. This approach to security can help prevent breaches or mitigate their impact. Access control analytics can also contribute to resource optimization. By analyzing access data, organizations can identify areas with low traffic or unnecessary access restrictions, allowing them to streamline security protocols and allocate resources more efficiently. For example, during periods of low activity, security staff can be redeployed to areas with higher security needs. In addition, access control systems with robust reporting capabilities can generate comprehensive audit trails, documenting every access event, including who gained access, when, and where. These audit trails let firms prove security compliance. They provide a transparent record of security-related activities that can be easily reviewed during audits. Likewise, many modern access control systems allow for customizable reporting. Organizations can tailor reports to meet their specific needs and objectives. Whether it's generating reports for management, security teams, or compliance officers, customizable reporting ensures that the data presented is relevant and actionable.

The purchase of access control hardware itself, including electronic locks, access control panels, biometric readers, and card readers, can be expensive. The price varies depending on the sophistication and features of the hardware. Installing access control systems often requires skilled technicians or professionals, which adds to the overall cost, which includes wiring, mounting hardware, and configuring the system to meet the facility's specific needs. Many organizations already have security systems, such as video surveillance, alarm systems, and intrusion detection. Integrating new access control hardware with these existing systems can be complex and costly. Assessing the compatibility of the new access control hardware with existing systems is critical. Different vendors may use proprietary protocols or technologies that may not easily integrate. Compatibility issues can lead to increased costs and complexity.

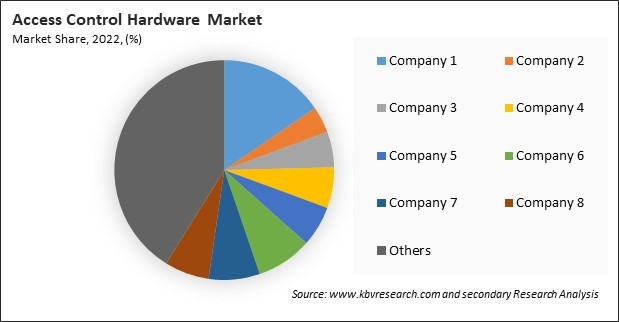

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansion.

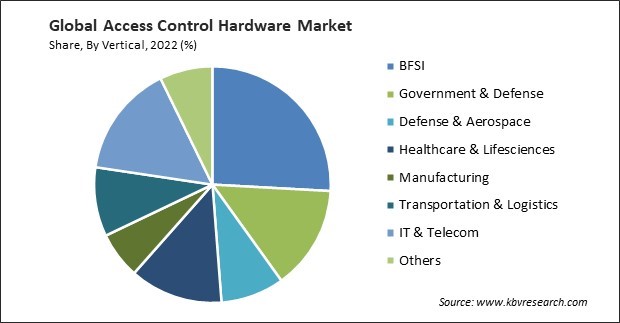

Based on vertical, the market is divided into defense & aerospace, manufacturing, healthcare & life sciences, transportation & logistics, government & defense, IT & telecom, BFSI, and others. In 2022, the IT and telecom segment acquired a significant revenue share in the market. The rise of remote work and the need for secure access to corporate networks have driven demand for advanced access control solutions. IT and telecom companies require robust authentication methods and access policies to check that only authorized personnel can access sensitive data and systems remotely. This has led to the adoption of cutting-edge access control technologies, including multi-factor authentication (MFA) and cloud-based access control systems. Therefore, the demand in this segment is expected to grow in the future.

By application, the market is segmented into electronic locks, card-based readers, biometric readers, multi-technology readers, access controllers, and others. The electronic locks segment procured a substantial revenue share in the market in 2022. Touchless or contactless access solutions from electronic locks have helped reduce physical contact and avoid transmitting infections like COVID-19 during the global health crisis. Additionally, the ability to integrate electronic locks into broader access control systems, including video surveillance and alarm systems, further enhances their appeal for commercial and industrial users. As a result, the demand in the segment will rise in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.45 Billion |

| Market size forecast in 2030 | USD 7.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.8% from 2023 to 2030 |

| Number of Pages | 393 |

| Number of Table | 673 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the market is divided into North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed the highest revenue share in the market in 2022. This dominant position can be attributed to several key factors. The U.S. possesses a mature and technology-driven economy, fostering a conducive environment for adopting advanced access control solutions. Moreover, the nation's heightened focus on security across various commercial, industrial, and residential sectors amplifies the demand for robust access control systems. The U.S. also boasts a robust ecosystem of technology providers, research institutions, and regulatory bodies, fostering innovation and compliance with evolving security standards. As a result, there will be a rising demand in the North America segment in the coming years.

Free Valuable Insights: Global Access Control Hardware Market size to reach USD 7.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bosch Security Systems GmbH (Robert Bosch GmbH), Suprema, Inc., Cisco Systems, Inc., Johnson Controls International PLC, Schneider Electric SE, Siemens AG, Honeywell International, Inc., Thales Group S.A., Southco, Inc. (Touchpoint, Inc.) and Hanwha Vision Co., Ltd. (Hanwha Corporation)

By Application (Volume, Units, USD Million, 2019-2030)

By Vertical (Volume, Units, USD Million, 2019-2030)

By Geography (Volume, Units, USD Million, 2019-2030)

The Market size is projected to reach USD 7.6 billion by 2030.

Increasing Awareness of Security Threats Across Various Sectors are driving the Market in coming years, however, Higher Costs Associated with Installation and Implementation restraints the growth of the Market.

Bosch Security Systems GmbH (Robert Bosch GmbH), Suprema, Inc., Cisco Systems, Inc., Johnson Controls International PLC, Schneider Electric SE, Siemens AG, Honeywell International, Inc., Thales Group S.A., Southco, Inc. (Touchpoint, Inc.) and Hanwha Vision Co., Ltd. (Hanwha Corporation)

In the year 2022, the market attained a volume of 61,922.7 Units experiencing a growth of 5.5% (2019-2022).

The Card-based Readers segment lead the Market by Application in 2022 achieving a market value of $2.2 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.