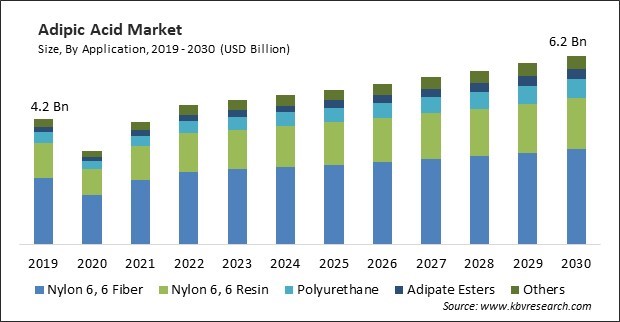

The Global Adipic Acid Market size is expected to reach $6.2 billion by 2030, rising at a market growth of 3.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,778.6 Kilo Tonnes, experiencing a growth of 3.7% (2019-2022).

Adipate esters are commonly used as plasticizers in the polymer industry. They improve the flexibility, durability, and workability of plastics and elastomers. Consequently, Adipate esters contributed $196.4 million revenue in the market in 2022. These esters help reduce the glass transition temperature of polymers, making them more pliable and less brittle. Adipate esters have relatively low volatility compared to other plasticizers, making them less likely to evaporate and cause emissions, making them suitable for applications with low volatility. Adipate esters can enhance the performance of end products, such as textiles, automotive components, and wire and cable insulation, by improving their flexibility and durability. Some of the factors impacting the market are growing consumption of nylon 6, 6 in the global automotive industry, increasing innovation and research of adipic acid, and Stringent regulations to prevent hazardous effects.

The automotive industry increasingly focuses on reducing vehicle weight to enhance fuel efficiency and lower emissions. Nylon 6,6, which is strong, lightweight, and durable, is used in engine parts, fuel lines, and various structural components. Using nylon 6,6 in the automotive sector can reduce weight, which contributes to better fuel efficiency. As governments worldwide impose stricter emissions and fuel efficiency regulations, automakers seek lightweight materials like nylon 6,6 to meet these standards. Nylon 6,6 offers excellent mechanical properties, including resistance to impact, chemicals, and heat. These properties make it a preferred material for various automotive components, such as air intake manifolds, radiator end tanks, and electrical connectors. Additionally, Ongoing R&D efforts focus on finding more efficient and cost-effective ways to produce adipic acid. Innovations in production technology can lead to higher yields, lower energy consumption, and lower production costs. Environmental concerns have spurred research into more sustainable methods for producing adipic acid. Bio-based production methods using renewable feedstocks are a prime example of innovation that aligns with the growing demand for eco-friendly and sustainable products. Research and innovation led to the discovery of novel applications for adipic acid. Collaboration between academia, industry, and government research organizations can drive innovation in adipic acid. Such partnerships can accelerate the development of new technologies and applications. They lead to improvements in production processes, the development of sustainable alternatives, and the creation of new applications, all of which can increase the market.

However, adhering to stringent regulations often requires manufacturers to invest in safety measures, environmental controls, and compliance procedures. These additional costs can affect the overall profitability of adipic acid production. Obtaining regulatory approvals and meeting compliance requirements can be time-consuming and complex. Companies may face delays and administrative challenges in bringing new products or processes to market. Regulatory agencies may restrict the use of adipic acid in certain applications or at specific concentrations due to environmental or health concerns. These restrictions can limit the potential market.

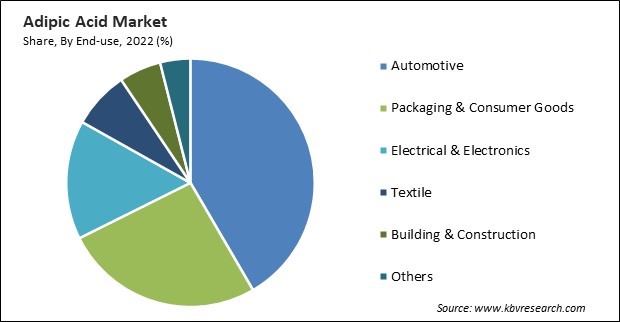

On the basis of End-use, the market is segmented into Automotive, Packaging & Consumer Goods, Electrical & Electronics, Textile, Building & Construction, and Others. In 2022, the automotive segment accounted for the largest revenue share in the market. The inherent properties of nylon 6,6, derived from adipic acid, make it an ideal material for various automotive applications. Engine components, such as gears, bearings, and bushings, benefit from the high strength and heat resistance of nylon, ensuring optimal performance in demanding conditions. Additionally, the material is extensively used in the production of cable and wiring due to its electrical insulating capabilities, resistance to abrasion, and chemical stability. In the realm of vehicle interiors, adipic acid-derived nylon is employed for seat fabrics, carpets, and other textile elements, providing durability and wear resistance.

On the basis of application, the market is segmented into nylon 6, 6 fiber, nylon 6, 6 resin, polyurethane, adipate esters, and others. The polyurethane segment acquired a substantial revenue share in the market in 2022. Due to polyurethane's low weight and high abrasion resistance, it is used to create durable shoe soles. The largest use of polyurethane in the footwear industry is for sports and trekking shoes and boots. Polyurethane is also used in sports and high-quality safety shoe soles. It is widely used as an insulating material in the building and construction industry. In the future, the increased use of polyurethane in various applications is expected to fuel its global demand.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.6 Billion |

| Market size forecast in 2030 | USD 6.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 3.9% from 2023 to 2030 |

| Number of Pages | 328 |

| Number of Table | 610 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, End-use Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region held the highest revenue share in the market in 2022. The rising automotive, textiles, and electronics industries in major countries such as India, China, etc., contribute to the market's huge demand. China includes the world's most extensive electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries, thus providing a massive market.

Free Valuable Insights: Global Adipic Acid Market size to reach USD 6.2 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ascend Performance Materials LLC, Asahi Kasei Corporation, BASF SE, Koch Industries, Inc. (Invista BV), Liaoyang Tianhua Chemical Co., Ltd, Radici Partecipazioni S.p.A., Solvay SA, Sumitomo Chemical Co., Ltd., DOMO Chemicals GmbH, and LANXESS AG.

By Application (Volume, Kilo Tonnes, USD Million, 2019-2030)

By End-use (Volume, Kilo Tonnes, USD Million, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

The Market size is projected to reach USD 6.2 billion by 2030.

Growing consumption of nylon 6, 6 in the global automotive industry are driving the Market in coming years, however, Stringent regulations to prevent hazardous effects restraints the growth of the Market.

Ascend Performance Materials LLC, Asahi Kasei Corporation, BASF SE, Koch Industries, Inc. (Invista BV), Liaoyang Tianhua Chemical Co., Ltd, Radici Partecipazioni S.p.A., Solvay SA, Sumitomo Chemical Co., Ltd., DOMO Chemicals GmbH, and LANXESS AG.

In the year 2022, the market attained a volume of 2,778.6 Kilo Tonnes, experiencing a growth of 3.7% (2019-2022).

The Nylon 6, 6 Fiber segment is leading the Market by Application in 2022 thereby, achieving a market value of $3.2 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2.3 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.