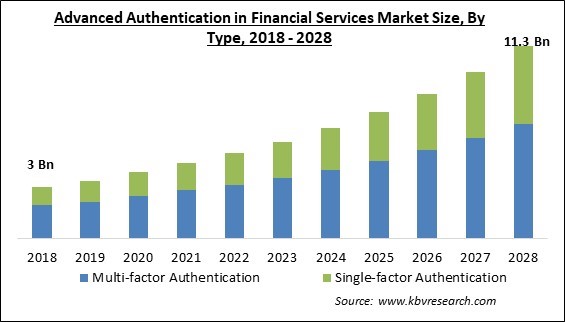

The Global Advanced Authentication in Financial Services Market size is expected to reach $11.3 billion by 2028, rising at a market growth of 14.5% CAGR during the forecast period.

Advanced authentication is a method of authentication that makes adaptive use of real-world identity signals to greatly strengthen identity verification for system and information security. Advanced authentication techniques can be conceptually distinguished from traditional authentication techniques, which frequently only rely on passwords and usernames or other means of identification, like tokens or security codes that can be easily stolen and used again by attackers with the right motivation.

The issue with the security of passwords has persisted for a long time. The most popular technique used by scammers to access a user account is still password theft, in addition to the dark web circulation of stolen credentials (password dumping). As a result, customers expose themselves to danger when they share passwords, use recycled or weak passwords, or engage in risky behavior that compromises the security of their data.

Furthermore, rather than working to avoid fraud in the first place, some financial services companies depend on reactive protocols, like acting only after it has already occurred. The security measures and historical authentication that banks and financial institutions have implemented frequently exist at both the back-end and front-end of digital transactions, which is a fundamental problem.

With advanced authentication, it is possible to verify a computer system user's identity. Hardware tokens, software tokens, and biometric systems are a few examples. With more traditional methods like usernames and passwords, several unconventional identity verification methods can be used in advanced authentication.

Due to the increased demand for contactless payments brought on by the pandemic, point of sale (POS) terminals equipped with biometric technology, as well as other technologies that receive payment through digital interface and contactless chip cards were increasingly necessary. During the pandemic, using customer relationship management (CRM) and other financial solutions for businesses was made possible by the emergence of advanced authentication in financial services market systems. Therefore, the pandemic had a minor effect on advanced authentication in financial services market.

Consumers gain a lot from the streamlined experience that digital payments offer. With technologies like biometric security and encryption, non-cash payments and transactions are meant to be secure. In addition, a World Bank report claims that the COVID-19 outbreak has expanded the use of cashless transactions, with two-thirds of adults making or receiving them globally as of late, with developing nations' share rising significantly. Hence, the expansion of advanced authentication in financial services market is being driven by increased non-cash payments.

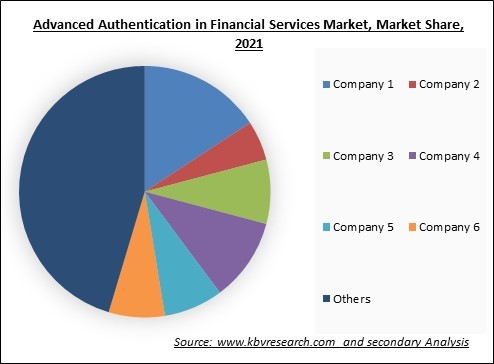

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Automation in financial services aids in improving employee success and workplace happiness, minimizing errors, and boosting productivity. By automating repetitive tasks and improving data analysis, staff members can devote more time to strategic initiatives that provide insight into new business development opportunities. With the increasing automation of the financial services sector, a rapid need for securing internal and external interactions and transactions rises. Hence, advanced authentication in financial services market will benefit from expanding financial service applications during the anticipated period.

Advanced authentication techniques might not scale, especially for large financial institutions that process many transactions. As a result, longer authentication times and lower user satisfaction may come from this. Advanced authentication techniques may result in false negatives when an unauthorized user is allowed access due to a failed authentication. When delicate data or transactions are involved, this can be especially dangerous. Although advanced authentication techniques increase security and convenience, they are constrained by user and technological issues, privacy worries, scalability, and false negatives. All these factors significantly hamper the growth of the market.

Based on type, the advanced authentication in financial services market is categorized into single-factor authentication and multi-factor authentication. The multi-factor authentication segment garnered the highest revenue share in the advanced authentication in financial services market in 2021. Growth is explained by a proportionally larger increase in cyberattacks, security lapses, and online fraud. Installing multi-factor authentication (MFA) systems in the staff members' smartphones and computing equipment to confirm the user's identity aids in avoiding such risks.

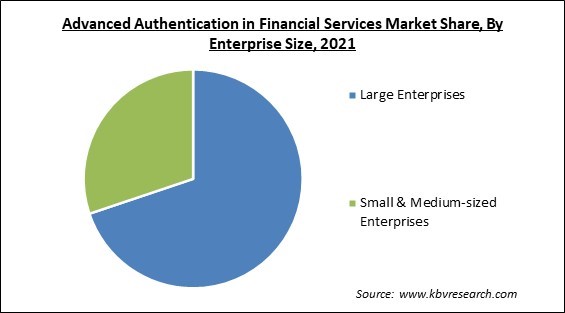

On the basis of enterprise size, the advanced authentication in financial services market is divided into large enterprises and small & medium-sized enterprises. The small and medium-sized enterprises (SMEs) segment recorded a significant revenue share in the advanced authentication in financial services market in 2021. This segment is growing due to elements including stringent regulatory compliance, cheaper IT infrastructure, and fraud detection and prevention technologies. For SMEs, advanced authentication has many benefits, including data accessibility, automated syncing, protection of user data, maintaining the security of POS, and preventing identity theft crimes.

Based on authentication method, the advanced authentication in financial services market is segmented into biometrics, smart cards, mobile smart credentials, and others. The biometrics segment witnessed the maximum revenue share in the advanced authentication in financial services market in 2021. Due to the anonymous aspect of digital transactions, businesses, and customers must work together to develop a mutually beneficial level of trust. As a result, consumers today look for visible indicators of security when engaging with a firm to achieve this.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.4 Billion |

| Market size forecast in 2028 | USD 11.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 14.5% from 2022 to 2028 |

| Number of Pages | 232 |

| Number of Table | 343 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Enterprise Size, Authentication Method, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the advanced authentication in financial services market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the advanced authentication in financial services market in 2021. This is due to numerous biometric payment solution companies' availability and widespread use. Also, the regional banks have undertaken various initiatives to promote the use of biometric payment systems for transactional purposes. To entice new and recurring customers, banks provide a range of promotions and incentives. North America is the only region where the environment is conducive to the early adoption of breakthrough technology, particularly autonomous banking.

Free Valuable Insights: Global Advanced Authentication in Financial Services Market size to reach USD 11.3 Billion by 2028

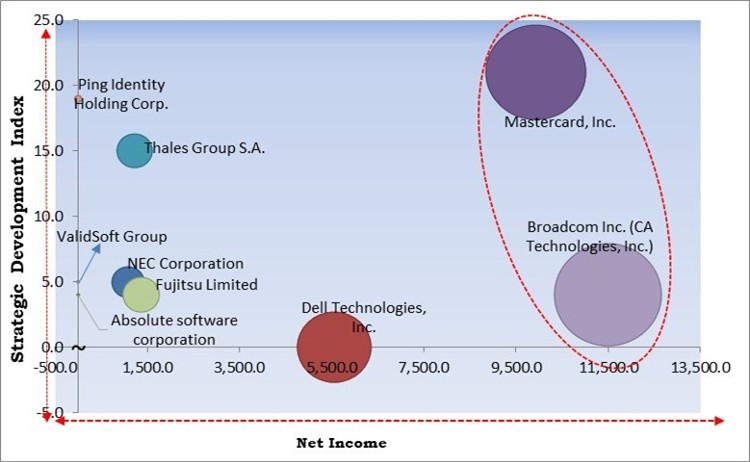

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Mastercard, Inc. and Broadcom Inc. (CA Technologies, Inc.) are the forerunners in the Advanced Authentication in Financial Services Market. Companies such as Dell Technologies, Inc., Thales Group S.A., NEC Corporation are some of the key innovators in Advanced Authentication in Financial Services Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Broadcom, Inc. (CA Technologies, Inc.), Dell Technologies, Inc., Mastercard, Inc., Thales Group S.A., NEC Corporation, ValidSoft Group, SecurEnvoy Limited (Shearwater Group PLC), Ping Identity Holding Corp. (Thoma Bravo, L.P.), Absolute Software Corporation and Fujitsu Limited.

By Type

By Enterprise Size

By Authentication Method

By Geography

The global Advanced Authentication in Financial Services Market size is expected to reach $11.3 billion by 2028.

Increase in the number of online transactions and online banking are driving the market in coming years, however, Limitations associated with the usage and adoption of advanced authentication restraints the growth of the market.

Broadcom, Inc. (CA Technologies, Inc.), Dell Technologies, Inc., Mastercard, Inc., Thales Group S.A., NEC Corporation, ValidSoft Group, SecurEnvoy Limited (Shearwater Group PLC), Ping Identity Holding Corp. (Thoma Bravo, L.P.), Absolute Software Corporation and Fujitsu Limited.

The Large Enterprises segment is leading the Global Advanced Authentication in Financial Services Market by Enterprise Size in 2021 thereby, achieving a market value of $7.4 billion by 2028.

The North America market dominated the Global Advanced Authentication in Financial Services Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.