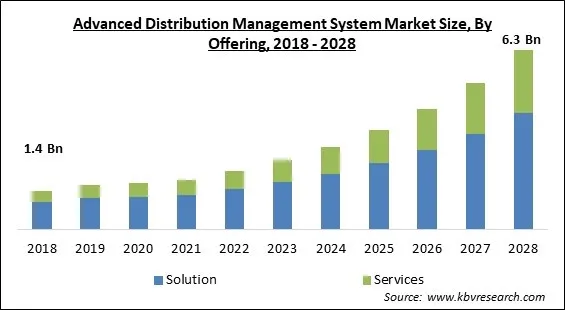

The Global Advanced Distribution Management System Market size is expected to reach $6.3 billion by 2028, rising at a market growth of 20.5% CAGR during the forecast period.

The software platform that covers the full range of distribution management and optimization is known as an advanced distribution management system (ADMS). An ADMS offers services that automate outage restoration and improve distribution grid performance. Fault location, isolation, and restoration are among the ADMS feature being developed for electric utilities, as are volt/volt-ampere reactive optimization, conservation via voltage reduction, peak demand management, and help for micro grids and electric cars.

The next degree of software sophistication to achieve modern aims is ADMS (Advanced Distribution Management System). SCADA, OMS, and DMS are all part of ADMS, which is a unified software platform. It combines the features of DMS and OMS applications with SCADA's real-time data collecting capabilities to maximize the capabilities of each system. From a single, straightforward graphical user interface, all of this data is visually shown and handled. With a new generation of utility personnel on the horizon, the need to become fluent in and manage all of these systems (OMS, DMS, and SCADA) will inevitably grow. In addition, a distribution operator's responsibilities are already growing.

Simplicity is the best reaction to this complexity. One integrated platform removes the requirement for a single individual to be in charge of multiple software and servers and attend training to manage and fix them all. A single ADMS streamlines operational tasks and removes the need for various operating models to be maintained and coordinated. Another crucial goal for bringing complete data onto one platform is interoperability. For instance, Industry standards like MultiSpeak are critical for seamlessly transferring data like AMI or GIS from other systems. Vendors should also be required to integrate with other systems via Multispeak or custom interfaces. A brief use case will demonstrate the ADMS system's ease of use and efficiency.

With the surge in COVID-19 cases, ADMS systems in the energy sector took a hit, particularly for data collecting and remote monitoring. Regulatory authorities and government initiatives in different countries are primarily emphasized keeping the standard of living of the citizens and offering a constant power supply to facilitate the work from home culture, so ADMS solutions in smart grids and utilities are expected to grow during the pandemic. The COVID-19 pandemic has had an impact on the demand for advanced distribution management systems, allowing providers to think strategically. The pandemic also provided an opportunity for businesses to implement a robust ADMS to reduce energy loss, supply, and deficit.

Increasing network complexity necessitates the adoption of integrated single platform advanced distribution management systems by diverse firms in order to efficiently execute network operations. This platform unifies all applications, solutions, and relevant data into a single platform, allowing network operators to run their networks more smoothly and efficiently. The hacker and intruders of current generation use much clever and sophisticated techniques and tools to breach the software privacy and gaining an unauthorised access in organization, hence this vulnerability enhance the demand of reliable, safe, and efficient unified single platform.

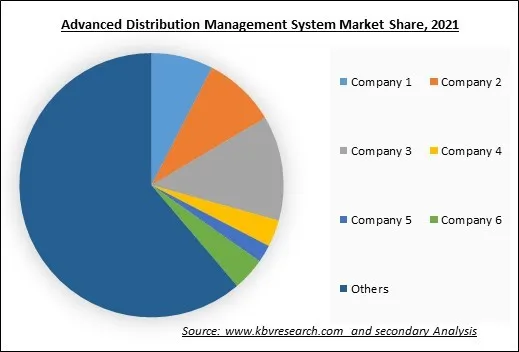

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

The emergence of advanced distribution management systems has been pushed by the increasing demand for electric automobiles. For instance, according to Schneider Electric, as the number of electric vehicles has grown, so has electricity consumption as well as according to the governments of the United Kingdom and France, conventional vehicle sales could reach a new height by 2040. The distribution of EV chargers with the help of ADMS has risen to accommodate this trend of electric vehicles. ADMS is a key player in the development of infrastructure to help people switch to electric automobiles.

The most data-sensitive areas are power and utility. It creates a large volume of data on a regular basis, necessitating a highly secure architecture with many levels of data security. In this technological era, data privacy is a key problem. People are worried about their personal information, and people will only disclose it if people are confident in its security and secrecy. Smart grids are complex because people deal with the data and information collected by smart meters. To protect the information, additional security levels must be added, as well as the use of big data analytical tools to make investment decisions.

Based on Offering, the market is segmented into Solution (Outage Management System, Energy Management System, Geographic Information System, Meter Data Management System & Distributed Energy Resources Management System, and Customer Information System) and Services. The solutions segment acquired the highest revenue share in the advanced distribution management system market in 2021. Numerous businesses are increasingly requesting the ADMS software platform, which combines outage management systems, supervisory control and data acquisition systems, fault detection, isolation, and service restoration, among other uses.

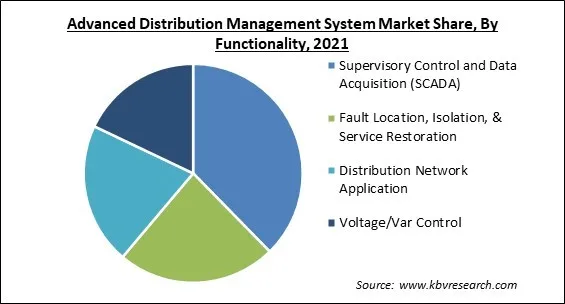

Based on Functionality, the market is segmented into Supervisory Control and Data Acquisition (SCADA), Fault Location, Isolation, & Service Restoration, Distribution Network Application, and Voltage/Var Control. The Fault Location, Isolation, and Service Restoration segment garnered a significant revenue share in the advanced distribution management system market in 2021. The FLSIR program is becoming increasingly popular because it may limit the number of customers affected by a defect via automatically isolating the problem region and restoring service to the remaining customers by shifting them to neighbouring circuits.

Based on Deployment Mode, the market is segmented into Cloud and On-premise. The cloud segment garnered the maximum revenue share in the advanced distribution management system market in 2021. This is owing to simplified distributed energy resource management, improved outage management, and ease in complicated device unification. The cloud is best suited to maintain an advanced software for any type of objective.

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The small and medium enterprises garnered a substantial revenue share in the advanced distribution management system in 2021. This is because of the inclusion of various advanced software in the organization that would help to expand the small and medium-sized business owners to transform into large enterprises.

Based on End User, the market is segmented into Energy & Utilities, Transportation & Logistics, Telecom, Government & Defense, IT & ITeS, Manufacturing, and Others. The energy and utilities segment garnered the maximum revenue share in the advanced distribution management system market in 2021. The energy and utility industries are expanding the need for ADMS because it aids utility businesses in optimizing energy distribution, reducing electricity losses, and minimizing shortages. ADMS assists utility company operators in the management of a variety of services such as system outages, power supply restoration, network optimization, and peak load control.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.8 Billion |

| Market size forecast in 2028 | USD 6.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 20.5% from 2022 to 2028 |

| Number of Pages | 412 |

| Number of Tables | 662 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Functionality, Deployment Mode, Organization Size, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the advanced distribution management system market with the largest revenue share in 2021. This is due to rapid technological advancements and the penetration of supervisory control and data acquisition (SCADA) in diverse fields, strict government regulations requiring the implementation of an advanced distributed management system to lessen electric loss and cost, and rising smart city projects.

Free Valuable Insights: Global Advanced Distribution Management System Market size to reach USD 6.3 Billion by 2028

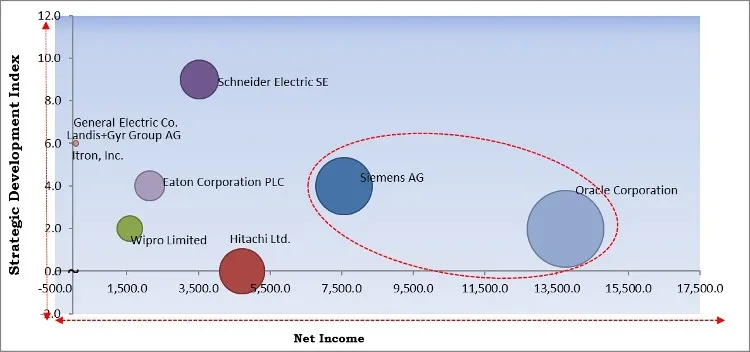

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Oracle Corporation and Siemens AG are the forerunners in the Advanced Distribution Management System Market. Companies such as Schneider Electric SE, Hitachi Ltd., Eaton Corporation PLC are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, General Electric (GE) Co., Schneider Electric SE, Hitachi, Ltd., Oracle Corporation, Itron, Inc., Eaton Corporation PLC, Landis+Gyr Group AG, Wipro Limited, and Operation Technology, Inc. (ETAP).

By Offering

By Functionality

By Deployment Mode

By Organization Size

By End User

By Geography

The advanced distribution management system market size is projected to reach USD 6.3 billion by 2028.

Rising need for a secure, reliable, and efficient unified single platform are driving the market in coming years, however, Cyber-security and data privacy are significant issues limited growth of the market.

Siemens AG, General Electric (GE) Co., Schneider Electric SE, Hitachi, Ltd., Oracle Corporation, Itron, Inc., Eaton Corporation PLC, Landis+Gyr Group AG, Wipro Limited, and Operation Technology, Inc. (ETAP).

The Large Enterprises segment acquired maximum revenue share in the Global Advanced Distribution Management System Market by Organization Size in 2021, thereby, achieving a market value of $4.49 billion by 2028

The Supervisory Control and Data Acquisition (SCADA) segment is leading the Global Advanced Distribution Management System Market by Functionality in 2021; thereby, achieving a market value of $2.30 billion by 2028.

The North America market dominated the Global Advanced Distribution Management System Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.14 billion by 2028

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.