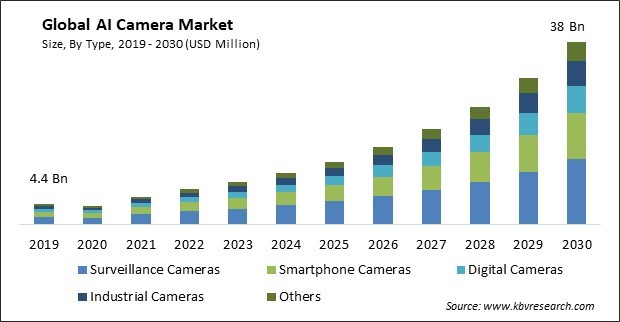

The Global AI Camera Market size is expected to reach $38 billion by 2030, rising at a market growth of 22.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 38,251.3 thousand units experiencing a growth of 20.5% (2019-2022).

AI cameras in the manufacturing segment monitor the condition of machinery and equipment in real-time. It identifies signs of wear and tear, overheating, or other issues, allowing for predictive maintenance. Consequently, the manufacturing segment would generate approximately 8.3% share of the market by 2030. This reduces downtime, lowers maintenance costs, and extends the lifespan of equipment. Remote monitoring of manufacturing operations using AI cameras allows for oversight and control from anywhere. This is particularly valuable for multi-site or global manufacturing operations.

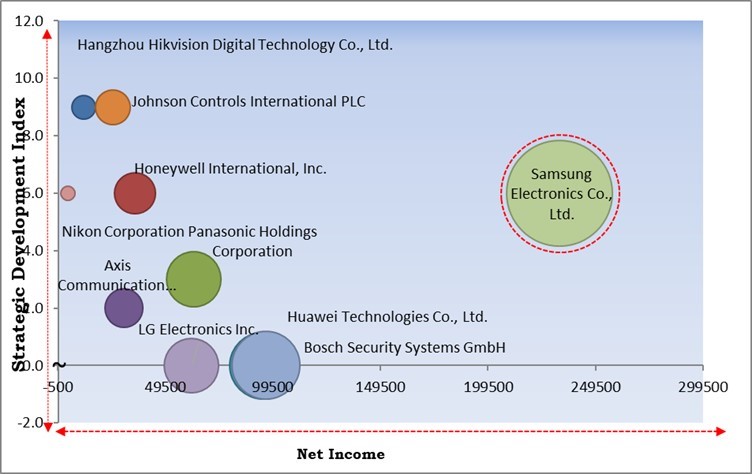

The major strategies followed by the market participants are Product launch as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Panasonic Holdings Corporation unveiled the LUMIX G9II digital mirrorless camera. The new product has the features of a sensor and Phase Detection Auto-Focus (PDAF) technology. Moreover, In September, 2023, Nikon Corporation unveiled the ECLIPSE Ji. The new product has a microscopic design without eyepieces. ECLIPSE Ji uses AI in order to automate the analysis of cellular images and organize research workflows involving cancer and nerve diseases.

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunners in the Market. In June, 2023, Samsung Electronics Co., Ltd. released its business strategy and foundry technology innovations. The new technology is based on gate-all-around (GAA)-based advanced node technology and assists in meeting the requirements of customers using AI applications. and companies such as Panasonic Holdings Corporation, Honeywell International, Inc., Johnson Controls International PLC are some of the key innovators in the Market.

Surveillance solutions combining artificial intelligence with camera technology are increasingly being adopted across various sectors for security, safety, and operational efficiency. The need for enhanced security and monitoring solutions has driven the demand for AI cameras. Surveillance systems with AI capabilities can identify and respond to security threats in real-time. Surveillance cameras with AI can detect suspicious activities, unauthorized access, and potential security breaches, aiding in crime prevention and identifying perpetrators. The rising demand for surveillance solutions is a significant driver of growth in the market.

AI cameras are integral to advanced driver-assistance systems (ADAS), providing critical visual input for lane-keeping assistance, adaptive cruise control, and collision avoidance systems. These systems enhance driver safety and reduce accidents. AI cameras play a central role in autonomous vehicle technology, providing real-time perception of the vehicle's surroundings. They help with navigation, object detection, and decision-making, moving users closer to fully autonomous transportation. It monitor traffic flow and congestion, optimize traffic signal timing, and provide real-time traffic information to drivers, reducing congestion and improving transportation efficiency. As the demand for AI-driven transportation solutions grows, it drives the market.

Unauthorized access to these systems or the data they collect can result in data breaches. Hackers could access sensitive visual data, compromising individuals' privacy and security. Using these for surveillance and facial recognition can raise serious privacy concerns. Unauthorized data collection can infringe upon individuals' privacy rights. These often rely on network connections for data transmission. Weak or unsecured networks can expose data to potential interception and unauthorized access. AI cameras that use facial recognition or other biometric data must handle such data with extreme care to prevent misuse or identity theft. The lack of standardization in the market slows its growth and adoption.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on type, market is classified into surveillance cameras, smartphone cameras, digital cameras, industrial cameras, and others. In 2022, the surveillance cameras segment witnessed the largest revenue share in the market. The rising urban population has increased the demand for continual surveillance to ensure citizens' safety. In addition, businesses are investing in surveillance cameras powered by artificial intelligence to provide 24/7 protection for their infrastructure and overall premises. The AI cameras capture images and videos to create security protocols using facial recognition to monitor and analyze populations in real time and to process videos to identify potential threats. These cameras are equipped with sophisticated analytic capabilities, such as vehicle detection, person detection, face detection, traffic counting, person counting, and license plate recognition.

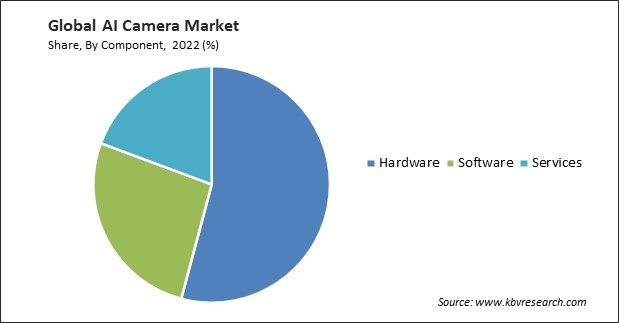

By component, the market is categorized into hardware, software, and services. The software segment covered a considerable revenue share in the market in 2022. The camera software is essential for improving, compositing, and transforming photographs and videos to professional grade. The software includes a variety of functions and shooting modes. It is in charge of incorporating complex AI algorithms that enable intelligent features like scene recognition, facial recognition, object tracking, and image enhancement. In addition, they allow instantaneous scene recognition, exposure, and autofocus adjustments by facilitating the processing of images in real time.

On the basis of technology, the market is divided into image/face recognition, voice/speech recognition, computer vision, context awareness, and others. The context awareness segment procured a promising growth rate in the market in 2022. Context-aware AI cameras can recognize objects and entities in their surroundings with greater accuracy. They consider the context in which these objects appear, making it easier to distinguish between similar-looking items and reducing false positives. Context-aware cameras adjust exposure, focus, and other image settings based on the lighting conditions and the nature of the scene. This ensures that images and videos are of higher quality and provide better situational awareness. Context-aware AI cameras can recognize various scenes and environments, such as landscapes, sports events, or indoor settings.

By vertical, the market is segmented into consumer electronics, manufacturing, sports, agriculture, retail, healthcare, transportation, government & law enforcement, automotive, and others. In 2022, the consumer electronics segment registered the maximum revenue share in the market. These are altering how images and videos are captured and interacted with, thereby transforming the outlook of the consumer electronics segment. It can also apply real-time effects and filters to images and videos, providing users with inventive options for capturing distinctive, visually appealing content.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 7.4 Billion |

| Market size forecast in 2030 | USD 38 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 22.9% from 2023 to 2030 |

| Number of Pages | 496 |

| Number of Table | 893 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Technology, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. Consumer interest in technologically advanced devices is rising, and numerous significant consumer electronics companies are expanding in the region. Increasing disposable incomes and the availability of prominent brands in the electronics sector are accelerating product adoption. Additionally, growing government initiatives to employ AI-based systems in surveillance and law enforcement initiatives are anticipated to create new growth opportunities for the regional market.

Free Valuable Insights: The Global AI Camera Market size to reach USD 38 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Axis Communications AB, Bosch Security Systems GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc., Huawei Technologies Co., Ltd., Johnson Controls International PLC, LG Electronics, Inc. (LG Corporation), Nikon Corporation, Panasonic Holdings Corporation, and Samsung Electronics Co., Ltd.

By Component

By Type (Volume, thousand units, USD Million, 2019-2030)

By Technology

By Vertical(Volume, thousand units, USD Million, 2019-2030)

By Geography (Volume, thousand units, USD Million, 2019-2030)

This Market size is expected to reach $38 billion by 2030.

Rising demand for surveillance solutions are driving the Market in coming years, however, Concerns regarding Data security restraints the growth of the Market.

Axis Communications AB, Bosch Security Systems GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc., Huawei Technologies Co., Ltd., Johnson Controls International PLC, LG Electronics, Inc. (LG Corporation), Nikon Corporation, Panasonic Holdings Corporation, and Samsung Electronics Co., Ltd.

In the year 2022, the market attained a volume of 38,251.3 thousand units experiencing a growth of 20.5% (2019-2022).

The Hardware segment is leading the Market by Component in 2022, thereby, achieving a market value of $19.9 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $13.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.