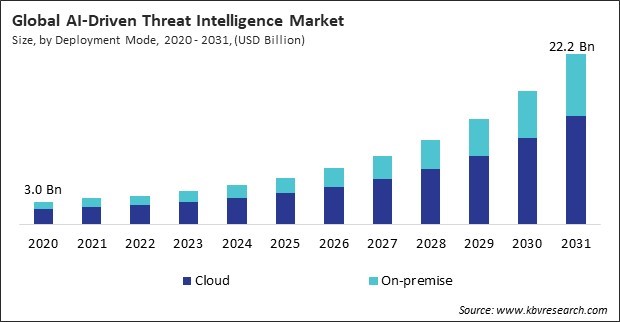

“Global AI-Driven Threat Intelligence Market to reach a market value of USD 22.2 Billion by 2031 growing at a CAGR of 23.3%”

The Global AI-Driven Threat Intelligence Market size is expected to reach $22.2 billion by 2031, rising at a market growth of 23.3% CAGR during the forecast period.

AI-driven threat intelligence helps healthcare organizations monitor their systems in real-time, identify potential vulnerabilities, and respond quickly to emerging threats, making it a crucial investment in this sector. Thus, the healthcare & lifesciences segment recorded 12% revenue share in the market in 2023. The segment's growth is driven by the sector’s increasing reliance on digital systems for managing patient records, diagnostics, and medical devices. As a result of the growing number of data breaches as well as ransomware attacks, the healthcare industry has become a main target for hackers.

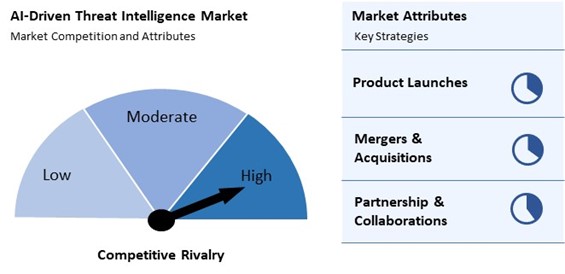

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2024, IBM Corporation partnered with Palo Alto Networks, a global cybersecurity firm, to enhance cybersecurity with AI. Additionally, In June, 2024, Trend Micro announced a partnership with Nvidia, an American software company, to provide cybersecurity tools safeguarding private AI clouds, emphasizing data privacy, real-time analysis, and swift threat response.

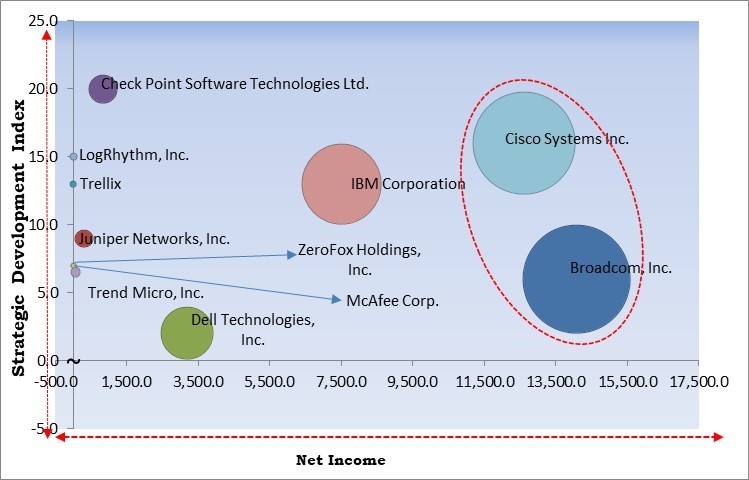

Based on the Analysis presented in the KBV Cardinal matrix; Broadcom, Inc. and Cisco Systems Inc. are the forerunner in the Market. In September, 2023, Symantec, a division of Broadcom Inc., teamed up with Google Cloud, a cloud platform offered by Google, to integrate generative AI into its security platform, enhancing capabilities to detect and respond to cyber threats. Companies such as IBM Corporation, Dell Technologies, Inc. and Check Point Software Technologies Ltd. are some of the key innovators in AI-Driven AI-Driven Threat Intelligence Market.

The ability of AI to learn from past incidents and improve its detection algorithms over time is another major driver of integrating big data and machine learning in threat intelligence. Unlike static security systems that must be manually updated to address new threats, machine learning models can evolve by learning from previous security events, such as breaches, phishing attempts, or malware infections. This continuous learning process enhances the accuracy and effectiveness of AI-driven systems in detecting future threats. Therefore, as more organizations adopt AI and big data analytics in their cybersecurity strategies, the market for AI-driven threat intelligence continues to grow rapidly.

Beyond detection, AI also automates the analysis and response to cyber threats. Once a threat is identified, AI can assess its impact and suggest or implement countermeasures, such as isolating infected devices or blocking communication with malicious actors. This automation decreases response times and enables security teams to focus on more intricate duties that necessitate human expertise. Thus, AI-driven automation in threat detection and response is becoming essential for organizations looking to strengthen their cybersecurity defenses.

The deployment of AI-driven threat intelligence solutions requires significant investment in infrastructure, software, and skilled personnel, which poses a major barrier to adoption, particularly for small and medium-sized enterprises (SMEs). These systems need advanced hardware and networking capabilities capable of effectively handling large datasets and real-time analysis. Due to the prohibitive costs of upgrading or sustaining this infrastructure, small and medium-sized enterprises (SMEs) may find it challenging to compete with larger organizations that possess the financial resources to invest in such technologies. However, the high implementation costs can prevent SMEs from adopting these advanced technologies which hampers the widespread growth of the market, as it remains largely inaccessible to organizations with limited financial resources.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration above shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

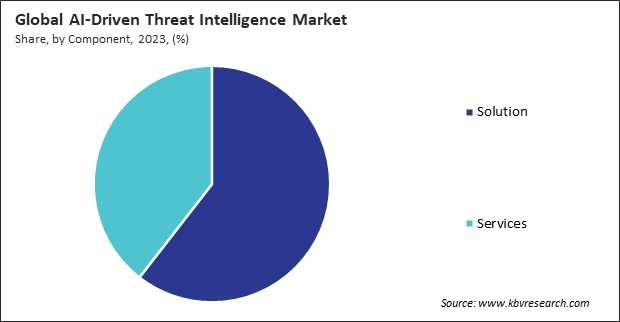

Based on component, the market is bifurcated into solution and services. The services segment procured 39% revenue share in the market in 2023. This segment comprises consulting, deployment, integration, and support services that assist organizations in effectively implementing and maintaining AI-driven threat intelligence systems. As AI technologies are complex and require specialized expertise for integration with existing security frameworks, many businesses, particularly those with legacy systems, rely on external service providers for deployment and ongoing management.

The solution segment is further divided into threat intelligence platforms, security information & event management (SIEM), security orchestration, automation, & response (SOAR), and others. The threat intelligence platforms segment acquired 30% revenue share in the market in 2023. The segment's growth reflects its crucial role in gathering, analyzing, and disseminating real-time information about potential cyber threats. These platforms are highly valued for their ability to aggregate data from various sources, identify emerging threats, and provide actionable insights to organizations, enabling them to stay ahead of cyberattacks.

The services segment is further segmented into professional service, consulting, managed service, and others. The professional service segment witnessed 41% revenue share in the market in 2023. The growing demand for specialized expertise in deploying, integrating, and optimizing AI-driven threat intelligence solutions drives the segment. Professional services typically encompass a wide range of offerings, including system installation, training, and support, which are critical for organizations to maximize the effectiveness of their AI-driven cybersecurity tools.

On the basis of deployment mode, the market is classified into cloud and on-premise. The cloud segment procured 67% revenue share in the market in 2023. Cloud-based AI-driven threat intelligence solutions offer significant advantages like scalability, flexibility, and lower upfront costs. These solutions enable organizations to quickly adapt to evolving cyber threats and easily manage and update their security systems without substantial infrastructure investments.

By application, the market is divided into threat detection, risk management, security operations, incident response, and others. The risk management segment witnessed 26% revenue share in the market in 2023. AI-driven risk management tools help organizations assess and mitigate potential vulnerabilities, enabling them to prioritize security measures and allocate resources more effectively. These tools provide valuable insights into internal and external risks, allowing businesses to take preemptive action before threats materialize.

Based on industry vertical, the market is segmented into BFSI, government & defense, IT & telecom, healthcare & lifesciences, retail & eCommerce, energy & utilities, manufacturing, and others. The BFSI segment procured 24% revenue share in the market in 2023. This comes as no surprise, given the financial industry's vulnerability to cyberattacks due to the high volume of sensitive data and financial transactions it handles. With growing incidents of fraud, data breaches, and identity theft, the BFSI sector has become a primary target for cybercriminals, driving the demand for AI-driven threat intelligence to safeguard customer data and maintain regulatory compliance.

On the basis of organization size, the market is bifurcated into large enterprises and small & medium-sized enterprises (SMEs). The large enterprises segment garnered 59% revenue share in the market in 2023. Large organizations often manage vast amounts of data across extensive IT infrastructures, making them prime targets for sophisticated cyberattacks. Large enterprises are increasingly investing in AI-driven threat intelligence solutions that offer advanced threat detection, response automation, and risk management capabilities to counter these threats.

Free Valuable Insights: Global AI-Driven Threat Intelligence Market size to reach USD 22.2 Billion by 2031

The AI-Driven Threat Intelligence Market is highly competitive, driven by the growing need for advanced security solutions that can proactively identify and mitigate cyber threats. Providers are competing to offer platforms that leverage artificial intelligence and machine learning to deliver real-time threat detection, analysis, and response. As the sophistication of cyberattacks continues to increase, organizations seek solutions that can stay ahead of evolving threats. This intensifies competition, with a focus on delivering faster, more accurate, and adaptive threat intelligence capabilities.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired 39% revenue share in the market in 2023. Significant investments in AI and cybersecurity, a high level of awareness of cybersecurity threats, and an advanced technological infrastructure are all contributing to the regional market's growth. The United States, in particular, has been a leading adopter of AI-driven cybersecurity solutions, fueled by the rising number of cyberattacks targeting financial institutions, healthcare systems, and government agencies.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 4.4 Billion |

| Market size forecast in 2031 | USD 22.2 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 23.3% from 2024 to 2031 |

| Number of Pages | 479 |

| Number of Tables | 774 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment Mode, Component, Organization Size, Application, Industry Vertical, Region |

| Country scope |

|

| Companies Included | Check Point Software Technologies Ltd., Trellix, Broadcom, Inc. (Symantec Corporation), Juniper Networks, Inc., LogRhythm, Inc., McAfee Corp, Trend Micro, Inc., IBM Corporation, Cisco Systems Inc., ZeroFox Holdings, Inc. |

By Deployment Mode

By Component

By Organization Size

By Application

By Industry Vertical

By Geography

This Market size is expected to reach $22.2 billion by 2031.

Rising Frequency and Sophistication of Cyberattacks are driving the Market in coming years, however, Substantial Data Privacy and Security Concerns restraints the growth of the Market.

Check Point Software Technologies Ltd., Trellix, Broadcom, Inc. (Symantec Corporation), Juniper Networks, Inc., LogRhythm, Inc., McAfee Corp, Trend Micro, Inc., IBM Corporation, Cisco Systems Inc., ZeroFox Holdings, Inc.

The expected CAGR of this Market is 23.3% from 2024 to 2031.

The Solution segment is leading the Market by Component in 2023; thereby, achieving a market value of $12.3 billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $8.4 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges