“Global AI-Driven Traffic Management Market to reach a market value of USD 144.1 Billion by 2031 growing at a CAGR of 29.7%”

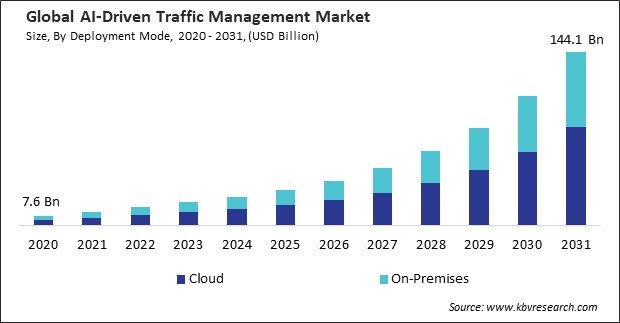

The Global AI-Driven Traffic Management Market size is expected to reach $144.1 billion by 2031, rising at a market growth of 29.7% CAGR during the forecast period.

The North America region witnessed 37% revenue share in the AI-driven traffic management market in 2023. This can be attributed to several factors, including the early adoption of advanced technologies, significant investments in smart city initiatives, and robust infrastructure development. The presence of key market players and extensive research and development activities in the United States and Canada also contribute to the region’s dominance in this market.

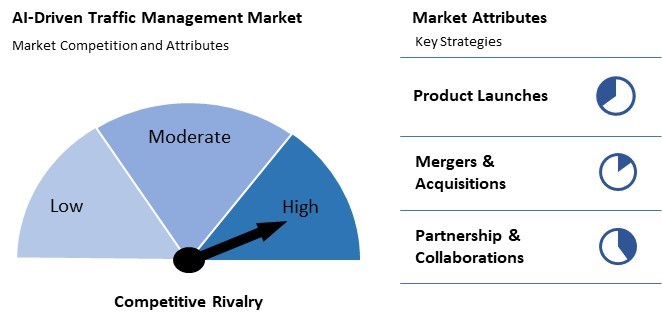

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February 2024, Iteris, Inc. has partnered with Arity to integrate enhanced traffic data solutions into its ClearMobility® Platform. This collaboration aims to improve transportation efficiency and safety by utilizing Arity's near real-time traffic insights, enriching Iteris' ClearGuide® and ClearData® applications. Moreover, In August, 2024, Econolite Group, Inc. and Derq are partnering with Caltrans to deploy an advanced intersection safety system in Orange County, utilizing AI-driven insights and video detection. This initiative aims to enhance road safety and support Caltrans' Vision Zero goal to eliminate road fatalities by 2050.

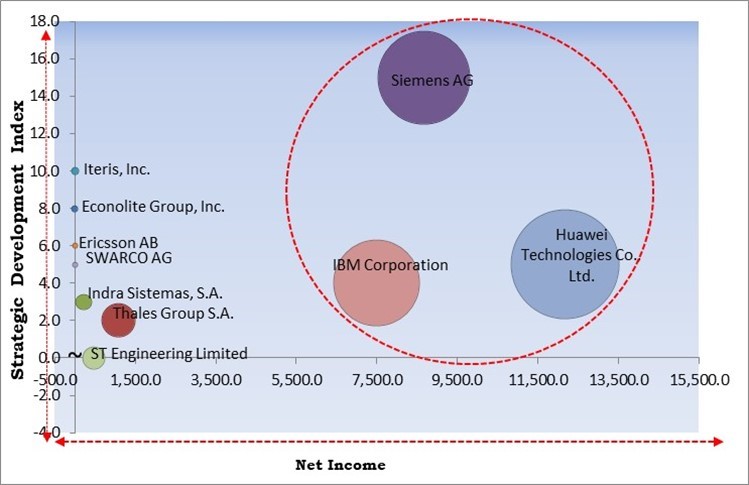

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd., Siemens AG and IBM Corporation are the forerunners in the AI-Driven Traffic Management Market. In April, 2024, Huawei Technologies Co., Ltd. and HKT came into partnership to leverage AI for enhancing network security, improving user experience, and promoting sustainability. The integration of AI technologies will automate operations, optimize services, and support intelligent network transformation, leading to significant advancements in the telecom sector. Companies such as Iteris, Inc. and Ericsson AB are some of the key innovators in AI-Driven Traffic Management Market.

As urban areas become more populated, the density of vehicles and pedestrians increases. This congestion leads to longer travel times, higher rates of accidents, and elevated levels of air pollution. Advanced AI-powered traffic solutions can analyze real-time traffic patterns, optimize signal timings, reroute traffic, and reduce congestion. With urban growth, cities face pressure on infrastructure and resources. In conclusion, accelerating urbanization, leading to demand for advanced traffic solutions, drives the market's growth.

Additionally, With the rise in urban populations and vehicle ownership, road traffic accidents have become a pressing concern worldwide. According to the World Health Organization (WHO), road traffic injuries are a leading cause of death globally, with approximately 1.35 million fatalities each year. This alarming statistic has prompted governments and transportation authorities to prioritize safety measures and implement advanced technologies to mitigate risks. Thus, emphasis on safety and incident management drives the market's growth.

Implementing these systems often requires substantial infrastructure investments. This includes upgrading existing traffic signals, installing sensors and cameras, and establishing a robust communication network to support data exchange. The high upfront costs can deter municipalities, particularly those with limited budgets. Integrating advanced AI solutions with existing traffic management systems can be complex and costly. In conclusion, the high implementation costs of advanced traffic solutions are hampering the market's growth.

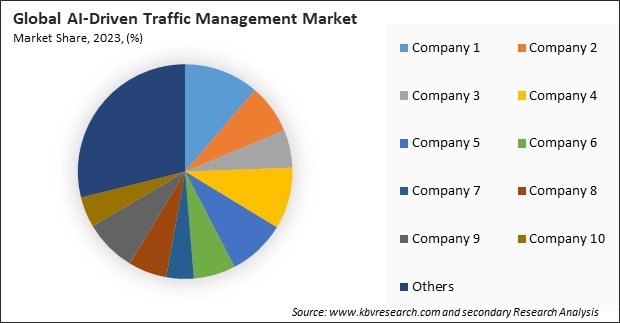

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

By deployment mode, this market is divided into cloud and on-premises. In 2023, the on-premises segment registered 44% revenue share in this market. Concerns over data security, control, and compliance with local regulations often drive this preference for on-premises deployment. On-premises solutions allow organizations direct control over their data and systems, ensuring that sensitive traffic data remains within their infrastructure. This deployment mode is particularly favored by governmental agencies and large-scale traffic management centers that require high levels of customization and integration with existing infrastructure.

Based on technology, this market is categorized into machine learning (ML), computer vision, natural language processing (NLP), internet of things (IoT), and others. The computer vision segment witnessed 27% revenue share in this market in 2023. Computer vision technology enables the automatic extraction, analysis, and understanding of useful information from a single image or a sequence of images. In traffic management, computer vision is used for vehicle detection, license plate recognition, and monitoring traffic conditions through video surveillance.

Based on component, this market is divided into software, hardware, and services. In 2023, the hardware segment garnered 35% revenue share in this market. This segment includes physical components such as sensors, cameras, and other devices essential for functioning traffic management systems. The high revenue share of the hardware segment indicates substantial investment in the physical infrastructure required to implement these solutions.

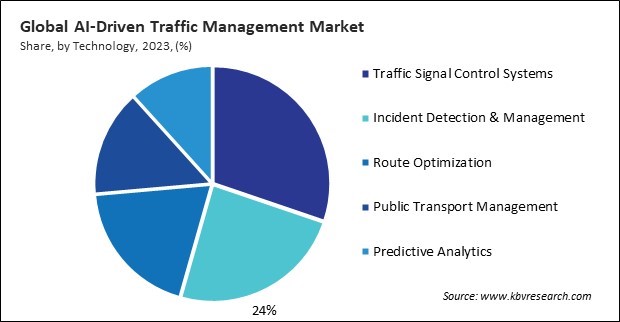

On the basis of application, this market is segmented into traffic signal control systems, route optimization, incident detection & management, public transport management, and others. In 2023, the incident detection & management segment attained 24% revenue share in this market. This segment encompasses technologies and systems that detect real-time traffic incidents, such as accidents or breakdowns, and manage the response to these incidents. The significant share of this segment underscores the importance of rapid incident detection and effective management in minimizing traffic disruptions, enhancing road safety, and ensuring the smooth flow of traffic.

Based on end user, this market is divided into government authorities, highway operators, and others. In 2023, the highway operators segment procured 32% revenue share in this market. Highway operators, which include organizations responsible for maintaining and operating highways and expressways, increasingly adopt AI-driven solutions to enhance traffic flow, reduce travel time, and improve safety on high-speed roadways. These solutions involve AI for predictive maintenance, real-time traffic monitoring, and incident management.

Free Valuable Insights: Global AI-Driven Traffic Management Market size to reach USD 144.1 Billion by 2031

The AI-driven traffic management market is characterized by diverse competition among various emerging companies and startups. These players leverage innovative technologies to enhance traffic flow, reduce congestion, and improve safety. Although they face challenges from established firms, the market's growth potential encourages continuous advancements, fostering a dynamic and competitive landscape.

Region-wise, this market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 25% revenue share in this market. Governments in the region are increasingly focusing on adopting advanced traffic management technologies to address the challenges of traffic congestion, pollution, and road safety. The region’s substantial revenue share also reflects the growing technological advancements and the rising implementation of AI-driven solutions in traffic management.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 18.9 Billion |

| Market size forecast in 2031 | USD 144.1 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 29.7% from 2024 to 2031 |

| Number of Pages | 367 |

| Number of Tables | 563 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Technology, Deployment Mode, Component, Application, End User, Region |

| Country scope |

|

| Companies Included | Siemens AG (Siemens Mobility), Iteris, Inc., Econolite Group, Inc., Thales Group S.A., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Ericsson AB, SWARCO AG, IBM Corporation, Indra Sistemas, S.A., and ST Engineering Limited (Temasek Holdings Limited ) |

By Deployment Mode

By Technology

By Component

By Application

By End User

By Geography

This Market size is expected to reach $144.1 billion by 2031.

Accelerating Urbanization Leading To Demand For Advanced Traffic Solutions are driving the Market in coming years, however, High Implementation Costs Of Advanced Traffic Solutions restraints the growth of the Market.

Siemens AG (Siemens Mobility), Iteris, Inc., Econolite Group, Inc., Thales Group S.A., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Ericsson AB, SWARCO AG, IBM Corporation, Indra Sistemas, S.A., and ST Engineering Limited (Temasek Holdings Limited )

The expected CAGR of this Market is 29.7% from 2024 to 2031.

The Machine Learning (ML) segment captured the maximum revenue in the Market by Technology in 2023, thereby, achieving a market value of $52.04 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $51,523.2 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges