“Global AI Enhanced HPC Market to reach a market value of USD 5.0 Billion by 2031 growing at a CAGR of 9.2%”

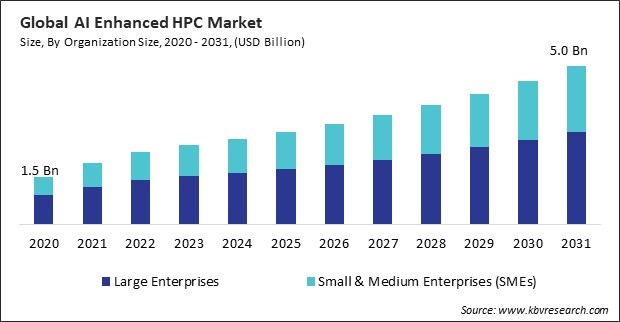

The Global AI Enhanced HPC Market size is expected to reach $5.0 billion by 2031, rising at a market growth of 9.2% CAGR during the forecast period.

Organizations are utilizing AI-driven HPC applications to analyze extensive datasets that pertain to energy consumption, predictive infrastructure maintenance, and the integration of renewable energy sources. As the global focus shifts toward sustainability and efficiency, the energy and utilities segment are expected to leverage AI-enhanced HPC technologies to drive innovation and address emerging energy production and distribution challenges. Therefore, in 2023, the energy and utilities segment held 7% revenue share in the AI enhanced HPC market. The sector increasingly uses HPC to model and simulate energy systems, optimize resource management, and enhance operational efficiency.

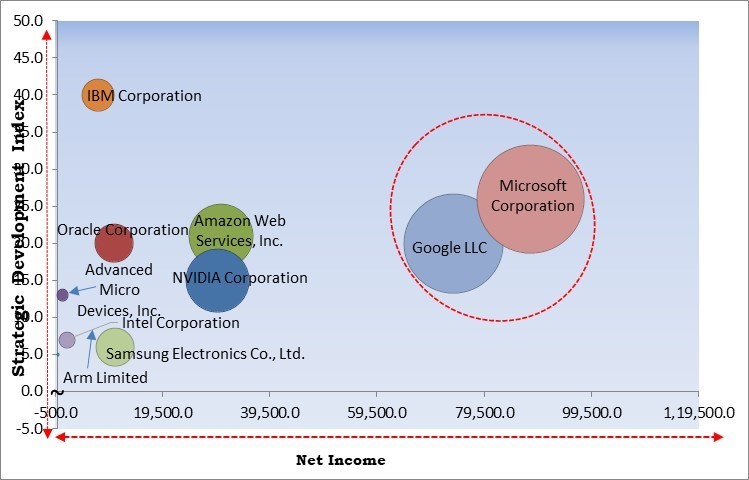

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2024, Arm Limited came into partnership with PyTorch and ExecuTorch to enhance AI performance on Arm-based hardware, enabling efficient deep learning workloads from edge to cloud. The integration of Kleidi technology supports developers with resources and optimizations, driving advancements in the deep learning market. Additionally, In July, 2024, Amazon Web Services, Inc. came into partnership with GE HealthCare to develop AI models and applications for healthcare, aiming to enhance patient care through AWS's machine learning and generative AI technologies for improved data access, analysis, and personalized solutions.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google, LLC are the forerunners in the AI Enhanced HPC Market. Companies such as Amazon Web Services, Inc., NVIDIA Corporation, and Samsung Electronics Co., Ltd. are some of the key innovators in AI Enhanced HPC Market. In May, 2024, Microsoft Corporation came into partnership with Topcon Healthcare to enhance healthcare through AI-powered solutions using the Harmony platform and Nuance Precision Imaging Network. This collaboration aims to improve care access and quality with advanced eye scans and secure cloud technologies.

Organizations are moving beyond basic data processing to employ advanced analytics techniques, including machine learning, deep learning, and artificial intelligence. These techniques require significant computational resources to analyze complex models and datasets, driving the need for AI-enhanced HPC.

Additionally, Cloud-based HPC solutions facilitate collaboration among geographically dispersed teams. Researchers and developers can access powerful computing resources from anywhere, enabling collaborative projects and data sharing in real-time. The cloud allows professionals from various fields—such as data science, engineering, and healthcare—to work together seamlessly, fostering innovation and accelerating project timelines. Hence, rising adoption of cloud-based HPC solutions is propelling the growth of the market.

HPC systems generate a substantial amount of heat, necessitating advanced cooling systems to maintain optimal operating conditions. These cooling solutions often consume large amounts of energy, compounding the overall environmental impact of the HPC infrastructure. Many cooling systems rely on water resources, leading to potential depletion of local water supplies and impacting surrounding ecosystems. Therefore, potential environmental impact of high energy consumption is hindering the growth of the market.

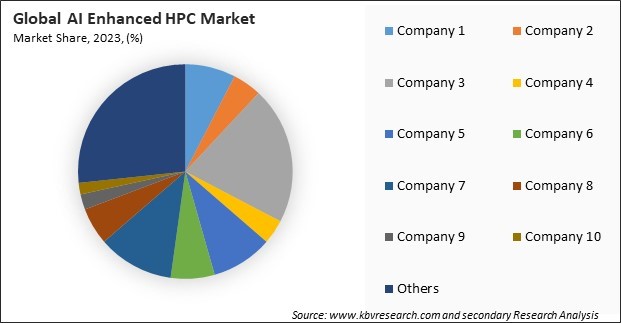

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration above shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater to demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on component, the market is divided into hardware, software, and services. In 2023, the software segment garnered 52% revenue share in the market. This can be ascribed to the growing demand for sophisticated algorithms and applications that utilize AI to improve computational capabilities. Software solutions are critical for optimizing workloads, data management, and providing analytics tools that utilize AI for decision-making.

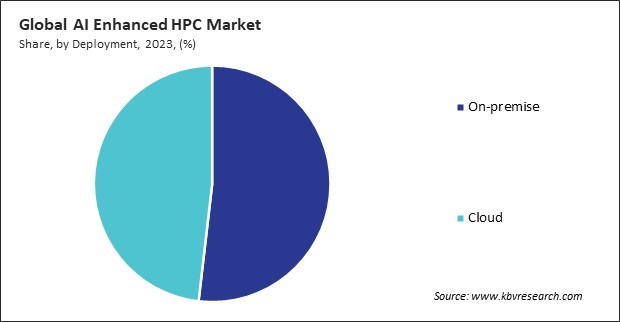

By deployment mode, the market is segmented into cloud and on-premise. In 2023, the cloud segment attained 48% revenue share in the market. The cloud offers significant advantages, including scalability, flexibility, and reduced capital expenditure, making it an attractive option for many businesses.

Based on organization size, the market is categorized into small & medium enterprises (SMEs) and large enterprises. In 2023, the large enterprises segment registered 61% revenue share in the market. This dominance is primarily due to the substantial investments made by large organizations in advanced technologies to drive innovation and maintain competitive advantages.

By computing type, the market is divided into parallel computing, distributed computing, and exascale computing. The exascale computing segment procured 11% revenue share in the market in 2023. Exascale computing is becoming increasingly vital for addressing the most demanding scientific and industrial challenges, including climate modelling, drug discovery, and complex simulations.

Based on vertical, the market is divided into energy and utilities, industrial, manufacturing, pharmaceuticals, analytics for financial services, visualization and simulation, biological and medical, and others. In 2023, the analytics for financial services segment procured 22% revenue share in the market. Financial institutions are leveraging AI-enhanced HPC solutions to perform complex analyses, risk assessments, and fraud detection at unprecedented speeds.

Free Valuable Insights: Global AI Enhanced HPC Market size to reach USD 5.0 Billion by 2031

The AI-enhanced HPC market is fiercely competitive, driven by advancements in computing power and AI integration. Key attributes include enhanced data processing speeds, predictive analytics, and improved scalability. Companies focus on optimizing performance, energy efficiency, and seamless AI integration to meet growing demand across sectors like finance, healthcare, and defense. The market is fueled by the need for faster, more complex simulations and real-time data processing, with AI increasingly essential for handling large-scale computational tasks.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 28% revenue share in the market. Countries such as China, Japan, and India are investing heavily in AI and HPC infrastructure to enhance their capabilities in research, manufacturing, and other industries.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 2.5 Billion |

| Market size forecast in 2031 | USD 5.0 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 9.2%from 2024 to 2031 |

| Number of Pages | 359 |

| Number of Tables | 563 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Organization Size, Deployment, Component, Computing Type, Vertical, Region |

| Country scope |

|

| Companies Included | Advanced Micro Devices, Inc., Arm Limited (SoftBank Group Corp.), NVIDIA Corporation, Oracle Corporation, Google LLC, IBM Corporation, Intel Corporation, Microsoft Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.) and Samsung Electronics Co., Ltd. (Samsung Group) |

By Organization Size

By Deployment

By Component

By Computing Type

By Vertical

By Geography

This Market size is expected to reach $5.0 billion by 2031.

Growing Demand for Computational Power in Data-Driven Industries are driving the Market in coming years, however, High Initial Investment and Operational Costs Operations restraints the growth of the Market.

Advanced Micro Devices, Inc., Arm Limited (SoftBank Group Corp.), NVIDIA Corporation, Oracle Corporation, Google LLC, IBM Corporation, Intel Corporation, Microsoft Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.) and Samsung Electronics Co., Ltd. (Samsung Group)

The expected CAGR of this Market is 9.2% from 2024 to 2031.

The On-premise segment is leading the Market by Deployment in 2023, thereby, achieving a market value of $2.5 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1.6 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges