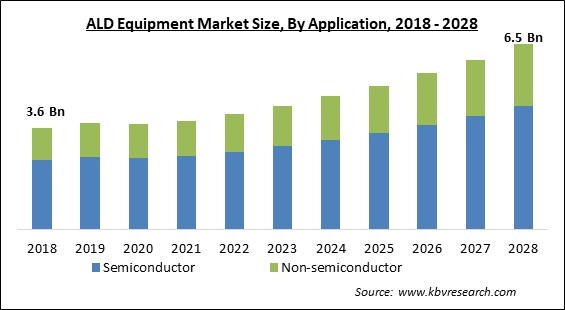

The Global ALD Equipment Market size is expected to reach $6.5 billion by 2028, rising at a market growth of 8.3% CAGR during the forecast period.

Atomic layer deposition, often known as ALD, is a method of thin film deposition that produces layers without pinholes and allows for the resolution of atomic layer thickness. This is accomplished through the self-limiting reaction's consecutive atomic layer creation. High-k dielectric films used in CMOS processors, MEMS, memory devices, and sensors are frequently produced using ALD in the semiconductor industry. For the creation of functional and protective coatings within fuel cells or other applications needing corrosion or wear resistance, ALD technologies are used.

For the development of next-generation devices, they are also utilized to coat high aspect ratio nanostructures, like nanowires and nanotubes. Atomic layer deposition is a vapor-phase deposition process, which was also historically known as atomic layer epitaxy, which is used to create ultra-thin films with perfect growth control. ALD is currently undergoing significant evolution, mostly due to the ongoing trend of electronic device downsizing. High-quality thin films are also rapidly helping many other cutting-edge technologies.

The precursor molecule interacts with the surface in a self-limiting manner in each alternate pulse, ensuring that the reaction terminates after all of the reactive groups on the substrate have been utilized. The type of precursor-surface contact determines whether an ALD cycle is complete. Depending on the need, the ALD cycle can be repeated more than once to increase the number of thin film layers. As ALD is frequently carried out at low temperatures, which is advantageous when working with delicate substrates, certain thermally unstable precursors can still be used as long as the decomposition rate is moderate.

The COVID-19 pandemic landed a significant impact on various industries all over the world. Several businesses, irrespective of their sizes were majorly demolished while a large number of companies and their manufacturing facilities were closed temporarily due to the COVID-19 pandemic. The ALD equipment market was also hampered as a consequence of the pandemic. Due to supply chain delays and frequent lockdowns, the COVID-19 pandemic has had a substantial impact on the producers of Atomic Layer Deposition (ALD) Equipment. Furthermore, the expansion of the Atomic Layer Deposition (ALD) Equipment market in the initial period of the outbreak has been constrained by the economic recession and geopolitical issues all over the world as a result of the abrupt emergence of the pandemic.

The creation of data-driven solutions has increased significantly as a result of the rise of technologies, like the Internet of Things, artificial intelligence, and 5G. Many businesses place a strong emphasis on research and development (R&D) activities in order to create cutting-edge solutions utilizing such technologies. Due to the need to provide sophisticated, effective, and intelligent solutions, there is now a greater demand for ICs in order to be embedded in devices. Additionally, there is a growing market for complicated and tiny ICs due to the growing popularity of miniaturized, lightweight, and quick electronic gadgets. This is anticipated to fuel the expansion of the ALD equipment market since ALD makes it possible to deposit ultra-thin Nanolayers on a variety of substrates.

With the advancement of several technologies as well as the rapid spread of modernization all over the world, concerns about the depletion of resources are also emerging. One of the most prevalent concerns is the rapidly increasing consumption of energy as a result of several factors, such as the increasing use of automated machinery within the commercial as well as the residential sector. According to the International Energy Administration, the consumption of renewable energy increased to 28% in 2020 from 26% in 2019. Solar energy can be transformed into electricity with the use of PV panels and solar cells. Therefore, the growth of the ALD equipment market is witnessing exponential growth due to the increasing demand for photovoltaics.

Semiconductor manufacturing processes require clean facilities and clean machinery. The process can be hampered and severely damaged by even a small amount of dust. Order cancellations and further losses could occur as a result of supply delays brought on by production mistakes. Manufacturing semiconductors is frequently hampered by issues with mechanical integrity, faults in raw materials, and chip-level issues. Furthermore, to create high-quality semiconductor devices and integrated circuits (ICs), cutting-edge and creative methods are required at the fabrication stage. Wafer complexity has substantially increased as a result of the growing trend toward miniaturization, which is caused by the existence of numerous patterns over the chip level. This factor is impeding the growth of the ALD equipment market.

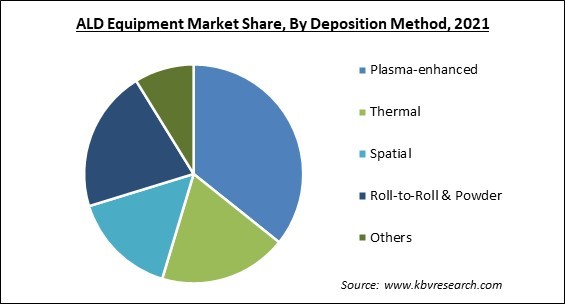

Based on Deposition Method, the ALD Equipment Market is segmented into Plasma-enhanced ALD, Thermal ALD, Spatial ALD, Roll-to-Roll ALD, Powder ALD, and Others. In 2021, the thermal ALD segment garnered a substantial revenue share of the ALD equipment market. A and B are the two reactants in a binary process called thermal ALD. The ALD chamber is pumped with the initial reactant, A. The chemicals are then purged once the wafer has been treated. The second reactant, B, then goes through the identical process. In order to deposit films, thermal ALD systems generally use DI water identically as a co-reactant along with the metal-organic precursor.

On the basis of Film Type, the ALD Equipment Market is segregated into Oxide Films, Metal Films, Sulfide Films, Nitride Films, and Fluoride Films. In 2021, the fluoride films segment procured a significant revenue share of the ALD equipment market. ALD of fluorides has witnessed rising demand in recent years because of their high suitability for optical applications and low refractive index, which enables enhanced transmission at IR and UV wavelengths. Lithium-ion battery protective coatings can also be created using substances, like aluminum fluoride.

By Application, the ALD Equipment Market is bifurcated into Semiconductor (More-than Moore, Research & Development Facilities, and More Moore) and Non-Semiconductor (Energy, Medical, Conventional Optics, and Coating). In 2021, the semiconductor segment recorded the highest revenue share of the ALD equipment market. The major factor that is propelling the growth of the segment is the increasing expansion of the semiconductor industry due to the COVID-19 pandemic. The COVID-19 pandemic has been exceptional and astonishing, with positive demand for semiconductors in all countries and regions compared to levels before the outbreak.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.8 Billion |

| Market size forecast in 2028 | USD 6.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.3% from 2022 to 2028 |

| Number of Pages | 309 |

| Number of Tables | 570 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Deposition Method, Film Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the ALD Equipment Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific accounted for the highest revenue share of the ALD equipment market. The financial support provided by numerous governments is a key component fueling industry expansion in the Asia Pacific. Furthermore, numerous key market players selling ALD equipment should benefit from the expanding research facilities and improvements in the semiconductor sector in Asia and the Pacific. Another important element fueling the market's expansion is the affordable availability of trained labor in the Asia Pacific region.

Free Valuable Insights: Global ALD Equipment Market size to reach USD 6.5 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Applied Materials, Inc., ASM International N.V., Tokyo Electron Ltd., Lam Research Corporation, Kurt J. Lesker, Veeco Instruments Inc., Optorun Co., Ltd., CVD Equipment Corporation, Eugene Technology Co. Ltd., and Beneq Oy.

By Deposition Method

By Film Type

By Application

By Geography

The global ALD Equipment Market size is expected to reach $6.5 billion by 2028.

The seamlessly growing semiconductor industry are driving the market in coming years, however, A large number of complexities within manufacturing along with technical challenges restraints the growth of the market.

Applied Materials, Inc., ASM International N.V., Tokyo Electron Ltd., Lam Research Corporation, Kurt J. Lesker, Veeco Instruments Inc., Optorun Co., Ltd., CVD Equipment Corporation, Eugene Technology Co. Ltd., and Beneq Oy.

The Plasma-enhanced market acquired the highest revenue share in the Global ALD Equipment Market by Deposition Method in 2021, thereby, achieving a market value of $2.1 billion by 2028.

The Asia Pacific market dominated the Global ALD Equipment Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.