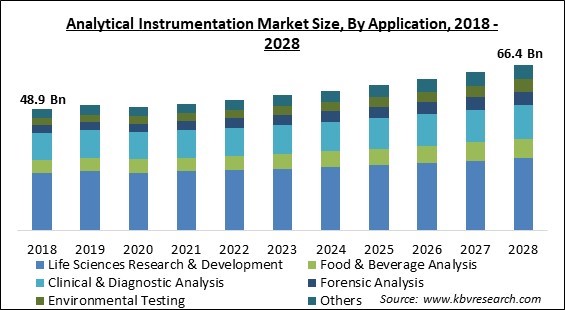

The Global Analytical Instrumentation Market size is expected to reach $66.4 billion by 2028, rising at a market growth of 4.0% CAGR during the forecast period.

Analytical instrumentation is laboratory equipment used to investigate the separation, identification, and quantification of chemical components in both natural and synthetic materials. These analytical tools are employed to gather quantitative and qualitative data regarding the existence of a number of components in a particular sample. These tools are also used in a wide range of clinical diagnostic procedures as well as life sciences research to create new therapeutic and diagnostic products.

Pharmaceutical and biotechnology sectors have emerged as the leading end-users of analytical equipment due to their significant usage of these tools throughout the drug development process as a result of their vast R&D activities. Pharmaceutical enterprises are actively engaging and investing in R&D for the development of advanced and efficient products. Consequently, increased R&D investments and instrument adoption rates are likely to drive market growth.

In addition, enterprises are developing innovative technologies to fulfil expanding demand and exploit untapped market potential, which is being driven by the technological advancement of analytical instrumentation. Additionally, the use of analytical instrumentation solutions is anticipated to increase due to the growing development of precision medicine. In order to identify illnesses and create customized therapies, precision medicine utilizes analytical instrumentation for next-generation sequencing, molecular imaging, molecular dynamics, and molecular diagnostics.

For example, genomic sequencing is used in molecular diagnostics to analyze a patient's biomarkers. These tests carried out with different analytical tools, provide knowledge on the optimal course of action or even forecast the treatments that are most appropriate for a specific patient. Additionally, the 3D structures of biological organisms like proteins are widely studied using microscopes and techniques like cryogenic electron microscopy in the drug development process.

The COVID-19 pandemic caused a decline in the business of analytical instruments, including heat analyzers, spectroscopy, and chromatography-related equipment. This was brought on by the implementation of severe lockdown regulations, the interruption of supply networks, and a decline in clinical trial activity during that time. However, the pandemic caused a huge increase in demand for PCR, microarray, and sequencing technology-related instruments in 2021. Several novel PCR products were introduced during this time to address the rising COVID-19 cases. Problems like late product delivery along with an uneven demand for goods, hampered the supply chain of the analytical instruments industry.

This has propelled significant improvements in precision diagnoses and therapeutics as well as developments like next generation sequencing (NGS) and large genomic data. Additionally, there have been significant developments in gene therapy and the creation of precision medicines to treat ailments like cancer, TB, and Alzheimer's. As a result, more pharmaceutical and biotech businesses are starting to enter this market. Therefore, the growth of the analytical instrumentation market is being booted by the rise of precision medicine, providing individualized medicines and treatments.

Water and wastewater involve many processes, like chromatography. Therefore, the chromatography sector's development is driven by the incorporation of cutting-edge technologies like Big Data and artificial intelligence (AI). Such technologies are anticipated to automate the categorization of data and enhance the reliability of quantitative results due to the large amount of data generated during chromatography. Therefore, the requirement of analytical instrumentation in different R&D activities mainly to evaluate the characteristics and parameters of water & wastewater treatment is accelerating the market growth.

The complexity of analytical instruments has significantly risen due to technological improvements, making it necessary to have a skilled crew handle them efficiently. Another significant obstacle is the lack of supporting infrastructure to establish testing facilities. Due to the fragmentation and predominance of small businesses in the manufacturing industry, sample collection from these businesses might be difficult for testing service providers in many developing nations. Lack of institutional cooperation and equipment shortage are two other significant problems. As a result, the lack of qualified specialists will probably limit how widely laboratory instruments and consumables are used by end users, thus slowing the market's growth.

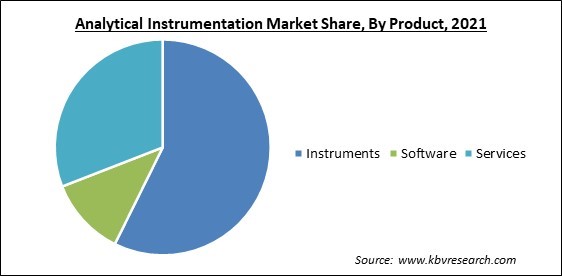

Based on product, the analytical instrumentation market is categorized into instruments, services, and software. The software segment procured a considerable growth rate in the analytical instrumentation market in 2021. Software is frequently utilized in various contexts, including academic research and clinical diagnosis, for data processing and result interpretation in analytical operations. For instance, with the help of flow cytometry software data is acquired & controlled, after which the results are statistical analysis is done. Over the course of the projected period, such software abilities are expected to fuel segment expansion.

On the basis of technology, the analytical instrumentation market is divided into polymerase chain reaction, spectroscopy, microscopy, chromatography, flow cytometry, sequencing, microarray, and others. The chromatography segment recorded a significant revenue share in the analytical instrumentation market in 2021. The diverse applications in life science, pharmaceutical, and other areas are mostly accountable for the segment's rise. The three types of chromatography are gas, liquid, and ion. Complex proteomic studies are discovered using liquid chromatography. Ion chromatography techniques are employed in fields where quality control is necessary like environmental testing.

Based on application, the analytical instrumentation market is segmented into life sciences research & development, clinical & diagnostic analysis, food & beverage analysis, forensic analysis, environmental testing, and others. The clinical & diagnostic analysis segment acquired a substantial revenue share in the analytical instrumentation market in 2021. There is a strong demand for diagnostic tests due to the rising prevalence of cancer and chronic diseases, which is projected to fuel demand for analytical equipment goods like flow cytometers for clinical testing. Additionally, it is projected that the approval and introduction of novel analytical apparatus for clinical laboratories will accelerate segment growth. This makes it possible to identify samples quickly, cheaply, and accurately.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 51 Billion |

| Market size forecast in 2028 | USD 66.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4% from 2022 to 2028 |

| Number of Pages | 283 |

| Number of Table | 432 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Technology, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the analytical instrumentation market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed the highest revenue share in the analytical instrumentation market in 2021. This considerable market share can be due to the region's established pharmaceutical sector and healthcare system, which have generated a sizable demand for analytical instruments for clinical and research applications. The need for analytical instruments and instrumentation have also been spurred by high number of R&D projects that aim to develop vaccines and medicines for different diseases and by engaging more public-private support in cancer research.

Free Valuable Insights: Global Analytical Instrumentation Market size to reach USD 66.4 Billion by 2028

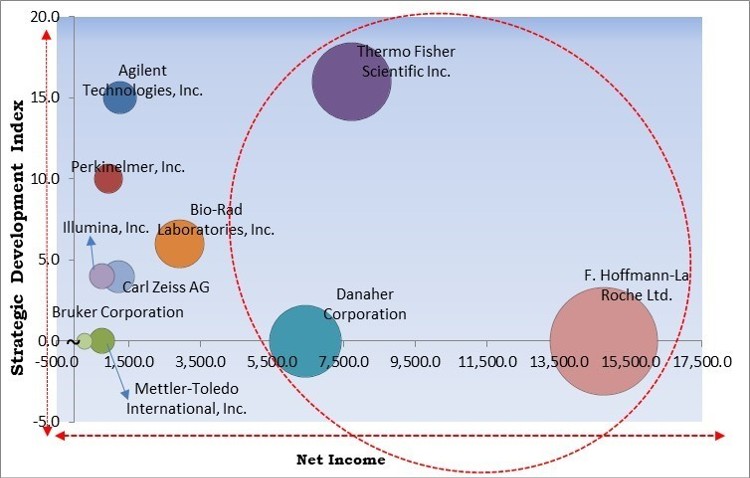

The major strategies followed by the market participants are Acquisition. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc. and Danaher Corporation are the forerunners in the Analytical Instrumentation Market. Companies such as Bio-Rad Laboratories, Inc., Carl Zeiss AG, and Agilent Technologies, Inc. are some of the key innovators in Analytical Instrumentation Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Illumina, Inc., Bio-Rad Laboratories, Inc., Carl Zeiss AG, Danaher Corporation, Bruker Corporation, F. Hoffmann-La Roche Ltd., and Mettler-Toledo International, Inc.

By Product

By Technology

by Application

By Geography

The global Analytical Instrumentation Market size is expected to reach $66.4 billion by 2028.

Increasing usage of analytical instrumentation in water and wastewater treatment are driving the market in coming years, however, Dearth of skilled professionals to operate analytical equipment restraints the growth of the market.

Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Illumina, Inc., Bio-Rad Laboratories, Inc., Carl Zeiss AG, Danaher Corporation, Bruker Corporation, F. Hoffmann-La Roche Ltd., and Mettler-Toledo International, Inc.

The Life Sciences Research & Development segment acquired maximum revenue share in the Global Analytical Instrumentation Market by Application in 2021 thereby, achieving a market value of $28.9 billion by 2028.

The Instruments segment is leading the Global Analytical Instrumentation Market by Product in 2021 thereby, achieving a market value of $37.2 billion by 2028.

The North America market dominated the Global Analytical Instrumentation Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $27.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.