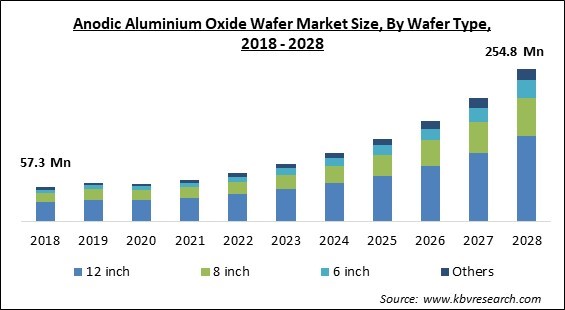

The Global Anodic Aluminium Oxide Wafer Market size is expected to reach $254.8 Million by 2028, rising at a market growth of 21.0% CAGR during the forecast period.

Anodic Aluminum Oxide (AAO) is a self-organized substance that resembles a honey-comb structure created by the high-density arrays of parallel and uniform nanopores. AAO is produced by Aluminum’s electrochemical oxidation (anodization) in a condition that balances out the growth and the localized dissolution of aluminum oxide.

Dense anodic alumina is formed with limited thickness during the absence of such dissolution. The diameter of the nanopores is controllable, with great precisions getting as small as five nanometers and as large as several hundred nanometers, and the length of the pore is a few tens of nanometers to a few hundred micrometers.

In electronics, a wafer, also known as a slice or substrate, is a thin slice of a semiconductor, like crystalline silicon (c-Si), which is utilized for the manufacturing of integrated circuits and, in photovoltaics, to create solar cells. The wafer is the substrate for microelectronic devices built upon and in the wafer.

Wafer goes through various microfabrication processes, like ion implantation, doping, etching, thin-film deposition of numerous materials, and photolithographic patterning. In the end, the individual microcircuits are separated with the help of wafer dicing and packed as an integrated circuit.

Anodizing aluminum has been used for decorative and corrosion purposes since the early last century. The porous nature of anodic alumina films was found during the 1930s and was further elaborated between the 1950s-1970s. Various acids like chromic acid, oxalic acid, phosphoric acid, or sulphuric acid are used to produce an anodic aluminum oxide membrane.

The outbreak of the COVID-19 pandemic has severely affected the anodic aluminum oxide wafer market. With the government of various nations imposing lockdowns, the production & manufacturing facilities were shut down globally, which caused a crisis and unavailability of the workforce. With the inputs from various industry experts belonging to the different stages of the value chain, like end users, distributors, and suppliers, the decline in growth can be seen. Thus, the economic impact of the pandemic has been quite disruptive. Despite this, as the restriction from COVID-19 is lifting slowly and the industries are getting back on track, the market is expected to recover from the losses and show growth in the projected period.

The anodic aluminum oxide (AAO) features an interesting nanoporous structure capable enough to be used as a template for nanopatterning, highly anisotropic nanowire fabrication, and Microelectromechanical (MEMs) devices fabrication. There is a strong demand for high-quality and performance spiral inductors for radio frequency integrated circuits (RFIC). Due to this, ferromagnetic materials are integrated into the spiral inductors to enhance their performance and reduce their size. The ability of AAO template to help manufacture MEMs devices will boost the anodic aluminum oxide wafer market.

Semiconductor electronic devices are usually covered with a protective enclosure to surround the internal components and protect them from any adverse condition. These enclosures are created based on different fabrication methods to form a final product in a single sheet, preferably made of aluminum alloys. Anodic Aluminum Oxide-nanopores (AAO-np) structures fabricated on the aluminum alloy using a two-step anodizing process are known to exhibit good crystallinity with an oxide layer.

During manufacturing and assembly, physical defects or containments can be induced into the wafer. These problems can cause a decrease in the production yield, longer processing time, or even production failure. Semiconductors' Front-of-line environment can also affect the quality of the wafers. There is also a possibility of contamination due to foreign material, and static charges could pollute the wafer and its dice.

On the basis of wafer type, the anodic aluminum oxide wafer market is divided into 6-inch, 8-inch, 12-inch and others. The 12-inch segment witnessed the largest revenue share in the anodic aluminum oxide wafer market in 2021. This is because this wafer type is more enhanced than other wafer types. The broader width for tighter designs and higher yields helps in profit margins. Also, a 12-inch wafer needs much less capital expenditure to maintain and build. The 12-inch wafer is used for memory, mobile phones, and PCs. The demand for a 12-inch wafer is increasing due to these factors and thus propelling the segment’s growth.

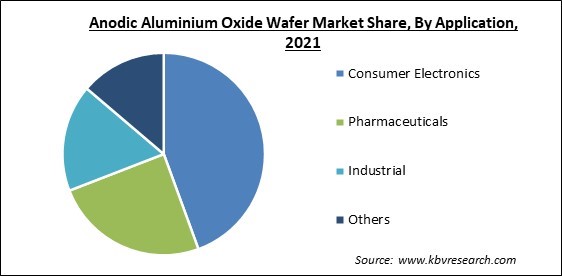

By application, the anodic aluminum oxide wafer market is classified into consumer electronics, pharmaceuticals, industrial and others. The pharmaceutical segment recorded a remarkable growth rate in the anodic aluminum oxide wafer market in 2021. This is due to using a wafer system containing HPC, glycine, and mannitol, which can disintegrate within 30 seconds. The modified wafer system consists of pectin cross-linked with zinc ions serving as the drug reservoir and mucoadhesive polymer combination of pectin, carmellose, and gelatin, which gives effective release of model drug diphenhydramine hydrochloride in approximately six hours.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 69.4 Million |

| Market size forecast in 2028 | USD 254.8 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 21% from 2022 to 2028 |

| Number of Pages | 160 |

| Number of Tables | 280 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Wafer Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the anodic aluminum oxide wafer market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region procured the largest revenue share in the anodic aluminum oxide wafer market in 2021. This is due to the availability of high-end enhanced technologies, increased demand for innovative electronics, and growth in the manufacturing industry. Globally, the Asia Pacific is the fastest economically growing region, and also the presence of many key tech market players is working as a catalyst for the market’s growth in the region.

Free Valuable Insights: Global Anodic Aluminium Oxide Wafer Market size to reach USD 254.8 Million by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bonnell Aluminium (Tredegar Corporation), Dajcor Aluminum Ltd., Monocrystal, PLC (JSC Energomera Concern), Superior Metal Technologies, LLC (AGS Capital, LLC), InRedox LLC, Aluminium Products Company (ALUPCO), A. & D. Prévost Inc., Lorin Industries, Inc., CoorsTek, Inc., and Petersen Aluminum Corporation (PAC) (Carlisle Construction Materials) (Carlisle Companies Incorporated)

By Wafer Type

By Application

By Geography

The global Anodic Aluminium Oxide Wafer Market size is expected to reach $254.8 Million by 2028.

Increased Usage Of AAO Template For Making Mems Devices are driving the market in coming years, however, Defects In Wafers, Affect The Performance Of The Device restraints the growth of the market.

Bonnell Aluminium (Tredegar Corporation), Dajcor Aluminum Ltd., Monocrystal, PLC (JSC Energomera Concern), Superior Metal Technologies, LLC (AGS Capital, LLC), InRedox LLC, Aluminium Products Company (ALUPCO), A. & D. Prévost Inc., Lorin Industries, Inc., CoorsTek, Inc., and Petersen Aluminum Corporation (PAC) (Carlisle Construction Materials) (Carlisle Companies Incorporated)

The Consumer Electronics segment acquired maximum revenue share in the Global Anodic Aluminium Oxide Wafer Market by Application in 2021 thereby, achieving a market value of $110 Million by 2028.

The Asia Pacific market dominated the Global Anodic Aluminium Oxide Wafer Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $95.5 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.