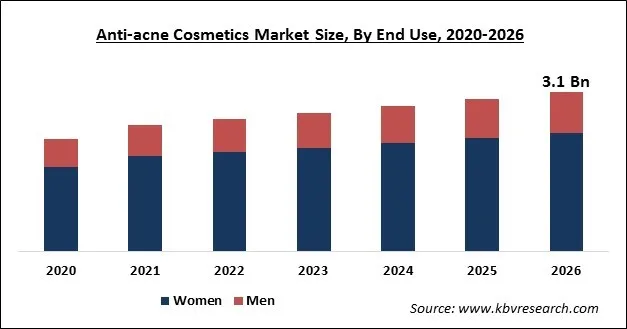

The Global Anti-acne Cosmetics Market size is expected to reach $3.1 billion by 2026, rising at a market growth of 6.1% CAGR during the forecast period. Acne is a typical skin issue that prompts the event of lesions called zits or pimples. The exceptionally regular kind of skin issue in young people is known as acne vulgaris. Anti-acne cosmetics aid in clearing up blackheads, pimples, whiteheads, and different types of lesions.

The negative social disrespect related to acne and the increasing utilization of beauty care products (cosmetics) by men as well as women, particularly from developing countries, are the major variables driving the market development. Acne is the most widely recognized skin issue among youths. As indicated by an article published by the Journal of The European Academy of Dermatology and Venereology, over 95% of young men and almost 85% of young ladies are experiencing acne. Out of these, almost 40% suffer moderate-to-severe acne and almost half keep on having acne in their adulthood. Accordingly, the high occurrences of this skin issue are expected to fuel the market development.

Acne patients are at a high possibility of experiencing anxiety, depression, low confidence, low quality of life, and dejection. This can be ascribed to the emotional and mental affiliations that a person has with his/her looks. These mental impacts are additionally increased by the expanding utilization of the internet, social media, and photograph-editing applications.

This increasing occurrence of acne in youth is another significant factor driving the growth of the global anti-acne cosmetics market. There are many players who are adding capacities & focus on the price and quality leadership which will enhance profitability. Simultaneously, companies aim for various technological developments, equipment improvements, and process advancements with an aim to cut down the prices & enhance quality.

Based on Product, the market is segmented into Creams & Lotions, Cleanser & Toner, Mask and Other Products. The creams & lotions segment procured the highest revenue share in 2019 due to the massive demand for these items as they give safety from the skin and bacterial infections like eczema and psoriasis.

Based on End Use, the market is segmented into Women and Men. In 2019, the women end-use segment emerged as the leading segment and procured the maximum revenue share of the global anti-acne cosmetics market. The women's end-use segment would exhibit a substantial growth rate during the forecast period.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 2.2 Billion |

| Market size forecast in 2026 | USD 3.1 Billion |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 6.1% from 2020 to 2026 |

| Number of Pages | 148 |

| Number of Tables | 260 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global Anti-acne Cosmetics Market to reach a market size of $3.1 Billion by 2026

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2019, Asia Pacific emerged as the leading region in the global market. Additionally, the region would exhibit highest growth during the forecast years. Asia Pacific is among the most popular importer for the U.S.- based items due to a high target population. Countries, like Japan, Australia, and South Korea, are some of the biggest consumers for U.S.- based brands.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Estee Lauder Companies, Inc. (Clinique), Unilever PLC (Murad Skincare), Johnson and Johnson, L'Oreal Group, LVMH SE, Beiersdorf AG, KOSE Corporation, Rohto Pharmaceutical Co., Ltd. (Mentholatum), The Proactiv Company LLC (Guthy-Renker LLC), and Ancalima Lifesciences Limited.

By Product

By End Use

By Geography

The global anti-acne cosmetics market size is expected to reach $3.1 billion by 2026.

Organic & natural products are finding high demand are driving the market in coming years, however, side-effects of anti-acne cosmetics have limited the growth of the market.

Estee Lauder Companies, Inc. (Clinique), Unilever PLC (Murad Skincare), Johnson and Johnson, L'Oreal Group, LVMH SE, Beiersdorf AG, KOSE Corporation, Rohto Pharmaceutical Co., Ltd. (Mentholatum), The Proactiv Company LLC (Guthy-Renker LLC), and Ancalima Lifesciences Limited.

The Creams & Lotions market dominated the Global Anti-acne Cosmetics Market by Product in 2019.

The Asia Pacific market dominated the Global Anti-acne Cosmetics Market by Region in 2019, growing at a CAGR of 6.8 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.