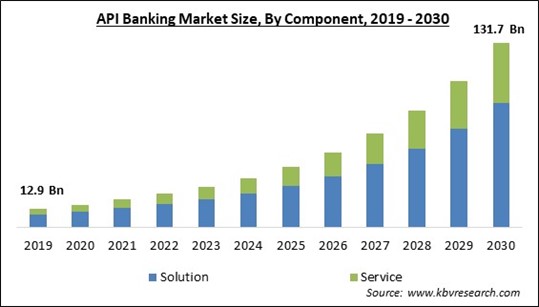

The Global API Banking Market size is expected to reach $131.7 billion by 2030, rising at a market growth of 24.2% CAGR during the forecast period.

Numerous people access their bank accounts through mobile browsers or smartphones. As smartphone adoption increases, more individuals will use digital banking in the near future, increasing the requirement for a platform solution among banks. The North America region acquired $9,344.4 million in 2022, as a result of digitization of banking, regulatory initiatives, FinTech partnerships, and customer-focused solutions. To capitalize on the opportunities presented by this changing landscape, businesses in this region are employing strategies like API marketplaces, developer outreach programs, standardization efforts, and secure API management.

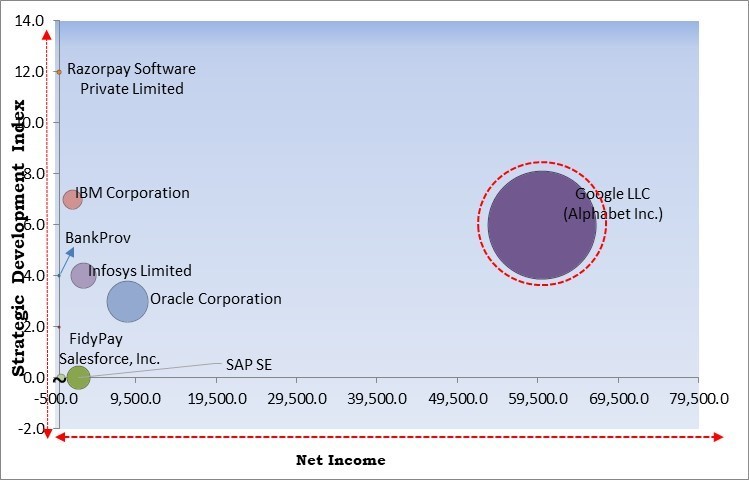

The major strategies followed by the market participants are Product launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2023, Oracle Corporation announced the launch of new services for demand deposit account processing. These include Oracle Banking Accounts Cloud Service, Oracle Banking Payments, and Oracle Banking Enterprise Limits and Collateral Management Cloud. Additionally, In November, 2022, Razorpay Software Private Limited announced the launch of RazorpayX Digital Lending 2.0, a digital lending solution that works in compliance with RBI guidelines. The solution features a full-stack lending suite for automated money transfers.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC is the forerunner in the Market. In March, 2022, Google LLC introduced Google Cloud Contact Center AI Platform, an extension to its Contact Center AI end-to-end solution. The features of the new extension include compatibility with Android and iOS, multiple channel management, AI-driven customer needs prediction, and Automated scheduling. Companies such as Oracle Corporation, Infosys Limited, IBM Corporation are some of the key innovators in the Market.

Banks are investing substantially in digital transformation to meet changing consumer expectations and remain competitive. API is crucial to this transformation because it enables institutions to provide customers with a seamless omnichannel experience. Through API integration, banks can provide services like real-time balance updates, transaction history, fund transfers, and personalized recommendations throughout multiple channels, such as mobile apps, websites, and other digital touchpoints. In addition, the end-to-end digitalization of services has always posed a challenge for legacy institutions. Banks rely on physical documents for onboarding and Know Your Customer (KYC) checks. Consequently, the growing digitalization of the financial industry would increase API adoption, resulting in market expansion.

API banking is becoming more popular as a result of open banking legislation like the Revised Payment Services Directive (PSD2) of the European Union and comparable programs in other countries. In order to compete, innovate, and work together with FinTech firms, these regulations require banks to make their customer data as well as payment infrastructure available through APIs. Additionally, API allows FinTech businesses and third-party developers to securely access banking data, create new financial products & services, and provide clients with tailored experiences. Application programming interfaces (APIs) are used by open banking services to perform a secure data transfer of financial information. As a result, these elements have played a vital role in expanding the market.

Ensuring the security and confidentiality of consumer data and transactions is a significant implementation challenge and risk associated with open banking APIs. Open banking APIs necessitate the disclosure of sensitive and personal data, such as account information, balances, preferences, transactions, and identity, to multiple third-party providers. This increases the data's exposure and susceptibility to potential intrusions, fraud, and abuse. Service providers must implement robust and dependable security measures, such as encryption, authentication, authorization, and monitoring, to protect the data and prevent unauthorized access or alteration. This may impede the growth of the market during the forecast period.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

By component, the market is segmented into solution and service. In 2022, the solution segment held the highest revenue share in the market. This is due to the open banking initiatives mandated by regulators in multiple regions. Open banking requires banks to provide a secure and standardized application programming interface (API) that enables authorized third-party providers to access consumer data and initiate payments.

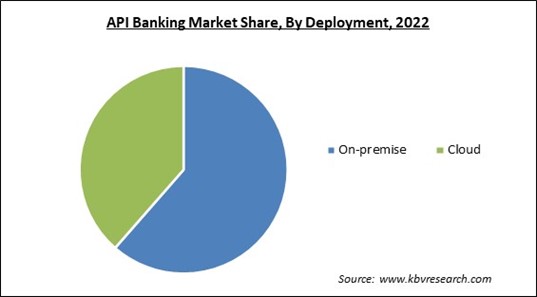

Based on deployment, the market is fragmented into on-premise and cloud. In 2022, the cloud segment garnered a significant revenue share in the market. This is due to its scalability and adaptability, which enables financial institutions and banks. With API operating on cloud infrastructure, banks can scale their resources up or down in response to fluctuating demand. In addition, cloud-based API banking enables the seamless integration of third-party systems, FinTech applications, and partner platforms.

On the basis of enterprise size, the market is bifurcated into large enterprises and small and medium-sized businesses. In 2022, the large enterprise segment dominated the market with the maximum revenue share. API banking enables large businesses to provide customers with more customized and seamless services. Enterprises can provide a comprehensive and user-friendly experience by integrating with multiple financial and non-financial applications. API banking promotes rapid innovation by enabling collaboration between large enterprises, fintech firms, and other third-party developers.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 23.8 Billion |

| Market size forecast in 2030 | USD 131.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 24.2% from 2023 to 2030 |

| Number of Pages | 213 |

| Number of Table | 324 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment, Enterprise Size, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, APAC region covered a considerable revenue share in the market. This is a result of the initiatives taken by regulatory authorities in Asia-Pacific, like the Monetary Authority of Singapore (MAS) and the Reserve Bank of India (RBI), to promote open banking and encourage API usage in the financial sector. These regulations have facilitated the growth of API banking services and increased their market penetration.

Free Valuable Insights: Global API Banking Market size to reach USD 131.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Google LLC (Alphabet Inc.), BankProv (PROVIDENT BANCORP, INC.), TIBCO (The Information Bus Company) Software. Inc., FidyPay (Jambopay Express Pvt Ltd), Oracle Corporation, Razorpay Software Private Limited, Infosys Limited, IBM Corporation, SAP SE and Salesforce, Inc

By Component

By Deployment

By Enterprise Size

By Geography

The Market size is projected to reach USD 131.7 billion by 2030.

Digital transformation and customer experience are driving the Market in coming years, however, Data security and privacy concerns with open banking APIs restraints the growth of the Market.

Google LLC (Alphabet Inc.), BankProv (PROVIDENT BANCORP, INC.), TIBCO (The Information Bus Company) Software. Inc., FidyPay (Jambopay Express Pvt Ltd), Oracle Corporation, Razorpay Software Private Limited, Infosys Limited, IBM Corporation, SAP SE and Salesforce, Inc

The expected CAGR of this Market is 24.2% from 2023 to 2030.

The On-premise segment acquired maximum revenue in the Global API Banking Market by Deployment in 2022; thereby, achieving a market value of $78.3 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $47.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.