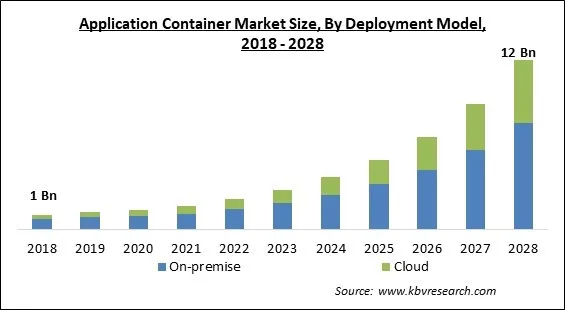

The Global Application Container Market size is expected to reach $12 billion by 2028, rising at a market growth of 33.1% CAGR during the forecast period.

Multiple solutions can be created, upgraded, and deployed on a single OS kernel with the help of an application container platform. The technology enables the automation of several activities, including lifecycle management solution scaling, monitoring, scheduling, and upgrading. Enterprises can improve their core skills, such as security, network connection, customer interactions, and end-to-end services level monitoring, with the use of application container technology.

It enables the end-user companies to reduce operating expenses and maximize the resource usage of their application infrastructure. Due to the expanding usage of hybrid cloud technologies, there has been an increase in interest in the application container market recently. Private and public clouds are used in hybrid cloud computing deployments.

The hybrid cloud computing model offers the cloud environment flexibility. Due to these system installations, businesses can keep their private and confidential data in remote clouds. Enterprises can improve their core skills, such as security, network connection, customer interactions, and end-to-end services level monitoring, with the use of application container technology. It enables the end-user companies to reduce operating expenses and maximize the resource usage of their application infrastructure.

IT operations are typically conducted via "working from home" arrangements, so the lockdown hasn't disrupted the application container market. As a result, application containers are still in high demand in the IT sector. In addition, application containers have been shown to improve productivity and application development while working from home. As a result, during the Covid-19 pandemic, all software organizations adopted the application container. Due to the prevalence of working-from-home arrangements in the information technology industry, the lockdown has primarily had little impact on the application container industry.

Due to the many advantages of application container technology over virtual machines, the industry is anticipated to grow more quickly. For instance, a virtual machine with its full operating system can be several gigabytes in size, whereas an application container is only 10 megabytes. Because of this, virtual machines and containers can both be hosted on the same server. Another significant advantage is that application containers can be started very immediately, as opposed to virtual machines, which may take several minutes to boot up their operating platforms and start running the apps they host.

Coordination is necessary for businesses to expand and adapt to the escalating competition. Only by implementing cutting-edge technologies and creating and distributing contemporary applications will this be possible. Application containers speed up the development of applications by cutting down on testing time and simplifying testing procedures, resulting in increased agility. Container orchestration also simplifies the deployment of applications in various contexts, such as virtual or physical infrastructures and public, private, or hybrid clouds.

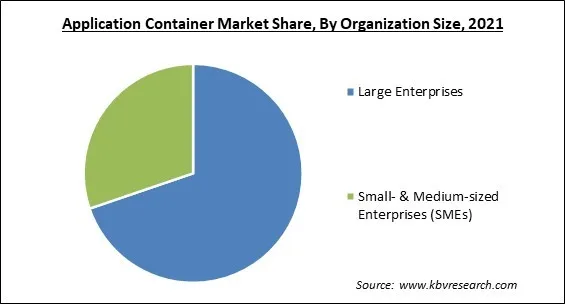

The practice of running several, uncontrollable instances of a program through containers and the ensuing high resource consumption are referred to as "container sprawl." In several situations, resource usage leaves less available for running practical containers. Additionally, the possibility of misconfiguration and improper handling of uncontrollable containers on a certain host raise those risks. The cost of the public cloud environment may increase due to container sprawl. Large businesses are more susceptible to container sprawls than Small and Medium-sized Businesses (SMEs).

On the basis of deployment model, the Application Container Market is fragmented into On-premise and Cloud. The on-premise segment acquired the highest revenue share in the application container market in 2021. Due to ongoing development in on-premises deployment, this displays many cloud-like traits like high levels of virtualization and relative isolation from hardware limitations. On-premises refers to IT network elements, including hardware and software,that are hosted locally. IT assets hosted on a public cloud platform or a distant data centre contrast with this.

Based on organization size, the Application Container Market is classified into Small- & Medium-sized Enterprises (SMEs) and Large Enterprises. The small- & medium-sized enterprises (SMEs) segment recorded a substantial revenue share in the application container market in 2021. It is because small businesses upgrade their essential competencies, including client relations, security, network connectivity, and end-to-end services level monitoring, due to the application container technology. The application container enables end-user companies to reduce operating costs and maximize the resource usage of their application infrastructure.

By Vertical, the Application Container Market is segmented into Telecom & IT, Government, Healthcare, BFSI, Retail, education and others. The telecom & IT segment garnered the highest revenue share in the application container market in 2021. Containers have emerged as a highly important enabling technology. As part of the digital transformation projects, numerous organizations are primarily focusing on replacing their traditional, manually-based IT jobs with software that can automate the test, installation, and runtime procedures.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 12 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 33.1% from 2022 to 2028 |

| Number of Pages | 241 |

| Number of Tables | 373 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Deployment Model, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Application Container Market is analysed across North America, Europe, Asia Pacific and LAMEA. The North America region acquired the largest revenue share in the application container market in 2021. Due to factors like the presence of cutting-edge ICT infrastructure in the area, ongoing R&D effort by technology providers, and a vast cloud network built by major cloud service providers. With the ample availability of the supporting infrastructure needed for the deployment of cutting-edge analytics and the existence of top cloud service providers, the market for application containers will maintain its trend of dominance during the projection period.

Free Valuable Insights: Global Application Container Market size to reach USD 12 Billion by 2028

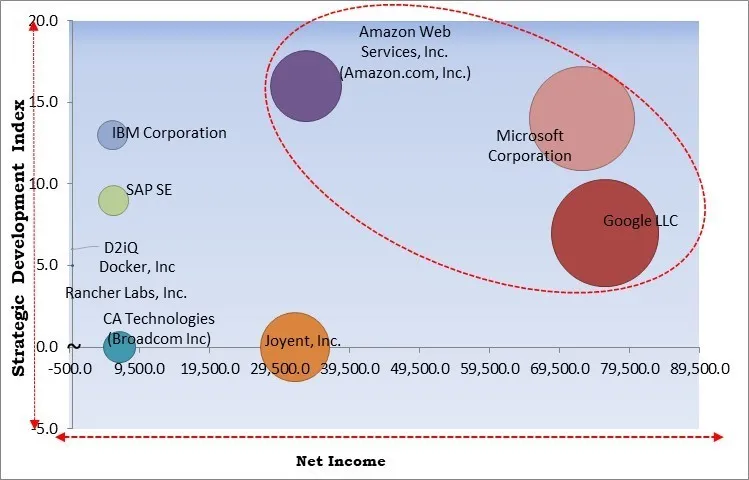

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Google LLC, Microsoft Corporation and Amazon Web Services, Inc. are the forerunners in the Application Container Market. Companies such as Joyent, Inc., IBM Corporation and SAP SE are some of the key innovators in Application Container Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, SAP SE, Microsoft Corporation, Broadcom, Inc. (CA Technologies), Rancher Labs, Inc. (SUSE SE), Joyent, Inc. (Samsung Group), Docker, Inc. (Mirantis), D2iQ

By Deployment Model

By Organization Size

By Vertical

By Geography

The global Application Container Market size is expected to reach $12 billion by 2028.

Application Container Technology Becoming More Popular Than Virtual Machines are driving the market in coming years, however, Application Container Sprawl's Emergence restraints the growth of the market.

Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, SAP SE, Microsoft Corporation, Broadcom, Inc. (CA Technologies), Rancher Labs, Inc. (SUSE SE), Joyent, Inc. (Samsung Group), Docker, Inc. (Mirantis), D2iQ

The expected CAGR of the Application Container Market is 33.1% from 2022 to 2028.

The Large Enterprises market is leading the Global Application Container Market by Organization Size in 2021; thereby, achieving a market value of $8.0 billion by 2028.

The North America market dominated the Global Application Container Market by Region in 2021; thereby, achieving a market value of $4.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.