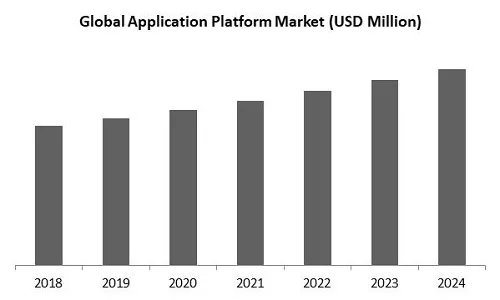

“Global Application Platform Market to reach a market value of USD 34.62 Billion by 2032 growing at a CAGR of 6.2%”

The Global Application Platform Market size is expected to reach $34.62 billion by 2032, rising at a market growth of 6.2% CAGR during the forecast period.

The application platform market includes software and cloud-based platforms that allow enterprises to build, manage, deploy, and scale digital applications efficiently. The evolution has been driven by widespread digital transformation across various sectors, shifting development for bespoke, in-house software toward cloud-based, reusable, and platform-driven models. The growth of cloud computing, platform-as-a-service (PaaS), and government cloud policies and offerings has strengthened this transformation, allowing fast delivery, scalability, and reduced infrastructure complexity. Modern platforms now support microservices and cloud-native architectures, hybrid or multi-cloud environments, and low-code/no-code development, making them strategic assets for enterprise IT modernization and digital service delivery.

Application platforms now integrate AI, analytics, automation, and security directly into their core services. No-code and low-code tools are democratizing application development, enabling business users and citizen developers to build workflows, apps, and dashboards with minimal technical expertise. Market leaders like Microsoft, Google, and AWS compete through ecosystem expansion, AI-enabled capabilities, strategic partnerships, and strong developer communities, while local vendors differentiate through industry-focused solutions. Competition centers on ecosystem strength, innovation, compliance, and the capability to deliver intelligent, agile, and secure digital platforms at scale.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2024, Siemens partnered with FPT Software to enhance the availability of its low-code platform, Mendix, in the South Korean and Japanese markets. As a designated reseller and delivery partner, FPT Software will leverage Mendix’s capabilities to provide rapid application development and deployment services, enabling clients to achieve faster time-to-market and reduced software development costs. This collaboration aims to drive digital transformation for businesses, particularly in the finance and manufacturing sectors, while strengthening the partnership between Siemens and FPT Software. Moreover, In January, 2024, Siemens came into partnership with Amazon Web Services (AWS) to integrate Amazon Bedrock into its Mendix low-code platform, democratizing generative AI in software development. This collaboration empowers businesses to create and upgrade applications without programming expertise, addressing skilled labor shortages and accelerating digitalization. With Mendix's robust low-code capabilities and AWS's advanced AI technologies, companies can enhance competitiveness, resilience, and sustainability across various sectors.

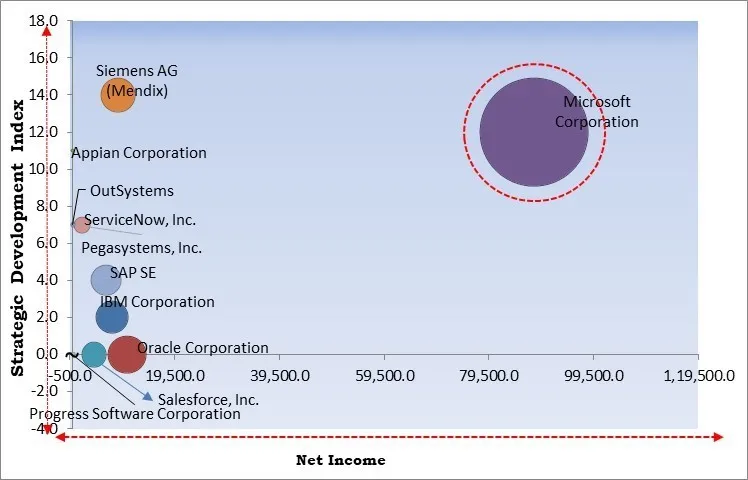

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Application Platform Market. In May, 2023, Microsoft Corporation partnered with Builder.ai, a startup that helps companies make applications without any coding experience. Following this partnership, Microsoft aims to enable clients to create business apps on the platform, Builder.ai which includes Natasha, its own AI assistant, into its Teams video and chat software. Companies such as Siemens AG, SAP SE, IBM Corporation are some of the key innovators in Application Platform Market.

The COVID-19 pandemic impacted the application platform market, especially at first, when businesses put off or canceled planned IT investments in favor of keeping their operations going in the short term. Budget problems in industries like retail, manufacturing, hospitality, travel, and transportation made demand even lower, especially for small and medium-sized businesses. Remote working conditions, limited access to the site, and a lack of skilled IT workers made it hard to carry out and deploy projects, which caused delays and higher costs. At the same time, problems in the supply chain and a lack of workers made it harder for vendors to develop, test, and deliver products and services. Smaller providers had even more trouble running their businesses. Even though sectors like BFSI and healthcare were relatively stable, uneven demand across end-use industries caused temporary market instability and slowed growth before it started to stabilize again. Thus, the COVID-19 pandemic had a negative impact on the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Application Platform Market size to reach USD 34.62 Billion by 2032

Based on Type, the market is segmented into Software and Services. The services segment acquired 34% revenue share in the market in 2024. The services segment of the application platform market is centered around offering professional and managed solutions that support the deployment, maintenance, and optimization of application platforms. This includes consulting services, system integration, training, support, and managed services that help organizations maximize the value of their application investments.

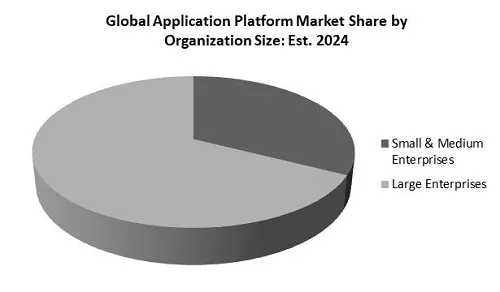

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium-Sized Enterprises (SMEs). The small & medium-sized enterprises (SMEs) segment acquired 38% revenue share in the market in 2024. The small and medium-sized enterprises (SMEs) segment of the application platform market focuses on organizations that are more agile, with moderate IT infrastructure and resource constraints compared to larger counterparts. SMEs often seek application platforms that offer simplicity, cost-effectiveness, and ease of implementation, enabling them to adopt technology without significant disruption to ongoing operations.

Based On The application platform market is anticipated to grow at a significant rate in the North America and Europe regions. This is because of strong cloud adoption, advanced digital infrastructure, and early uptake of AI-enabled, low-code, and cloud-native technologies. North America is leading the market because of the presence of major platform providers like AWS, Google, and Microsoft, along with strong enterprise and government demand for secure, scalable, and compliant application platforms. High investments in digital transformation across industries like healthcare, BFSI, retail, and public services further supports the expansion. Furthermore, the Europe application platform market is projected to capture substantial market share supported by increasing adoption of platform-as-a-service and low-code tools, and robust enterprise digitization, especially in regulatory bodies and government.

In the Asia Pacific and LAMEA region, the application platform market is estimated to experience prominent growth during the forecast period. The market is driven by expanding cloud infrastructure, rapid digitalization, and rising adoption of mobile and cloud-native applications. Asia Pacific is witnessing strong demand from SMEs and large enterprises seeking cost-effective and agile platforms to support digital services, fintech, e-commerce, and smart government initiatives. The increase of low-code/no-code platforms is especially impactful in this region because of developer skills gaps and the requirement for faster application deployment. Moreover, the LAMEA application platform market is also growing. The market is driven by rising cloud adoption, gradual IT modernization, and digital government programs. Also, enhancing connectivity, growing awareness of platform-based development, and cloud investments by hyperscalers are some of the elements leading to market growth.

The application platform market is always changing and driven by new ideas. Providers try to stand out by making their products easier to use, more flexible, and better at working with other systems. Competition is focused on providing adaptable, scalable environments that accommodate various development frameworks and enable smooth deployment. Competitive pressures force constant improvements in features, developer experience, support services, and partnerships with other companies in the ecosystem. To stand out, market participants focus on flexibility, customization, and performance. At the same time, changing customer needs and new technologies keep competition strong across all segments and use cases.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 22.73 Billion |

| Market size forecast in 2032 | USD 34.62 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 6.2% from 2025 to 2032 |

| Number of Pages | 418 |

| Number of Tables | 249 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Organization Size, Region |

| Country scope |

|

| Companies Included | Microsoft Corporation, Salesforce, Inc., IBM Corporation, Oracle Corporation, SAP SE, Siemens AG (Mendix), Pegasystems, Inc., ServiceNow, Inc., Appian Corporation, Progress Software Corporation, and OutSystems |

By Type

By Organization Size

By Geography

This Market size is expected to reach USD 34.62 Billion by 2032.

The application platform market is projected to grow at a CAGR of 6.2% between 2025 and 2032.

Global digital transformation initiatives, supportive policy frameworks, and the shift toward cloud-native architectures are accelerating enterprise modernization.

Microsoft Corporation, Salesforce, Inc., IBM Corporation, Oracle Corporation, SAP SE, Siemens AG (Mendix), Pegasystems, Inc., ServiceNow, Inc., Appian Corporation, Progress Software Corporation, and OutSystems

The Software segment led the maximum revenue in the Global Application Platform Market by Type in 2024, thereby, achieving a market value of $21.8 billion by 2032.

The North America region dominated the Global Application Platform Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $13.1 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges