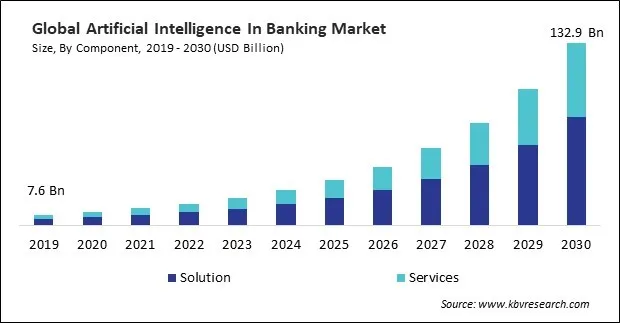

“Global Artificial Intelligence In Banking Market to reach a market value of USD 132.9 Billion by 2030 growing at a CAGR of 31.3%”

The Global Artificial Intelligence in Banking Market size is expected to reach $132.9 billion by 2030, rising at a market growth of 31.3% CAGR during the forecast period.

Virtual assistants analyze customer profiles and transaction histories to suggest relevant banking products and services. This personalized recommendation contributes to increased cross-selling and upselling opportunities for the bank. Consequently, the virtual assistants’ segment would generate approximately 18.23% share of the market by 2030. Virtual assistants seamlessly integrate with various channels, including mobile apps, websites, and messaging platforms. This assures a consistent and unified user experience across different touchpoints. Virtual assistants continually learn and adapt based on user interactions and feedback.

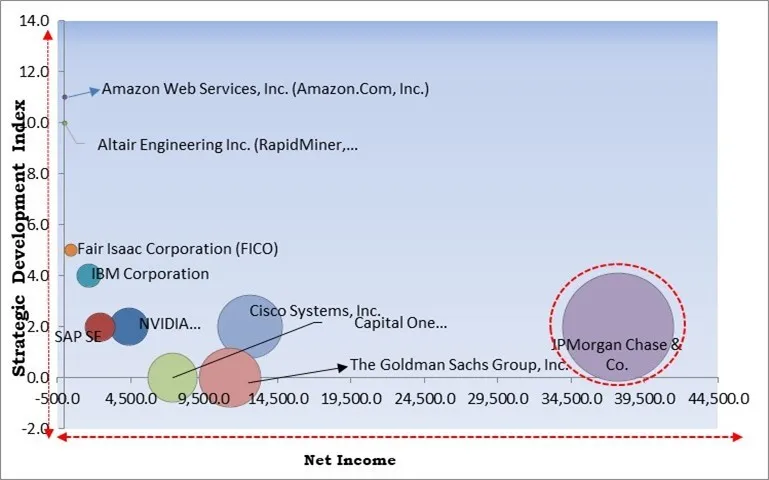

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November 2023, IBM Corporation has entered into collaboration with NatWest Group plc, a private banking company. Through this collaboration, NatWest has unveiled improvements to the bank's virtual assistant, Cora, by utilizing generative AI to offer customers access to a broader range of information through conversational interactions. In November 2023, Amazon Web Services, Inc. has signed an agreement with Mitsubishi UFJ Financial Group, Inc., a financial service firm. Under this agreement, MUFG will use AWS' cloud technologies to incorporate generative artificial intelligence (AI) and machine learning capabilities, automate processes, and provide personalized financial services with the aim of meeting customer requirements. Moreover, Mitsubishi UFJ Financial Group is leveraging AWS cloud technology to boost operational efficiency and improve employee engagement and performance.

Based on the Analysis presented in the KBV Cardinal matrix; JPMorgan Chase & Co. is the forerunners in Market. In July 2023, JPMorgan Chase & Co. entered into a partnership with TIFIN Group LLC, a financial service provider. In this partnership, JPMorgan is assisting TIFIN in developing its second cohort of AI-powered fintech companies. Furthermore, as part of this partnership, JPMorgan and TIFIN have launched TIFIN.AI, a thematic innovation platform aimed at launching companies that offer B2B AI assistants to enhance wealth outcomes. And Companies such as Cisco Systems, Inc., The Goldman Sachs Group, Inc., and Capital One Financial Corporation are some of the key innovators in the Market.

Voice-enabled interfaces allow customers to interact with banking services using natural language commands. Increased convenience, enabling customers to check account balances, make transactions, or inquire about recent activities through voice commands. Voice recognition enables hands-free banking transactions. Customers can perform transactions, like fund transfers or bill payments, without manual inputs, making banking more accessible and convenient. Voice-enabled interactions reduce the friction associated with typing or navigating through complex menus. Therefore, the market is expanding significantly due to the increasing voice and speech recognition.

AI algorithms analyze currency exchange rates and market trends. Automated currency conversion, optimized forex trading strategies, and efficiently handled cross-border transactions. AI automates AML and KYC processes for cross-border transactions. Streamlined customer due diligence, faster onboarding of global clients, and improved detection of potentially illicit activities. AI contributes to the development of innovative cross-border payment solutions. Thus, because of the globalization and cross-border transactions, the market is anticipated to increase significantly.

Smaller banks may face financial strain when attempting to invest in advanced AI technologies, limiting their ability to compete with larger institutions with greater financial resources. High implementation costs may lead to a significant portion of the IT budget being allocated to AI, leaving limited funds for other innovative projects and technological advancements. Financial institutions may postpone or slow AI adoption initiatives due to budget constraints, leading to delayed implementation timelines and missed opportunities for innovation. Thus, high implementation costs of AI in banking can slow down the growth of the market.

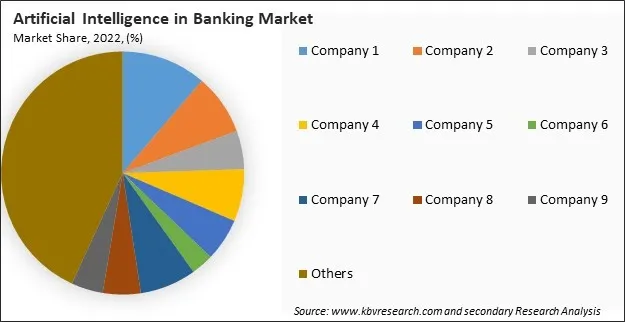

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

By component, the market is categorized into services and solution. The services segment covered a considerable revenue share in the market in 2022. Services leveraging AI enhance credit scoring processes by analyzing various data points, including non-traditional factors. This results in more accurate assessments of an individual's creditworthiness, improving risk management strategies for lending institutions. Services in personalized banking leverage AI to analyze customer behavior and preferences. This enables the delivery of personalized financial advice, tailored investment strategies, and customized product recommendations, contributing to a more engaging and client-centric wealth management experience.

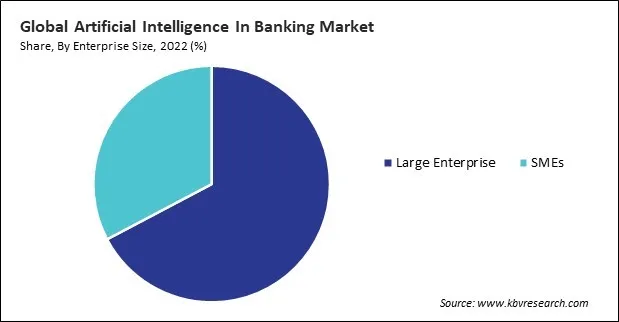

By enterprise size, the market is segmented into large enterprise and SMEs. In 2022, the large enterprise segment registered the maximum revenue share in the market. Large enterprises have the resources to build and maintain robust AI infrastructure. This includes high-performance computing systems, data storage solutions, and networks capable of handling the computational demands of AI algorithms and models. Large banks often integrate AI capabilities directly into their core banking systems. This integration allows seamless interactions between AI-driven processes and traditional banking functions, enhancing efficiency and overall system performance. Large enterprises drive innovation in the banking industry by using AI to develop new and innovative financial products and services. These include AI-driven investment platforms, digital wallets, and personalized financial planning tools.

On the basis of technology, the market is divided into natural language processing (NLP), machine learning & deep learning, computer vision, and others. The machine learning & deep learning segment garnered a significant revenue share in the market in 2022. Machine learning & deep learning (ML & DL) models analyze a wide range of data, including historical financial behavior, to assess creditworthiness and manage risk. ML models segment customers based on their behavior and preferences, enabling personalized marketing, product recommendations, and services. ML models analyze customer behavior to predict the likelihood of churn, allowing banks to implement targeted retention strategies. ML and DL models analyze transaction data to detect patterns indicative of money laundering activities, ensuring compliance with AML regulations.

Based on application, the market is classified into risk management, customer service, virtual assistant, financial advisory, and others. In 2022, the risk management segment witnessed the largest revenue share in the market. AI algorithms can help reduce the number of false positives in fraud alerts. These systems can improve accuracy using historical data to inform their detection strategies. This helps to ensure that valid transactions are not mistakenly flagged as fraudulent. AI simulates various economic conditions and scenarios and supports scenario modelling and stress testing. This allows banks to assess the resilience of their portfolios and operations under different stressors, helping them prepare for unexpected events.

Free Valuable Insights: Global Artificial Intelligence In Banking Market size to reach USD 132.9 Billion by 2030

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. AI contributes to financial inclusion initiatives in the Asia Pacific by offering tailored solutions for underbanked populations. Asia Pacific banks increasingly deploy chatbots and virtual assistants to improve customer service and support. AI algorithms are used for credit scoring and risk management, particularly in regions with diverse and evolving economies. Wealth management services in Asia Pacific benefit from AI-driven tools for portfolio optimization, financial planning, and personalized investment advice.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 15.6 Billion |

| Market size forecast in 2030 | USD 132.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 31.3% from 2023 to 2030 |

| Number of Pages | 297 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Technology, Enterprise Size, Application, Region |

| Country scope |

|

| Companies Included | Amazon Web Services, Inc. (Amazon.Com, Inc.), IBM Corporation, NVIDIA Corporation, SAP SE, Cisco Systems, Inc., Fair Isaac Corporation (FICO), JPMorgan Chase & Co., The Goldman Sachs Group, Inc., Altair Engineering Inc. (RapidMiner, Inc.), Capital One Financial Corporation |

By Component

By Enterprise Size

By Technology

By Application

By Geography

This Market size is expected to reach $132.9 billion by 2030.

Increasing voice and speech recognition are driving the Market in coming years, however, High implementation costs of AI in banking restraints the growth of the Market.

Amazon Web Services, Inc. (Amazon.Com, Inc.), IBM Corporation, NVIDIA Corporation, SAP SE, Cisco Systems, Inc., Fair Isaac Corporation (FICO), JPMorgan Chase & Co., The Goldman Sachs Group, Inc., Altair Engineering Inc. (RapidMiner, Inc.), Capital One Financial Corporation

The expected CAGR of this Market is 31.3% from 2023 to 2030.

The Natural Language Processing (NLP) region is leading the Market by Technology in 2022 there by, achieving a market value of $52.6 billion by 2030.

The North America region dominated the Market by Region in 2022 there by, achieving a market value of $45.2 billion by 2030, growing at a CAGR of 30.4 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges