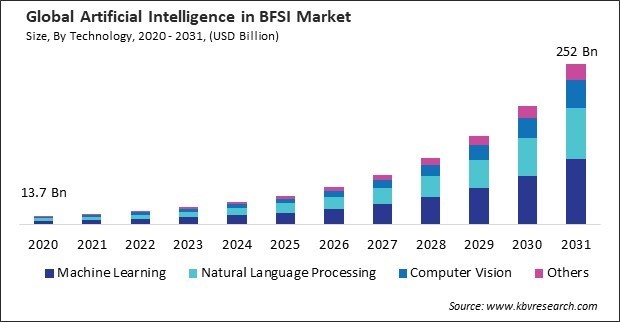

“Global Artificial Intelligence in BFSI Market to reach a market value of USD 252 Billion by 2031 growing at a CAGR of 32.3%”

The Global Artificial Intelligence in BFSI Market size is expected to reach $252 billion by 2031, rising at a market growth of 32.3% CAGR during the forecast period.

The BFSI sector is subject to stringent regulatory requirements and risk management standards, necessitating data analytics and predictive tools to assess and mitigate risks effectively. Therefore, data analytics and prediction segment would generate 11.07% revenue share in 2031. Predictive analytics models analyze credit, market, and operational risks by incorporating historical data, macroeconomic indicators, and external factors.

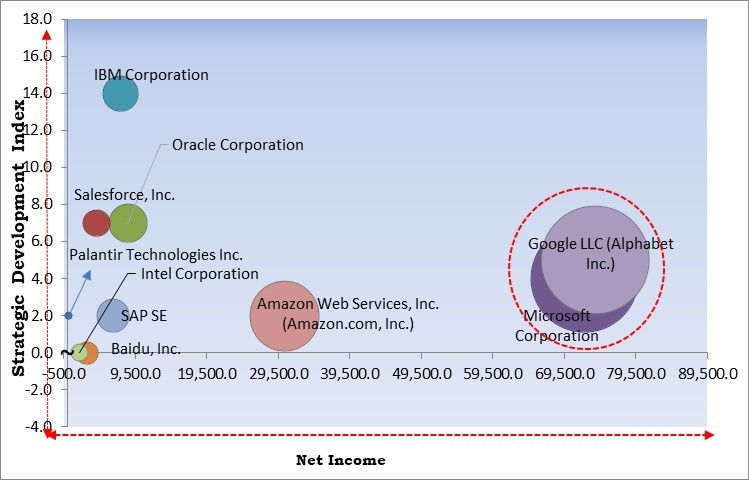

The major strategies followed by the market participants are Partnerships, Collaborations, and Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, in 2023, November, Google LLC is collaborating with Symphony Limited, the market infrastructure and tech firm, to ramp up its voice analytics offering to banks and investment firms. This collaboration will enhance the portfolio of the company. Additionally, in 2023, November, IBM Corporation collaborated with NatWest, a major retail and commercial bank in the United Kingdom, to enhance the customer experience. Through this collaboration, the banks can deliver an empowering value proposition.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In April, 2024, Microsoft Corporation collaborated with Abu Dhabi Bank (FAB), offering personal and private banking services, to develop new AI-based banking capabilities. Through this collaboration the company will accelerate advances in generative AI, intelligent automation, and machine learning for financial services. Companies such as Amazon Web Services, Inc., Oracle Corporation, IBM Corporation are some of the key innovators in Market.

AI-driven advanced analytics enable BFSI firms to harness vast amounts of structured and unstructured data to make informed, data-driven decisions. By identifying patterns, correlations, and anomalies in market data, AI-powered predictive models can generate forecasts and probabilistic predictions, enabling traders, portfolio managers, and investors to make informed decisions and optimize investment strategies. Therefore, these aspects will boost the demand.

Robotic process automation (RPA) technology automates repetitive, rule-based tasks by mimicking human actions within digital systems. In BFSI, RPA bots can perform various tasks such as data entry, document processing, account reconciliation, and transaction processing. Cognitive automation technologies accelerate loan approvals, reduce manual errors, and improve operational efficiency by automating these decision-making processes. Thus, these factors will assist in the growth of the market.

The regulatory framework governing the BFSI sector is multifaceted and continuously evolving. Navigating through the intricate web of regulations, each with its requirements and compliance standards, requires comprehensive expertise and resources. Ensuring the interpretability of AI-driven decisions is essential for regulatory compliance and fostering stakeholder trust. Hence, these aspects will lead to a downturn in the demand in the upcoming years.

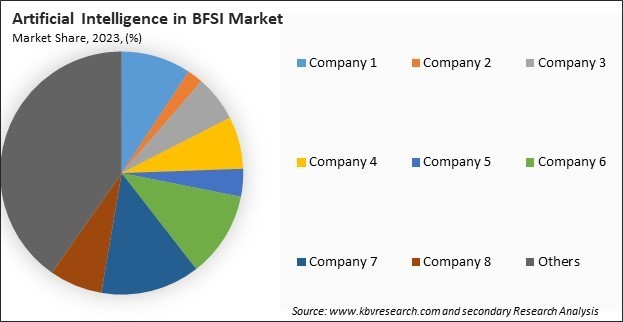

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

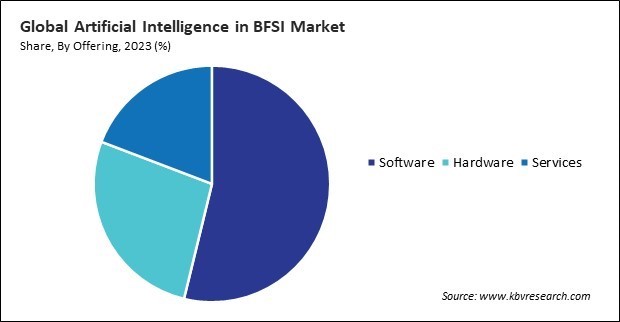

Based on offering, the market is segmented into hardware, software, and services. In 2023, the hardware segment garnered 26.99% revenue share in the market. AI-specific hardware configurations, such as GPU-accelerated servers and AI inference appliances, accelerate model training and inference tasks, enabling real-time decision-making and responsiveness in BFSI operations. Thus, the segment will grow rapidly in the coming years.

Based on technology, the market is divided into machine learning, natural language processing, computer vision, and others. In 2023, the natural language processing segment witnessed 30.91% revenue share in the market. By leveraging NLP-powered anomaly detection and fraud detection models, BFSI institutions enhance fraud detection accuracy and reduce false positives, minimizing financial losses and reputational risks. Therefore, the segment will expand rapidly in the upcoming years.

Based on solution, the market is divided into chatbots, fraud detection & prevention, anti-money laundering, customer relationship management, data analytics & prediction, and others. In 2023, the fraud detection and prevention segment witnessed 21.27% revenue share in the market. BFSI institutions are investing in AI-driven fraud prevention solutions to secure digital transactions, authenticate user identities, and detect suspicious activities across multiple channels. Therefore, owing to these factors, the segment will grow rapidly in the coming years.

Free Valuable Insights: Global Artificial Intelligence in BFSI Market size to reach USD 252 Billion by 2031

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 36.51% revenue share in the market in 2023. North America, particularly the United States, is a global hub for technological innovation and AI development. The region boasts a rich ecosystem of AI startups, driving advancements in machine learning, natural language processing, and predictive analytics. Thus, these factors will lead to enhanced demand in the segment.

Competition in the Artificial Intelligence sector within Banking, Financial Services, and Insurance (BFSI) is fierce, with a mix of established technology giants, startups, and in-house initiatives from major financial institutions vying to offer innovative AI solutions. Key battlegrounds include specialized applications such as fraud detection, risk assessment, and personalized financial services, with a focus on ensuring regulatory compliance, data security, and forging strategic partnerships to access domain expertise and valuable datasets.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 27.8 Billion |

| Market size forecast in 2031 | USD 252 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 32.3% from 2024 to 2031 |

| Number of Pages | 287 |

| Number of Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market share analysis, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Technology, Solution, Region |

| Country scope |

|

| Companies Included | Microsoft Corporation, IBM Corporation, Palantir Technologies Inc., Salesforce, Inc., SAP SE, Baidu, Inc., Google LLC (Alphabet Inc.), Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, Intel Corporation |

By Offering

By Technology

By Solution

By Geography

This Market size is expected to reach $252 billion by 2031.

Need for predictive analytics and decision support are driving the Market in coming years, however, Regulatory compliance and legal framework challenges restraints the growth of the Market

Microsoft Corporation, IBM Corporation, Palantir Technologies Inc., Salesforce, Inc., SAP SE, Baidu, Inc., Google LLC (Alphabet Inc.), Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, Intel Corporation

The expected CAGR of this Market is 32.3% from 2024 to 2031.

The Machine Learning segment is generating the highest revenue in the Market by Technology in 2023, thereby, achieving a market value of $102.9 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $87.1 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges