Asia Pacific ASIC Chip Market Size, Share & Trends Analysis Report By Type (Semi- custom ASIC, Full custom ASIC, and Programmable ASIC), By End User, By Country and Growth Forecast, 2023 - 2030

Published Date : 15-Mar-2024 |

Pages: 122 |

Report Format: PDF + Excel |

COVID-19 Impact on the Asia Pacific ASIC Chip Market

The Asia Pacific ASIC Chip Market would witness market growth of 8.6% CAGR during the forecast period (2023-2030).

The China market dominated the Asia Pacific ASIC Chip Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $3,623.4 million by 2030. The Japan market is experiencing a CAGR of 7.8% during (2023 - 2030). Additionally, The India market would exhibit a CAGR of 9.2% during (2023 - 2030).

In the ever-changing field of semiconductor technology, application-specific integrated circuits (ASICs) have become a crucial component for driving various electronic devices and systems. As the need for tailored and efficient solutions rises across different industries, the market has experienced notable expansion and development. The versatility of ASICs extends across a broad spectrum of application domains, each harnessing the specialized capabilities of these chips to address unique challenges. One of the prominent areas of application is the telecommunications industry, where ASICs power critical components such as base stations, routers, and network switches. The demand for high-speed data processing and efficient packet switching in the era of 5G networks propels the integration of ASICs into the heart of telecommunications infrastructure.

Moreover, ASICs play a pivotal role in the automotive sector, contributing to developing advanced driver assistance systems (ADAS), autonomous vehicles, and in-vehicle entertainment systems. Their ability to handle complex algorithms with low latency aligns perfectly with real-time processing requirements in automotive applications. ASICs are instrumental in powering the sophisticated features of ADAS. These systems encompass a range of safety and convenience functions, including adaptive cruise control, lane departure warning, collision avoidance, and automated emergency braking. ASICs, with their tailored design, enable efficient processing of the algorithms involved in real-time sensor data analysis, allowing vehicles to respond quickly to changing road conditions.

In addition, India has witnessed significant growth in its telecom network, especially with the proliferation of mobile devices and the increasing demand for high-speed data services. This expansion has led to a growing need for specialized ASICs in various network elements, such as base stations, routers, and switches. As per the data released in 2023 from Invest India, the telecom industry is one of the most important sectors in the Indian economy, with a 6.5% contribution to the country’s GDP. In the last quarter of FY 2022-2023, the industry’s gross revenue was INR 85,356 Cr ($11.38 Bn). Hence, the expanding telecom and medical device sectors in the Asia Pacific will assist in the growth of the regional market.

Free Valuable Insights: The Global ASIC Chip Market is Predict to reach $ 35.5 Billion by 2030, at a CAGR of 8.2%

Based on Type, the market is segmented into Semi- custom ASIC, Full custom ASIC, and Programmable ASIC. Based on End User, the market is segmented into Data Processing Systems, Telecommunication Systems, Aerospace Subsystem & Sensors, Consumer Electronics, Medical Instrumentation, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Taiwan, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Advanced Micro Devices, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)

- ON Semiconductor Corporation

- Taiwan Semiconductor Manufacturing Company Limited

- NVIDIA Corporation

- Intel Corporation

- Infineon Technologies AG

- Texas Instruments, Inc.

- Seiko Epson Corporation

- BITMAIN Technologies Holding Company

Asia Pacific ASIC Chip Market Report Segmentation

By Type

- Semi- custom ASIC

- Full custom ASIC

- Programmable ASIC

By End User

- Data Processing Systems

- Telecommunication Systems

- Aerospace Subsystem & Sensors

- Consumer Electronics

- Medical Instrumentation

- Others

By Country

- China

- Japan

- India

- South Korea

- Taiwan

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific ASIC Chip Market, by Type

1.4.2 Asia Pacific ASIC Chip Market, by End User

1.4.3 Asia Pacific ASIC Chip Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2022

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2024, Feb – 2019, Feb) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. Asia Pacific ASIC Chip Market by Type

5.1 Asia Pacific Semi- custom ASIC Market by Country

5.2 Asia Pacific Full custom ASIC Market by Country

5.3 Asia Pacific Programmable ASIC Market by Country

Chapter 6. Asia Pacific ASIC Chip Market by End User

6.1 Asia Pacific Data Processing Systems Market by Country

6.2 Asia Pacific Telecommunication Systems Market by Country

6.3 Asia Pacific Aerospace Subsystem & Sensors Market by Country

6.4 Asia Pacific Consumer Electronics Market by Country

6.5 Asia Pacific Medical Instrumentation Market by Country

6.6 Asia Pacific Others Market by Country

Chapter 7. Asia Pacific ASIC Chip Market by Country

7.1 China ASIC Chip Market

7.1.1 China ASIC Chip Market by Type

7.1.2 China ASIC Chip Market by End User

7.2 Japan ASIC Chip Market

7.2.1 Japan ASIC Chip Market by Type

7.2.2 Japan ASIC Chip Market by End User

7.3 India ASIC Chip Market

7.3.1 India ASIC Chip Market by Type

7.3.2 India ASIC Chip Market by End User

7.4 South Korea ASIC Chip Market

7.4.1 South Korea ASIC Chip Market by Type

7.4.2 South Korea ASIC Chip Market by End User

7.5 Taiwan ASIC Chip Market

7.5.1 Taiwan ASIC Chip Market by Type

7.5.2 Taiwan ASIC Chip Market by End User

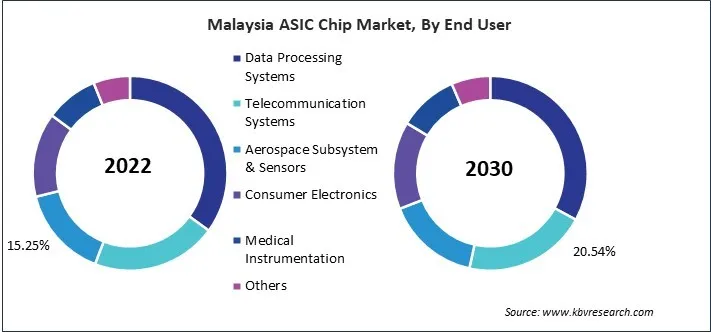

7.6 Malaysia ASIC Chip Market

7.6.1 Malaysia ASIC Chip Market by Type

7.6.2 Malaysia ASIC Chip Market by End User

7.7 Rest of Asia Pacific ASIC Chip Market

7.7.1 Rest of Asia Pacific ASIC Chip Market by Type

7.7.2 Rest of Asia Pacific ASIC Chip Market by End User

Chapter 8. Company Profiles

8.1 Advanced Micro Devices, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.1.5.2 Acquisition and Mergers:

8.1.6 SWOT Analysis

8.2 Samsung Electronics Co., Ltd. (Samsung Group)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Partnerships, Collaborations, and Agreements:

8.2.5 SWOT Analysis

8.3 ON Semiconductor Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Partnerships, Collaborations, and Agreements:

8.3.5.2 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 Taiwan Semiconductor Manufacturing Company Limited

8.4.1 Company overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 SWOT Analysis

8.5 NVIDIA Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 Recent strategies and developments:

8.5.5.1 Acquisition and Mergers:

8.6 Intel Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expenses

8.6.5 Recent strategies and developments:

8.6.5.1 Partnerships, Collaborations, and Agreements:

8.6.5.2 Product Launches and Product Expansions:

8.6.5.3 Acquisition and Mergers:

8.6.6 SWOT Analysis

8.7 Infineon Technologies AG

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Partnerships, Collaborations, and Agreements:

8.7.5.2 Product Launches and Product Expansions:

8.7.5.3 Acquisition and Mergers:

8.7.6 SWOT Analysis

8.8 Texas Instruments, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 SWOT Analysis

8.9 Seiko Epson Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expenses

8.9.5 SWOT Analysis

8.10. BITMAIN Technologies Holding Company

8.10.1 Company Overview

8.10.2 Recent strategies and developments:

8.10.2.1 Partnerships, Collaborations, and Agreements:

8.10.2.2 Product Launches and Product Expansions:

8.10.3 SWOT Analysis

TABLE 2 Asia Pacific ASIC Chip Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– ASIC Chip Market

TABLE 4 Product Launches And Product Expansions– ASIC Chip Market

TABLE 5 Acquisition and Mergers– ASIC Chip Market

TABLE 6 Asia Pacific ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 7 Asia Pacific ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 8 Asia Pacific Semi- custom ASIC Market by Country, 2019 - 2022, USD Million

TABLE 9 Asia Pacific Semi- custom ASIC Market by Country, 2023 - 2030, USD Million

TABLE 10 Asia Pacific Full custom ASIC Market by Country, 2019 - 2022, USD Million

TABLE 11 Asia Pacific Full custom ASIC Market by Country, 2023 - 2030, USD Million

TABLE 12 Asia Pacific Programmable ASIC Market by Country, 2019 - 2022, USD Million

TABLE 13 Asia Pacific Programmable ASIC Market by Country, 2023 - 2030, USD Million

TABLE 14 Asia Pacific ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 15 Asia Pacific ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 16 Asia Pacific Data Processing Systems Market by Country, 2019 - 2022, USD Million

TABLE 17 Asia Pacific Data Processing Systems Market by Country, 2023 - 2030, USD Million

TABLE 18 Asia Pacific Telecommunication Systems Market by Country, 2019 - 2022, USD Million

TABLE 19 Asia Pacific Telecommunication Systems Market by Country, 2023 - 2030, USD Million

TABLE 20 Asia Pacific Aerospace Subsystem & Sensors Market by Country, 2019 - 2022, USD Million

TABLE 21 Asia Pacific Aerospace Subsystem & Sensors Market by Country, 2023 - 2030, USD Million

TABLE 22 Asia Pacific Consumer Electronics Market by Country, 2019 - 2022, USD Million

TABLE 23 Asia Pacific Consumer Electronics Market by Country, 2023 - 2030, USD Million

TABLE 24 Asia Pacific Medical Instrumentation Market by Country, 2019 - 2022, USD Million

TABLE 25 Asia Pacific Medical Instrumentation Market by Country, 2023 - 2030, USD Million

TABLE 26 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

TABLE 27 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

TABLE 28 Asia Pacific ASIC Chip Market by Country, 2019 - 2022, USD Million

TABLE 29 Asia Pacific ASIC Chip Market by Country, 2023 - 2030, USD Million

TABLE 30 China ASIC Chip Market, 2019 - 2022, USD Million

TABLE 31 China ASIC Chip Market, 2023 - 2030, USD Million

TABLE 32 China ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 33 China ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 34 China ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 35 China ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 36 Japan ASIC Chip Market, 2019 - 2022, USD Million

TABLE 37 Japan ASIC Chip Market, 2023 - 2030, USD Million

TABLE 38 Japan ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 39 Japan ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 40 Japan ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 41 Japan ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 42 India ASIC Chip Market, 2019 - 2022, USD Million

TABLE 43 India ASIC Chip Market, 2023 - 2030, USD Million

TABLE 44 India ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 45 India ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 46 India ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 47 India ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 48 South Korea ASIC Chip Market, 2019 - 2022, USD Million

TABLE 49 South Korea ASIC Chip Market, 2023 - 2030, USD Million

TABLE 50 South Korea ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 51 South Korea ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 52 South Korea ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 53 South Korea ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 54 Taiwan ASIC Chip Market, 2019 - 2022, USD Million

TABLE 55 Taiwan ASIC Chip Market, 2023 - 2030, USD Million

TABLE 56 Taiwan ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 57 Taiwan ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 58 Taiwan ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 59 Taiwan ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 60 Malaysia ASIC Chip Market, 2019 - 2022, USD Million

TABLE 61 Malaysia ASIC Chip Market, 2023 - 2030, USD Million

TABLE 62 Malaysia ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 63 Malaysia ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 64 Malaysia ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 65 Malaysia ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 66 Rest of Asia Pacific ASIC Chip Market, 2019 - 2022, USD Million

TABLE 67 Rest of Asia Pacific ASIC Chip Market, 2023 - 2030, USD Million

TABLE 68 Rest of Asia Pacific ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 69 Rest of Asia Pacific ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 70 Rest of Asia Pacific ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 71 Rest of Asia Pacific ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 72 Key information – Advanced Micro Devices, Inc.

TABLE 73 Key Information – Samsung Electronics Co., Ltd.

TABLE 74 Key Information – ON Semiconductor Corporation

TABLE 75 Key Information– Taiwan Semiconductor Manufacturing Company Limited

TABLE 76 Key Information – NVIDIA Corporation

TABLE 77 Key Information – Intel Corporation

TABLE 78 Key Information – Infineon Technologies AG

TABLE 79 Key Information – Texas Instruments, Inc.

TABLE 80 Key Information – Seiko Epson Corporation

TABLE 81 Key Information – BITMAIN Technologies Holding Company

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific ASIC Chip Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting ASIC Chip Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2024, Feb – 2019, Feb) Leading Players

FIG 8 Porter’s Five Forces Analysis – ASIC Chip Market

FIG 9 Asia Pacific ASIC Chip Market share by Type, 2022

FIG 10 Asia Pacific ASIC Chip Market share by Type, 2030

FIG 11 Asia Pacific ASIC Chip Market by Type, 2019 - 2030, USD Million

FIG 12 Asia Pacific ASIC Chip Market share by End User, 2022

FIG 13 Asia Pacific ASIC Chip Market share by End User, 2030

FIG 14 Asia Pacific ASIC Chip Market by End User, 2019 - 2030, USD Million

FIG 15 Asia Pacific ASIC Chip Market share by Country, 2022

FIG 16 Asia Pacific ASIC Chip Market share by Country, 2030

FIG 17 Asia Pacific ASIC Chip Market by Country, 2019 - 2030, USD Million

FIG 18 Recent strategies and developments: Advanced Micro Devices, Inc.

FIG 19 SWOT Analysis: Advanced Micro Devices, Inc.

FIG 20 SWOT Analysis: Samsung Electronics Co., Ltd

FIG 21 Recent strategies and developments: ON Semiconductor Corporation

FIG 22 SWOT Analysis: ON Semiconductor Corporation

FIG 23 SWOT Analysis: Taiwan Semiconductor Manufacturing Company Limited

FIG 24 SWOT Analysis: NVIDIA Corporation

FIG 25 Recent strategies and developments: Intel Corporation

FIG 26 SWOT Analysis: Intel corporation

FIG 27 Recent strategies and developments: Infineon Technologies AG

FIG 28 SWOT Analysis: Infineon Technologies AG

FIG 29 SWOT Analysis: Texas Instruments, Inc.

FIG 30 SWOT Analysis: Seiko Epson Corporation

FIG 31 Recent strategies and developments: BITMAIN Technologies Holding Company

FIG 32 SWOT Analysis: BITMAIN Technologies Holding Company