The Asia Pacific Collateralized Debt Obligation Market would witness market growth of 12.4% CAGR during the forecast period (2024-2031).

The China market dominated the Asia Pacific Collateralized Debt Obligation Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $3,571.7 Million by 2031. The Japan market is registering a CAGR of 11.8% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 13.4% during (2024 - 2031).

CDOs can be used with credit default swaps to hedge against the risk of default on underlying assets. This application enables investors to manage their exposure more effectively, protecting their portfolios from credit events. Synthetic CDOs expose the credit risk of a portfolio of reference assets without owning the actual securities, allowing investors to speculate on or hedge against credit risk flexibly.

Additionally, CDOs can be incorporated into SIVs, providing retail and institutional investors access to sophisticated investment products previously limited to larger institutional players. CDOs allow smaller investors to gain access to segments of the bond market that may otherwise be difficult to reach, broadening investment opportunities.

This expanding asset base creates a fertile environment for the development of CDOs in China. The substantial increase in financial assets allows banks to broaden their portfolios of investments and develop structured products that are more appealing to a wider spectrum of investors. Also, banks can mitigate risks and enhance returns by pooling various types of debt instruments, which is particularly attractive in a financial landscape characterized by increasing volatility.

Free Valuable Insights: The Global Collateralized Debt Obligation Market is Predict to reach USD 63.2 Billion by 2031, at a CAGR of 11.2%

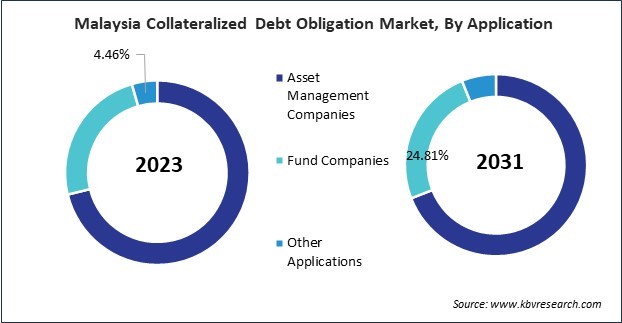

Based on Type, the market is segmented into Collateralized Loan Obligations (CLOs), Collateralized Bond Obligations (CBOs), Collateralized Synthetic Obligations (CSOs) and Structured Finance CDOs (SFCDOs). Based on Application, the market is segmented into Asset Management Companies, Fund Companies, and Other Applications. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

By Type

By Application

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.