The Asia Pacific Fatty Alcohols Market would witness market growth of 5.6% CAGR during the forecast period (2024-2031). In the year 2022, the Asia Pacific market's volume surged to 1,229.0 kilo tonnes, showcasing a growth of 23.0% (2020-2023).

In the Fatty Alcohols Market, short-chain fatty alcohols are widely used in personal care products, such as lotions, creams, and shampoos, where they act as emollients, thickeners, and surfactants. They are also commonly found in industrial applications, including lubricants, solvents, and plasticizers. Their biodegradability makes them a preferred choice in environmentally friendly formulations. Hence, In Japan, 72.91 kilo tonnes of short-chain fatty alcohols is expected to be utilized by the year 2031.

The China market dominated the Asia Pacific Fatty Alcohols Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $778.4 million by 2031. The Japan market is registering a CAGR of 5% during (2024 - 2031). Additionally, The India market would obtain a CAGR of 6.3% during (2024 - 2031).

Emerging market trends in the fatty alcohols market indicate evolving preferences, technological advancements, and regulatory landscapes shaping the market's trajectory. These trends offer valuable insights into future opportunities and challenges for industry stakeholders. A significant trend driving the fatty alcohols market is the increasing consumer preference for natural, sustainable, and ethically sourced ingredients. Consumers are becoming more conscious of the environmental impact of their purchasing decisions and are seeking products formulated with renewable resources. As a result, there is a growing demand for fatty alcohols derived from natural sources such as palm oil, coconut oil, and shea butter.

In addition, adopting green chemistry principles is another prominent trend shaping the fatty alcohols market. Green chemistry focuses on minimizing the use of hazardous chemicals, reducing waste, and maximizing resource efficiency throughout the product lifecycle. Fatty alcohol manufacturers are exploring eco-friendly production processes, renewable feedstocks, and biodegradable formulations to align with sustainability goals and regulatory requirements.

The emergence of numerous local cosmetics brands and startups is contributing to the demand for fatty alcohols. Many of these brands focus on formulating products with high-quality, sustainable ingredients, leading to increased utilization of fatty alcohols in their formulations. The men’s grooming industry in India is expanding rapidly, with a growing range of products like shaving creams, gels, and skincare items. Fatty alcohols are vital in these formulations, providing lubrication and skin-conditioning benefits, which are essential for enhancing product performance. Therefore, the expansion of the personal care industry and the rising pharmaceutical sector in the region are driving the market's growth.

Free Valuable Insights: The Global Fatty Alcohols Market is Predict to reach USD 7.5 Billion by 2031, at a CAGR of 5.5%

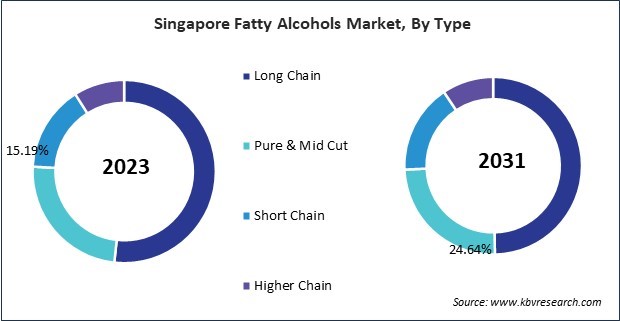

Based on Type, the market is segmented into Long Chain, Pure & Mid Cut, Short Chain, and Higher Chain. Based on Application, the market is segmented into Soaps & Detergents, Personal Care, Plasticizers, Lubricants, Pharmaceutical Formulation, Amines, and Other Applications. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.