The Asia Pacific Filler Masterbatch Market would witness market growth of 7.4% CAGR during the forecast period (2023-2030). In the year 2021, the Asia Pacific market's volume surged to 1033.92 hundred Tonnes, showcasing a growth of 4.4% (2019-2022).

Filler masterbatches are widely used in injection molding processes to enhance the mechanical properties, dimensional stability, and surface finish of plastic parts. These masterbatches can incorporate various fillers such as calcium carbonate, talc, or glass fibers to modify properties like stiffness, impact resistance, and heat distortion temperature, making them suitable for a diverse range of applications including automotive components, consumer goods, and packaging. Therefore, the Japan market utilized 83.30 hundred tonnes of filler masterbatch in injection & blow molding in 2022.

The China market dominated the Asia Pacific Filler Masterbatch Market by Country in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $85,584.9 Thousands by 2030. The India market is registering a CAGR of 7.8% during (2023 - 2030). Additionally, The Japan market would showcase a CAGR of 7% during (2023 - 2030).

The ability to modify the color and aspect of polymer products has emerged as a determining factor in the adoption of filler masterbatch. Manufacturers value filler masterbatch's flexibility in achieving consistent and vibrant colors in their end products. The ease of color matching and the ability to control pigment dispersion ensure uniformity and aesthetic appeal, particularly in industries like packaging and consumer goods. This customization aspect adds a layer of versatility to filler masterbatch, making it an attractive choice for a broad range of applications.

While developed economies leverage filler masterbatch for high-performance applications and sustainability, emerging markets are witnessing increased adoption in traditional industries. The cost-effective nature of filler masterbatch makes it a viable solution for industries in emerging economies, such as construction, where the demand for affordable yet durable materials is high. For example, according to Invest India, the construction sector will grow to $1.4 trillion by 2025.

According to Invest India, the 3D printing industry in India is projected to increase from $12.6 billion in 2020 to $37.2 billion in 2026. The rising popularity of 3D printing in India, across sectors such as manufacturing, healthcare, education, and automotive, has led to an increased demand for advanced materials. Lightweighting is a key consideration in various industries, including aerospace and automotive, where 3D printing is increasingly utilized in India. Therefore, due to the above-mentioned factors, the filler masterbatch market will grow significantly in this region.

Free Valuable Insights: The Global Filler Masterbatch Market is Predict to reach $ 588.9 Million by 2030, at a CAGR of 7.1%

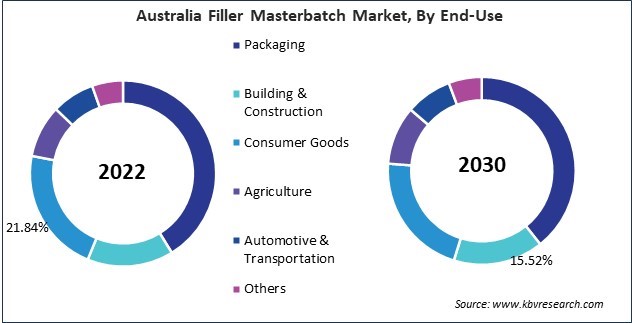

Based on Carrier Polymer, the market is segmented into Polyethylene (PE), and Polypropylene (PP). Based on Application, the market is segmented into Injection & Blow Molding, Films & Sheets, Tapes, and Others. Based on End-Use, the market is segmented into Packaging, Building & Construction, Consumer Goods, Agriculture, Automotive & Transportation, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

By Carrier Polymer (Volume, Hundred Tonnes, USD Million, 2019-2030)

By Application (Volume, Hundred Tonnes, USD Million, 2019-2030)

By End-Use (Volume, Hundred Tonnes, USD Million, 2019-2030)

By Country (Volume, Hundred Tonnes, USD Million, 2019-2030)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.