The Asia Pacific Fluoropolymer Tubing Market would witness market growth of 5.6% CAGR during the forecast period (2024-2031). In the year 2022, the Asia Pacific market's volume surged to 10,508.7 Tonnes, showcasing a growth of 18.1% (2020-2023).

Perfluoroalkoxy Alkane (PFA) is a widely used material for fluoropolymer tubing, known for its excellent chemical resistance and high-temperature performance. PFA tubing is commonly employed in industries such as semiconductor manufacturing, chemical processing, and pharmaceuticals, where it is used to transport aggressive chemicals and ultra-pure fluids. Its smooth surface minimizes the risk of contamination, making it ideal for high-purity applications. Thus, the Perfluoroalkoxy Alkane (PFA) in China market registered a volume of 287.48 Tonnes in 2023.

The China market dominated the Asia Pacific Fluoropolymer Tubing Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $73,262.3 Thousands by 2031. The Japan market is registering a CAGR of 4.9% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 6.2% during (2024 - 2031).

The aerospace industry is anticipated to substantially increase demand for this due to technological advancements, rising aircraft production, and the widespread adoption of lightweight materials, among other factors. The aerospace sector is growing, the demand for this will grow as well.

This is extensively used in the food and beverage industry to convey liquids, gases, and food products. Its non-reactive, non-contaminating, and FDA-compliant properties make it suitable for beverage dispensing, food processing, and dairy production, where hygiene, purity, and product integrity are critical. In addition, food and beverage processing often involves temperature variations, including high temperatures during pasteurization, sterilization, or cooking and low temperatures during refrigeration or freezing.

India has emerged as a major hub for electronic manufacturing, with the government's "Make in India" initiative promoting domestic production and reducing reliance on imports. The country's electronics manufacturing ecosystem encompasses various products, including consumer electronics, telecommunication devices, industrial equipment, and automotive electronics. As electronic manufacturing continues to expand in India, there will be a corresponding increase in the demand for this used in various applications, such as wiring harnesses, cable assemblies, and component encapsulation. The expanding healthcare industry in Australia has fueled the demand for medical devices and equipment used in diagnosis, treatment, and patient care. These tubing is extensively used in medical device manufacturing for applications such as catheters, endoscopes, surgical instruments, and implantable devices. Its biocompatibility, chemical resistance, and flexibility make it suitable for various medical applications, driving demand from device manufacturers. Thus, the growing electronics and healthcare sectors in Asia Pacific will help in the growth of the regional market.

Free Valuable Insights: The Global Fluoropolymer Tubing Market is Predict to reach USD 812.4 Million by 2031, at a CAGR of 5.1%

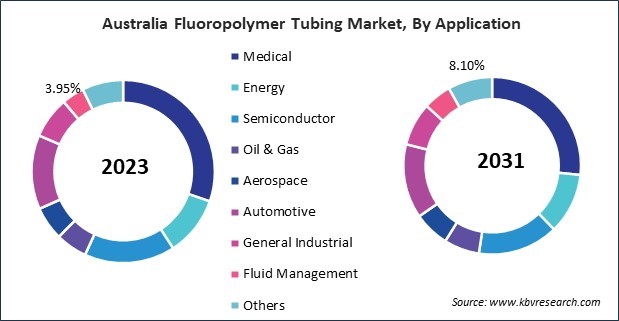

Based on Material, the market is segmented into Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy Alkane (PFA), Ethylene Tetrafluoroethylene (ETFE), PVDF, and Others. Based on Application, the market is segmented into Medical, Energy, Semiconductor, Oil & Gas, Aerospace, Automotive, General Industrial, Fluid Management, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

By Material (Volume, Tonnes, USD Million, 2020-2031)

By Application (Volume, Tonnes, USD Million, 2020-2031)

By Country (Volume, Tonnes, USD Million, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.