The Asia Pacific Generative AI in BFSI Market would witness market growth of 33.4% CAGR during the forecast period (2024-2031).

The China market dominated the Asia Pacific Generative AI in BFSI Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $659.9 Million by 2031. The Japan market is experiencing a CAGR of 32.7% during (2024 - 2031). Additionally, The India market would register a CAGR of 34.4% during (2024 - 2031).

Generative AI also significantly enhances BFSI in the realm of operational efficiency. Time-consuming and labor-intensive processes, such as document verification, compliance reporting, and data entry, often burden financial institutions. Generative AI automates these repetitive tasks, reducing human error and accelerating process times. For instance, natural language processing (NLP), a subset of generative AI, can quickly analyze and interpret complex legal documents or financial statements, extracting relevant information and flagging potential compliance issues. This automation reduces the time and cost of these tasks and enhances accuracy and compliance adherence.

For example, AI can expedite claims processing in the insurance sector by assessing the details of a claim against policy terms and identifying any inconsistencies or potential fraud. This process, which could take days or weeks manually, can now be completed in hours, leading to faster payouts and improved customer satisfaction. Operational efficiency is crucial for financial firms seeking to stay competitive, as it allows them to allocate more resources towards innovation and customer service rather than routine administrative tasks.

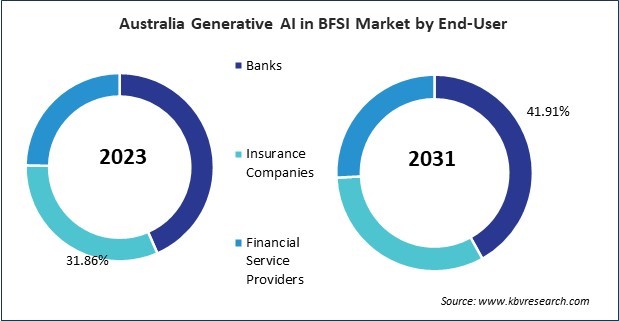

Australia’s BFSI sector increasingly utilizes generative AI for compliance, fraud detection, and customer experience. Major banks like Commonwealth Bank and Westpac use AI to analyze vast datasets, helping them maintain regulatory compliance and detect fraud patterns in real-time. Australia’s regulatory environment, which mandates strong data protection, has driven financial institutions to adopt AI solutions that improve compliance and protect customer data. Additionally, with a high demand for online banking and digital financial services, Australian banks are investing in AI-driven customer support solutions to enhance user experience and maintain competitiveness in the digital age. Thus, the collective demand and investments in generative AI underscore the region’s vital role in advancing AI-driven solutions catering to local needs and global standards.

Free Valuable Insights: The Global Generative AI in BFSI Market is Predict to reach USD 8.7 Billion by 2031, at a CAGR of 32.7%

Based on End-User, the market is segmented into Banks, Insurance Companies, and Financial Service Providers. Based on Application, the market is segmented into Fraud Detection, Risk Assessment, Customer Experience, Algorithmic Trading, and Other Application. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

By End-User

By Application

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.