The Asia Pacific Household Vacuum Cleaners Market would witness market growth of 6.8% CAGR during the forecast period (2024-2031). In the year 2022, the Asia Pacific market's volume surged to 34,257.58 thousand Units, showcasing a growth of 14.3% (2020-2023).

Offline channels play a crucial role in the Household Vacuum Cleaners Market, providing a tangible and immersive experience for consumers. In physical retail spaces, customers can interact with products, assess build quality, and receive personalized assistance from knowledgeable staff. Brick-and-mortar stores, ranging from department stores to specialty home appliance shops, serve as touchpoints for potential buyers to explore different vacuum cleaner models before making a purchase decision. Additionally, offline channels facilitate immediate gratification, allowing customers to take their chosen vacuum cleaner home on the same day, addressing the need for instant solutions. Thus, the China Market consumed 7,372.07 thousand units in 2023.

The China market dominated the Asia Pacific Household Vacuum Cleaners Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $2,711.1 million by 2031. The Japan market is registering a CAGR of 6.1% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 7.5% during (2024 - 2031).

The growth of e-commerce also enables vacuum cleaner brands to expand their market reach beyond geographical boundaries. Brands can sell their products to a audience without needing a physical presence in every market. This accessibility boosts brand visibility and allows companies to tap into emerging markets where demand for household appliances grows, but traditional retail infrastructure may be underdeveloped.

Vacuum cleaner manufacturers have altered their consumer engagement strategies as a result of the prevalence of digital media. When compared to traditional media, the employment of digital marketing tactics, like search engine optimization (SEO), content marketing, email marketing, and social media advertising, enables firms to engage a larger audience in a manner that is both more effective and more cost-effective. For example, using targeted Facebook or Instagram ads, vacuum cleaner brands can reach specific demographic groups likely interested in their products, such as pet owners or families with allergies, who might benefit from features like enhanced filtration systems.

According to the Ministry of Statistics and Programme Implementation (MOSPI), India’s per capita disposable income rose significantly in 2021-2022. This increase in disposable income has empowered more Indian households to afford modern home appliances. Additionally, the e-commerce sector in India has experienced explosive growth, with Invest India stating that India's online shopper base will grow to be the 2nd largest globally by 2030, with nearly 500-600 Mn shoppers. Major online platforms like Amazon India and Flipkart have made it easier for consumers to purchase vacuum cleaners, offering a broad range of products, detailed reviews, and convenient home delivery. This e-commerce boom and rising incomes have significantly contributed to the increasing adoption of vacuum cleaners in Indian homes. Hence, the Asia Pacific market is poised for continued growth.

Free Valuable Insights: The Global Household Vacuum Cleaners Market is Predict to reach USD 28 Billion by 2031, at a CAGR of 6.4%

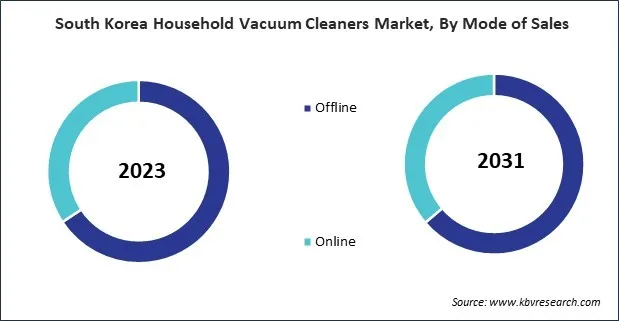

Based on Type, the market is segmented into Corded and Cordless. Based on Mode of Sales, the market is segmented into Offline and Online. Based on Product, the market is segmented into Cylinder Vacuum Cleaners (Corded and Cordless), Upright Vacuum Cleaners (Corded and Cordless), Handheld Vacuum Cleaners (Corded and Cordless), Stick Vacuum Cleaners (Corded and Cordless), Steam Vacuum Cleaners (Corded and Cordless), Robotic Vacuum Cleaners (Cordless), and Others (Corded and Cordless). Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

By Type (Volume, Thousand Units, USD Billion, 2020-2031)

By Mode of Sales (Volume, Thousand Units, USD Billion, 2020-2031)

By Product (Volume, Thousand Units, USD Billion, 2020-2031)

By Country (Volume, Thousand Units, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.