The Asia Pacific Persulfates Market would witness market growth of 3.7% CAGR during the forecast period (2024-2031). In the year 2022, the Asia Pacific market's volume surged to 1,507.36 hundred tonnes, showcasing a growth of 18.0% (2020-2023).

Potassium persulfate, with the chemical formula K2S2O8, is a versatile compound with strong oxidizing properties that finds wide application in various industries. It appears as a white, crystalline powder and is soluble in water. One of its primary uses is as an initiator for polymerization reactions, particularly in the production of acrylics, elastomers, and vinyl polymers. This makes potassium persulfate an essential component in the manufacturing of plastics, adhesives, and coatings. Thus, the China market consumed 49.71 hundred tonnes of Potassium persulfate in 2023.

The China market dominated the Asia Pacific Persulfates Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $157.7 million by 2031. The Japan market is registering a CAGR of 3.4% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 4.1% during (2024 - 2031).

The adoption of these chemicals has been steadily increasing across industries, driven by several factors, including regulatory requirements, technological advancements, and the need for effective solutions in various applications. For example, the polymer industry relies heavily on these chemicals as initiators for polymerization reactions. As the demand for polymers continues to rise across various sectors, including packaging, automotive, construction, and healthcare, the adoption of persulfate-based initiators has also increased.

Also, the adoption of these chemicals in environmental remediation projects is driven by the need to address soil and groundwater contamination at contaminated sites. Persulfate-based in situ chemical oxidation (ISCO) technologies offer an effective and cost-efficient solution for treating organic contaminants such as petroleum hydrocarbons, chlorinated solvents, and pesticides. Environmental consulting firms, remediation contractors, and regulatory agencies increasingly incorporate these chemicals based ISCO techniques into their remediation strategies to achieve successful site cleanups.

According to the National Investment Promotion and Facilitation Agency, India’s domestic apparel & textile industry contributes approx. 2.3 % to the country’s GDP, 13% to industrial production, and 12% to exports. India makes about 4% of the world’s apparel and textile trade. India is one of the world’s largest producers of cotton and jute. India is also the 2nd largest producer of silk worldwide, and 95% of the world’s hand-woven fabric comes from India. Also, India is set to achieve $250 Bn textiles production by 2030. Likewise, as per the International Trade Administration (ITA), as of 2021, China’s water treatment plants treated wastewater for 98.1% of municipalities and 28% of rural areas. China plans to build or renovate 80,000 km of sewage collection pipeline networks in the next few years. Also, the Chinese government plans to invest $50 billion in wastewater treatment for various heavy-polluting industries. Hence, the growing investment in wastewater treatment and the rising textile industry in the region is driving the market’s growth.

Free Valuable Insights: The Global Persulfates Market is Predict to reach USD 1.1 Billion by 2031, at a CAGR of 3.6%

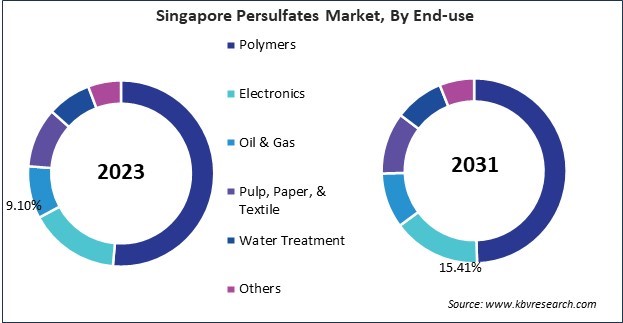

Based on Type, the market is segmented into Ammonium, Sodium and Potassium. Based on End-use, the market is segmented into Polymers, Electronics, Oil & Gas, Pulp, Paper, & Textile, Water Treatment, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

By Type (Volume, Hundred Tonnes, USD Billion, 2020-31)

By End-use (Volume, Hundred Tonnes, USD Billion, 2020-31)

By Country (Volume, Hundred Tonnes, USD Billion, 2020-31)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.