The Asia Pacific Plastic Container Market would witness market growth of 5.8% CAGR during the forecast period (2024-2031). In the year 2022, the Asia Pacific market's volume surged to 21,057.0 kilo tonnes, showcasing a growth of 23.2% (2020-2023).

The pharmaceutical sector represents a critical application within the plastic container market, driven by the need for safe, efficient, and compliant packaging solutions. Plastic containers in this industry are essential for packaging a wide array of pharmaceutical products, including tablets, capsules, liquids, and injectables. These containers are designed to meet stringent regulatory requirements, ensuring the protection of sensitive medications from environmental factors like moisture and light, which can degrade product efficacy. Common materials used include polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), chosen for their durability and chemical resistance. Hence, in Japan, 1,052.5 kilo tonnes of plastic containers is expected to be utilized in pharmaceutical sector by the year 2031.

The China market dominated the Asia Pacific Plastic Container Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $13,147.2 million by 2031. The Japan market is expected to witness a CAGR of 5.1% during (2024 - 2031). Additionally, The India market would register a CAGR of 6.4% during (2024 - 2031).

Plastic containers are widely used in the chemical and industrial sectors for packaging hazardous materials, industrial chemicals, lubricants, and solvents. Their ability to withstand corrosive substances, coupled with their robust design, makes plastic containers a preferred option for packaging in this sector. Plastic containers made from polyethylene (PE) and polypropylene (PP) resist a wide range of chemicals, ensuring the safe storage and transport of hazardous substances.

The adoption of plastic containers has been driven by several factors, including technological advancements, consumer demand for convenience, and the need for cost-effective packaging solutions. Over the years, plastic container manufacturing has become more sophisticated, allowing for the production of lighter, more durable, and eco-friendly containers. Innovations in injection molding, blow molding, and thermoforming have enabled manufacturers to produce various container shapes and sizes at scale, improving efficiency and reducing production costs.

China’s chemical sector has experienced significant expansion in recent years. Investment in chemical products and raw materials production increased by 19 percent in 2022, which was much faster than the average growth rate for all industries. Due to this quick expansion, the demand for a variety of chemical products, such as polymers, which are extensively utilized in the manufacture of plastic containers, has surged.

Furthermore, as the chemical sector in China continues to expand, the demand for raw materials and plastic products, such as containers for chemical storage, packaging, and transportation, is rising. Plastic containers are essential for packaging chemicals safely due to their durability, resistance to corrosion, and ability to withstand harsh environmental conditions. With China being a global leader in chemical production, the need for plastic containers to store and transport chemical products is expected to grow alongside the sector's expansion. Thus, the rising food delivery industry in India and the expansion of the chemical sector in China are significant drivers of growth in the plastic container market.

Free Valuable Insights: The Global Plastic Container Market is Predict to reach USD 105 Billion by 2031, at a CAGR of 5.4%

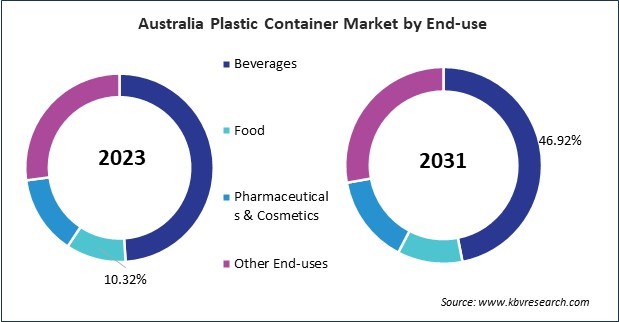

Based on Container Type, the market is segmented into Bottles & Jars, Pails, Tubs, Cups & Bowls, and Other Container Types. Based on End-use, the market is segmented into Beverages, Food, Pharmaceuticals & Cosmetics, and Other End-uses. Based on Material, the market is segmented into Polyethylene Terephthalate (PET), Polypropylene (PP), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Other Materials. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

By Container Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By End-use (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Material (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.