The Asia Pacific Power Generation Equipment Market would witness market growth of 5.1% CAGR during the forecast period (2024-2031).

The China market dominated the Asia Pacific Power Generation Equipment Market, by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $14,279.8 Million by 2031. The Japan market is registering a CAGR of 4.4% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 5.7% during (2024 - 2031).

CHP systems and cogeneration plants utilize this equipment to produce electricity and heat simultaneously for heating, cooling, and industrial processes. Waste heat recovery units, steam turbines, and absorption chillers capture and utilize waste heat from power generation processes for heating or cooling applications.

In addition, to facilitate energy storage and grid balancing, power-producing equipment is connected with energy storage devices, including flywheels, batteries, and pumped hydro storage. Energy storage solutions increase the flexibility, dependability, and efficiency of power-producing assets by storing extra energy during off-peak hours and releasing it during periods of high demand or grid disruptions.

With India’s ambitious renewable energy targets, there will be a substantial demand for power generation equipment specifically designed for renewable energy sources such as solar, wind, hydro, and biomass. As per the Government of India, the nation is committed to attaining energy independence by 2047 and a Net Zero energy consumption status by 2070. To achieve this goal, India’s energy transformation is based on increasing the usage of renewable energy in all economic sectors. Green hydrogen is regarded as a potentially viable substitute for facilitating this transition. Hydrogen can be employed for various purposes, including the long-term storage of renewable energy, industrial fossil fuel replacement, sustainable transportation, decentralized power generation, aviation, and marine transportation. The Union Cabinet sanctioned the National Green Hydrogen Mission on January 4, 2022. Hence, the expansion of the region’s renewable energy sector is driving the market’s growth.

Free Valuable Insights: The Global Power Generation Equipment Market is Predict to reach USD 157.7 Billion by 2031, at a CAGR of 4.6%

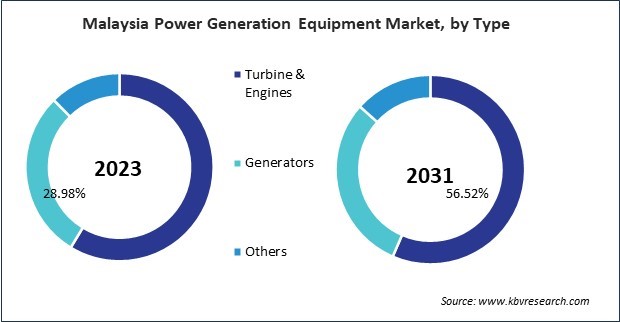

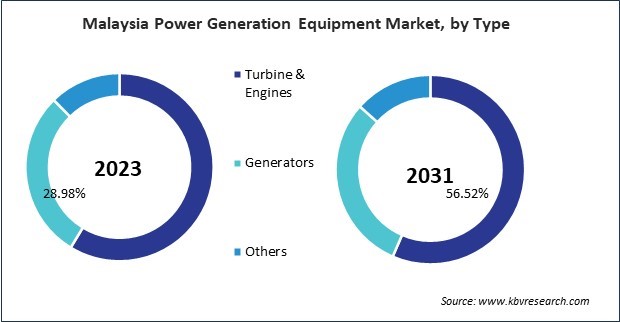

Based on Type, the market is segmented into Turbine & Engines, Generators, and Others. Based on Application, the market is segmented into Utility, Industrial, Commercial, and Residential. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Mitsubishi Heavy Industries Ltd.

- Wartsila Corporation

- ABB Ltd.

- Siemens Energy AG

- General Electric Company

- Caterpillar, Inc.

- Bharat Heavy Electricals Ltd.

- Schneider Electric SE

- Cummins, Inc.

- Toshiba Energy Systems & Solutions Corporation (Toshiba Corporation)

Asia Pacific Power Generation Equipment Market Report Segmentation

By Type

- Turbine & Engines

- Generators

- Others

By Application

- Utility

- Industrial

- Commercial

- Residential

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Power Generation Equipment Market, by Type

1.4.2 Asia Pacific Power Generation Equipment Market, by Application

1.4.3 Asia Pacific Power Generation Equipment Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.2.4 Geographical expansion

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2023, Nov – 2020, Mar) Leading Players

4.4 Porter’s Five Forces Analysis

Chapter 5. Asia Pacific Power Generation Equipment Market, by Type

5.1 Asia Pacific Turbine & Engines Market, by Country

5.2 Asia Pacific Generators Market, by Country

5.3 Asia Pacific Others Market, by Country

Chapter 6. Asia Pacific Power Generation Equipment Market, by Application

6.1 Asia Pacific Utility Market, by Country

6.2 Asia Pacific Industrial Market, by Country

6.3 Asia Pacific Commercial Market, by Country

6.4 Asia Pacific Residential Market, by Country

Chapter 7. Asia Pacific Power Generation Equipment Market, by Country

7.1 China Power Generation Equipment Market

7.1.1 China Power Generation Equipment Market, by Type

7.1.2 China Power Generation Equipment Market, by Application

7.2 Japan Power Generation Equipment Market

7.2.1 Japan Power Generation Equipment Market, by Type

7.2.2 Japan Power Generation Equipment Market, by Application

7.3 India Power Generation Equipment Market

7.3.1 India Power Generation Equipment Market, by Type

7.3.2 India Power Generation Equipment Market, by Application

7.4 South Korea Power Generation Equipment Market

7.4.1 South Korea Power Generation Equipment Market, by Type

7.4.2 South Korea Power Generation Equipment Market, by Application

7.5 Singapore Power Generation Equipment Market

7.5.1 Singapore Power Generation Equipment Market, by Type

7.5.2 Singapore Power Generation Equipment Market, by Application

7.6 Malaysia Power Generation Equipment Market

7.6.1 Malaysia Power Generation Equipment Market, by Type

7.6.2 Malaysia Power Generation Equipment Market, by Application

7.7 Rest of Asia Pacific Power Generation Equipment Market

7.7.1 Rest of Asia Pacific Power Generation Equipment Market, by Type

7.7.2 Rest of Asia Pacific Power Generation Equipment Market, by Application

Chapter 8. Company Profiles

8.1 Mitsubishi Heavy Industries Ltd.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.1.5.2 Acquisition and Mergers:

8.1.6 SWOT Analysis

8.2 Wartsila Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental Analysis and Regional Analysis

8.2.4 Research & Development Expenses

8.2.5 SWOT Analysis

8.3 ABB Ltd.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 Siemens Energy AG

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 Recent strategies and developments:

8.4.5.1 Geographical Expansions:

8.4.6 SWOT Analysis

8.5 General Electric Company

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expense

8.5.5 SWOT Analysis

8.6 Caterpillar, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expense

8.6.5 Recent strategies and developments:

8.6.5.1 Product Launches and Product Expansions:

8.6.5.2 Acquisition and Mergers:

8.6.6 SWOT Analysis

8.7 Bharat Heavy Electricals Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expenses

8.7.5 SWOT Analysis

8.8 Schneider Electric SE

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 Recent strategies and developments:

8.8.5.1 Partnerships, Collaborations, and Agreements:

8.8.5.2 Product Launches and Product Expansions:

8.8.6 SWOT Analysis

8.9 Cummins, Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Regional & Segmental Analysis

8.9.4 Research & Development Expenses

8.9.5 Recent strategies and developments:

8.9.5.1 Partnerships, Collaborations, and Agreements:

8.9.5.2 Product Launches and Product Expansions:

8.9.5.3 Acquisition and Mergers:

8.9.6 SWOT Analysis

8.10. Toshiba Energy Systems & Solutions Corporation (Toshiba Corporation)

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Segmental and Regional Analysis

8.10.4 Research and Development Expense

TABLE 1 Asia Pacific Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 2 Asia Pacific Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Power Generation Equipment Market

TABLE 4 Product Launches And Product Expansions– Power Generation Equipment Market

TABLE 5 Acquisition and Mergers– Power Generation Equipment Market

TABLE 6 Geographical expansion – Power Generation Equipment Market

TABLE 7 Asia Pacific Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 8 Asia Pacific Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 9 Asia Pacific Turbine & Engines Market, by Country, 2020 - 2023, USD Million

TABLE 10 Asia Pacific Turbine & Engines Market, by Country, 2024 - 2031, USD Million

TABLE 11 Asia Pacific Generators Market, by Country, 2020 - 2023, USD Million

TABLE 12 Asia Pacific Generators Market, by Country, 2024 - 2031, USD Million

TABLE 13 Asia Pacific Others Market, by Country, 2020 - 2023, USD Million

TABLE 14 Asia Pacific Others Market, by Country, 2024 - 2031, USD Million

TABLE 15 Asia Pacific Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 16 Asia Pacific Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 17 Asia Pacific Utility Market, by Country, 2020 - 2023, USD Million

TABLE 18 Asia Pacific Utility Market, by Country, 2024 - 2031, USD Million

TABLE 19 Asia Pacific Industrial Market, by Country, 2020 - 2023, USD Million

TABLE 20 Asia Pacific Industrial Market, by Country, 2024 - 2031, USD Million

TABLE 21 Asia Pacific Commercial Market, by Country, 2020 - 2023, USD Million

TABLE 22 Asia Pacific Commercial Market, by Country, 2024 - 2031, USD Million

TABLE 23 Asia Pacific Residential Market, by Country, 2020 - 2023, USD Million

TABLE 24 Asia Pacific Residential Market, by Country, 2024 - 2031, USD Million

TABLE 25 Asia Pacific Power Generation Equipment Market, by Country, 2020 - 2023, USD Million

TABLE 26 Asia Pacific Power Generation Equipment Market, by Country, 2024 - 2031, USD Million

TABLE 27 China Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 28 China Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 29 China Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 30 China Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 31 China Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 32 China Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 33 Japan Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 34 Japan Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 35 Japan Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 36 Japan Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 37 Japan Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 38 Japan Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 39 India Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 40 India Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 41 India Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 42 India Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 43 India Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 44 India Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 45 South Korea Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 46 South Korea Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 47 South Korea Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 48 South Korea Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 49 South Korea Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 50 South Korea Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 51 Singapore Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 52 Singapore Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 53 Singapore Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 54 Singapore Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 55 Singapore Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 56 Singapore Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 57 Malaysia Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 58 Malaysia Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 59 Malaysia Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 60 Malaysia Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 61 Malaysia Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 62 Malaysia Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 63 Rest of Asia Pacific Power Generation Equipment Market, 2020 - 2023, USD Million

TABLE 64 Rest of Asia Pacific Power Generation Equipment Market, 2024 - 2031, USD Million

TABLE 65 Rest of Asia Pacific Power Generation Equipment Market, by Type, 2020 - 2023, USD Million

TABLE 66 Rest of Asia Pacific Power Generation Equipment Market, by Type, 2024 - 2031, USD Million

TABLE 67 Rest of Asia Pacific Power Generation Equipment Market, by Application, 2020 - 2023, USD Million

TABLE 68 Rest of Asia Pacific Power Generation Equipment Market, by Application, 2024 - 2031, USD Million

TABLE 69 Key Information – Mitsubishi Heavy Industries Ltd.

TABLE 70 Key Information – Wartsila Corporation

TABLE 71 Key Information – ABB Ltd.

TABLE 72 Key Information – Siemens Energy AG

TABLE 73 Key Information – General Electric Company

TABLE 74 key information – Caterpillar, Inc.

TABLE 75 Key information – Bharat Heavy Electricals Ltd.

TABLE 76 Key Information – Schneider Electric SE

TABLE 77 Key information – Cummins, Inc.

TABLE 78 Key Information – Toshiba Energy Systems & Solutions Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Power Generation Equipment Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Power Generation Equipment Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 6 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2023, Nov – 2020, Mar) Leading Players

FIG 7 Porter’s Five Forces Analysis – Power Generation Equipment Market

FIG 8 Asia Pacific Power Generation Equipment Market share, by Type, 2023

FIG 9 Asia Pacific Power Generation Equipment Market share, by Type, 2031

FIG 10 Asia Pacific Power Generation Equipment Market, by Type, 2020 - 2031, USD Million

FIG 11 Asia Pacific Power Generation Equipment Market share, by Application, 2023

FIG 12 Asia Pacific Power Generation Equipment Market share, by Application, 2031

FIG 13 Asia Pacific Power Generation Equipment Market, by Application, 2020 - 2031, USD Million

FIG 14 Asia Pacific Power Generation Equipment Market share, by Country, 2023

FIG 15 Asia Pacific Power Generation Equipment Market share, by Country, 2031

FIG 16 Asia Pacific Power Generation Equipment Market, by Country, 2020 - 2031, USD Million

FIG 17 Recent strategies and developments: Mitsubishi Heavy Industries Ltd.

FIG 18 Swot Analysis: Mitsubishi Heavy Industries Ltd.

FIG 19 SWOT Analysis: Wartsila Corporation

FIG 20 SWOT Analysis: ABB ltd.

FIG 21 SWOT Analysis: Siemens Energy AG

FIG 22 SWOT Analysis: General Electric Company

FIG 23 SWOT Analysis: Caterpillar, Inc.

FIG 24 SWOT Analysis: Bharat Heavy Electricals Ltd.

FIG 25 SWOT Analysis: Schneider Electric SE

FIG 26 Recent strategies and developments: Cummins, Inc.

FIG 27 SWOT Analysis: Cummins, Inc.