The Asia Pacific Procurement Outsourcing Market would witness market growth of 11.3% CAGR during the forecast period (2024-2031).

The China market dominated the Asia Pacific Procurement Outsourcing Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $915.5 million by 2031. The Japan market is registering a CAGR of 10.6% during (2024 - 2031). Additionally, The India market would obtain a CAGR of 12.1% during (2024 - 2031).

Advanced technologies, such as AI, ML, and analytics, are frequently integrated into the processes of procurement outsourcing firms. This allows organizations to benefit from predictive analytics, automated sourcing, and smarter contract management, which can drive efficiencies and enhance decision-making. Companies experiencing seasonal fluctuations can leverage procurement outsourcing to scale their procurement activities up or down quickly. This flexibility allows organizations to respond efficiently to changing demands without maintaining a large internal procurement team year-round.

The adoption of procurement outsourcing has accelerated due to various factors. Organizations adopting procurement outsourcing often consider it a critical component of broader transformation initiatives. By outsourcing, they can re-engineer their procurement processes to align with overall business strategy, fostering innovation and agility. The shift towards procurement outsourcing is frequently intertwined with digital transformation efforts. Companies are adopting outsourcing to cut costs and integrate advanced technologies, such as e-procurement systems and analytics platforms, that enhance procurement capabilities.

The competitive nature of China’s IT landscape compels organizations to optimize their procurement processes. By outsourcing procurement functions, companies can leverage the expertise of specialized service providers, ensuring access to the latest technologies and best practices. This trend is particularly evident as businesses aim to remain agile and responsive in a fast-paced market, enhancing their ability to meet evolving customer demands. As revenue and growth rates in the IT industry continue to soar, adopting procurement outsourcing is expected to gain momentum, facilitating improved efficiency, cost management, and competitive advantage for organizations operating within this vibrant sector. In conclusion, the growth of the IT sector in China and the robust growth of the BFSI sector in India is a significant driver for the procurement outsourcing market in the region.

Free Valuable Insights: The Global Procurement Outsourcing Market is Predict to reach USD 12.5 Billion by 2031, at a CAGR of 10.7%

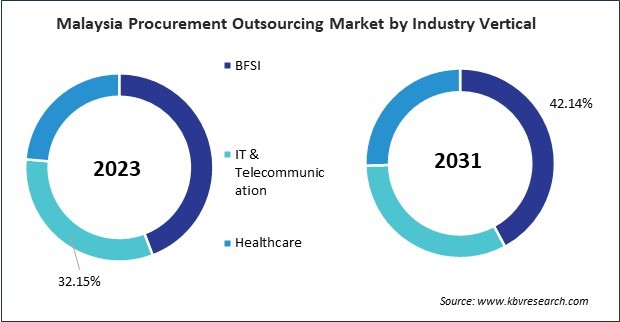

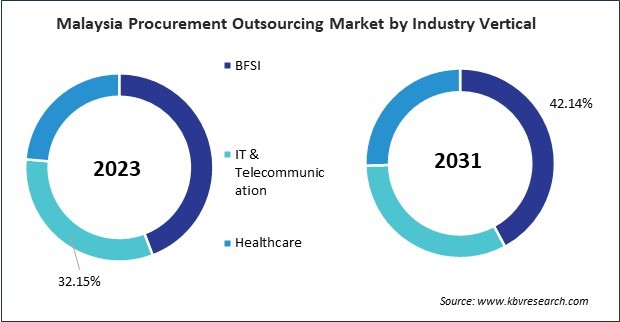

Based on Component, the market is segmented into Services and Solutions. Based on Deployment, the market is segmented into Cloud and On-Premise. Based on Industry Vertical, the market is segmented into BFSI, IT & Telecommunication, and Healthcare. Based on Organization Size, the market is segmented into Large Enterprises and Small and Medium-sized Enterprises (SMEs). Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Infosys Limited

- TATA Consultancy Services Ltd.

- HCL Technologies Ltd.

- WNS (Holdings) Ltd.

- NB Ventures, Inc. (Global eProcure)

- Wipro Limited

- IBM Corporation

- Accenture PLC

- Genpact Limited

- Capgemini SE

Asia Pacific Procurement Outsourcing Market Report Segmentation

By Component

By Deployment

By Industry Vertical

- BFSI

- IT & Telecommunication

- Healthcare

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Country

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Procurement Outsourcing Market, by Component

1.4.2 Asia Pacific Procurement Outsourcing Market, by Deployment

1.4.3 Asia Pacific Procurement Outsourcing Market, by Industry Vertical

1.4.4 Asia Pacific Procurement Outsourcing Market, by Organization Size

1.4.5 Asia Pacific Procurement Outsourcing Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2020, Jul – 2024, Jul) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. Asia Pacific Procurement Outsourcing Market by Component

5.1 Asia Pacific Services Market by Country

5.2 Asia Pacific Solutions Market by Country

Chapter 6. Asia Pacific Procurement Outsourcing Market by Deployment

6.1 Asia Pacific Cloud Market by Country

6.2 Asia Pacific On-Premise Market by Country

Chapter 7. Asia Pacific Procurement Outsourcing Market by Industry Vertical

7.1 Asia Pacific BFSI Market by Country

7.2 Asia Pacific IT & Telecommunication Market by Country

7.3 Asia Pacific Healthcare Market by Country

Chapter 8. Asia Pacific Procurement Outsourcing Market by Organization Size

8.1 Asia Pacific Large Enterprises Market by Country

8.2 Asia Pacific Small and Medium-sized Enterprises (SMEs) Market by Country

Chapter 9. Asia Pacific Procurement Outsourcing Market by Country

9.1 China Procurement Outsourcing Market

9.1.1 China Procurement Outsourcing Market by Component

9.1.2 China Procurement Outsourcing Market by Deployment

9.1.3 China Procurement Outsourcing Market by Industry Vertical

9.1.4 China Procurement Outsourcing Market by Organization Size

9.2 Japan Procurement Outsourcing Market

9.2.1 Japan Procurement Outsourcing Market by Component

9.2.2 Japan Procurement Outsourcing Market by Deployment

9.2.3 Japan Procurement Outsourcing Market by Industry Vertical

9.2.4 Japan Procurement Outsourcing Market by Organization Size

9.3 India Procurement Outsourcing Market

9.3.1 India Procurement Outsourcing Market by Component

9.3.2 India Procurement Outsourcing Market by Deployment

9.3.3 India Procurement Outsourcing Market by Industry Vertical

9.3.4 India Procurement Outsourcing Market by Organization Size

9.4 South Korea Procurement Outsourcing Market

9.4.1 South Korea Procurement Outsourcing Market by Component

9.4.2 South Korea Procurement Outsourcing Market by Deployment

9.4.3 South Korea Procurement Outsourcing Market by Industry Vertical

9.4.4 South Korea Procurement Outsourcing Market by Organization Size

9.5 Australia Procurement Outsourcing Market

9.5.1 Australia Procurement Outsourcing Market by Component

9.5.2 Australia Procurement Outsourcing Market by Deployment

9.5.3 Australia Procurement Outsourcing Market by Industry Vertical

9.5.4 Australia Procurement Outsourcing Market by Organization Size

9.6 Malaysia Procurement Outsourcing Market

9.6.1 Malaysia Procurement Outsourcing Market by Component

9.6.2 Malaysia Procurement Outsourcing Market by Deployment

9.6.3 Malaysia Procurement Outsourcing Market by Industry Vertical

9.6.4 Malaysia Procurement Outsourcing Market by Organization Size

9.7 Rest of Asia Pacific Procurement Outsourcing Market

9.7.1 Rest of Asia Pacific Procurement Outsourcing Market by Component

9.7.2 Rest of Asia Pacific Procurement Outsourcing Market by Deployment

9.7.3 Rest of Asia Pacific Procurement Outsourcing Market by Industry Vertical

9.7.4 Rest of Asia Pacific Procurement Outsourcing Market by Organization Size

Chapter 10. Company Profiles

10.1.1 Company Overview

10.1.2 Financial Analysis

10.1.3 Segmental and Regional Analysis

10.1.4 Research & Development Expenses

10.1.5 Recent strategies and developments:

10.1.5.1 Partnerships, Collaborations, and Agreements:

10.1.6 SWOT Analysis

10.2 Infosys Limited

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Segmental and Regional Analysis

10.2.4 Research & Development Expense

10.2.5 Recent strategies and developments:

10.2.5.1 Partnerships, Collaborations, and Agreements:

10.2.6 SWOT Analysis

10.3 Wipro Limited

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Segmental and Regional Analysis

10.3.4 Research & Development Expenses

10.3.5 SWOT Analysis

10.4 Genpact Limited

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Segmental and Regional Analysis

10.4.4 Recent strategies and developments:

10.4.4.1 Partnerships, Collaborations, and Agreements:

10.5 Capgemini SE

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Regional Analysis

10.5.4 Recent strategies and developments:

10.5.4.1 Acquisition and Mergers:

10.5.5 SWOT Analysis

10.6 HCL Technologies Ltd. (HCL Enterprises)

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Segmental and Regional Analysis

10.6.4 Research & Development Expenses

10.6.5 Recent strategies and developments:

10.6.5.1 Product Launches and Product Expansions:

10.6.5.2 Acquisition and Mergers:

10.6.6 SWOT Analysis

10.7 WNS (Holdings) Ltd.

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Segmental and Regional Analysis

10.7.4 Recent strategies and developments:

10.7.4.1 Acquisition and Mergers:

10.8 NB Ventures, Inc. (Global eProcure)

10.8.1 Company Overview

10.9 IBM Corporation

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Regional & Segmental Analysis

10.9.4 Research & Development Expenses

10.9.5 Recent strategies and developments:

10.9.5.1 Partnerships, Collaborations, and Agreements:

10.9.6 SWOT Analysis

10.10. Accenture PLC

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Segmental Analysis

10.10.4 Research & Development Expenses

10.10.5 Recent strategies and developments:

10.10.5.1 Acquisition and Mergers:

10.10.6 SWOT Analysis

TABLE 1 Asia Pacific Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 2 Asia Pacific Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Procurement Outsourcing Market

TABLE 4 Product Launches And Product Expansions– Procurement Outsourcing Market

TABLE 5 Acquisition and Mergers– Procurement Outsourcing Market

TABLE 6 Asia Pacific Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 7 Asia Pacific Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 8 Asia Pacific Services Market by Country, 2020 - 2023, USD Million

TABLE 9 Asia Pacific Services Market by Country, 2024 - 2031, USD Million

TABLE 10 Asia Pacific Solutions Market by Country, 2020 - 2023, USD Million

TABLE 11 Asia Pacific Solutions Market by Country, 2024 - 2031, USD Million

TABLE 12 Asia Pacific Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 13 Asia Pacific Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 14 Asia Pacific Cloud Market by Country, 2020 - 2023, USD Million

TABLE 15 Asia Pacific Cloud Market by Country, 2024 - 2031, USD Million

TABLE 16 Asia Pacific On-Premise Market by Country, 2020 - 2023, USD Million

TABLE 17 Asia Pacific On-Premise Market by Country, 2024 - 2031, USD Million

TABLE 18 Asia Pacific Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 19 Asia Pacific Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 20 Asia Pacific BFSI Market by Country, 2020 - 2023, USD Million

TABLE 21 Asia Pacific BFSI Market by Country, 2024 - 2031, USD Million

TABLE 22 Asia Pacific IT & Telecommunication Market by Country, 2020 - 2023, USD Million

TABLE 23 Asia Pacific IT & Telecommunication Market by Country, 2024 - 2031, USD Million

TABLE 24 Asia Pacific Healthcare Market by Country, 2020 - 2023, USD Million

TABLE 25 Asia Pacific Healthcare Market by Country, 2024 - 2031, USD Million

TABLE 26 Asia Pacific Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 27 Asia Pacific Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 28 Asia Pacific Large Enterprises Market by Country, 2020 - 2023, USD Million

TABLE 29 Asia Pacific Large Enterprises Market by Country, 2024 - 2031, USD Million

TABLE 30 Asia Pacific Small and Medium-sized Enterprises (SMEs) Market by Country, 2020 - 2023, USD Million

TABLE 31 Asia Pacific Small and Medium-sized Enterprises (SMEs) Market by Country, 2024 - 2031, USD Million

TABLE 32 Asia Pacific Procurement Outsourcing Market by Country, 2020 - 2023, USD Million

TABLE 33 Asia Pacific Procurement Outsourcing Market by Country, 2024 - 2031, USD Million

TABLE 34 China Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 35 China Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 36 China Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 37 China Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 38 China Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 39 China Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 40 China Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 41 China Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 42 China Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 43 China Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 44 Japan Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 45 Japan Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 46 Japan Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 47 Japan Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 48 Japan Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 49 Japan Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 50 Japan Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 51 Japan Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 52 Japan Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 53 Japan Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 54 India Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 55 India Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 56 India Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 57 India Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 58 India Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 59 India Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 60 India Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 61 India Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 62 India Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 63 India Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 64 South Korea Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 65 South Korea Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 66 South Korea Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 67 South Korea Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 68 South Korea Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 69 South Korea Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 70 South Korea Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 71 South Korea Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 72 South Korea Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 73 South Korea Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 74 Australia Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 75 Australia Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 76 Australia Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 77 Australia Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 78 Australia Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 79 Australia Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 80 Australia Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 81 Australia Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 82 Australia Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 83 Australia Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 84 Malaysia Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 85 Malaysia Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 86 Malaysia Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 87 Malaysia Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 88 Malaysia Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 89 Malaysia Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 90 Malaysia Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 91 Malaysia Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 92 Malaysia Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 93 Malaysia Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 94 Rest of Asia Pacific Procurement Outsourcing Market, 2020 - 2023, USD Million

TABLE 95 Rest of Asia Pacific Procurement Outsourcing Market, 2024 - 2031, USD Million

TABLE 96 Rest of Asia Pacific Procurement Outsourcing Market by Component, 2020 - 2023, USD Million

TABLE 97 Rest of Asia Pacific Procurement Outsourcing Market by Component, 2024 - 2031, USD Million

TABLE 98 Rest of Asia Pacific Procurement Outsourcing Market by Deployment, 2020 - 2023, USD Million

TABLE 99 Rest of Asia Pacific Procurement Outsourcing Market by Deployment, 2024 - 2031, USD Million

TABLE 100 Rest of Asia Pacific Procurement Outsourcing Market by Industry Vertical, 2020 - 2023, USD Million

TABLE 101 Rest of Asia Pacific Procurement Outsourcing Market by Industry Vertical, 2024 - 2031, USD Million

TABLE 102 Rest of Asia Pacific Procurement Outsourcing Market by Organization Size, 2020 - 2023, USD Million

TABLE 103 Rest of Asia Pacific Procurement Outsourcing Market by Organization Size, 2024 - 2031, USD Million

TABLE 104 Key Information – Tata Consultancy Services Ltd.

TABLE 105 Key Information – Infosys Limited

TABLE 106 Key Information – Wipro Limited

TABLE 107 Key Information – Genpact Limited

TABLE 108 Key Information – Capgemini SE

TABLE 109 Key Information – HCL Technologies Ltd.

TABLE 110 key information – WNS (Holdings) Ltd.

TABLE 111 key information – NB Ventures, Inc.

TABLE 112 Key Information – IBM Corporation

TABLE 113 Key Information – Accenture PLC

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Procurement Outsourcing Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Procurement Outsourcing Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2020, Jul – 2024, Jul) Leading Players

FIG 8 Porter’s Five Forces Analysis – Procurement Outsourcing Market

FIG 9 Asia Pacific Procurement Outsourcing Market share by Component, 2023

FIG 10 Asia Pacific Procurement Outsourcing Market share by Component, 2031

FIG 11 Asia Pacific Procurement Outsourcing Market by Component, 2020 - 2031, USD Million

FIG 12 Asia Pacific Procurement Outsourcing Market share by Deployment, 2023

FIG 13 Asia Pacific Procurement Outsourcing Market share by Deployment, 2031

FIG 14 Asia Pacific Procurement Outsourcing Market by Deployment, 2020 - 2031, USD Million

FIG 15 Asia Pacific Procurement Outsourcing Market share by Industry Vertical, 2023

FIG 16 Asia Pacific Procurement Outsourcing Market share by Industry Vertical, 2031

FIG 17 Asia Pacific Procurement Outsourcing Market by Industry Vertical, 2020 - 2031, USD Million

FIG 18 Asia Pacific Procurement Outsourcing Market share by Organization Size, 2023

FIG 19 Asia Pacific Procurement Outsourcing Market share by Organization Size, 2031

FIG 20 Asia Pacific Procurement Outsourcing Market by Organization Size, 2020 - 2031, USD Million

FIG 21 Asia Pacific Procurement Outsourcing Market share by Country, 2023

FIG 22 Asia Pacific Procurement Outsourcing Market share by Country, 2031

FIG 23 Asia Pacific Procurement Outsourcing Market by Country, 2020 - 2031, USD Million

FIG 24 SWOT Analysis: Tata Consultancy Services Ltd.

FIG 25 SWOT Analysis: Infosys Limited

FIG 26 SWOT Analysis: Wipro Limited

FIG 27 SWOT Analysis: Capgemini SE

FIG 28 Recent strategies and developments: HCL Technologies Ltd.

FIG 29 SWOT Analysis: HCL Technologies Ltd.

FIG 30 SWOT Analysis: IBM Corporation

FIG 31 SWOT Analysis: Accenture PLC