The Asia Pacific Vinyl Acetate Monomer Market would witness market growth of 4.8% CAGR during the forecast period (2024-2031). In the year 2022, the Asia Pacific market's volume surged to 2,846.4 kilo tonnes, showcasing a growth of 19.2% (2020-2023).

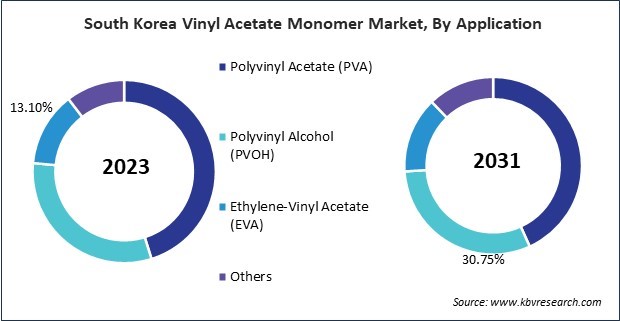

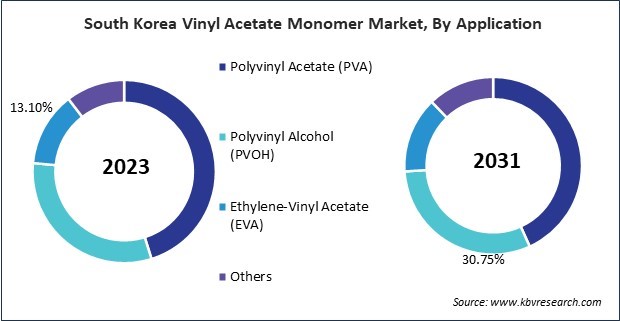

Polyvinyl Acetate is a versatile polymer extensively utilized in various industries, including adhesives, coatings, textiles, and construction. In adhesives, PVA offers excellent bonding properties, water resistance, and flexibility, making it ideal for woodworking, packaging, and paper bonding applications. Thus, the South Korea market utilized 107.05 kilo tonnes of Polyvinyl Acetate in the market 2022.

The China market dominated the Asia Pacific Vinyl Acetate Monomer Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,656.6 Million by 2031. The Japan market is showcasing a CAGR of 4.1% during (2024 - 2031). Additionally, The India market would register a CAGR of 5.4% during (2024 - 2031).

Vinyl acetate monomer (VAM) is a colorless liquid with a pungent odor, and it is produced through the reaction of acetylene and acetic acid. VAM is a versatile chemical intermediate building block for synthesizing polymers, resins, and other specialty chemicals.

Moreover, vinyl acetate monomer (VAM) is used in various industries and sectors owing to its versatile properties and compatibility with different materials. For example, VAM is a primary raw material for producing polyvinyl acetate (PVA) and copolymers like ethylene-vinyl acetate (EVA), which are widely used in adhesives and sealants.

The expansion of the chemical industry in India leads to increased demand for raw materials and intermediates, including VAM. As the chemical sector grows, there is a higher requirement for VAM in various applications such as adhesives, coatings, textiles, and packaging materials. The growth of the chemical industry in India opens up new market opportunities for VAM manufacturers and suppliers.

Free Valuable Insights: The Global Vinyl Acetate Monomer Market is Predict to reach USD 13.5 Billion by 2031, at a CAGR of 4.7%

Based on End-user, the market is segmented into Construction, Packaging, Textile, Cosmetics, and Others. Based on Application, the market is segmented into Polyvinyl Acetate (PVA), Polyvinyl Alcohol (PVOH), Ethylene-Vinyl Acetate (EVA), and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Celanese Corporation

- LyondellBasell Industries Holdings B.V.

- The Dow Chemical Company

- DuPont de Nemours, Inc.

- Wacker Chemie AG

- Kuraray Europe GmbH (Kuraray Co., Ltd.)

- INEOS Group Holdings S.A

- Sinopec Group (China Petrochemical Corporation)

- Sipchem Company

- Exxon Mobil Corporation

Asia Pacific Vinyl Acetate Monomer Market Report Segmentation

By End-user (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Construction

- Packaging

- Textile

- Cosmetics

- Others

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Polyvinyl Acetate (PVA)

- Polyvinyl Alcohol (PVOH)

- Ethylene-Vinyl Acetate (EVA)

- Others

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

TABLE 1 Asia Pacific Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 2 Asia Pacific Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 3 Asia Pacific Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 4 Asia Pacific Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 5 Asia Pacific Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 6 Asia Pacific Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 7 Asia Pacific Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 8 Asia Pacific Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 9 Asia Pacific Construction Market by Country, 2020 - 2023, USD Million

TABLE 10 Asia Pacific Construction Market by Country, 2024 - 2031, USD Million

TABLE 11 Asia Pacific Construction Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 12 Asia Pacific Construction Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 13 Asia Pacific Packaging Market by Country, 2020 - 2023, USD Million

TABLE 14 Asia Pacific Packaging Market by Country, 2024 - 2031, USD Million

TABLE 15 Asia Pacific Packaging Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 16 Asia Pacific Packaging Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 17 Asia Pacific Textile Market by Country, 2020 - 2023, USD Million

TABLE 18 Asia Pacific Textile Market by Country, 2024 - 2031, USD Million

TABLE 19 Asia Pacific Textile Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 20 Asia Pacific Textile Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 21 Asia Pacific Cosmetics Market by Country, 2020 - 2023, USD Million

TABLE 22 Asia Pacific Cosmetics Market by Country, 2024 - 2031, USD Million

TABLE 23 Asia Pacific Cosmetics Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 24 Asia Pacific Cosmetics Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 25 Asia Pacific Others Market by Country, 2020 - 2023, USD Million

TABLE 26 Asia Pacific Others Market by Country, 2024 - 2031, USD Million

TABLE 27 Asia Pacific Others Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 28 Asia Pacific Others Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 29 Asia Pacific Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 30 Asia Pacific Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 31 Asia Pacific Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 32 Asia Pacific Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 33 Asia Pacific Polyvinyl Acetate (PVA) Market by Country, 2020 - 2023, USD Million

TABLE 34 Asia Pacific Polyvinyl Acetate (PVA) Market by Country, 2024 - 2031, USD Million

TABLE 35 Asia Pacific Polyvinyl Acetate (PVA) Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 36 Asia Pacific Polyvinyl Acetate (PVA) Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 37 Asia Pacific Polyvinyl Alcohol (PVOH) Market by Country, 2020 - 2023, USD Million

TABLE 38 Asia Pacific Polyvinyl Alcohol (PVOH) Market by Country, 2024 - 2031, USD Million

TABLE 39 Asia Pacific Polyvinyl Alcohol (PVOH) Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 40 Asia Pacific Polyvinyl Alcohol (PVOH) Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 41 Asia Pacific Ethylene-Vinyl Acetate (EVA) Market by Country, 2020 - 2023, USD Million

TABLE 42 Asia Pacific Ethylene-Vinyl Acetate (EVA) Market by Country, 2024 - 2031, USD Million

TABLE 43 Asia Pacific Ethylene-Vinyl Acetate (EVA) Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 44 Asia Pacific Ethylene-Vinyl Acetate (EVA) Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 45 Asia Pacific Others Market by Country, 2020 - 2023, USD Million

TABLE 46 Asia Pacific Others Market by Country, 2024 - 2031, USD Million

TABLE 47 Asia Pacific Others Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 48 Asia Pacific Others Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 49 Asia Pacific Vinyl Acetate Monomer Market by Country, 2020 - 2023, USD Million

TABLE 50 Asia Pacific Vinyl Acetate Monomer Market by Country, 2024 - 2031, USD Million

TABLE 51 Asia Pacific Vinyl Acetate Monomer Market by Country, 2020 - 2023, Kilo Tonnes

TABLE 52 Asia Pacific Vinyl Acetate Monomer Market by Country, 2024 - 2031, Kilo Tonnes

TABLE 53 China Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 54 China Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 55 China Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 56 China Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 57 China Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 58 China Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 59 China Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 60 China Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 61 China Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 62 China Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 63 China Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 64 China Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 65 Japan Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 66 Japan Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 67 Japan Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 68 Japan Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 69 Japan Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 70 Japan Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 71 Japan Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 72 Japan Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 73 Japan Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 74 Japan Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 75 Japan Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 76 Japan Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 77 India Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 78 India Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 79 India Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 80 India Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 81 India Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 82 India Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 83 India Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 84 India Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 85 India Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 86 India Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 87 India Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 88 India Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 89 South Korea Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 90 South Korea Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 91 South Korea Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 92 South Korea Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 93 South Korea Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 94 South Korea Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 95 South Korea Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 96 South Korea Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 97 South Korea Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 98 South Korea Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 99 South Korea Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 100 South Korea Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 101 Singapore Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 102 Singapore Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 103 Singapore Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 104 Singapore Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 105 Singapore Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 106 Singapore Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 107 Singapore Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 108 Singapore Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 109 Singapore Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 110 Singapore Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 111 Singapore Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 112 Singapore Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 113 Malaysia Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 114 Malaysia Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 115 Malaysia Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 116 Malaysia Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 117 Malaysia Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 118 Malaysia Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 119 Malaysia Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 120 Malaysia Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 121 Malaysia Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 122 Malaysia Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 123 Malaysia Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 124 Malaysia Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 125 Rest of Asia Pacific Vinyl Acetate Monomer Market, 2020 - 2023, USD Million

TABLE 126 Rest of Asia Pacific Vinyl Acetate Monomer Market, 2024 - 2031, USD Million

TABLE 127 Rest of Asia Pacific Vinyl Acetate Monomer Market, 2020 - 2023, Kilo Tonnes

TABLE 128 Rest of Asia Pacific Vinyl Acetate Monomer Market, 2024 - 2031, Kilo Tonnes

TABLE 129 Rest of Asia Pacific Vinyl Acetate Monomer Market by End-user, 2020 - 2023, USD Million

TABLE 130 Rest of Asia Pacific Vinyl Acetate Monomer Market by End-user, 2024 - 2031, USD Million

TABLE 131 Rest of Asia Pacific Vinyl Acetate Monomer Market by End-user, 2020 - 2023, Kilo Tonnes

TABLE 132 Rest of Asia Pacific Vinyl Acetate Monomer Market by End-user, 2024 - 2031, Kilo Tonnes

TABLE 133 Rest of Asia Pacific Vinyl Acetate Monomer Market by Application, 2020 - 2023, USD Million

TABLE 134 Rest of Asia Pacific Vinyl Acetate Monomer Market by Application, 2024 - 2031, USD Million

TABLE 135 Rest of Asia Pacific Vinyl Acetate Monomer Market by Application, 2020 - 2023, Kilo Tonnes

TABLE 136 Rest of Asia Pacific Vinyl Acetate Monomer Market by Application, 2024 - 2031, Kilo Tonnes

TABLE 137 Key Information – Celanese Corporation

TABLE 138 Key Information – LyondellBasell Industries Holdings B.V.

TABLE 139 Key Information – The Dow Chemical Company

TABLE 140 Key Information –DuPont de Nemours, Inc.

TABLE 141 Key Information – Wacker Chemie AG

TABLE 142 Key Information – kuraray europe gmbh

TABLE 143 Key Information – INEOS Group Holdings S.A.

TABLE 144 Key Information – Sinopec Group

TABLE 145 Key Information – Sipchem Company

TABLE 146 Key Information – Exxon Mobil Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Vinyl Acetate Monomer Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Vinyl Acetate Monomer Market

FIG 4 Porter’s Five Forces Analysis – Vinyl Acetate Monomer Market

FIG 5 Asia Pacific Vinyl Acetate Monomer Market share by End-user, 2023

FIG 6 Asia Pacific Vinyl Acetate Monomer Market share by End-user, 2031

FIG 7 Asia Pacific Vinyl Acetate Monomer Market by End-user, 2020 - 2031, USD Million

FIG 8 Asia Pacific Vinyl Acetate Monomer Market share by Application, 2023

FIG 9 Asia Pacific Vinyl Acetate Monomer Market share by Application, 2031

FIG 10 Asia Pacific Vinyl Acetate Monomer Market by Application, 2020 - 2031, USD Million

FIG 11 Asia Pacific Vinyl Acetate Monomer Market share by Country, 2023

FIG 12 Asia Pacific Vinyl Acetate Monomer Market share by Country, 2031

FIG 13 Asia Pacific Vinyl Acetate Monomer Market by Country, 2020 - 2031, USD Million

FIG 14 SWOT Analysis: Celanese Corporation

FIG 15 SWOT Analysis: LyondellBasell Industries Holdings B.V.

FIG 16 SWOT Analysis: The Dow Chemical Company

FIG 17 Swot Analysis: DuPont de Nemours, Inc.

FIG 18 Recent strategies and developments: Wacker Chemie AG

FIG 19 Swot Analysis: Wacker Chemie AG

FIG 20 SWOT ANALYSIS: Kuraray Europe GmbH

FIG 21 SWOT Analysis: INEOS GROUP HOLDINGS S.A.

FIG 22 Swot Analysis: Chinsa Petrochemical Corporation

FIG 23 SWOT Analysis: Sipchem Company

FIG 24 SWOT Analysis: Exxon Mobil Corporation