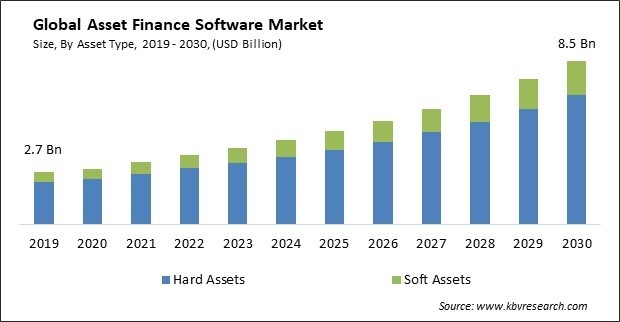

The Global Asset Finance Software Market size is expected to reach $8.5 billion by 2030, rising at a market growth of 11.6% CAGR during the forecast period.

Significant price increases on cars and other expensive items have prompted businesses to finance or borrow money rather than make direct purchases. Therefore, banks segment would generate $350.2 million revenue in the market in 2022. Particularly in the banking industry, cloud computing enables quicker and simpler access to data for financial services such as regulatory reporting, risk mitigation, analytics, deep learning, and discovering risk management can scale to accommodate varying data volumes, and users can rely on the cloud to remove blind spots brought on by data silos; the end effect is cleaner, contextualized data structures. Some of the factors impacting the market are growing demand for more efficient financial processes, adoption of technology in financial processes and high installation costs of software.

Finance software is essential for many firms since it enables them to manage their financial operations efficiently and effectively. This market is driven by businesses looking to optimize resource allocation, enhance overall financial planning and reporting, and cut expenses. Asset tracking, leasing management, and depreciation calculations are just a few of the processes that asset finance software automates. Automated asset tracking enables optimal management of assets by providing real-time visibility into their location and state. By outsourcing these procedures, asset finance software can boost operational effectiveness and cut costs. Accounting reconciliations, ledger maintenance, financial statement creation, and budgeting are easily automated using asset financial software. Additionally, Businesses looking to optimize asset finance operations are drawn to this technological transition, which increases the demand for specialized software solutions to address these changing needs, including usage-based pricing and support for risk-free interest rate products and a thorough UI overhaul to enhance user experience and boost operational effectiveness. Therefore, these benefits of asset finance software increase their demand and adoption and these factors are expected to present the market with lucrative growth potential.

However, the high price tag of this software can be incredibly challenging for smaller businesses or those with limited financial resources. Asset finance software typically involves licensing fees, which can vary depending on factors such as the software provider, the scope of features, and the number of users. These upfront costs can be substantial, particularly for enterprise-level solutions. Customizing the software to align with an organization's unique workflows and processes often requires additional development work, which can increase implementation costs. Integration with existing systems, databases, and third-party applications can also add complexity and cost to the implementation process. As a result, it is expected that these limitations will significantly impact the potential growth of the market.

Based on asset type, the asset finance software market is categorized into hard assets and soft assets. In 2022, the soft assets segment witnessed a significant revenue share in the asset finance software market. The soft assets segment is expected to experience constant growth due to the rising number of startups in Asia Pacific, the Middle East & Africa, and South America. This growth has created a need for soft assets, such as software and light equipment, which are required to set up these startups. As a result, the demand for soft investments is expected to expand significantly.

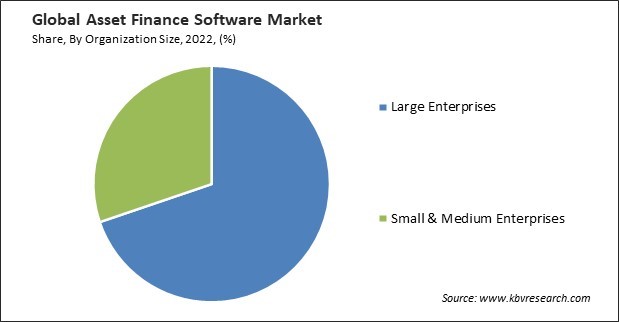

Based on organization size, the market is characterized into large enterprises and small & medium enterprises. In 2022, the large enterprise segment witnessed the maximum revenue share in the market. Asset finance software enables large organizations to track and manage a vast array of assets, including equipment, machinery, vehicles, and more, across multiple locations. The software automates complex financing processes, such as lease origination, contract management, and payment processing, reducing manual workloads and errors. Large organizations can also leverage asset finance software for accurate budgeting, financial forecasting, and expense tracking related to asset portfolios. Asset financing could make it easier to raise funds for additional financing requirements. Spreading out the costs of an asset helps maintain a company's cash flow.

Based on deployment type, the market is divided into on-premise and cloud. In 2022, the cloud segment recorded a substantial revenue share in the market. Cloud-driven deployment has numerous benefits, such as minimal maintenance, reduced costs, faster distribution, and increased scalability. Among the various cloud services available, SaaS is the most widely adopted by financial institutions. Cloud solutions also enable vendors to connect their services, resulting in a smooth process throughout every phase of a lease or loan. For instance, during origination, necessary steps like credit checks or digital signatures can be integrated into a seamless process that multiple vendors deliver.

Based on vertical, the market is classified into banks, transportation, construction, IT & related services, healthcare, agriculture, and others. In 2022, the healthcare segment attained a significant revenue share in the market. The need to purchase or modify new equipment is one of the most frequent needs these organizations and enterprises must meet. Healthcare asset financing can be utilized for growth, machinery acquisition, and other infrastructure needs, whether for a new MRI machine or a batch of motorized hospital beds.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.6 Billion |

| Market size forecast in 2030 | USD 8.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 11.6% from 2023 to 2030 |

| Number of Pages | 281 |

| Number of Table | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Asset Type, Organization Size, Deployment Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America segment recorded the largest revenue share in the market. North America has assumed a significant role in deploying technology and infrastructure. The existence of major IT firms and the expanding digitization in the United States and Canada are the key market drivers. The market is expected to develop due to the increased use of connected, innovative, and secure technologies for asset-centric applications.

Free Valuable Insights: Global Asset Finance Software Market size to reach USD 8.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Oracle Corporation, CGI, Inc., Fidelity National Information Services, Inc., CHG-MERIDIAN AG, Banqsoft A/S (KMD A/S), NETSOL Technologies, Inc., Odessa Technologies, Inc., Alfa Financial L.L.C, Intelligent Environments Europe Ltd (Parabellum Investments) and Lendscape Limited (Bowmark Capital LLP).

By Asset Type

By Organization Size

By Deployment Type

By Vertical

By Geography

The Market size is projected to reach USD 8.5 billion by 2030.

Growing demand for more efficient financial processes are driving the Market in coming years, High installation costs of software restraints the growth of the Market.

Oracle Corporation, CGI, Inc., Fidelity National Information Services, Inc., CHG-MERIDIAN AG, Banqsoft A/S (KMD A/S), NETSOL Technologies, Inc., Odessa Technologies, Inc., Alfa Financial L.L.C, Intelligent Environments Europe Ltd (Parabellum Investments) and Lendscape Limited (Bowmark Capital LLP).

The expected CAGR of this Market is 11.6% from 2023 to 2030.

The Hard Assets segment is generating the highest revenue in the Market by Asset Type in 2022; thereby, achieving a market value of $6.7 billion by 2030.

The North America region dominated the Market by Region in 2022; thereby, achieving a market value of $2.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.