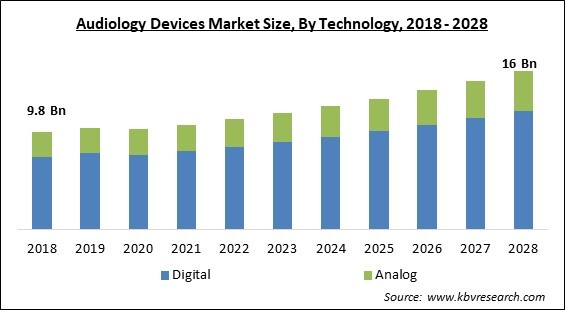

The Global Audiology Devices Market size is expected to reach $16 billion by 2028, rising at a market growth of 6.2% CAGR during the forecast period.

The electronic tools used by audiologists for the accurate diagnosis and therapy of hearing loss or impairment are known as audiology devices. A significant number of people are predicted to have some degree of hearing loss in the coming years, and a lot of them would need hearing rehabilitation. Additionally, because of unsafe listening habits, a big proportion of the population is at the risk of developing permanent and preventable hearing loss. This will likely further fuel the market for audio logical devices throughout the forecast period.

The market's expansion can also be attributed to factors, including the rising elderly population, occurrences of hearing diseases, and government programs that enable simple access to hearing aids. The prevalence of the geriatric population is increasing all over the world. Hearing loss and impairment are very common in elderly age of people. However, it is anticipated that the rate at which hearing impairments are treated will rise as market participants increasingly combine traditional devices with cutting-edge telemedicine.

A platform for online audiology was introduced by lively in 2019 and offers all customers hearing aids, testing, and round-the-clock online assistance. Additionally, the market is anticipated to benefit from ongoing technology advancements that improve the listening experience for consumers as well as the introduction of specialized devices made for veterans and serving military personnel. The development of new features, like Bluetooth connectivity, voice processing, contactless charging, and many others, together with technological improvements in areas like wireless devices, are anticipated to accelerate the growth of the market.

The outbreak of the COVID-19 pandemic has transformed how medical treatment is provided globally. Many hospitals and departments have been re-profiled for treating patients with COVID-19 as a result of the increasing demand brought on by the rising rate of hospitalization of COVID-19 patients. In order to reserve and redirect the limited capacity and resources, such as hospital beds and care experts, toward COVID-19 patient care, many elective procedures were canceled or postponed globally. The redistribution of intensive care resources had a disproportionately negative impact on the delivery of ENT-related surgeries and services. Considering the proximity, test setup, and length of appointments, the Centers for Disease Control and Prevention claims that ENT clinics or audiology centers present a medium-to-high risk for COVID-19 infection.

Hearing loss affects people of all ages and is ranked third among physical conditions by The Hearing Loss Association of America (HLAA), behind arthritis and heart disease. People of all ages can experience gradual hearing loss, which ranges in severity from minor to severe. Depending on the reason, it might be mild, severe, transitory, or permanent. The WHO defines hearing loss as the inability to hear as well in both ears as someone with a normal hearing threshold of 25 dB or better. The need for diagnosis and treatment is anticipated to rise with an increase in prevalence, which is anticipated to boost the market for audiology devices.

One of the major factors that are driving the growth of the audiology devices market is the rising prevalence of Meniere’s disease all over the world. Meniere's disease can be referred as a chronic inner ear condition that affects hearing and balance. Vertigo and hearing loss are two symptoms of the inner ear ailment Meniere's disease. Meniere's illness typically only affects one ear. Meniere's illness can strike at any age, but it typically manifests between the ages of 20 and 40. Although it's a chronic ailment, there are a number of therapies that can aid in the management of the symptoms and lessen the long-term effects on the patient's life.

A significant factor limiting market growth is the high cost of hearing aids, including cochlear implants as well as bone-anchored systems, particularly in price-sensitive regions. Healthcare providers generally lack the financial resources for investment in sophisticated technologies, particularly in developing nations. Additionally, the staff needs to undergo comprehensive training programs in the proper handling and maintenance of bone-anchored devices and cochlear implants. Technology-advanced hearing aids must be developed through extensive R&D efforts.

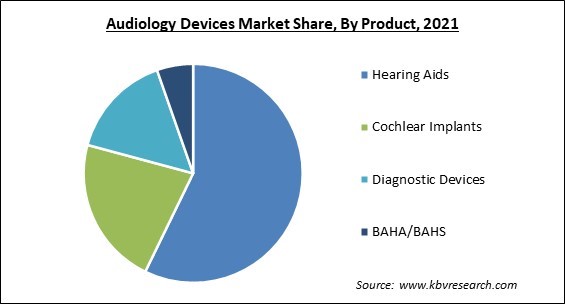

Based on product, the audiology devices market is segmented into Hearing Aids (Behind-the-ear and In-the-ear & others), Cochlear Implants, BAHA/BAHS and Diagnostic Devices. In the hearing aids segment, the behind-the-ear segment registered the biggest revenue share of the market. This increasing growth of the segment is attributed to the fact that this type of devices is easily deployable and most used type of devices across the market. Therefore, the adoption of these hearing aids is surging.

On the basis of technology, the audiology devices market is bifurcated into Digital and Analog. In 2021, the digital segment procured the highest revenue share of the audiology devices market. The growth of the segment is expediting due to their improved and rapid adaptability. Hearing aids are devices that amplify sound and are made to help those who suffer hearing loss. A microphone that picks up sound, an amplifier circuit that makes the sound louder, a small loudspeaker that transmits the amplified sound into the ear canal, and batteries that power the electronic circuits are all common elements found in most hearing aids.

By distribution channel, the audiology devices market is fragmented into Offline and Online. In 2021, the offline segment acquired the biggest revenue share of the audiology devices market. The growth of the segment is accelerating due to the expanding number of retail stores all over the world. Moreover, due to the dominance of retail stores on the market in various countries, various retailers are including hearing devices in their portfolios.

Based on End-User, the Audiology Equipment market is categorized into Hospitals & Clinics, Ambulatory Surgical Centers, and Others. In 2021, the Ambulatory Surgical Centers segment witnessed a significant revenue share of the audiology devices market. The rapidly rising growth of the segment is attributed to the increasing burden on clinics and hospitals. Due to the emergence of the COVID-19 pandemic, people are becoming hesitant while visiting hospitals and clinics. In order to address this challenge, the people are rapidly shifting toward ambulatory surgical centers. Hence, the growth of the segment is surging.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 10.6 Billion |

| Market size forecast in 2028 | USD 16 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.2% from 2022 to 2028 |

| Number of Pages | 290 |

| Number of Tables | 515 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Product, Distribution Channel, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the audiology devices market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, North America accounted for the largest revenue share of the audiology devices market. The development of audiology systems, a rise in the number of audiologists, as well as the introduction of cutting-edge digital platforms by existing suppliers can all be credited with the expansion of the regional audiology devices market. The introduction of patient-centered audiology systems that make it simple to handle the product results in patient compliance, which further fuels market expansion.

Free Valuable Insights: Global Audiology Devices Market size to reach USD 16 Billion by 2028

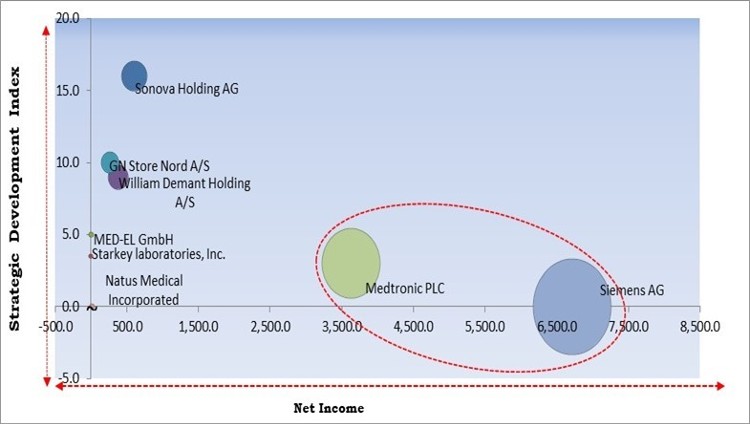

The major strategies followed by the market participants are Product Launches and Partnerships. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC and Siemens AG are the forerunners in the Audiology Devices Market. Companies such as Starkey laboratories, Inc., William Demant Holding A/S and MED-EL GmbH are some of the key innovators in Audiology Devices Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, Medtronic PLC, William Demant Holding A/S, GN Store Nord A/S, Sonova Holding AG, WS Audiology A/S, Natus Medical Incorporated, MED-EL GmbH, Starkey laboratories, Inc., and Benson Medical Instruments.

By Technology

By Product

By Distribution Channel

By End User

By Geography

The global Audiology Devices Market size is expected to reach $16 billion by 2028.

Increasing Cases Of Hearing Loss are driving the market in coming years, however, High Initial Cost And The Final Price restraints the growth of the market.

Siemens AG, Medtronic PLC, William Demant Holding A/S, GN Store Nord A/S, Sonova Holding AG, WS Audiology A/S, Natus Medical Incorporated, MED-EL GmbH, Starkey laboratories, Inc., and Benson Medical Instruments.

The Hearing Aids segment acquired maximum revenue share in the Global Audiology Devices Market by Product in 2021 thereby, achieving a market value of $8.8 billion by 2028.

The Hospitals & Clinics segment is leading the Global Audiology Devices Market by End User in 2021 thereby, achieving a market value of $9.8 billion by 2028.

The North America market dominated the Global Audiology Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $5,467.4 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.