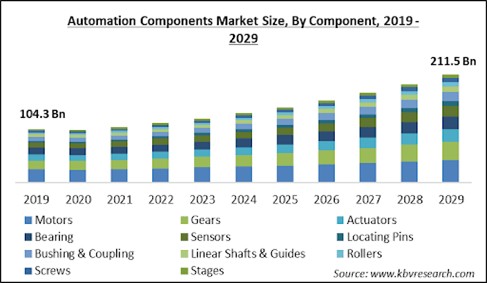

The Global Automation Components Market size is expected to reach $211.5 billion by 2029, rising at a market growth of 9.1% CAGR during the forecast period.

Automation is a technology that uses automated machinery or equipment in various industries to minimize or eliminate the need for human labor and boost productivity quickly. Manufacturing industry are expanding swiftly, which has sped up technological advancements such as dispersed production by factories or services, autonomous plants, and remote operations to automate tasks.

The graph, therefore, shows the advancement of automation in terms of technology, politics, and the economy. The capability of the machinery is increased by using automation components to make it smarter. Motors, sensors, and actuators are useful for converting existing machinery into intelligent machinery. The installation of machinery also makes use of automation components.

Some industries that could use automation components are those in the medical, aerospace, defense, electronic, steel & metal sectors. The exponential growth in the global population has caused a tremendous increase in demand for basic goods such as electronics, personal care items, food, beverages, and medicines in developing nations like India, China, and Africa. Demand for manufacturing equipment has also expanded due to an upsurge in consumer product demand, which promotes the use of automation components in machine manufacturing & maintenance.

Additionally, since automation & robotics are employed in several sectors for production lines and other duties, the demand for automation components, including sensors, motors, screws, gears, and other parts, is growing. For small- and large-scale companies, leading players in the sector offer automation components. These scenarios are anticipated to fuel the market's expansion for automation components.

The pandemic adversely hit the manufacturing industry due to the decreased consumption of high-priced items and the consumers' desire to spend solely on the most basic goods and services. During the lockdowns, consumers curtailed their spending on consumer products, high-priced textiles, electronics, automobiles, or machinery, which impacted the market's primary application sectors. However, with nations restarting economic and trade activities with consumer lifestyles stabilizing, it is anticipated that expenditure on these products and services will increase, hence driving demand for automation solutions in the future years.

The automobile industry is projected to drive the implementation of automation & controls in this nation as many automakers seek to increase their investments there. In addition, the leading companies in the oil & gas and utilities sectors are reportedly aiming to upgrade their manufacturing facilities, which is anticipated to propel the market for automation components along with the rising investments in the automotive industry. Furthermore, increased consumer spending and the ability of companies to utilize automation to maintain or increase production output contribute to the market's expansion.

The primary driving force behind the automation using IoT is the potential reduction in operating costs that results from the conversion of automation devices, transmitters, sensors, and actuators to internet-enabled components. The cost of labor represents half of the overall cost of operating an industrial facility, which is a major portion. Most of the time, there are two types of employees who work in manual labor, i.e., direct and indirect employees. Execution of the process is the responsibility of direct employees, and indirect staff is in charge of providing back-end support for direct staff. As a result, most businesses are turning to automation to cut operational costs, fueling the market for automation components.

Insufficient actuator maintenance may also result in excessive noise or air leakage. These systems are additionally known to collapse over time due to the dampening of their tubes' inner edges. In addition, the noise level during the operation of actuators is extremely high, and as a result, these systems are sometimes installed in separate rooms to reduce noise pollution. In some cases, using hazardous chemicals in actuators might result in the unintended release of chemicals into the air. This may have a negative impact on the nearby environment. These concerns with actuators may hinder their sales, hence inhibiting market expansion.

Based on components, the automation components market is segmented into motors, gears, actuators, bearing, sensors, locating pins, bushing & coupling, linear shafts & guides, rollers, screws and stages. In 2022, the bearings segment registered a considerable revenue share in the automation components market. A machine component called a bearing is useful for limiting the relative motion to just the appropriate motion. By lowering the friction between the moving parts of a machine, bearings enable unrestricted linear movement of the connected parts around a fixed axis.

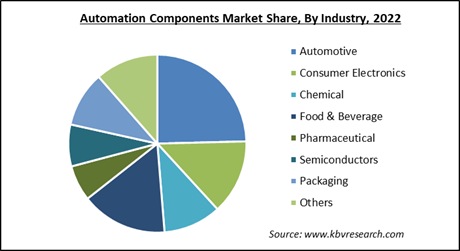

By industry, the automation components market is bifurcated into automotive, consumer electronics, chemical, food & beverage, pharmaceutical, semiconductors, packaging and others. In 2022, the automotive segment witnessed the largest revenue share in the automation components market. This segment's significant market share can be attributable to the global automobile industry's prolific output. In addition, the demand for automobiles with technologically advanced solutions is on the rise, resulting in an increase in vehicle production that requires instrumented products.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 116.4 Billion |

| Market size forecast in 2029 | USD 211.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 9.1% from 2023 to 2029 |

| Number of Pages | 254 |

| Number of Table | 392 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the automation components market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the Europe region dominated the automation components market with the maximum revenue share. Due to the existence of prosperous nations like Norway, Germany, and the United Kingdom, Europe is one of the key regions for electric two-wheelers. Furthermore, the region serves as a hub for numerous major automakers, including Volvo, BMW, and Audi. This is projected to have a favorable impact on the market's expansion.

Free Valuable Insights: Global Automation Components Market size to reach USD 211.5 Billion by 2029

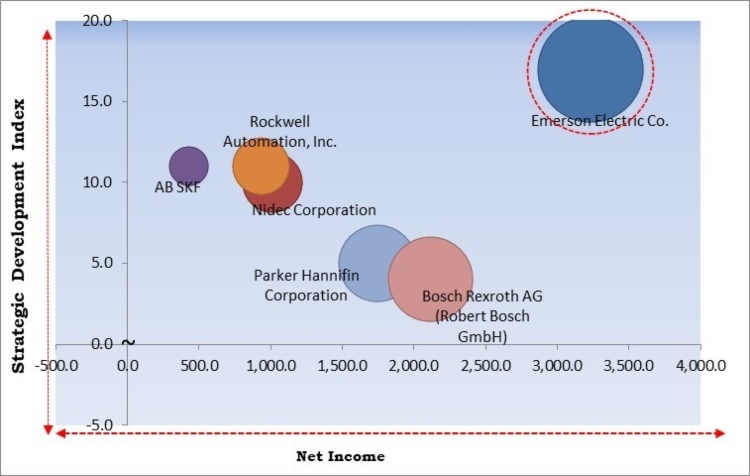

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Emerson Electric Co. is the forerunner in the Automation Components Market. Companies such as Bosch Rexroth AG (Robert Bosch GmbH), Parker Hannifin Corporation, Nidec Corporation are some of the key innovators in Automation Components Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bosch Rexroth AG (Robert Bosch GmbH), AB SKF, Emerson Electric Co., Nidec Corporation, Parker Hannifin Corporation, Rockwell Automation, Inc., Shanghai KGG Robots Co., Ltd., Automotion Components Ltd (The Wixroyd Group) and Stock Drive Products/Sterling Instrument (Designatronics, Inc.)

By Component

By Industry

By Geography

The Market size is projected to reach USD 211.5 billion by 2029.

Fourth industrial revolution (industry 4.0) in manufacturing sector are driving the market in coming years, however,Energy consumption, leakage and noise issue with actuators restraints the growth of the market.

Bosch Rexroth AG (Robert Bosch GmbH), AB SKF, Emerson Electric Co., Nidec Corporation, Parker Hannifin Corporation, Rockwell Automation, Inc., Shanghai KGG Robots Co., Ltd., Automotion Components Ltd (The Wixroyd Group) and Stock Drive Products/Sterling Instrument (Designatronics, Inc.)

The expected CAGR of this market is 9.1% from 2023 to 2029.

The Motors segment acquired maximum revenue share in the Global Automation Components Market by Component in 2022 thereby, achieving a market value of $44.7 billion by 2029.

The Europe market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $70.5 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.