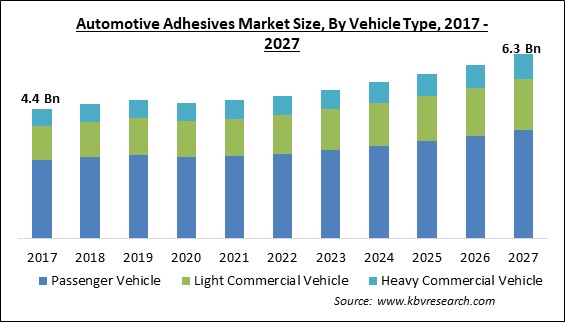

The Global Automotive Adhesives Market size is expected to reach $6.3 billion by 2027, rising at a market growth of 4.9% CAGR during the forecast period.

Adhesives are thin and light components that are used to join metals, composites, plastics, and other materials together. In the automotive sector, adhesives are increasingly being used to join various car components such as closures and structural modules. Increased use of adhesives by automakers decreases vehicle mass, improves front and rear lateral body stiffness, improves crash performance, and reduces noise, vibration, and harshness (NVH). Adhesive bonding also allows for the creation of new novel vehicle body designs and mixed-material designs that include high-strength steels, nonferrous metals, plastics, and composites. Adhesives can also be used to connect dashboards, door panels, electronics, light covers and lenses, as well as steel and alloyed components, due to their excellent bonding strength across a variety of surfaces.

Increased sales of automotive adhesives, owing to structural strength in vehicle sales, technological developments in automobile manufacturing, and adoption of smart cars, are driving market expansion. Furthermore, metallic components are substituted with composites that are bonded using adhesives, resulting in a reduction in vehicle weight and improved fuel efficiency. Additionally, the adoption of adhesives by automotive companies have led to various advantages for the consumers, such as reduced noise, low vibration and harshness in vehicles.

Automotive adhesives are frequently utilized in sealing, holding, and structural applications in both the manufacturing and aftermarket servicing of automobiles. Moreover, increasing demand for features such as corrosion protection and weight reduction is expanding the range of applications in various car designs. Due to its ubiquitous use in retaining and securing vehicle panels for interior and exterior settings, structural adhesives are expected to account for a considerable percentage of the automotive adhesive market, exceeding substitutes such as tapes & films and liquid gaskets. Also, on the basis of longer durability and eco-friendly properties, water-based and hot melt types of automotive adhesives are expected to increase at a quicker rate from 2020 to 2030.

The COVID-19 pandemic had a significant impact on the whole financial system as well as human life. As a result of the COVID-19 outbreak, various enterprise companies have had to limit their scheduled operations as a result of government-imposed lockdowns in a number of nations around the world. The lockdown has majorly impacted key enterprises and organizations. The authorities' lockdown initiative resulted in a temporary shutdown of the automobile and transportation sectors. The growth of the automotive adhesives market was significantly hampered as a result of this. The emergence of the coronavirus has had a significant influence on the oil product markets, due to the constraints on international travel as well as regional and local movement, which has hindered people and goods from freely moving about, putting a strain on demand for adhesive raw materials.

Autonomous electric vehicles (EVs) are electric vehicles which are equipped with advanced artificial intelligence and therefore are capable of self-parking and self-driving mechanisms. These EVs process billions of data points every second using a combination of sensors, cameras, and radar devices known as Advanced Driver Assistance Systems. The adoption rate of autonomous electric vehicles is predicted to rise in the coming years. In electric vehicles, numerous types of adhesives are employed in cameras, radars, and sensors. The need for EV adhesives is expected to rise in the near future as autonomous vehicles are developed and commercialized. This will thus serve as a crucial driver in the growth of the automotive adhesive market.

Plastics, composites, and aluminum are among the lightweight materials used by automakers. Steel is being phased out of the automotive industry in favor of these alternatives. Lightweight materials, unlike steel or cast-iron, cannot be welded or bolted together to keep them together. Adhesives and sealants are progressively being employed by manufacturers around the world to protect the structural integrity of lightweight automobiles. Adhesives are also widely used in automotive applications, ranging from small sensors to car chassis. As a result, the market for automotive adhesives and sealants is expected to rise due to rising demand and manufacturing of lightweight automobiles.

When it comes to defining the cost structure of their goods, adhesive producers look at the price and availability of raw materials. Plastic resins, inorganic chemicals, industrial inorganic chemicals, and refined petroleum products are among the raw materials utilized by the adhesive sector. The majority of these basic materials are petroleum-based compounds that are susceptible to commodity price volatility. In recent years, crude oil prices have been extremely volatile. This price change is mostly due to increased worldwide demand and upheaval in the Middle East. Additionally, constant developments in the making of hybrid and electric vehicles have made it difficult for adhesive makers to keep up with shifting end-user expectations.

Based on Resin Type, the market is segmented into Polyamide, Polyurethane, Silyl Modified Polymers (SMP), Silicone, Epoxy, Acrylics, and Others. The polyurethane segment witnessed a significant revenue share in the automotive adhesives market in 2020. It is the most ubiquitous resin used in the manufacturing of automobile adhesives and sealants. Their unique characteristic is that they are thermosetting polymers which don't melt when heated and are generated when isocyanate and polyol combine. The most often used adhesives are polyurethane adhesives, which provide extraordinarily strong bonding. They also have a high level of resistance to heat, moisture, and chemicals.

Based on Technology, the market is segmented into Water Based, Pressure Sensitive, Solvent Based, Hot Melt, and Others. The hot melt segment recorded a substantial revenue share in the automotive adhesives market in 2020. In terms of revenue, hot melt is one of the industry's fastest-growing technological sectors. Due to its capacity to produce a superior bond and great resistance to heat, moisture, and chemicals, hot melts based on reactive polyurethane are gaining acceptance in the automobile industry. In addition, when compared to water-based and solvent-based products, the usage of hot melts in the automotive industry speeds up the manufacturing process.

Based on Vehicle Type, the market is segmented into Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle. The passenger vehicle segment acquired the largest revenue share in the automotive adhesives market in 2020. Passenger automobiles are the most frequent means of transportation in industrialized countries, and their use is growing in underdeveloped countries as per capita income rises. The passenger vehicle sector has benefited from the emergence of vehicle financing, in which customers are given loans to purchase vehicles. In most developing countries, owning a passenger automobile is also seen as a show of social standing. The existence of the aforementioned trends, as well as the anticipated rise of passenger automobiles in developing nations, has fueled demand for automotive adhesives over the forecast period.

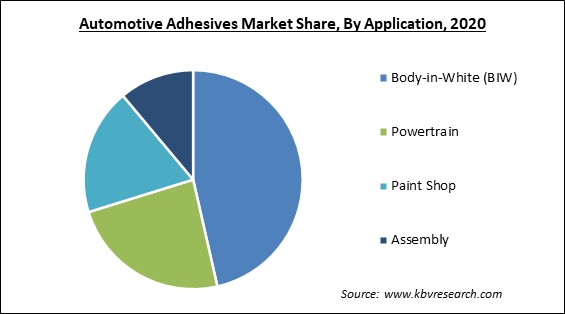

Based on Vehicle Type Application, the market is segmented into Body-in-White (BIW), Powertrain, Paint Shop, and Assembly. The body-in-white segment acquired the highest revenue share in the automotive adhesives market in 2020. Increased electric vehicle sales are a primary driver of the body-in-white segment's growth, since these vehicles require lightweight solutions in the form of materials and production methods in order to obtain higher battery mileage. The majority of body-in-white component manufacturers have provided new light weight solutions for their clients that comply with EV manufacturing safety regulations.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 4.6 Billion |

| Market size forecast in 2027 | USD 6.3 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.9% from 2021 to 2027 |

| Number of Pages | 303 |

| Number of Tables | 514 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Resin Type, Technology, Vehicle Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia-Pacific procured a substantial revenue share in the automotive adhesives market in 2020. The rising focus of automobile manufacturers on technological developments and the implementation of automotive fuel efficiency policies in various countries are the primary trends observed in the APAC automotive adhesives market. The rising use of lightweight materials in vehicle manufacturing and increasing vehicle production in APAC are the primary drivers identified in the APAC automotive adhesives market. Due to expanding application sectors in the automotive sector, the Asia-Pacific automotive adhesives market caters to a high demand for automotive adhesives, which provide safety, rigidity, and design flexibility in automobiles. Massive usage and manufacturing of automobiles and its components in China, Japan, Korea, India, and other countries would support this regional market.

Free Valuable Insights: Global Automotive Adhesives Market size to reach USD 6.3 Billion by 2027

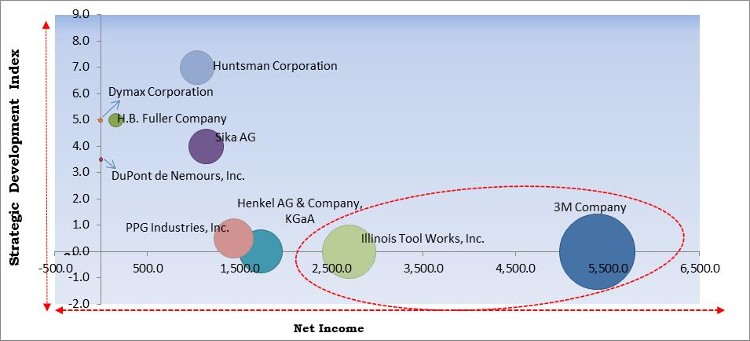

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; 3M Company and Illinois Tool Works, Inc. are the forerunners in the Automotive Adhesives Market. Companies such as Huntsman Corporation, Sika AG, PPG Industries, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Sika AG, Henkel AG & Company, KGaA, 3M Company, DuPont de Nemours, Inc., Huntsman Corporation, Dymax Corporation, Arkema S.A., PPG Industries, Inc., H.B. Fuller Company, and Illinois Tool Works, Inc.

By Resin Type

By Technology

By Vehicle Type

By Application

By Geography

The global automotive adhesives market size is expected to reach $6.3 billion by 2027.

Increase in Demand for Autonomous Electric Vehicles are driving the market in coming years, however, fluctuating raw material prices and evolving consumer demands limited the growth of the market.

Sika AG, Henkel AG & Company, KGaA, 3M Company, DuPont de Nemours, Inc., Huntsman Corporation, Dymax Corporation, Arkema S.A., PPG Industries, Inc., H.B. Fuller Company, and Illinois Tool Works, Inc.

The authorities lockdown initiative resulted in a temporary shutdown of the automobile and transportation sectors. The growth of the automotive adhesives market was significantly hampered as a result of this.

The Polyamide segment acquired maximum revenue share in the Global Automotive Adhesives Market by Resin Type in 2020, thereby, achieving a market value of $1.3 billion by 2027.

The Asia Pacific market dominated the Global Automotive Adhesives Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.