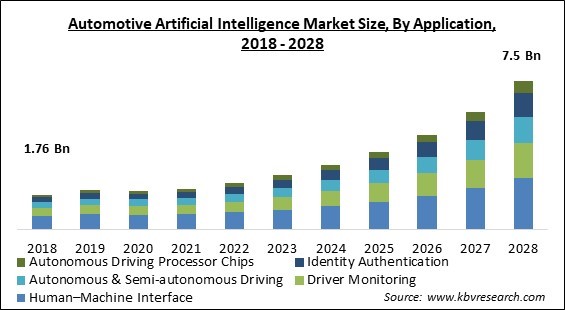

The Global Automotive Artificial Intelligence Market size is expected to reach $7.5 billion by 2028, rising at a market growth of 21.5% CAGR during the forecast period.

Artificial intelligence (AI) is among the most innovative computer science technologies. It is comparable to human intelligence in terms of features like language comprehension, thinking, learning, and problem solving. In the creation and modification of the technology, the market's manufacturers are confronted with huge intellectual obstacles. In addition, the expansion of the automotive sector is anticipated to increase the market for automotive artificial intelligence.

The automotive sector has reaped the benefits of artificial intelligence and is among the primary industries employing AI to augment and imitate human actions. In addition, the advent of standards like adaptive cruise control (ACC), advanced driver assistance system (ADAS), and blind spot alert, as well as the increase in demand for comfort features, entice automotive providers to AI.

Autonomous cars are distinguished according to their degree of autonomy. Level 5 cars are completely autonomous, requiring no human involvement for safe operation. Nowadays, the significant proportion of autonomous vehicles on the road, like the Cadillac CT6 and Audi A8, belong to levels 2 and 3, are capable of performing at least two duties concurrently, and need a human driver to operate safely.

To mitigate the effects of the COVID-19 pandemic, governments throughout the world were compelled to institute strict lockdowns and demand social isolation. As a result, the demand for new automobiles declined significantly. In addition, the availability of raw materials decreased, production slowed, and worldwide supply networks were disrupted. The automobile industry's losses have impeded the implementation of cutting-edge cybersecurity technologies. However, it is projected that the use of automotive artificial intelligence would expand over time owing to the growing demand for connected vehicles and the ongoing global vaccination campaign.

Human-machine interface (HMI) solutions for the automobile sector are now easier to handle and manage, hence boosting the user experience. A user may operate applications such as music systems, car lighting, and infotainment systems with such technologies. Due to the rising demand for better customer experience and additional features, the percentage of a vehicle's cost devoted to its electronics system has climbed from 1-2% to 8-12%.

Among the most recent innovations, in-car payments are intended to change the ways in which consumers pay for parking or tolls, refuel, and potentially even go grocery shopping. Open Banking, which allows consumers to pay immediately from their bank and eliminates friction and security concerns associated with their payment trip, might be utilized to develop in-car wallets as well as payment systems. By simplifying transaction fees and enhancing the entire user experience, third-party payment networks might be eliminated.

Autonomous cars are projected to be expensive due mostly to the commercialization of new technology systems. The majority of innovative technology are included into luxury and premium automobiles, which have a restricted client base due to their high price. Therefore, a high car price is likely to inhibit market expansion. In comparison to semi-autonomous cars, the demand for costly autonomous vehicles is predicted to be mild.

On the basis of application, the automotive artificial intelligence market is divided into Human-Machine Interface, Autonomous & Semi-autonomous Driving, Identity Authentication, Driver Monitoring and Autonomous Driving Processor Chips. Identity Authentication segment recorded a significant revenue share in the automotive artificial intelligence market in 2021. Authentication is the procedure of confirming the identity of a known user in order to grant access to an account, location or device. In addition, authentication of identity is employed when a person's authenticity must be demonstrated. In this situation, previous personal information provided is compared.

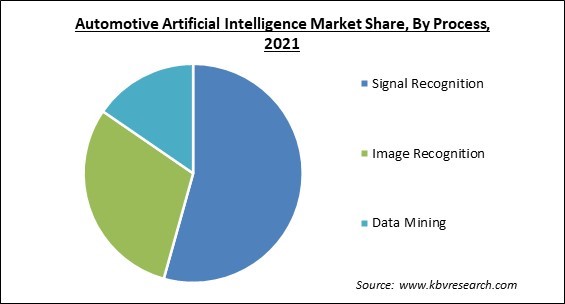

Based on Process, the automotive artificial intelligence market is classified into Signal Recognition, Image Recognition and Data Mining. Signal Recognition segment garnered the maximum revenue share in the automotive artificial intelligence market in 2021. Signal recognition is a technique for producing outcomes using spoken, visual patterns, and sound. The signals often relate to the speech or sound produced by a machine or a person, which may be identified by natural language processing (NLP) devices and used to provide a result. Signals are the unprocessed data that AI systems must be able to analyze in order to generate, comprehend, and make intelligent judgments.

By technology, the automotive artificial intelligence market is segmented into Deep Learning, Machine Learning & Computer Vision, Context- aware Computing, and Natural Language Processing. Machine Learning & Computer Vision segment recorded a significant revenue share in the automotive artificial intelligence market in 2021. Machine learning enables automobiles to assess and learn from various driving scenarios, therefore reducing accidents and making them safer and more fuel-efficient. It can generate precise models that could direct future activities and instantly uncover trends at a scale that was not before possible.

On the basis of offering, the automotive artificial intelligence market is bifurcated into Hardware and Software. The software segment procured the maximum revenue share in the automotive artificial intelligence market in 2021. This is due to the numerous advancements in AI software and software development kits. To actualize automotive applications, AI systems require several forms of software, including application programme interfaces for language, audio, vision, and sensor data, as well as machine learning techniques.

By component, the automotive artificial intelligence market is fragmented into Graphics processing unit (GPU), Microprocessors (Incl. ASIC), Field Programmable Gate Array (FPGA), Memory & Storage systems, Image Sensors, Biometric Scanners and Others. Graphics processing unit (GPU) segment acquired the maximum revenue share in the automotive artificial intelligence market in 2021. GPUs are gaining importance in the fast-emerging disciplines of autonomous driving and advanced driver assistance systems (ADAS). For real-time processing and analysis of sensor data, ADAS platforms can utilize the GPU's graphical compute power.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2 Billion |

| Market size forecast in 2028 | USD 7.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 21.5% from 2022 to 2028 |

| Number of Pages | 394 |

| Number of Tables | 593 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Process, Technology, Offering, Component, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the automotive artificial intelligence market is analyzed across North America, Europe, Asia Pacific and LAMEA. North America emerged as the leading region in the automotive artificial intelligence market with the highest revenue share in 2021. The quick growth of autonomous vehicle technology and the stringent government laws governing road safety are projected to promote moderate growth in artificial intelligence in the automotive industry in this region.

Free Valuable Insights: Global Automotive Artificial Intelligence Market to reach USD 7.5 Billion by 2028

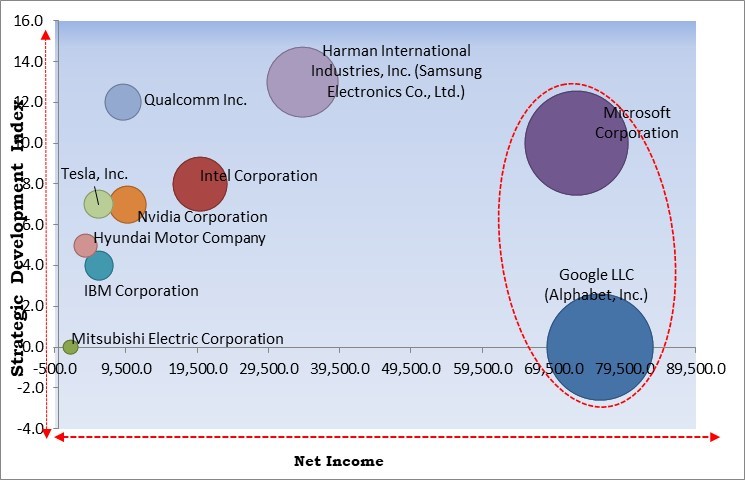

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC (Alphabet, Inc.) are the forerunners in the Automotive Artificial Intelligence Market. Companies such as Harman International Industries, Inc., Intel Corporation, Qualcomm Inc. are some of the key innovators in Automotive Artificial Intelligence Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, IBM Corporation, Google LLC (Alphabet, Inc.), Intel Corporation, Qualcomm Inc., Nvidia Corporation, Harman International Industries, Inc. (Samsung Electronics Co., Ltd.), Hyundai Motor Company, Mitsubishi Electric Corporation and Tesla, Inc.

By Application

By Process

By Technology

By Offering

By Component

By Geography

The global Automotive Artificial Intelligence Market size is expected to reach $7.5 billion by 2028.

Growing need for customer experience and efficiency of automobiles are driving the market in coming years, however, Surge in the overall cost of vehicle restraints the growth of the market.

Microsoft Corporation, IBM Corporation, Google LLC (Alphabet, Inc.), Intel Corporation, Qualcomm Inc., Nvidia Corporation, Harman International Industries, Inc. (Samsung Electronics Co., Ltd.), Hyundai Motor Company, Mitsubishi Electric Corporation and Tesla, Inc.

The Deep Learning market segment shows high market share in the Global Automotive Artificial Intelligence Market by Technology in 2021; thereby, achieving a market value of $2.8 billion by 2028.

The Human–Machine Interface market is leading the Global Automotive Artificial Intelligence Market by Application in 2021; thereby, achieving a market value of $2.6 billion by 2028.

The North America market dominated the Global Automotive Artificial Intelligence Market by Region in 2021; thereby, achieving a market value of $2.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.