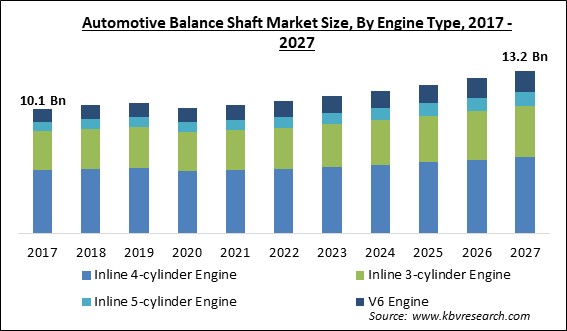

The Global Automotive Balance Shaft Market size is expected to reach $13.2 billion by 2027, rising at a market growth of 4.1% CAGR during the forecast period.

A balance shaft is a weighted shaft that is used to dampen vibrations in a vehicle's engine. A balance shaft system consists of two shafts that rotate in opposite directions at double the engine speed and have equal eccentric weights. The vertical second-order forces generated by the engine are canceled out by the centrifugal force produced by the shafts. Inline 4-cylinder engines frequently require balance shafts.

The market is expected to grow due to rising demand for inline 4-cylinder engines, increased acceptance of fuel-efficient vehicles with low carbon emissions, and increased demand for vehicle engines with decreased vibration, noise, and harshness. Additionally, a rise in demand for passenger automobiles from emerging nations, as well as technology improvements, are expected to provide potential possibilities.

To counterbalance and eliminate excessive engine vibration, balance shafts were created and installed. However, most engines function fine without their balance shaft belts, the additional vibration stresses other engine components such as bell housing, motor mounts, and even cooling line connections. A car may become unbalanced without balance shafts as the engine shifts around under high acceleration. Because balance shaft belts are frequently installed near timing belts, a broken balance shaft belt could quickly dislodge the timing belt. Many mechanics advise replacing both components at the same time, especially if the labor cost difference is small.

As the demand for noise, harshness, and vibration-free engines grows around the world, the market for automotive balancing shafts is expected to rise. Because of the significant increase in the vehicle industry, the demand for inline-4 cylinder engines is increasing. The need for environmentally friendly vehicles is increasing because of the government's rigorous emission rules. Aluminum balance shafts are increasingly being used by original equipment manufacturers (OEMs) due to their weight and strength advantages.

The COVID-19 pandemic had an impact on new car sales, particularly in 2020. As a result, supply chain disruptions occurred, creating delays in car production. Several automobile balance shaft manufacturers had component and material shortages, causing vehicle production to be delayed. The relaxation of lockdown restrictions, on the other hand, is likely to result in a surge in vehicle demand, boosting the growth of the automotive balancing shaft market. During the COVID-19 epidemic, some countries took steps to resurrect the car sector in their respective regions. For example, the Chinese government released a circular in April 2020 outlining efforts to stabilize and boost automotive consumption, extending subsidies to automakers through 2022.

Automobiles with inline 4-cylinder engines are becoming increasingly widespread. Inline-4 cylinder engines are becoming more popular due to improved fuel economy and affordability. Second-order vibration cannot be reduced in inline 4-cylinder engines due to unequal movement of connecting rods during crankshaft rotation. To decrease vibrations, balance shafts are commonly used in inline 4-cylinder engines. As a result, the rise in demand for inline 4-cylinder engines is likely to boost demand for balancing shafts, propelling the market forward over the upcoming years. Original equipment manufacturers (OEMs), governments, suppliers, and other stakeholders are under pressure to provide viable solutions within a set time frame due to global emission laws, fluctuating fuel prices, and rising environmental consciousness.

Vibration, noise, and harshness in vehicles have a substantial impact on vehicle performance and driving pleasure. The constant investment by the manufacturers on the development of better and advanced automotive components in order to optimize efficiency of the vehicle would accelerate the demand for automotive balance shaft in the market. Various vehicle balance shaft manufacturers offer creative methods to extend the characteristics of the balancer shaft to improve fuel economy, reduce pollutants, and reduce noise and vibrations. Along with that, consumers are increasingly investing in the automobiles that produce less noise and vibration for smooth driving experience.

Automakers face several issues, including raising the overall vehicle cost due to more complex and enhanced automotive parts, seeking to maintain a balance between product and cost quality, and continual component size optimization. Because balance shafts help improve automobile functions and features, the number of sophisticated features and functions raises vehicle cost accordingly. Along with that, there are many automotive manufacturers who are investing in their innovative and advanced products and hence, the overall cost of the automotive increases, which would restrict customers from adopting these vehicles and hence, hindering the growth of the automotive balance shaft market in the coming years.

Based on Manufacturing Process, the market is segmented into Forging, and Casting. The Forging segment acquired a substantial revenue share in the automotive balance shaft market in 2020. Forging is a metal-shaping process that uses concentrated compressive forces to shape metal. A hammer or a die is used to deliver the blows. The temperature at which forging is done is referred to as cold forging, warm forging, or hot forging. Forging is one of the widely adopted manufacturing process, which would gain high momentum in the coming years.

Based on Application, the market is segmented into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. The Light Commercial Vehicles segment witnessed a substantial revenue share in the automotive balance shaft market in 2020. The use of Automotive Balance Shafts in light commercial vehicles can be seen as a way to improve fuel economy and reduce emissions. Additionally, it can help with the smoothness and performance of the engine. Ultimately, this leads to a better driving experience for passengers and drivers alike. Automotive balance shafts improve fuel efficiency and power generation in light commercial vehicles (LCVs) due to low vibration levels when running at high revolution speeds.

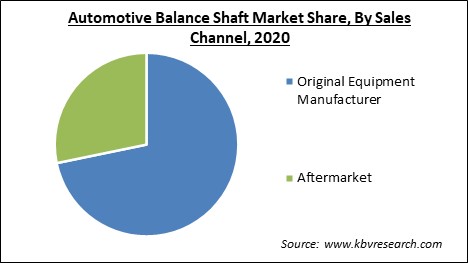

Based on Sales Channel, the market is segmented into Original Equipment Manufacturer, and Aftermarket. The Original Equipment Manufacturer segment recorded the highest market share in forecast period. OEM refers to a corporation that purchases products and then re-brands or combines them into a new product under its name. Microsoft, for instance, provides its Windows software to Dell Technologies, which integrates it into its personal computers and offers a complete PC system to the general public.

Based on Engine Type, the market is segmented into Inline 4-cylinder Engine, Inline 3-cylinder Engine, Inline 5-cylinder Engine, and V6 Engine. The 3-cylinder Engine segment procured a significant revenue share in the automotive balance shaft market in 2020. An Inline-Three Cylinder Engine is a three-cylinder internal combustion engine with the cylinders mounted in a straight line along the crankcase. The Inline-Three Cylinder Engine offers good fuel economy, smoothness, and low emissions. It also has a simple design that reduces the overall weight and size of the engine, as well as improves heat dissipation. It has a displacement of about 500 ccs and is most commonly found in motorcycles.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 10.2 Billion |

| Market size forecast in 2027 | USD 13.2 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.1% from 2021 to 2027 |

| Number of Pages | 235 |

| Number of Tables | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Engine Type, Manufacturing Process, Sales Channel, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific emerged as the leading region in the automotive balance shaft market with the largest revenue share in 2020. It is due to factors such as increased sales of new automobiles and increased adoption of fuel-efficient vehicles. The expansion of the industry is boosted by increased car manufacturing, particularly in emerging economies like India Singapore, Taiwan, and China. Furthermore, the adoption of strict government laws related to emissions, as well as an increase in environmental awareness, are projected to drive market expansion.

Free Valuable Insights: Global Automotive Balance Shaft Market size to reach USD 13.2 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include American Axle & Manufacturing, Inc., Engine Power Components, Inc., Hirschvogel Group, Linamar Corporation, MAT Foundry Group Ltd., Musashi Seimitsu Industry Co., Ltd., Ningbo Jingda Hardware Manufacture Co., Ltd., Otics Corporation, Sansera Engineering Limited, and TFO Corporation.

By Manufacturing Process

By Application

By Sales Channel

By Engine Type

By Geography

The automotive balance shaft market size is projected to reach USD 13.2 billion by 2027.

High adoption of Low-Carbon-Emission Vehicles are driving the market in coming years, however, high prices of automobile limited the growth of the market.

American Axle & Manufacturing, Inc., Engine Power Components, Inc., Hirschvogel Group, Linamar Corporation, MAT Foundry Group Ltd., Musashi Seimitsu Industry Co., Ltd., Ningbo Jingda Hardware Manufacture Co., Ltd., Otics Corporation, Sansera Engineering Limited, and TFO Corporation.

Yes, The relaxation of lockdown restrictions, on the other hand, is likely to result in a surge in vehicle demand, boosting the growth of the automotive balancing shaft market.

The Inline 4-cylinder Engine segment acquired the maximum revenue share in the Global Automotive Balance Shaft Market by Engine Type in 2020; thereby, achieving a market value of $6.1 billion by 2027.

The Asia Pacific is the fastest growing region in the Global Automotive Balance Shaft Market by Region in 2020, and would achieve a market value of $4.9 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.