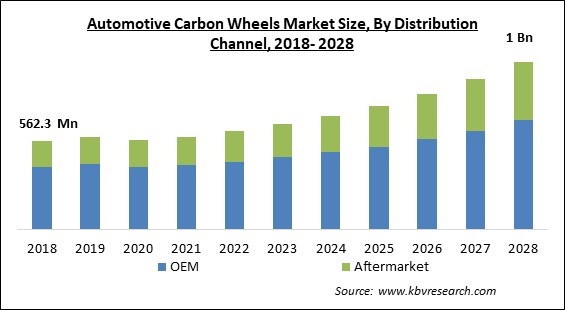

The Global Automotive Carbon Wheels Market size is expected to reach $1 billion by 2028, rising at a market growth of 9.2% CAGR during the forecast period.

Carbon fibre is a fantastic material to work with. In addition, carbon fibres are advantageous not only because of their high tensile strength, stiffness, and low weight, but also because of the limitless ways in which those fibres can be weaved and positioned to engineer strength and rigidity within a component in aspects that are inconceivable with conventional techniques.

The necessity to enhance fuel efficiency and minimize vehicle weight is projected to drive demand for automotive carbon wheels and grow the market growth. The decrease of vehicle weight, which leads to increased performance and efficiency, is a key priority for automakers. Reduced wheel weight enhances mobility, delivers a quieter and smoother ride, accelerates and slows faster, improves suspension, and continues to improve fuel efficiency. The automotive carbon wheels market is driven by all of these factors.

Carbon fibre reinforced polymers have a number of functional advantages as well as being visually appealing. As a result, carbon fibre is being used to make wheels by a number of OEMs and Tier 1 suppliers. These wheels are about half the weight of traditional aluminium or steel alloy wheels. For example, Ford Motor Company and its partner Carbon Revolution, in May 2016, released carbon wheels for the Shelby GT350R, Ford GT, and Shelby GT500 Mustang vehicles. Carbon wheels are also used by other OEMs like Ferrari N.V., McLaren Group, Porsche AG, Automobili Lamborghini S.p.A., and Koenigsegg Automotive AB. As a result, the automotive carbon wheel market is being driven by weight reduction and other related benefits all over the world.

Automotive carbon wheels are designed for high-performance vehicles like sports cars and SUVs, where wheel strength, weight, and vibration dampening are critical. People's purchasing power has increased as their disposable income has increased, raising their preference for luxury things such as performance vehicles. For example, Automobili Lamborghini S.p.A., a performance automobile manufacturer based in Germany, had a 43 percent increase in sales in 2019 with a number of 8,205 units sold internationally, up from 5,750 units sold the previous year. As a result, the automotive carbon wheel market is being driven by an increase in the sale of performance vehicles.

The production of vehicle and its products is disrupted during the pandemic owing to the shutdown of manufacturing units across the globe. The temporary closure of production facilities to stop the COVID-19 pandemic from spreading would lower industry demand. Manufacturing costs, on the other hand, would continue to be a key stumbling block to industry profitability and viability, as will advances that boost performance by reducing vehicle weight for greater fuel efficiency. However, since, everything is getting back on track, companies are increasingly resuming their production and hence, this would escalate the growth of the market over the forecast period.

Automobile manufacturers are constantly striving to lower vehicle weight in order to increase efficiency and performance. It enhances manoeuvrability for a quieter and better driving experience, quicker acceleration, faster deceleration, enhanced suspension, and better fuel efficiency by lowering the weight of the vehicle's wheels. These benefits have prompted the usage of composite materials like carbon fibre, which is projected to boost the market's expansion throughout the forecast period. For example, "Litespeed Racing," a United States-based company, produced the world's lightest carbon fibre wheel in November 2021. It's called the "Carbon One wheel," and it's the world’s largest lightest 20-inch wheel, weighing 14.2 pounds for a 20X9.5-inch size. These aspects would escalate the growth of the automotive carbon wheels market during the forecast period.

During the projected period, increased demand for luxury automobiles in the four-wheeler sector is anticipated to increase the market's possibilities. As the amount of millionaires rises as a result of greater wealth generation, luxury vehicles with carbon fibre wheels are becoming more popular. The major automakers that create the great majority of luxury vehicles include Audi, BMW, Mercedes-Benz, Jaguar, Volvo, Rolls-Royce, and Land Rover. Furthermore, as a result of advancements in automotive technology and economic growth in emerging countries, luxury automobile sales are likely to increase in the near future. Vehicle noise & vibration are reduced and vehicle performance is maintained when carbon fibre wheels are used.

The price is one of the downsides, if not the most one. It is a difficult material to construct, as well as requiring a lengthy elaboration procedure which does not meet contemporary production needs. However, due to the widespread usage of thermosetting resins, it is a challenging material to recycle. This point will become easier and more viable in the future, due to the employment of thermoplastic polymers. Finally, carbon fibre is an excellent electrical conductor. In addition, carbon fibre is employed more for decoration than for a practical purpose.

Based on Distribution Channel, the market is segmented into OEM and Aftermarket. The aftermarket segment garnered a significant revenue share in the automotive carbon wheels market in 2021. It is owing to the growing preference of automobile manufacturers towards this kind of distribution channel. Along with that, it includes replacement, appearance, collision and performance of different automobile parts.

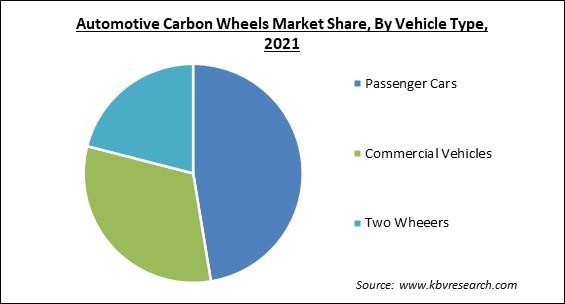

Based on Vehicle Type, the market is segmented into Passenger Cars, Commercial Vehicles, and Two Wheelers. Passenger cars segment acquired the maximum revenue share in the automotive carbon wheels market in 2021. The rise of the passenger vehicle sub-segment has been boosted by increased demand for passenger vehicles in developing countries like China and India as a consequence of trade development.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 562.3 Million |

| Market size forecast in 2028 | USD 1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.2% from 2022 to 2028 |

| Number of Pages | 145 |

| Number of Tables | 250 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Vehicle Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Europe emerged as the leading region in the automotive carbon wheels market with the highest revenue share in 2021. The existence of vital car manufacturers in the Europe region that use carbon fibre composite materials in their vehicles, like Porsche, Ferrari, BMW, Mercedes-Benz, Audi, and Lamborghini, and also a heavy reliance on materials engineering for improving light automotive composite materials like carbon fibre automotive rims and wheels, are anticipated to help the expansion of the carbon wheels market in Europe over the forecast period.

Free Valuable Insights: Global Automotive Carbon Wheels Market size to reach USD 1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Carbon Revolution Ltd., Thyssenkrupp AG, Hitachi Metals, Ltd. (Hitachi, Ltd.), Dymag Group Limited, HRE Performance Wheels, Litespeed Racing Inc., Rolko Kohlgrüber GmbH, Ronal Group, Rotobox d.o.o., and ESE Carbon Company.

By Distribution Channel

By Vehicle Type

By Geography

The global Automotive Carbon Wheels market size is expected to reach $1 billion by 2028.

Increasing need for fuel efficient vehicles are driving the market in coming years, however, High cost of carbon wheels limited the growth of the market.

Carbon Revolution Ltd., Thyssenkrupp AG, Hitachi Metals, Ltd. (Hitachi, Ltd.), Dymag Group Limited, HRE Performance Wheels, Litespeed Racing Inc., Rolko Kohlgrüber GmbH, Ronal Group, Rotobox d.o.o., and ESE Carbon Company.

Since, everything is getting back on track, companies are increasingly resuming their production and hence, this would escalate the growth of the market over the forecast period.

The OEM segment acquired maximum revenue share in the Global Automotive Carbon Wheels Market by Distribution Channel in 2021, thereby, achieving a market value of $660.7 million by 2028.

The Europe market dominated the Global Automotive Carbon Wheels Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $330.8 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.