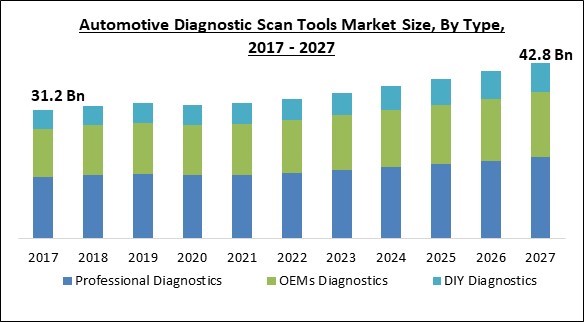

The Global Automotive Diagnostic Scan Tools Market size is expected to reach $42.8 billion by 2027, rising at a market growth of 4.5% CAGR during the forecast period.

Electronic systems in automobiles have grown steadily more advanced in everyday life, making it simpler to detect any damage. In previous years, electronic systems had their own methods in which a variety of instruments were employed to assess a single car. This process was carried out manually, which was exhausting and time consuming. To address this issue, garage equipment manufacturers created a common method for diagnosing the number of automobiles.

After then, the automotive diagnostic scan tools were utilized to detect any defect in a car by inserting the cable through into vehicle's diagnostic connector and executing a comprehensive scan. The major benefit of diagnostic scan tools is that they make it simple to find faults and correct them more rapidly.

Automotive diagnostic scan tools are a mix of software and electrical device software that serve as an interface with car diagnostic systems. Because of the movement in customer choice from manual to advanced automation diagnostics systems, the relevance of diagnostic scan instruments in vehicles is fast expanding. Automated diagnostic scan tools have been used to detect and analyses electronic system problems in automobiles.

As a result, it is critical for automobile users to repair vehicle faults. These instruments also allow for the reprogramming and upgrading of control modules in autos. Diagnostic scan tools, like all other automobile components, have evolved with the advent of technology.

The COVID-19 pandemic is not predicted to have an impact on the extraction of resources like steel, aluminum, and copper. With restrictions on trade in effect for the first six months of 2020, key extractors in China continued to harvest raw materials. Nevertheless, raw material costs, like copper, will continue to grow, with copper reaching USD 10,000 per ton for the very first time in ten years in May 2021. The automotive diagnostic scan tools market, on the other hand, is predicted to grow significantly by 2022, owing to increased awareness of the need of timely vehicle repair and maintenance, as well as severe emission standards imposed by various nations. The worldwide automobile sector has been severely impacted by the COVID-19 outbreak.

The market for automotive diagnostic scan equipment is predicted to expand in tandem with the growth in passenger car sales. Passenger car sales have increased in all three major automobile markets: China, the United States, and Europe. Manufacturers have been pushed to produce automobile diagnostic scan tools all over the world as a result of factors such as rising demand for low-emission commuting and government backing for car inspection laws.

The passenger car category is the fastest growing in the automotive industry and is predicted to increase significantly throughout the forecast period. According to an estimate, the overall numbers of passenger vehicles on the road will more than quadruple by 2040, with passenger automobiles expected to reach 2 billion by that time. Global passenger car sales are expected to increase to 72.5 million units in 2025, up from 64.1 million units in year 2021.

The current tendency in developed nations throughout the world is to purchase luxury category automobiles with accurate, better, and speedy diagnosis instruments. A huge increase in actual luxury goods in automobiles, a movement in customer preferences from sedans to SUVs, and rising disposable incomes has fueled global demand for luxury cars. The need for OBD solutions in personal and commercial cars is high, owing to the use of innovative technology in vehicles to achieve greater efficiency and sustainable. Connected automobiles and electric vehicles, for example, need improved diagnostic tools for managing and regulating high-tech vehicle components. In 2020, the high-end vehicle industry amounted for 6% of total automotive sales in the United States, resulting in a tiny but valuable niche. The rising purchasing power of developing economies namely China can be ascribed to the expansion.

To stay up with the rapid developments in car computer technology, workshops demand increasingly advanced scan instruments, yet most workshops cannot finance them all. Diagnostic scan instruments have seen a decrease in general price levels. Newer technologies, on the other hand, are more costly than traditional OBD-I systems. This has the potential to lower demand for newer and more innovative technology. Diagnostic scan tool manufacturers are always under pressure from OEMs to reduce diagnostic scan tool equipment prices. Several manufacturers are also reluctant to participate in R&D operations owing to high expenses, especially in emerging markets where OEMs are still releasing new models with minimal diagnostic scanning systems.

Based on Type, the market is segmented into Professional Diagnostics, OEMs Diagnostics and DIY Diagnostics. The OEM diagnostic tool is expected to develop significantly throughout the projected period, owing to the rising trend of forward integration among vehicle manufacturers.

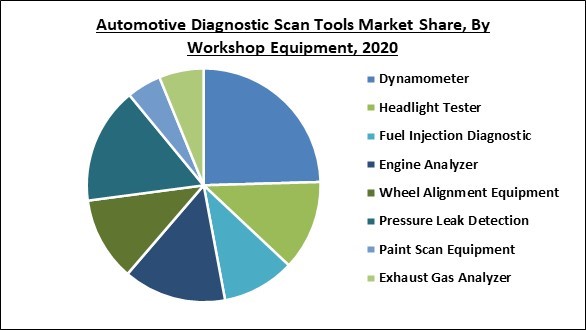

Based on Workshop Equipment, the market is segmented into Dynamometer, Headlight Tester, Fuel Injection Diagnostic, Engine Analyzer, Wheel Alignment Equipment, Pressure Leak Detection, Paint Scan Equipment and Exhaust Gas Analyzer. In 2020, dynamometer show highest revenue in Workshop Equipment. The dynamometer is a significant tool that increases accuracy and efficiency of the technician diagnosis. The capabilities of the dynamometer enable the technician to simulate various real-world operating conditions to find the root cause of a complaint which is owing to the adoption of dynamometer across the world.

Based on Connectivity, the market is segmented into USB, Wi-Fi, and Bluetooth. During the projection period, USB is projected to be the major market. USB connection is frequently utilized in all automobiles that have OBD-II. OBD-II is an on-board computer which monitors a vehicle's mileage, emissions, speed, and other related data. It's linked to the Check Engine light, which comes on when the computer identifies a problem. USB is both inexpensive and simple to use. It is an adaptor that transforms a laptop, tablet, or netbook into a powerful diagnostic scan tool and real-time performance analyzer.

Based on Vehicle Type, the market is segmented into Passenger Cars and Commercial Vehicles. Over the forecast period, the commercial vehicles category in the automotive diagnostic tools market is predicted to increase significantly. The increased desire for long-term emission advantages among HCV is the key reason driving the market for automobile diagnostic scan instruments. They are intended to guarantee the proper operation of emission control systems in order to ensure that cars satisfy emission limits during normal operation. Automotive diagnostic scan tools are useful for both vehicle owners and technicians since they give critical information regarding the need pertaining to the engine maintenance and possibly urgent repairs.

Based on Offering Type, the market is segmented into Diagnostic Equipment/Hardware and Diagnostic Software. The automotive diagnostic scan tools market is projected to be dominated by the diagnostic equipment/hardware segment. The expanding vehicle population in both developed and developing countries, as well as the increasing complexity of car electronics, can be contributed to the expansion of this industry. Vehicle diagnostic equipment/hardware tools are typically physical instruments used to assess the state of different automotive hardware components.

Based on Handheld Scan Tools, the market is segmented into Digital Pressure Tester, Scanner, TPMS Tools, Battery Analyzer and Code Readers. During the forecast period, the battery analyzer category is expected to grow rapidly in the automotive diagnostic scan tools market. With the increased electrification of automobiles, battery analyzers have grown in relevance. Because batteries have a shorter life than the components they power, they must be analysed on a regular basis. In addition, the growing demand for electric cars, which is driving the rise of automotive batteries, is driving the market growth for battery analyzers worldwide.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 32.5 Billion |

| Market size forecast in 2027 | USD 42.8 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.5% from 2021 to 2027 |

| Number of Pages | 389 |

| Number of Tables | 673 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Workshop Equipment, Connectivity, Vehicle Type, Offering Type, Handheld Scan Tools, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific has developed as a manufacturing powerhouse for automobiles. Infrastructural advancements and industrialisation operations in emerging markets have paved the way for new prospects for automobile OEMs. Furthermore, the growing spending power of the populace has fueled demand for vehicles.

Free Valuable Insights: Global Automotive Diagnostic Scan Tools Market size to reach USD 42.8 Billion by 2027

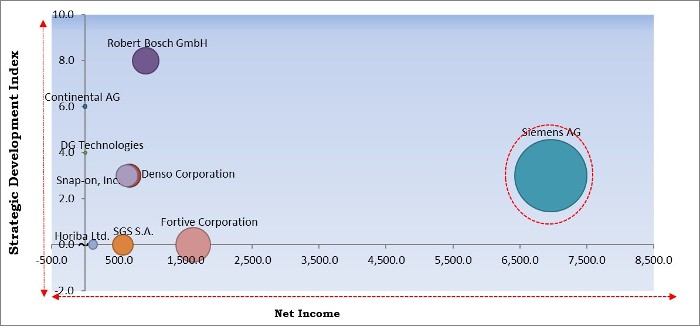

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Siemens AG is the major forerunners in the Automotive Diagnostic Scan Tools Market. Companies such as SGS S.A., Snap-on, Inc., Fortive Corporation are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, Siemens AG, Continental AG, Denso Corporation, Horiba Ltd., SGS S.A., Snap-on, Inc., Fortive Corporation (Fluke Corporation), DG Technologies (Dearborn Group), and Noregon Systems, Inc. (Hearst Communications, Inc.)

By Type

By Workshop Equipment

By Connectivity

By Vehicle Type

By Offering Type

By Handheld Scan Tools

By Geography

The global automotive diagnostic scan tools market size is expected to reach $42.8 billion by 2027.

Growing Consumer preference for premium cars are driving the market in coming years, however, the initial cost of modern diagnostic instruments is quite high limited the growth of the market.

Robert Bosch GmbH, Siemens AG, Continental AG, Denso Corporation, Horiba Ltd., SGS S.A., Snap-on, Inc., Fortive Corporation (Fluke Corporation), DG Technologies (Dearborn Group), and Noregon Systems, Inc. (Hearst Communications, Inc.)

The Professional Diagnostics segment is generating high revenue in the Global Automotive Diagnostic Scan Tools Market by Type in 2020, thereby, achieving a market value of $19.7 billion by 2027.

The Diagnostic Software segment has high growth rate of 5.7% during (2021 - 2027).

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.