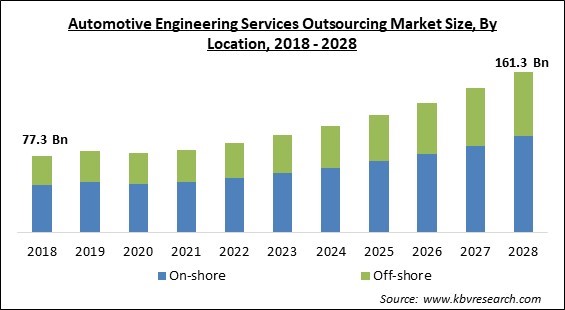

The Global Automotive Engineering Services Outsourcing Market size is expected to reach $161.3 billion by 2028, rising at a market growth of 10.2% CAGR during the forecast period.

Automotive engineering services are a subcategory of vehicle engineering that include advanced safety engineering in automotive as well as electrical, electronics, mechanical, software, and electrical systems. The development, operation, design, and manufacture of passenger cars and commercial vehicles all heavily rely on automotive engineering services.

Additionally, these services are designed to enhance the production process and save additional costs. The expansion of the market will be fueled by the rising demand for in-vehicle technological advances that would enable greater penetration of services like remote diagnostics and smart infotainment, as well as enhanced connection solutions.

Furthermore, intellectual property laws limit service providers from continuously using the current technology, and new invention costs a significant amount of time and money, which is one of the key barriers to market growth.

The expansion of the automotive ESO market is anticipated to be fueled by the expanding technological capabilities of Engineering Service Providers (ESPs) to achieve research and development (R&D) and product innovation in their offerings for connected automobiles, vehicle positioning, and guidance systems. The government's increasing efforts to promote the use of green automobiles in order to reduce the emissions of dangerous gases are also fueling the growth of the automotive ESO market.

Worldwide, the COVID-19 pandemic has had an impact on a wide range of businesses. Due to the COVID-19 pandemic, several nations implemented a total lockdown for a short period of time, which slowed down vehicle manufacturing. Due to the worldwide closure of manufacturing facilities, vehicle sales suffered. The worldwide automobile sector was impacted by the COVID-19 pandemic. The pandemic had little effect on the market for automotive engineering services. However, with a constrained capacity and the necessary safety precautions in place, the majority of manufacturers have resumed producing cars.

The process of hiring non-physical engineering tasks from a third party, like design, system integration, prototyping, and testing, is known as engineering services outsourcing (ESO). These services are required from the very beginning of the process of designing and developing a product, which makes use of a number of databases and IT-based technologies. Automobile manufacturers have come to the realization that they need to enhance their technical skills and creativity in order to meet customer demand. Many governments help manufacturers by providing incentives and tax breaks in return for their production of fully compliant vehicles. This supports the growth of the regional market

Automotive original equipment manufacturers (OEMs) are looking for ways to hone their core capabilities in the modern marketplace while outsourcing other facets of their operations to service providers. The growing use of outsourcing for automotive engineering services is influenced by a wide range of forces, including globalization, market fragmentation, operational complexity, and technical hurdles. There have been several partnerships between OEMs and engineering service companies. This supports the growth of the regional market.

Despite upbeat growth predictions, the automotive engineering service outsourcing industry is dealing with a number of challenges that are somewhat limiting its development. Many manufacturers are concentrating on creating these elements in-house rather than outsourcing them to engineering service providers because of the intricacy involved in the design of the gearbox, powertrain, and engine. This may limit the development of the market. Additionally, internal staff members are more likely than contractors' personnel to have a longer tenure at a facility and have a deeper understanding of the company's goals. The regional market would expand as a result of this factor.

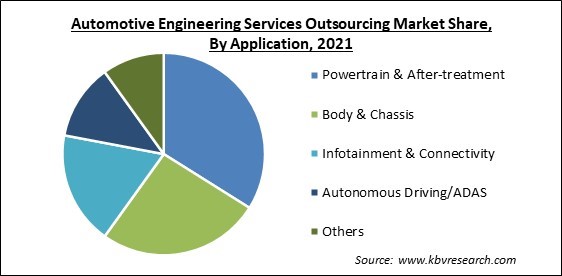

Based on application, the Automotive Engineering Service Outsourcing Market is divided into Infotainment & Connectivity, Body & Chassis, Powertrain & After-Treatment, Autonomous Driving/ADAS, and Others. The Autonomous Driving/ADAS segment is showcasing the promising growth rate during the forecast period. This is because the use of autonomous driving/ADAS is anticipated to rise significantly throughout the forecast period as a result of its capacity to recognize, identify, and provide safe mobility in its surroundings. Lidar, inertial measurement units, GPS, radar, and other sensors make up ADAS, which provides sophisticated sensory information and control systems to traverse courses.

Based on services, the Automotive Engineering Service Outsourcing Market is divided into Designing, Prototyping, System Integration, Testing, and Others. In terms of revenue, the prototyping segment led the Automotive Engineering Services Outsourcing Market in 2021. This is attributable to the automobile industry's growing use of 3D printing technology to create models of whole cars or assembly prototypes. With the use of 3D printing technology, producers may easily see flaws in the prototype and promptly fix them, enabling a cost-effective strategy. Companies are using 3D CAD software more often to enhance design quality, boost efficiency, establish a database for production, and improve communications via documentation.

Based on location, the Automotive Engineering Service Outsourcing Market is divided into on-shore and off-shore. In the automotive engineering service outsourcing market, the off-shore segment is registering a phenomenal growth rate during the anticipated period. This is explained by OEMs' growing propensity for outsourcing their services to low-cost nations like China, India, Brazil, Ukraine, and Mexico. India is heavily favored by OEMs since it has the most engineering degrees and the right capabilities compared to other low-cost nations for ESO, fueling the expansion in this area.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 82.9 Billion |

| Market size forecast in 2028 | USD 161.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.2% from 2022 to 2028 |

| Number of Pages | 251 |

| Number of Tables | 384 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Location, Service, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the automotive engineering service outsourcing market is categorized into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region dominated the Automotive Engineering Service Outsourcing Market in terms of revenue share in 2021. This is explained by China's rapid adoption of electric vehicles for personal transportation. Government regulations encouraging the use of green technology and minimizing or reducing emissions urge the category to expand throughout the predicted period. Additionally, the presence of skilled and affordable labor has contributed to the growth of ESPs in the Asia Pacific region.

Free Valuable Insights: Global Automotive Engineering Services Outsourcing Market size to reach USD 161.3 Billion by 2028

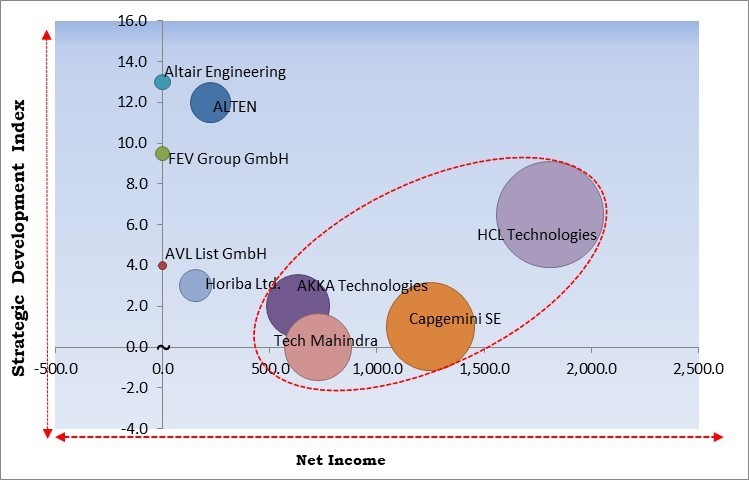

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; HCL Technologies Ltd., Capgemini SE, Tech Mahindra Limited, and AKKA Technologies SE are the forerunners in the Automotive Engineering Services Outsourcing Market. Companies such as ALTEN, Horiba Ltd., and Altair Engineering, Inc. are some of the key innovators in Automotive Engineering Services Outsourcing Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AKKA Technologies SE (Adecco Group AG) update parent company, Altair Engineering, Inc., ALTEN, AVL List GmbH, Horiba Ltd., Capgemini SE, HCL Technologies Ltd. (HCL Enterprises), Tech Mahindra Limited, FEV Group GmbH, and RLE International Group.

By Application

By Location

By Service

By Geography

The global Automotive Engineering Services Outsourcing Market size is expected to reach $161.3 billion by 2028.

Continued preference of auto manufacturers and OEMS' toward outsourcing services are driving the market in coming years, however, The rising trend of in-house design might restrict growth restraints the growth of the market.

AKKA Technologies SE (Adecco Group AG) update parent company, Altair Engineering, Inc., ALTEN, AVL List GmbH, Horiba Ltd., Capgemini SE, HCL Technologies Ltd. (HCL Enterprises), Tech Mahindra Limited, FEV Group GmbH, and RLE International Group.

The expected CAGR of the Automotive Engineering Services Outsourcing Market is 10.2% from 2022 to 2028.

The On-shore segment acquired maximum revenue share in the Global Automotive Engineering Services Outsourcing Market by Location in 2021 thereby, achieving a market value of $96.5 billion by 2028.

The Asia Pacific market dominated the Global Automotive Engineering Services Outsourcing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $64.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.