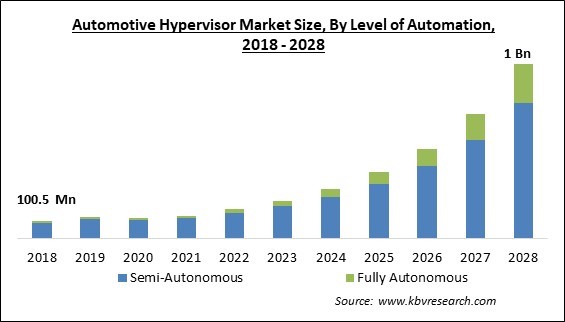

The Global Automotive Hypervisor Market size is expected to reach $1 billion by 2028, rising at a market growth of 34.9% CAGR during the forecast period.

Automotive hypervisors are embedded systems used for in-car entertainment developed expressly for vehicle use. It is a group of programs that can execute different virtual machine operations on the operating system of a host system. In addition, a hypervisor is a computer algorithm that decides how much hardware should be allotted to each program while enabling OSs to share a single CPU, memory, etc. The two most prevalent types of hypervisors are type 1 and type 2, and their use in automobiles depends on how the system is set up within the vehicle.

Previously, separate systems like the infotainment system, instrument cluster, and telematics were present in vehicles. Vehicle makers have been implementing a single hardware strategy to lower the cost of creating and maintaining these separate systems. But, putting all the functions on a specific hardware platform raises questions about security and safety. In this situation, hypervisors are crucial. A hypervisor creates a virtual environment enabling many systems to function in isolation from one another on the given hardware platform.

The automobile industry has a growing need for hypervisors every day. The security coherence of each OS as well as the hypervisor, must be maintained when multiple hypervisors are running on the same ECU. Due to strict regulations, all systems in the automotive industry must be fail-safe. OEMs must adhere to worldwide functional laws and safety standards, such as IEC 61508 and ISO 26262. As it isolates various runtime environments and avoids disclosing sensitive data in the event of a malfunction, automotive virtualization decreases security vulnerabilities in many ways.

ISO 26262, or the functional safety standard, is an international specification for the functional safety of automobile systems. Finding the safety integrity level, sometimes referred to as the ASIL level, is the first step in complying with ISO 26262. The levels are ASIL-A for the lowest and ASIL-D for the highest. The standard specifies how to construct the software for a level after the established level. Thus, hypervisors must comply with functional safety regulations and obtain safety certificates.

Because of the pandemic, the automobile software businesses also suffered a significant reduction in profit margin. The desire for safety and comfort features in cars has never decreased, notwithstanding this scenario. The COVID-19 pandemic had a big impact on market development and trends. However, the introduction of COVID-19 vaccines proved advantageous for the automotive and transportation industries. Post that, many businesses started to resume production in locations throughout the world where people have received vaccinations, adhering to rigorous safety precautions to protect workers. Major companies offering cutting-edge technology & solutions to OEMs also worked hard to recover the damage caused by COVID-19 through various tactics. Thus, it is anticipated that, the auto industry's expansion will propel the market's growth in the upcoming years.

Modern vehicles have developed from basic transportation tools to cutting-edge networking hubs. The development of automobiles due to connected car technology helps consumers drive more safely, avoid collisions, reduce CO2 and NOx emissions, enjoy linked lifestyle services like on-demand entertainment and infotainment, and save money on insurance through telematics. With internet connectivity, app-to-car connectivity, smarter parking, and better vehicle maintenance, connected vehicles have the potential to increase efficiency, decrease traffic congestion, and improve safety. This aids in cutting infrastructure expenditures as well. The growing number of connected automobiles has created the new revenue-generating potential for participants in the connected vehicle ecosystem. Hence, the development of connected infrastructure is expected to increase demand for advanced vehicles and propel the automotive hypervisor market.

The safety of both passengers and automobiles is currently customers' top priority. International regulatory organizations strive to improve driving safety. Studies indicate that in the upcoming years, traffic-related fatalities will overtake other causes of mortality. Driver distraction is one of the leading causes of these collisions. Drivers often look away from the road to examine an information cluster. Examining a display on a conventional information instrument cluster takes at least a half-second before returning to the road. The head-up display's output reduces distractions, so the driver may concentrate more on driving. Manufacturers are putting advanced information systems into their vehicles due to these benefits. Hence, all of these factors will encourage the growth of the automotive hypervisor market throughout the ensuing years.

The incorporation of software solutions has given automobiles computer-like specifications. Vehicle digitization has improved speed, convenience, and performance. There aren't many resources with practical knowledge of the newest and most popular technologies available to maintain or repair software issues because the automotive software business is still in its early stages of development. However, automobile manufacturers, vendors, and other stakeholders in the automotive and transportation industries also need to understand more about software-based maintenance and features because they, too, lack a thorough understanding of these topics. Thus, the expansion of the automotive hypervisor market is being constrained by issues including lower incorporation in an economy vehicle, shortage of experienced labor, automotive software engineers, and expertise.

Based on type, the automotive hypervisor market is bifurcated into type 1 and type 2. The type 2 segment procured a considerable growth rate in the automotive hypervisor market in 2021. Type 2 also functions on existing operating systems and expanded hosts. Additionally, demand for the type 2 hypervisor is expanding the quickest since it is more suited for automotive applications due to its OS multi-layer compatibility. Therefore, type 2 is anticipated to expand in the market in the upcoming years.

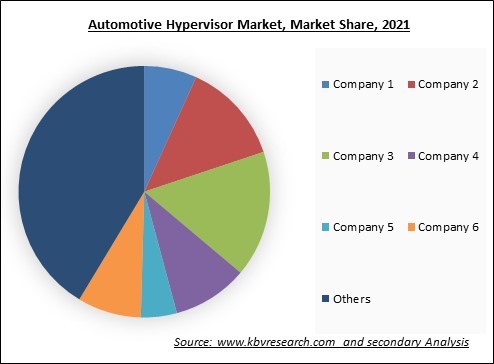

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on level of automation, the automotive hypervisor market is fragmented into semi-autonomous and fully autonomous. The fully autonomous segment witnessed a considerable growth rate in the automotive hypervisor market in 2021. The demand for autonomous vehicles has started to grow, propelling the segment's growth. The further development of autonomous vehicles requires consistent, reliable connectivity, suitable infrastructure in every location, and several project investments. In addition, autonomous vehicles will have cutting-edge safety, comfort, and utility features, increasing the complexity and hardware content of luxury automobiles' integrated technology.

On the basis of vehicle class, the automotive hypervisor market is categorized into mid-priced & economic vehicles, and luxury. The mid-priced and economic vehicles segment acquired a substantial revenue share in the automotive hypervisor market in 2021. Only a few cutting-edge technologies are included in economy-class passenger cars to ensure cost-effectiveness. The increasing development of technology has enabled the usage of novel features in economy vehicles while maintaining the price range. As a result, modern features like ADAS & safety, body & comfort, navigation, and cockpit telematics are included in vehicles of the economic class. The biggest demand for this range of vehicles is seen in the developing regions, fueling segment expansion.

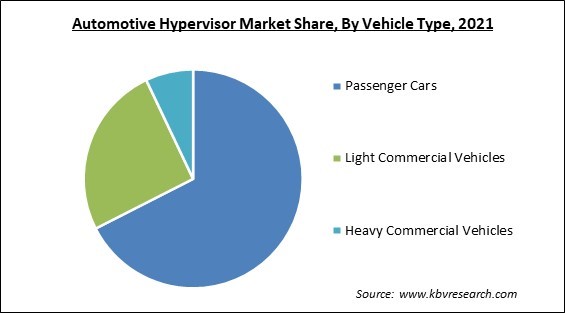

On the basis of vehicle type, the automotive hypervisor market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment acquired the largest revenue share in the automotive hypervisor market in 2021. The rising demand for passenger automobiles and their high-end features has been spurred by customers' rising disposable income, rising desire for luxury vehicles, and a shift in customer choice from sedans to SUVs. Additionally, in each vehicle class, increased demand for comfort and safety features is anticipated to support the expansion of the passenger car category over the projection period.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 133.2 Million |

| Market size forecast in 2028 | USD 1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 34.9% from 2022 to 2028 |

| Number of Pages | 237 |

| Number of Table | 410 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Level of Automation, Vehicle Class, Vehicle Type, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the automotive hypervisor market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired the highest revenue share in the automotive hypervisor market in 2021. The market for automotive hypervisors has expanded as a result of contributions from up-and-coming nations like Thailand and India. In addition, the increased use of advanced technologies like ADAS, safety, in-vehicle entertainment, navigation systems, as well as telematics in next-generation automobiles is largely responsible for the rise in demand for hypervisors. Also, Asia Pacific boasts a sizable ecosystem for advancing autonomous vehicles. Tech goliaths, automakers, makers of electric vehicles, full-stack developers, as well as tier 1 suppliers are included in this.

Free Valuable Insights: Global Automotive Hypervisor Market size to reach USD 1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Panasonic Holdings Corporation, NXP Semiconductors N.V., Elektrobit Automotive GmbH (Continental AG), Renesas Electronics Corporation, BlackBerry Limited, Visteon Corporation, Siemens Energy AG, Sasken Technologies Ltd, SYSGO GmbH (Thales Group), and Green Hills Software, AB.

By Type

By Level of Automation

By Vehicle Class

By Vehicle Type

By Geography

The global Automotive Hypervisor Market size is expected to reach $1 billion by 2028.

Concerns about the safety of passengers, other vehicles, and onlookers, as well as rising demand for commercial vehicles are driving the market in coming years, however, Automotive software maintenance and troubleshooting restraints the growth of the market.

Panasonic Holdings Corporation, NXP Semiconductors N.V., Elektrobit Automotive GmbH (Continental AG), Renesas Electronics Corporation, BlackBerry Limited, Visteon Corporation, Siemens Energy AG, Sasken Technologies Ltd, SYSGO GmbH (Thales Group), and Green Hills Software, AB.

The expected CAGR of the Automotive Hypervisor Market is 34.9% from 2022 to 2028.

The Type 1 market acquired the maximum revenue share in the Global Automotive Hypervisor Market by Type in 2021; thereby, achieving a market value of $790.1 billion by 2028.

The Asia Pacific market dominated the Global Automotive Hypervisor Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $388.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.