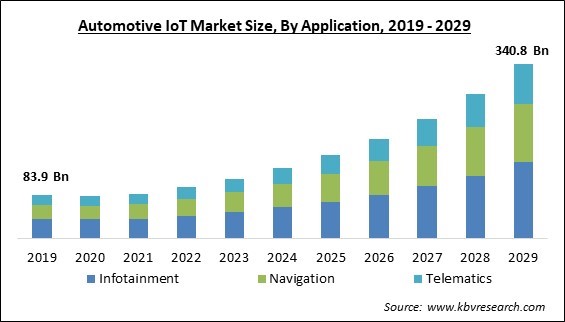

The Global Automotive IoT Market size is expected to reach $340.8 billion by 2029, rising at a market growth of 19.6% CAGR during the forecast period.

Various devices in a location can be connected through wired and wireless connections because of the Internet of Things (IoT) technology. An automotive IoT also helps to manage the vehicle's functions to prevent accidents or reduce driver fatigue. Furthermore, it makes it possible for complex parts like actuators, electronics, and sensors to communicate with one another and other online-connected automobiles.

The market is growing as a result of reasons such as the increasing demand for connected cars, government programs for smart traffic system management, and growing consumer awareness of road vehicle safety. For the automotive IoT market to grow profitably, several market participants are advancing technologies.

The connected vehicle is the most prominent and well-known application of the Internet of Things. The real IoT development in the automotive industry is happening behind the scenes, though, as today's cars become increasingly software-driven, with manufacturers and software developers vying for the lead.

The Internet of Things (IoT) is a framework of mechanical and digital objects that are autonomous in data transport and connected through computing devices. In addition, the advent of the automotive IoT market promotes the demand for automated devices to analyze real-time data on drivers and fleet operators. Also, it is linked to the Internet of smart automobiles, which provides three different communication channels: vehicle-to-vehicle, vehicle-to-infrastructure, and vehicle-to-vehicle.

The use of autonomous vehicles has increased during the pandemic. Many service-related jobs that require humans have restrictions imposed by many nations. It is now easier for people to function in an environment with a lethal virus because of the introduction of IoT in the automotive sector and developments like autonomous vehicles. China successfully delivered food, medicine, and even hospitalized COVID patients using its autonomous trucks. As a result, the automotive IoT market has significantly benefited from the outspread of COVID-19.

Power electronics, a crucial technology for hybrids, offers a lot of potential for semiconductor technology. The automotive IoT market is expected to be impacted by several emerging technologies, which are now in the introductory phase. The increasing use of HEVs and EVs drives the demand for automotive semiconductors. The governments of numerous nations provide a variety of incentives to encourage the usage of electric and hybrid vehicles domestically. Hence, the potential for electrification has expanded due to new car features and better technologies. Original equipment producers (OEMs) are adding microprocessors, ICs, and sensors to high-end electric vehicles.

Only essential or urgent maintenance tasks require them to visit the service centers. To provide these conveniences for car owners, predictive maintenance has had great success. Regularly, personnel is dispatched to perform preventive maintenance and routine diagnostic checks in accordance with predetermined timetables. This can be a labor- and resource-intensive operation with little guarantee that a failure won't happen between inspections. For more advanced remote condition monitoring and failure detection of the vehicle, use PdM. With the rising integration of predictive maintenance platforms in vehicles, the automotive IoT market is predicted to expand over the projection period.

ICT infrastructure development on highways is slower in emerging nations than in developed ones in places like Mexico, Brazil, and India. Only in metropolitan and semi-urban areas are 3G & 4G-LTE communication networks available, which are necessary for connectivity. Even though there are many third-party logistics businesses operating in semi-urban or rural locations, there are connectivity problems. Because of this, developing the automotive IoT market in developing nations may be hampered by the absence of adequate IT and communication infrastructure.

Based on offering, the automotive IoT market is classified into hardware, software and services. The services segment covered a considerable revenue share in the automotive IoT market in 2022. The major services driving the expansion of the automotive IoT services market include support & maintenance, consulting, deployment & integration, and others. In addition, the demand for automotive IoT retrofits is expanding, which is a driving factor for the services segment because owners of connected vehicles need appropriate solutions.

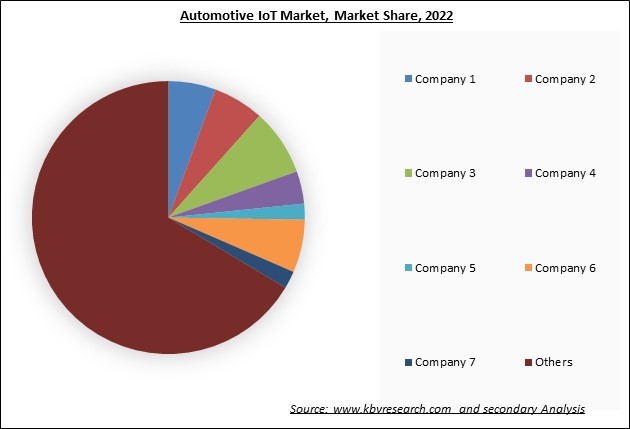

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

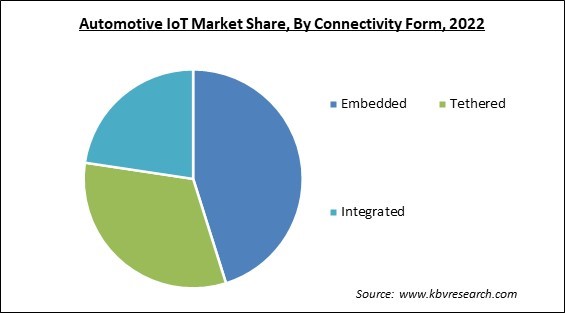

By connectivity form, the automotive IoT market is segmented into embedded systems, tethered systems, and integrated systems. The tethered systems segment garnered a significant revenue share in the automotive IoT market in 2022. The tethered system has hardware that enables the driver’s smartphone and vehicle connection. Moreover, a connected motor will send data, receive software updates, connect to other equipment (Internet of Things), and give the driver and passengers WiFi internet access. Telematics may also be accessed by connected technologies, and it has been demonstrated that electric automobiles greatly benefit from this.

On the basis of communication type, the automotive IoT market is fragmented into in-vehicle communication, vehicle-to-vehicle communication, vehicle-to-infrastructure communication. The vehicle-to-vehicle communication segment acquired a substantial revenue share in the automotive IoT market in 2022. The need for vehicle-to-vehicle communication is expanding since it is useful for connecting with neighboring automobiles. Sharing information on the traffic on the roads is advantageous. Vehicle-to-vehicle communication makes driving safer by transferring information between vehicles in real-time. To communicate real-time data from the car to the infrastructure, gadgets are utilized that use cameras and RFID readers.

Based on application, the automotive IoT market is divided into navigation, telematics, and infotainment. The infotainment segment accounted for the largest revenue share in the automotive IoT market in 2022. Wi-Fi capability has paved the way for smart infotainment systems and other advanced automotive technologies. Owners of vehicles can connect their smartphones to various devices like the music system and GPS and control them remotely. Currently, a person can utilize various built-in and third-party applications to connect his vehicle to a mobile.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 99.4 Billion |

| Market size forecast in 2029 | USD 340.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 19.6% from 2023 to 2029 |

| Number of Pages | 337 |

| Number of Table | 604 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Connectivity Form, Offering, Communication Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the automotive IoT market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region led the automotive IoT market by generating the largest revenue share in 2022. This region is home to a large number of manufacturing giants. They will be one of the elements influencing the market expansion in this region. The governments and other businesses in this region have increased their investments, which are beneficial in giving automobiles smart parking. The North American region's expanding need for smart cities will also fuel market expansion in the ensuing years.

Free Valuable Insights: Global Automotive IoT Market size to reach USD 340.8 Billion by 2029

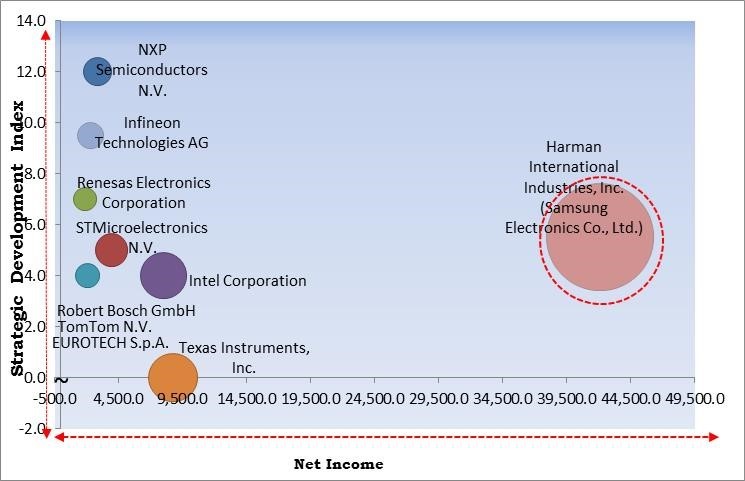

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Harman International Industries, Inc. (Samsung Electronics Co., Ltd.) are the forerunners in the Automotive IoT Market. Companies such as NXP Semiconductors N.V., Infineon Technologies AG, Renesas Electronics Corporation are some of the key innovators in Automotive IoT Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Intel Corporation, Robert Bosch GmbH, NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Texas Instruments, Inc., TomTom N.V., Harman International Industries, Inc. (Samsung Electronics Co., Ltd.), Renesas Electronics Corporation and EUROTECH S.p.A.

By Application

By Connectivity Form

By Offering

By Communication Type

By Geography

The Market size is projected to reach USD 340.8 billion by 2029.

Integration of predictive maintenance platform with vehicles are driving the market in coming years, however,Inadequate infrastructure to support connected vehicles' efficient functioning restraints the growth of the market.

Intel Corporation, Robert Bosch GmbH, NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Texas Instruments, Inc., TomTom N.V., Harman International Industries, Inc. (Samsung Electronics Co., Ltd.), Renesas Electronics Corporation and EUROTECH S.p.A.

The Embedded segment acquired maximum revenue share in the Global Automotive IoT Market by Connectivity Form in 2022 thereby, achieving a market value of $148.1 billion by 2029.

The In-vehicle Communication segment is leading the Market by Communication Type in 2022 thereby, achieving a market value of $148.8 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $116.5 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.